Global primary Aluminum production is expected to have increased marginally 0.7% Y-o-Y in 2022 to reach 68 MMT.

The increase in capacity additions in China had offset capacity curtailment in Europe and the USA.

Aluminium Market Outlook

An estimated 2.28 MMT capacity Aluminium capacity in China is expected to be commissioned through capacity replacement by the end of 2022.Rebound in Alumina prices are expected to put upward pressure on the prices.

Aluminium demand in the automotive and transportation industry is driven by light-weighting requirements to achieve fuel economy as well as emissions regulations in key markets like North America, Europe and China. Aluminium content per vehicle in key markets is expected to reach close to 570 pounds per vehicle by 2030.

Demand from the transportation segment is expected grow between 4-5% from 2021-2023. The demand from the packaging industry is expected to increase in coming years, as industries look for alternatives for plastic packaging.

The overall capacity in China is likely to remain 43–45 MMT during the next two years, as some of the capacity additions will involve swapping decommissioned capacity for new production.

High energy cost prevailing in the Europe is expected to affect the Aluminium production in the region.

Production of primary metal in China is expected to improve, with capacity additions and increase in operating rate during H2 2022. The domestic Aluminium supply in China is expected to increase by 9% Y-O-Y in December-22 and reach 3.45 MMT.

COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Aluminium

Ease of lockdown restrictions from Dec-2023 in China has resulted in surge in Covid-19 cases thus slowdown the end use demand.

Aluminium Pricing Insights

Aluminium prices rebounded as declining inventories outweighed demand concerns sparked by protests in several Chinese cities against strict COVID-19 restrictions.

Price sentiments continue to be driven by raising demand driven by stocking from customers. The market focus has shifted to import demand due to European recession fears amid high power prices and central banks’ monetary tightening.

Cost of raw materials, like scrap and alumina, is expected to rebound Q-o-Q during Q4 2022, due to high energy costs and increase in restocking activities.

Aluminium Supply Outlook

The domestic Aluminium supply in China is expected to increase by 9% Y-O-Y in December-22 and reach 3.45 MMT. High energy cost prevailing in the Europe is expected to affect the Aluminium production in the region.

In Europe, input cost may remain elevated, due to high electricity prices, coupled with elevated alumina and carbon anode costs. In North America, production costs may increase slightly, driven by increase in alumina prices.

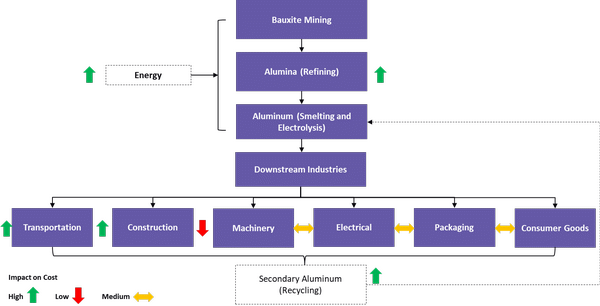

Aluminium Value Chain

Aluminium Market Insights

China has a major influence on the aluminum price as it accounts for 40 percent of both aluminum demand and consumption. The global economy influences aluminum prices greatly. The current global uncertainties have increased the volatility associated with price of aluminum. Though the global aluminum market was in slight deficit in 2021, capacity additions in China is expected to add more supply in 2022. Energy costs across regions are expected to increase, thereby increasing the cost of production of primary aluminum, thereby adding pressure to the price of the metal.

Supplier Intelligence

The category intelligence covers some of the key global and regional players such as Aluminum Corporation of China Limited, China Hongqiao Group Co., Ltd, Xinfa Group Co., Ltd., RUSAL, Vedanta Aluminium

Key global players have announced the reduction plan of carbon footprint. For instance, Hydro’s sustainability goals include - reducing own carbon emissions by 30% by the year 2030, zero fatalities and injury free work environment, rehabilitate available mined areas within two hydrological cycles.

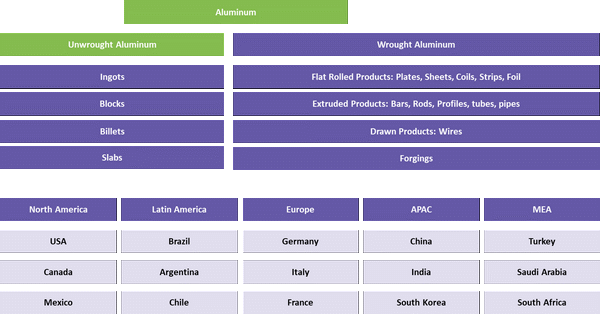

Segmentation Overview: