Regulatory Landscape - Overview

Catheters Regulatory Landscape: Product Overview

The catheters market encompasses medical devices designed for therapeutic and diagnostic purposes, facilitating the drainage, administration, or monitoring of fluids within the body. This market includes various types of catheters, such as dialysis catheters for vascular access in kidney failure treatments, urology catheters for urinary drainage, and intravascular catheters for medication delivery, fluid administration, and hemodynamic monitoring. These devices are widely used across hospitals, clinics, and other settings, driven by advancements in minimally invasive procedures and increasing demand for chronic disease management solutions.

FDA has centre for devices and Radiological Health (CDRH) which is responsible for regulation od manufacturing, repackage, relabel, import of medical devices in U.S. Five catheter devices were approved by FDA in 2024.

Catheter types

Based on product, the global catheter market has been segmented dialysis catheter, urology catheter, and intravascular catheter. And their subtypes are as follows:

| Dialysis Catheter | Urology Catheter | Intravascular Catheter |

| • Short-term Hemodialysis Catheters • Long-term Hemodialysis Catheters • Peritoneal Dialysis Catheters | • Nephrostomy Slip Lock • Double Loop Ureteral Stent • Ureteral Stone Basket • Ureteric Sequential Dilator • Urethral Balloon Catheter • Ureteral Balloon Dilator • Ureteral Access Sheath • Urodynamic Catheter • Ureteric Catheter • Nelaton Catheter • Nephrostomy Catheter • Others | • Central Venous Catheter • Arterial Catheter • Peripheral Inserted Central Venous Catheter 'PICC' • Midline Venous Catheter • Other |

Applications of Catheters

- Short-term hemodialysis catheters are particularly in demand due to their critical role in providing temporary vascular access for patients who need urgent dialysis or have no suitable fistula or graft for long-term dialysis. Additionally, advancements in catheter design, such as reduced risk of infections and improved patient comfort, are enhancing adoption rates. The growing need for quick and efficient treatment solutions, particularly in emergency and hospital settings, alongside increasing healthcare infrastructure improvements, is further propelling market growth for short-term hemodialysis catheters.

- Long-term hemodialysis catheters are utilized for patients with chronic kidney failure who need ongoing dialysis but are not suitable candidates for permanent vascular access like arteriovenous fistulas or grafts. These catheters are more durable and are typically tunneled under the skin to reduce the risk of infection and improve stability. These catheters are essential for patients who need ongoing dialysis treatment but do not have a permanent access point such as a fistula or graft.

- Urology catheters are medical devices used for the drainage, access, or treatment of the urinary system. These catheters are designed to manage a variety of urological conditions, such as urinary retention, kidney stones, bladder dysfunction, and obstructions in the urinary tract.

- PICC lines are used for long-term intravenous access, providing a reliable route for the administration of medications, fluids, nutrition, blood products, and for drawing blood samples. They are particularly beneficial for patients who require prolonged intravenous treatments, such as chemotherapy, long-term antibiotics, or total parenteral nutrition (TPN).

- Arterial catheters are primarily used in high-acuity settings like intensive care units (ICUs), operating rooms, and emergency care environments, where real-time hemodynamic monitoring is essential for patient management. The demand for arterial catheters is driven by the increasing prevalence of cardiovascular diseases, the rise in complex surgeries, and the need for precise monitoring of critically ill patients. Innovations in catheter materials, such as antimicrobial coatings and biocompatible designs, are helping reduce complications like infection and clotting, further driving market growth.

- Peritoneal dialysis catheters, on the other hand, facilitate a form of dialysis that uses the peritoneal membrane as a natural filter, providing patients with an alternative to hemodialysis. They are inserted into the abdominal cavity and are suitable for long-term use in patients who prefer or require this modality.

Catheter Product Development Steps:

FDA has segmented medical devices into type I, II, III. This classification is to define regulatory requirements any all the general medical devices.

Class I medical devices don’t need premarket notification and are of low risk only general controls are enough to ensure its safety and efficacy. Class II are of moderate risk and require premarket notification and general and special controls are required to confirm its safety and efficacy. Class III requires Premarket approval from FDA which typically includes clinical data. They are at highest risk and include products such as balloon catheters, pacemakers and heart valves. They can’t acquire safety and effectiveness through general controls and special controls. They usually include life sustaining, supporting, and long-term implantable devices in their category.

Catheters belong to class II and class III of medical devices so companies manufacturing catheters must get PMA from FDA for getting approval for its use in healthcare and sale into the market.

FDA Approved Catheters In 2024

- On 29 February 2024, AGENT Paclitaxel-Coated Balloon Catheter – P230035 was approved by FDA: They have a narrow tube along with a balloon at the end where arteries reopen which supplies blood to the heart and are blocked or become narrowed due to the disease like coronary artery disease (CAD). The balloon on its surface has a coating of paclitaxel drug which help to prevent arteries from blocking or narrowing again (restenosis).

- On 26 February 2024, INTELLANAV STABLEPOINT Ablation Catheter & Force Sensing System on the RHYTHMIA HDX Mapping System was approved by FDA:

- The INTELLANAV STABLEPOINT Ablation Catheter uses radiofrequency (RF) energy applied by the catheter tip to destroy heart tissue cells that are causing heart rhythm problems (arrhythmias).

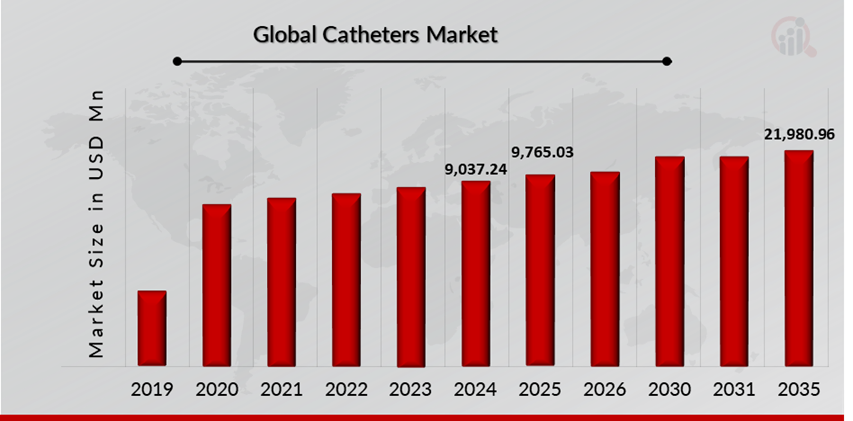

Catheters Market Size Overview:

As per MRFR analysis, the Catheter Market Size was estimated at 9,037.24 (USD Million) in 2024. The Catheter Market Industry is expected to grow from 9,765.03 (USD Million) in 2025 to 21,980.96 (USD Million) till 2035, at a CAGR (growth rate) is expected to be around 8.45% during the forecast period (2025 - 2035).The rising prevalence of chronic diseases such as kidney disease, diabetes, and cardiovascular conditions, urinary disorders and increasing launch of catheter products are the key market drivers enhancing the growth of the market.

Source: The Secondary Research, Primary Research, MRFR Database and Analyst Review

Catheter Regulatory Landscape:

There are several key regulatory agencies who oversee the approval and monitoring of Catheter to ensure their safety, efficacy, and quality.

| Regulatory agencies | Regulatory Ministry |

| Federal Food and Drug Administration | United States: Department of Health and Human Services (HHS) |

| The Medicines and Healthcare products Regulatory Agency | United Kingdom: The Medicines and Healthcare products Regulatory Agency (MHRA) under the Department of Health and Social Care (DHSC) |

| Central Drug Standard Control Organization | India: The Ministry of Health and Family Welfare |

| South African Health Products Regulatory Authority (SAHPRA) | National Department of Health. |

| Pharmaceuticals and Medical Devices Agency (PMDA) | Japan: Ministry of Health, Labour and Welfare. |

| National Medical Products Administration (NMPA) | China: The Ministry of Health |

| Health Sciences Authority | Singapore: The Ministry of Health |

| European Medicine Agency | European union |

| Brazilian Health Regulatory Agency (Anvisa) | Ministry of Health, part of the Brazilian National Health System (SUS) |

Catheters Guidelines:

Eligibility: The growing geriatric population across the globe is significantly driving demand for healthcare solutions, particularly in the areas of dialysis, urology, and intravascular procedures. catheters are medical devices which are used for wide range of patients in various health conditions patients with urinary retention, or neurological disorder, chronic kidney disease, post-surgical patients, for women post or pre childbirth or for delivering medication into the body. Based on the health condition doctors use suitable catheters for effective treatment of patients. For children pediatric catheters use and for newborn neonatal catheters are selected carefully for their safe and effective use, as they are more sensitive compared to adults. As the elderly population is more susceptible to chronic conditions such as kidney diseases, cardiovascular diseases, and urological disorders, the need for specialized medical devices like dialysis catheters, urology catheters, and intravascular catheters is increasing.

Catheter types: Catheters are segmented into different types such as: dialysis catheter, urology catheter, and intravascular catheter. And they are also classified based on the duration for which they are used into long- and short-term catheters.

Catheters Classification of the Product:

Catheters Regulatory Process Overview, By Country:

The rate of regulatory control increases from class I of medical devices to class III. Every Regulatory class of medical devices comprises different regulatory controls. (i.e., general controls, special controls, and premarket approval [PMA]).

Regulation of medical devices depends on the risk it has to consumer while undertaking treatment. All the devices need to be subjected to general controls (e.g. registration and listing), to ensure safety and efficacy of devices. Some devices which have risk to the consumer strictly needs premarket review from FDA before marketing to ensure its safety and efficacy to consumers.

Premarket approval includes process of scientific and regulatory testing of the class III medical devices, PMA gives enough valid scientific evidence which assure device safety and effectivity for its intended use. If device fails to fulfil PMA needs, it is considered to be adulterated under section 501(f) of the FD&C Act and not allowed to be marketed. Some devices need special controls which include labelling and post market studies. Device labels must include date of manufacturing, directions to use, intended use, place of business.

Manufacturer not sure of the regulatory class of its device may submit to FDA request for clarification. If FDA finds any registrant (manufacturer, importer, distributor other) violating FFDCA requirements or FDA regulations, corrective action is taken against them by the FDA.

As catheter usually belongs to class I and III the PMA is must for its successful approval by FDA

Cathers belonging to class I and class II are as follows:

| Catheter Type | Class of Medical Device |

| Dialysis catheter | Class II |

| Urology catheter | Class II or class III |

| Intravenous Catheter | Class II or class III |

Latest Breakthrough Designation granted to some of the catheters under medical devices category of FDA are as follows:

| Manufacturer | Product | Approval Date |

| Boston Scientific Corporation | Agent Paclitaxel-Coated Balloon Catheter | 2/29/2024 |

| Farapulse, Inc | Percutaneous Cardiac Ablation Catheter for Treatment of Atrial Fibrillation with Irreversible Electroporation | 1/30/2024 |

| Perfuze, Ltd. | Millipede 070 Aspiration Catheter, Perfuze Aspiration Tube Set | 10/18/2023 |

| Shockwave Medical, Inc. | Shockwave Intravascular Lithotripsy (Ivl) System with Shockwave C2 Coronary Intravascular Lithotripsy (Ivl) Catheter | 02/12/2021 |

Catheters Regulatory Updates and Amendment’s:

Quality management system regulation (QMSR) final rule was issued by FDA, which has amended device current good manufacturing practice (CGMP) needs for regulation of quality system (QS). Including international standard specific for quality management systems set by international organization for standardisation (ISO).

The latest action taken by FDA to promote consistency is Final Rule, in regulation of devices. Which intends to go in harmony with FDAs CGMP regulatory rules which are used by regulatory authorities. The rule will be effective from 2nd February 2026, after 2 years of its publication, till that manufacturers are required to follow and achieve compliance based on QS regulation.

On October 3, 2022, FDA has announced that manufacturers can send electronic copy (eCopy) or electronic Submission Template And Resource (eSTAR) premarket submissions online on the CDRH Customer Collaboration Portal (CDRH Portal).

Catheters Regulatory Challenges:

One of the primary challenges in regulatory compliance is the need for extensive clinical data to support the safety and effectiveness of catheter devices. Manufacturers are required to conduct thorough testing and clinical trials before their products can receive market authorization. This process can be costly and time-consuming, often leading to delays in getting innovative catheter technologies to market.

International variations in regulatory standards create further challenges for manufacturers aiming to market catheter devices globally.

Possible Risk in development of Catheters:

Development of catheters Complex manufacturing process they are required to be manufactured with high precision, material selection and sterilisation to ensure biocompatibility and minimize risk of infections. As the insertion and long-term use of catheters carry inherent risks, including catheter-related infections, thrombosis, and mechanical failures, which can lead to patient morbidity, extended hospital stays, and additional medical costs. These risks often lead to hesitant adoption of catheter-based treatments and the necessity for stringent protocols, further driving up the costs of healthcare and limiting widespread market growth.

Additionally, the need for regular maintenance and replacement of catheters to prevent infection further restrains market expansion as it adds complexity and costs to patient care. The ongoing challenge of balancing the effectiveness of these catheters with the prevention of complications continues to hinder the growth of the market.

Strict regulatory requirements of catheters, needs compliance and performance standards, delay in this process of risk assessment can lead to slow product development and commercialization.

Failure to meet regulatory requirement can lead to Voluntary product recalls by market players are significantly restraining the growth of the global dialysis catheters, urology catheters, and intravascular catheters market. These recalls, often prompted by safety concerns such as defects or potential risks of complications, disrupt the availability of products and undermine consumer confidence. As manufacturers are forced to pull devices from the market, it can lead to temporary shortages, increased costs for replacement products, and delays in patient treatments.

For instance, April 2024: The U.S. Food and Drug Administration (FDA) has announced a Class I recall of over 1,000 neurovascular catheters produced by Medos International Sàrl, a Swiss manufacturing company owned by Johnson & Johnson. The recall concerns the Cerebase DA Guide Sheath, a catheter commonly used to access brain blood vessels for the delivery of interventional devices. The recall follows multiple reports of fractures in the catheter's distal shaft, raising concerns that these fractures could lead to serious injuries or even death.

Risk mitigation strategies for Catheters:

Consult regulatory bodies during early phases of development to ensure compliance with class I. II, III medical device requirements.

Use biocompatible materials for product development so that it will not cause risk to patient and will be effective in the treatment also will all the regulatory requirements for medical devices by FDA.

Develop catheters with antimicrobial and hydrophilic coatings to reduce risk of infections in patients enhancing safety and efficacy of device.

Catheters Competitive Landscape Dashboard:

Companies With Marketed Catheters Products

- Braun SE

- Merit Medical Systems

- Cardinal Health

- Cook Medical

- Medline Industries

- Johnson & Johnson, Inc.

- AMECATH

- Medical Components, Inc.

- Abbott

- Boston Scientific Corporation

- Medtronic

Regulatory Landscape - Table of Content

Table of contents will appear here once available.

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”