Regulatory Landscape - Overview

Aesthetics Regulatory Landscape: Product Overview

The aesthetics market is a branch of medicine that focuses on improving the appearance of the body through non-surgical or minimally invasive procedures. These procedures are designed to address a variety of aesthetic concerns, such as wrinkles, age spots, acne, hair loss, and unwanted fat. The market scope encompasses products, Hyaluronic Acid or Body Contouring Devices that are utilized to treat and enhance facial lines. Some of these products are sold by Allergan (US) and Galderma S.A. (US).

Under U.S. food and drug administration (FDA), centre for devices and radiological health (CDRH) is responsible for looking after the regulations to ensure quality, safety and efficacy of the medical devices used in Aesthetics.

Aesthetics Types

Based on product, the global Aesthetics market has been segmented into facial aesthetics, body contouring/toning devices, cosmetic implants, skin aesthetics devices, tattoo removal devices, cold air laser hair removal devices, and others.

Facial aesthetics, body contouring/toning devices, cosmetic implants, skin aesthetics devices are further segmented into following:

| Facial aesthetics | Body Contouring/Toning Devices | Cosmetic Implants | Skin Aesthetic Devices |

| Botulinum Toxin Dermal Fillers Microdermabrasion Devices Radiofrequency Devices | Nonsurgical Fat Reduction Devices Cellulite Reduction Devices Liposuction Devices Magnetic Field Devices Electrostimulation Devices ultrasound Devices | Breast Implants Facial Implants | Laser Skin Resurfacing Devices Radio Frequency Based Devices Micro-Needling Products Devices Light Therapy Device, Ultrasound Based Devices |

Aesthetics Applications

Facial aesthetics encompasses a range of non-surgical treatments designed to enhance the appearance of the face by addressing signs of aging, volume loss, skin texture, and overall facial harmony. Among the most popular procedures are Botulinum toxin which temporarily relaxes facial muscles to smooth wrinkles, particularly around the eyes and forehead. For instance, Allergan Aesthetics, an AbbVie company launched of BOTOX Cosmetic (onabotulinumtoxinA) for the treatment of masseter muscle prominence (MMP) in adults in China.

Body contouring and toning devices have revolutionized the way individuals address body shape and appearance without resorting to invasive surgeries. These devices include a range of technologies designed to target stubborn fat, smooth out cellulite, and enhance muscle tone. Nonsurgical fat reduction devices, such as cryolipolysis (CoolSculpting), use cooling technology to freeze and eliminate fat cells, while liposuction devices like laser liposuction offer a minimally invasive way to remove fat with precision. For instance, in January 2021, Allergan Aesthetics, an AbbVie company, expanded its body contouring portfolio with the launch of CoolSculpting Elite, a next-generation fat reduction system. Building on the success of the original CoolSculpting technology, CoolSculpting Elite introduces new applicators that are designed to better fit the body's natural curves, improving both treatment efficiency and patient comfort. The system uses targeted cooling to freeze and eliminate fat cells in areas such as the abdomen, thighs, flanks, upper arms, and beneath the chin.

Cosmetic implants are surgical devices designed to enhance or alter the appearance of specific areas of the body, providing long term or permanent aesthetic improvements. These implants are commonly categorized into breast implants, facial implants, and other types, each serving different cosmetic purposes. Breast implants are used primarily for breast augmentation or reconstruction, allowing individuals to increase breast size, restore volume lost after surgery or trauma, or enhance breast symmetry. For instance, in September 2024, POLYTECH Health & Aesthetics GmbH announced the launch of the Opticon Plus, a new addition to its extensive portfolio of breast implants.

Skin aesthetics devices, including laser skin resurfacing devices, radiofrequency-based devices, micro-needling products, light therapy devices, skin lighteners, ultrasound-based devices, and other innovative technologies, are significantly driving the growth of the global medical aesthetics market. These advanced devices cater to a wide range of skin concerns, from anti-aging treatments and acne scars to pigmentation issues and skin rejuvenation. Laser skin resurfacing devices utilize focused beams of light to improve skin texture and tone, while radiofrequency-based devices offer non-invasive methods to tighten skin and reduce wrinkles. Micro-needling products, which stimulate collagen production, are gaining popularity for their ability to treat fine lines and acne scars.

Aesthetics Product Development Steps:

Federal Food Drug & Cosmetic Act (FD&C Act) is FDAs legal authority for regulation of both medical devices and electron radiation emitting products. The act contains regulatory requirements which defines FDAs level of control over these products. And to fulfil these requirements of act for the products, FDA develops, publish and implement the regulation.

Federal Register (FR) it is the official daily publication for rules, proposed rules and notifications, executive orders and presidential documents of given by federal agencies and organizations.

Code of Federal Regulations (CFR), It is codification of in general and permanent rules published in Federal Register by executive departments and agencies of federal Government, they are segmented into 50 titles representing wide areas which are subjected to federal regulation. Most of these regulations are present in title 21 CFR parts 800-1299. Part 878 of CFR contains General and plastic surgical devices.

Medical devices are segmented into class I, II, III based on the risk it poses, class I need only general controls, class II needs special controls including premarket notification and class III devices needs premarket approval from FDA.

Aesthetics devices fall into one of these categories, and accordingly suitable approvals from FDA are required for its successful launch in the market.

Aesthetics Market Size Overview:

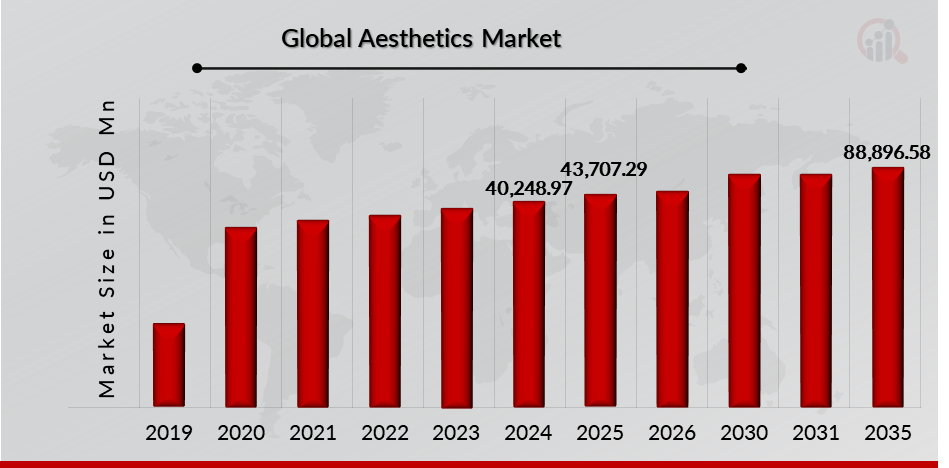

As per MRFR analysis, the Aesthetics Market Size was estimated at 40,248.97 (USD Million) in 2024. The Aesthetics Market Industry is expected to grow from 43,707.29 (USD Million) in 2025 to 88,896.58 (USD Million) till 2032, at a CAGR (growth rate) is expected to be around 10.41% during the forecast period (2025 - 2032).The rising demand for aesthetic procedures, increasing approval and launch for aesthetics products are th e key market drivers enhancing the growth of the market.

Source: The Secondary Research, Primary Research, MRFR Database and Analyst Review

Aesthetics Regulatory Landscape:

There are several key regulatory agencies who oversee the approval and monitoring of Aesthetics to ensure their safety, efficacy, and quality.

| Regulatory agencies | Regulatory Ministry |

| Federal Food and Drug Administration | United States: Department of Health and Human Services (HHS) |

| The Medicines and Healthcare products Regulatory Agency | United Kingdom: The Medicines and Healthcare products Regulatory Agency (MHRA) under the Department of Health and Social Care (DHSC) |

| Central Drug Standard Control Organization | India: The Ministry of Health and Family Welfare |

| South African Health Products Regulatory Authority (SAHPRA) | National Department of Health. |

| Pharmaceuticals and Medical Devices Agency (PMDA) | Japan: Ministry of Health, Labour and Welfare. |

| National Medical Products Administration (NMPA) | China: The Ministry of Health |

| Health Sciences Authority | Singapore: The Ministry of Health |

| European Medicine Agency | European union |

| Brazilian Health Regulatory Agency (Anvisa) | Ministry of Health, part of the Brazilian National Health System (SUS) |

Aesthetics Guidelines:

Some of the aesthetic treatments are not recommended until certain age, specially to young people before 18 years of age as the body is still developing, for instance rhinoplasty is considered safer from the age of 18. The proper age for different techniques and methods varies, for young people minimally invasive methods are preferred, and for middle aged extensive plastic surgery can also be recommended.

People with autoimmune pathologies like lupus, rheumatoid arthritis, and multiple sclerosis can face potential impact on physiological reaction of body upon aesthetic treatment. Can show adverse events, which can render aesthetic interventions nonviable for these individuals.

Furthermore, people with hypersensitivity to constituents used in the treatment. For instance, chemicals in chemical peel, are not advised to undergo the aesthetic procedure, as adverse immunological response can be severe and cause various complications.

Even people having bleeding disorder and those undergoing anticoagulant therapy may show increased propensity to ecchymosis and haemorrhage at the site of medical intervention, such things can affect efficacy of treatment and can cause adverse effects.

Aesthetics Classification of the Product:

Aesthetics Regulatory Process Overview, By Country:

U.S. food and drug administration FDA regulates aesthetics medical devices for ensuring safety and efficacy, quality. Under FDA there is Centre for Devices and Radiological Health (CDRH) which looks after all the regulations regarding medical devices.

The centre comprises five advisory committees, which includes medical devices advisory committee, containing 18 panels, covering medical speciality areas. Among them there is General and Plastic Surgery Devices Panel (GPSDP) responsible for reviewing and evaluating data for ensuring safety and efficacy of investigational general and plastic surgery devices marketed. And gives appropriate suggestions to food and drugs commission.

Regulatory classes are given by FDA for different medical devices which include class I (low risk) , class II (moderate risk), class III (high risk) . Different Aesthetic medical devices usually fall under one of these categories. Class I only need general controls and class II need special controls like premarket notification 510(K) and class III need premarket approval (PMA) which usually involve clinical trials and detailed safety efficacy data and FDA review process.

FDA’s includes Quality System Regulation (QSR) which is contained in 21 CFR Part 820 and needs manufacturer adhere to quality system for ensuring that their products meet quality requirements and specifications given by FDA. Quality systems for FDA-regulated products include good manufacturing practices (CGMPs). QSR gives standards regarding designing, manufacturing, packaging, labeling, storing, installing, and servicing of medical devices which are marketed for human use.

Post market surveillance activities include Medical Device Reporting (MDR), according to which it is mandatory for adverse events and device malfunctioning to be reported to agency. Further investigation of the issue and product recall if required is done.

Some of the FDA approvals received for Aesthetics in recent years

October 2024, Allergan Aesthetics, an AbbVie company received the U.S. FDA approval of BOTOX Cosmetic for temporary improvement in the appearance of moderate to severe vertical bands connecting the jaw and neck (platysma bands) in adults.

June 2023, Galderma announced that the U.S. Food and Drug Administration (FDA) approved Restylane Eyelight, a groundbreaking hyaluronic acid filler designed specifically to treat undereye hollows, commonly referred to as dark shadows. This product stands out as the first and only filler in the U.S. to utilize NASHA Technology, allowing for improved volume restoration in the delicate under-eye area for up to 18 months.

August 2020, Revance Therapeutics, Inc. announced the establishment of its commercial infrastructure to launch its innovative aesthetics portfolio, starting with the RHA Collection of dermal fillers. These are the first and only FDA-approved dermal fillers designed to correct dynamic facial wrinkles and folds

Aesthetics Regulatory Updates and Amendment’s:

there was no official progress towards aesthetics regulation in 2024 in England.

No official progress in aesthetics regulation of England in 2024 was observed, however, there has related update for Wales where for premises conducting non-surgical cosmetic procedures such as electrolysis or tattoos new licensing scheme was implemented and announced in November 2024.

Their first government missive concerning aesthetic regulation was out in 2023, it was first of many proposals surround non-surgical cosmetic procedures, and it sets number of recommendatory guidelines, including

based on risk of safety to public they have RAG-rating procedures, which determines aesthetic practitioners who can offer treatment based on red/amber/green category.

Mandatory 2 licences needed to all practitioners, including one for themselves and other for the premises. Allowing only trained and qualified practitioners to carry certain procedures, while licensed non medic can only administer certain treatments under the supervision of suitable certified medical professionals.

In September 2023, these Proposals were published on Department of Health & Social Care (DHSC) website.

Aesthetics Regulatory Challenges:

Food And Drug Administration (FDA) Warning Letter Associated with The Dermal Fillers; FDA warning letters regarding dermal fillers are restraining the Aesthetics market growth by undermining consumer confidence in treatment safety and efficacy. Increased regulatory scrutiny leads to higher compliance costs for manufacturers and practitioners, creating barriers to innovation and market entry. For instance, in October 2021, the FDA's warning against the use of needle-free devices for injecting dermal fillers is significantly restraining the dermal filler market by raising safety concerns and consumer apprehension. These high-pressure "pens" lack the precision needed for effective and safe application, leading to potential complications and adverse effects. The FDA emphasized that only FDA-approved fillers should be administered using traditional syringes or cannulas, as improper methods could increase the risk of contamination and infection. Reports of unapproved devices being sold online and promoted via social media have further heightened public awareness about these risks, prompting caution among potential users. This regulatory alert can lead to diminished consumer confidence in dermal filler procedures, ultimately hampering market growth as individuals may hesitate to pursue aesthetic enhancements due to fears of adverse outcomes.

Compliance with regulatory frameworks given by FDA is utmost important to get required premarket notification which will not delay the approval process and material used for the device manufacturing should be biocompatible, not harming the patient, otherwise it will lead to safety issues and disapproval or product recall by FDA.

Possible Risk in development of Aesthetics:

Fake And Counterfeit Version of Botox Fillers

The prevalence of fake and counterfeit versions of Botox is significantly restraining the global Aesthetics market, posing serious risks to consumer safety and undermining trust in legitimate products. These illicit versions, often sold at drastically reduced prices through unregulated channels, can contain harmful substances or improper formulations that lead to severe adverse reactions. For instance, in April 2024, recent reports from the FDA have linked counterfeit products to severe adverse effects, including blurred vision, drooping eyelids, and respiratory issues, resulting in hospitalizations for some victims. With 19 individuals across nine states experiencing these harmful reactions after receiving injections from untrained providers in non-healthcare settings, public confidence in aesthetic treatments is waning. The ongoing investigation involving the CDC and state health departments underscores the seriousness of the issue, as healthcare providers are urged to scrutinize products for signs of counterfeiting. As consumers become increasingly aware of these risks, they may hesitate to pursue legitimate cosmetic procedures, thereby hampering market growth and complicating efforts to promote safe and effective aesthetic treatments.

Shortage Of Trained and Experienced Dermatologist/ Plastic Surgeon

The limited availability of skilled dermatologists or plastic surgeons is adversely affecting the growth of the Aesthetics market. In addition, the lack of training programs for dermatologists and the limited availability of scholarship and research funds are resulting in fewer admissions to undergraduate and postgraduate dermatology courses than required. According to the International Society of Aesthetic Plastic Surgery (ISAPS), in 2021, there were approximately 1,000 and 600 plastic surgeons in the France and UK respectively. Furthermore, the slow adoption of new technologies in emerging countries such as Romania and the Czech Republic among others contributes to the shortage of dermatologists or plastic surgeons.

market faces challenges such as high costs, cultural resistance, safety concerns, and economic downturns that limit access. Regulatory hurdles and FDA approvals can slow adoption, particularly for new technologies. Despite these, opportunities abound in expanding access to underserved groups, such as men, and offering personalized treatments. Innovations in nonsurgical fat reduction and tattoo removal offer further growth potential, while medical spas and more affordable financing options provide new avenues for market expansion.

Aesthetics Competitive Landscape Dashboard:

Companies With Marketed Aesthetics Products

-

Abbvie, Inc.

-

Merz Pharma

-

Candela Medical

-

Cynosure

-

Bausch Health

-

Companies, Inc.

-

Galderma

-

BTL Group of Companies

-

Lumenis

-

Cutera, Inc.

-

Alma Lasers

Regulatory Landscape - Table of Content

Table of contents will appear here once available.

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”