Summary Overview

Management Consulting Market Overview:

The global management consulting business is expanding steadily, driven by increased demand in areas such as manufacturing, retail, healthcare, and logistics. Organizations are increasingly looking to consultants for help navigating complicated operational environments, streamlining processes, and driving change. Our paper provides an in-depth review of procurement trends, highlighting tactics that prioritize cost savings, digital enablement, and performance improvement.

Key future challenges include controlling transformation costs, ensuring solutions scale with expansion, protecting sensitive information, and integrating new strategies with old systems. To remain competitive, firms are embracing digital procurement technologies and strategic sourcing techniques based on real-time market knowledge and flexible operating models.

Market Size: The global Management Consulting market is projected to reach USD 559.61 billion by 2035, growing at a CAGR of approximately 4.68% from 2025 to 2035.

Growth Rate: 4.68%

-

Manufacturing and Supply Chain Optimization: Organizations are under growing pressure to simplify operations by implementing integrated processes and ensuring real-time data visibility.

-

Retail and E-Commerce Acceleration: Consultants help businesses use scalable solutions to increase agility and digital growth.

-

Technology Advancements: Cutting-edge advances in artificial intelligence and machine learning are changing how organizations estimate demand, automate decision-making, and achieve new levels of efficiency.

-

Modular Solution Design: The transition to configurable, modular technology platforms allows enterprises to modify capabilities based on demand, decreasing complexity while preserving flexibility.

-

Cloud Investment Strategies: Businesses are preferring cloud-first systems to cut infrastructure costs, boost remote accessibility, and maintain operational reliability.

-

Regional Growth: North America and Asia-Pacific continue to lead in digital adoption, thanks to strong infrastructure and a rising demand for innovation.

Key Trends and Sustainability Outlook:

-

Cloud-Enabled Agility: Businesses are moving to the cloud to gain operational scalability, cost savings, and real-time access to critical data.

-

Next-Generation Capabilities: The integration of technologies such as IoT, AI, and blockchain is becoming increasingly important in enabling better decision-making and transparency across ecosystems.

-

Sustainability Alignment: There is an increased emphasis on environmental and regulatory compliance. Advanced systems now enable sustainable resource management and ESG tracking.

-

Industry-Specific Solutions: There is a growing need for sector-specific changes, particularly in high-impact businesses that require nuanced, tailored methods.

-

Insight-Driven Performance: Data and analytics are critical to enabling better operations, including forecasting and performance monitoring.

Growth Drivers:

-

Enterprise Digital Transformation: Businesses are adopting digital initiatives to increase operational agility, boost performance, and future-proof their business models.

-

Process Automation: Strategic automation projects aim to reduce manual processes, risk, and increase cost efficiency.

-

Scalable Development Models: Consulting partners assist firms in implementing systems and structures that enable long-term development and adaptation.

-

Regulatory Alignment: With increasing regulatory constraints, organizations must implement compliant, auditable procedures. Consulting skills ensures that governance and risk mitigation are implemented from the start.

-

Global Operations Enablement: Multinational corporations require help on managing cross-border operations, such as multi-currency, multi-lingual support, and region-specific compliance methods.

Overview of Market Intelligence Services for the Management Consulting Market:

Recent evaluations have highlighted persisting issues for organizations, including high implementation costs and an increasing desire for personalized solutions. To overcome this complexity, firms are increasingly relying on procurement analytics to find cost-saving possibilities, improve supplier performance, and maintain strategy alignment. Market intelligence reports give actionable data that enable businesses to maintain compliance and industry standards.

Procurement Intelligence for Management Consulting: Category Management and Strategic Sourcing

As firms face increasing pressure to increase efficiency and reduce costs, procurement has emerged as a key competitive advantage. Effective category management and strategic sourcing strategies are proving vital for decreasing costs while maintaining ongoing access to high-quality, mission-critical solutions. Consulting businesses advise customers on how to use data-driven tactics such as expenditure analysis and supplier performance tracking to get the most out of their procurement investments over time. Businesses that use focused market data are better positioned to predict changes in supplier dynamics, respond to market volatility, and future-proof their sourcing strategy.

Pricing Outlook for Management Consulting: Spend Analysis

The pricing environment for business IT solutions is projected to be somewhat dynamic, impacted by a variety of changing variables. Rapid improvements in digital technologies, rising demand for cloud-native systems, increased customisation requirements, and regional market diversity are all major factors.

Graph shows general upward trend pricing for Management Consulting and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To deal with these changing cost challenges, firms are focused on optimizing procurement processes, strengthening vendor relationships, and adopting modular solution designs that decrease complexity and allow for scalable investment. Streamlining vendor assessment and performance monitoring and utilizing digital procurement technologies to improve openness and uniformity.

Partnering with reputable technology providers and effectively structuring procurement agreements such as multi-year contracts or subscription-based models can considerably increase cost predictability and value realization. While pricing constraints remain, firms that prioritize scalable technology adoption, rigorous implementation planning, and cloud-first infrastructure are best positioned to preserve operational agility and cost effectiveness.

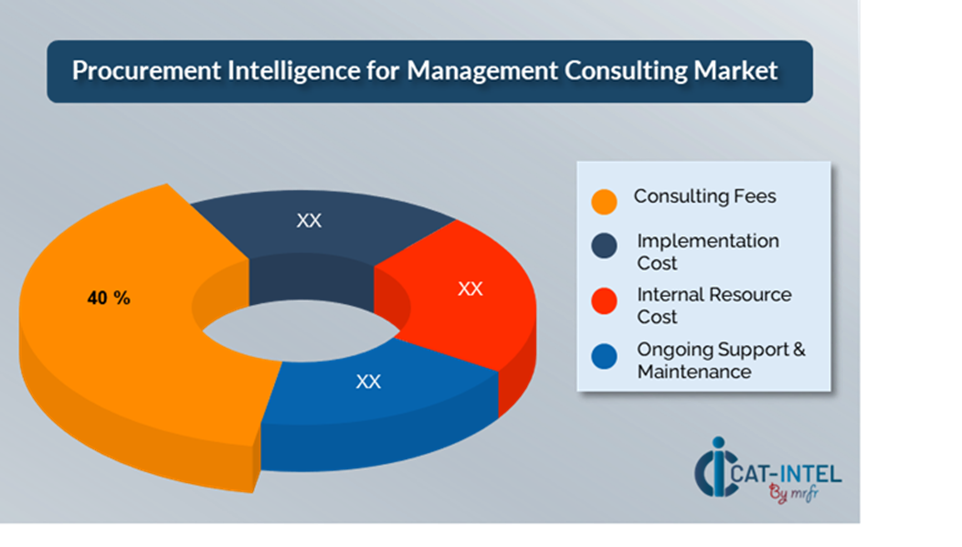

Cost Breakdown for Management Consulting: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Consulting Fees: (40%)

-

Description: Consultant fees cover time, knowledge, and intellectual property. They might be set, hourly, or project-based, depending on the engagement.

-

Trend: As corporations prioritize digital transformation, consulting firms with skills in AI, data analytics, and cybersecurity are charging greater rates.

- Implementation Cost: (XX%)

- Internal Resource Cost: (XX%)

- Ongoing Support & Maintenance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In today's rapidly changing business technology world, streamlining procurement procedures and implementing data-driven negotiating methods may lead to considerable cost savings and operational improvements. Organizations may benefit from long-term relationships with innovative solution providers, particularly those that provide scalable, cloud-based platforms, as well as volume-based savings and packaged service packages. Subscription-based and multi-year contract formats are becoming more common, allowing businesses to lock in cheap rates while hedging against future cost rises.

Working with vendors that are committed to innovation and flexibility adds value by providing access to next-generation capabilities such as sophisticated analytics, AI-powered insights, and modular architecture. These qualities not only lower long-term expenses but also prepare firms for long-term scalability and agility. Using a multi-vendor strategy can help to decrease operational risks such service interruption, compliance gaps, and pricing volatility. Diversifying providers strengthens negotiating power and ensures access to best-in-class capabilities across the technology ecosystem.

Supply and Demand Overview for Management Consulting: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The business IT solutions market continues to expand, fuelled by the rapid speed of digital transformation in industries such as manufacturing, retail, and healthcare. Several variables influence the developing supply and demand dynamics, including technology breakthroughs, industry-specific demands, and global economic situations.

Demand Factors:

-

Digital Transformation Initiatives: The requirement for centralized data management and process automation is driving the demand for unified technology solutions across sectors.

-

Cloud Adoption Trends: An increasing desire for cloud-based solutions is creating demand for scalable, adaptable, and subscription-based models that can increase operations fast while minimizing IT infrastructure expenses.

-

Industry-Specific Customization: Healthcare and manufacturing have unique requirements, such as regulatory compliance and alignment with industry workflows.

-

Integration Capabilities: As organizations increasingly embrace digital ecosystems, the requirement for smooth integration between enterprise systems and other business applications, such as IoT devices, grows.

Supply Factors:

-

Technological Advancements: AI, machine learning, and cloud computing are altering the possibilities of corporate technology solutions. They try to provide more complex, data-driven solutions.

-

Vendor Ecosystem Growth: The development of the vendor ecosystem, from large-scale global providers to small, specialized players, provides organizations with a variety of possibilities.

-

Global Economic Conditions: Exchange rates, labor costs, and regional technology adoption all impact the pricing and availability of corporate IT solutions.

-

Scalability and Flexibility: Modern enterprise solutions are more modular, allowing suppliers to service enterprises of varied sizes and complexities, evolving as organizations develop ensuring long-term value and adaptability.

Regional Demand-Supply Outlook: Management Consulting

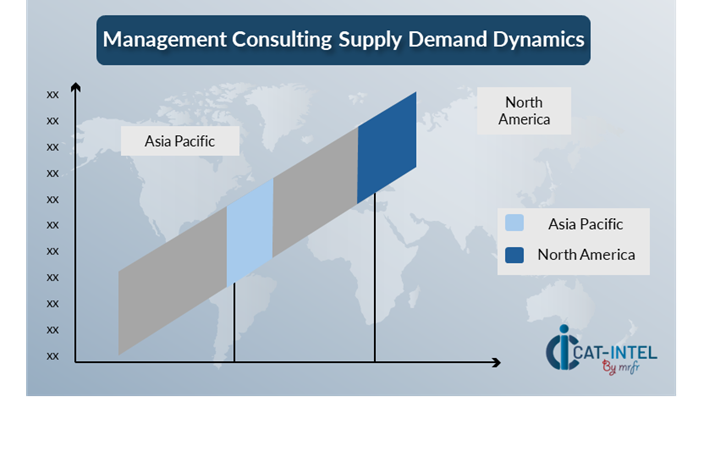

The Image shows growing demand for Management Consulting in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Management Consulting Market

North America, particularly the United States, is a dominant force in the global Management Consulting market due to several key factors:

-

Strong Economic Base: North America, notably the United States and Canada, has a thriving and diverse economy. This financial strength enables significant expenditures in advisory services across a variety of areas.

-

High Adoption of Technology and Innovation: North American firms are at the forefront of digital transformation and technological innovation, increasingly relying on consulting services to embrace new technologies and gain a competitive edge.

-

Presence of Major Consulting Firms: North America is home to some of the world's largest and most important management consulting companies, solidifying the continent's leadership in the consulting industry.

-

Highly Developed Infrastructure: The region has highly developed infrastructure in terms of technology, transportation, and logistics, making it simpler for consulting businesses to function efficiently.

-

Strong Demand for Operational Excellence: North American organizations are always looking for ways to increase operational efficiency, innovate, and stay ahead of competition, resulting in a steady demand for professional guidance and strategic insights.

North America Remains a key hub Management Consulting Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the corporate IT solutions market is both diversified and competitive, with a mix of global industry leaders and regional innovators. The mix of big, established providers and specialized local competitors has a substantial influence on critical elements including pricing structures, solution customisation, and service quality. The industry is primarily driven by well-known worldwide technology suppliers that provide complete, all-inclusive business solutions. These providers use their size, reputation, and variety of services to assist major enterprises with diverse and complicated requirements.

The competitive dynamics of the business IT solutions market are defined by a complex combination of global leaders and regional innovators. As firms increasingly emphasize digital transformation and operational optimization, collaborating with the appropriate supplier whether a global behemoth or a specialized regional provider will be critical in ensuring the most appropriate, scalable, and cost-effective solutions. Consulting firms may assist organizations negotiate this complex and competitive supplier ecosystem, advising them on industry-specific needs, technology adoption targets, and long-term scalability.

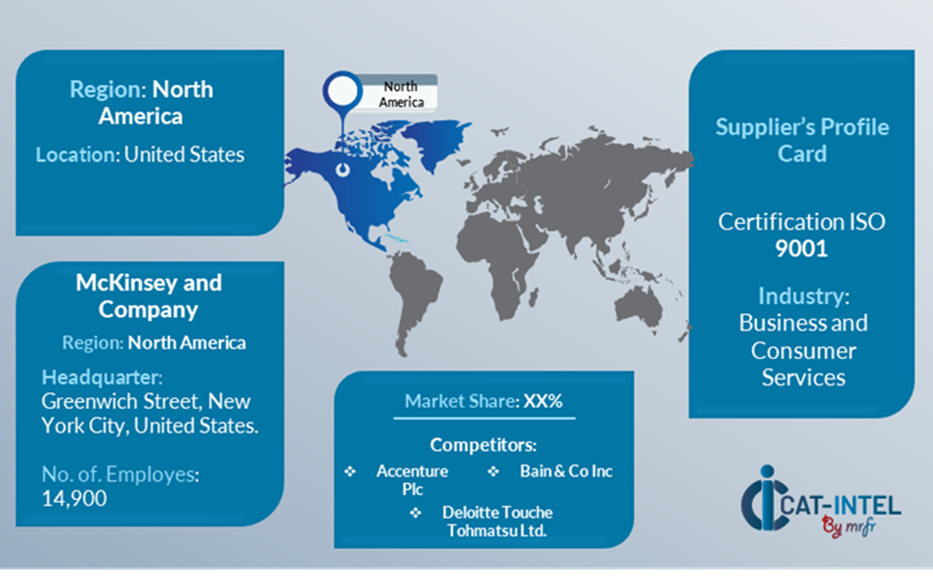

Key Suppliers in the Management Consulting Market Include:

- McKinsey and Company

- Boston Consulting Group

- Deloitte Consulting

- Accenture

- Bain & Company

- PwC Advisory Services

- Ernst and Young (EY) Advisory Services

- KPMG

- Capgemini

- IBM Global Services

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The management consulting market is rapidly expanding, driven by organizations looking to simplify operations, increase efficiency, and better resource management. |

Cloud Adoption |

Cloud-based solutions are increasingly being used across sectors, driven by the demand for scalable, cost-effective techniques and remote work flexibility. |

Product Innovation |

Industry-specific modules suited to areas such as manufacturing, retail, and healthcare assist customers in optimizing their operations, making them more adaptable and responsive to market changes. |

Technological Advancements |

Machine learning, IoT integration, and robotic process automation (RPA) are revolutionizing consulting services by enabling predicting insights, automating repetitive operations, and optimizing business processes for clients. |

Global Trade Dynamics |

Management consultants assist firms in navigating these transformations, advising them on how to adapt to the changing landscape, particularly in multinational corporations with complex operations. |

Customization Trends |

Companies are searching for flexible, modular techniques that can be integrated with third-party technologies and services, which is why management consultants are focused on providing bespoke solutions to suit each client's specific issues. |

|

Management Consulting Attribute/Metric |

Details |

Market Sizing |

The global Management Consulting market is projected to reach USD 559.61 billion by 2035, growing at a CAGR of approximately 4.68% from 2025 to 2035.

|

Management Consulting Technology Adoption Rate |

Approximately 65% of firms worldwide have implemented consulting-driven strategies to incorporate new technology, with a major move toward cloud-based and AI-driven solutions to improve operational efficiency and scalability.

|

Top Management Consulting Industry Strategies for 2025 |

Management consultants' key strategies include integrating AI and machine learning for predictive analytics and decision-making and prioritizing cybersecurity to ensure client protection in a digital world. |

Management Consulting Process Automation |

Approximately 55% of consulting projects now involve the automation of typical corporate activities such as payroll, compliance reporting, and inventory management, which improves operational efficiency and allows firms to focus on more strategic goals.

|

Management Consulting Process Challenges |

The consulting sector has significant obstacles, including high implementation costs, employee reluctance to change, the complications of data transfer, and the ongoing requirement for periodic upgrades to ensure solutions stay relevant in a fast-changing market. |

Key Suppliers |

Leading consulting organizations include McKinsey & Company, Boston Consulting Group (BCG), and Deloitte, which offer comprehensive solutions across several sectors and assist corporations in navigating challenging issues.

|

Key Regions Covered |

North America, Europe, and Asia-Pacific are major markets for consulting services, with rising demand from industries such as manufacturing, retail, and healthcare.

|

Market Drivers and Trends |

The consulting market is expanding because to the growing need for centralized management strategies, real-time business insights, and the integration of modern technologies like as IoT, AI, and data analytics to improve decision-making and operational efficiencies.

|