Summary Overview

Maize Gluten Protein and Soybean Meal Market Overview:

The global Maize Gluten Protein and Soybean Meal market is growing steadily, driven by increased demand in key areas such as animal feed, aquaculture, pet food, and agriculture. This market covers a variety of high-protein feed products that aim to improve cattle nutrition, increase feed efficiency, and promote sustainable farming methods. Our paper provides a detailed examination of procurement trends in this industry, highlighting cost-cutting tactics and the expanding use of novel sourcing methods to simplify supply chains and increase productivity.

The industry confronts several significant difficulties, including fluctuating raw material prices, the need for scalable sourcing strategies, upholding quality and safety requirements, and assuring seamless interaction with changing farming practices. To remain competitive, businesses are increasingly turning to digital procurement tools and strategic sourcing methodologies to optimize purchasing decisions, secure supply continuity, and reduce exposure to market volatility.

Market Size: The global Maize Gluten Protein and Soybean Meal market is projected to reach USD 26.31 billion by 2035, growing at a CAGR of approximately 3.42% from 2025 to 2035.

Growth Rate: 3.42%

Sector Contributions: Growth in the market is driven by:-

Manufacturing & Supply Chain Optimization: Leading manufacturers are investing in modern tracking systems to improve logistics, decrease downtime, and maintain uniform quality across production lines.

-

Animal Nutrition and Agri-Commodity Expansion: Feed makers are refining formulation techniques to satisfy changing nutritional criteria while increasing cost efficiency and digestibility.

-

Technological Transformation: Advances in artificial intelligence, machine learning, and agricultural technology are changing the way nutritional profiles are studied and adjusted.

-

Product Innovation: Modular nutrition solutions are gaining momentum, allowing feed manufacturers to customize protein mixes, increasing feed conversion rates and lowering waste.

-

Investment and Infrastructure: Companies are increasing production capacity and updating processing facilities to meet rising global demand while lowering operating costs.

-

Regional Insights: Asia Pacific and North America continue to dominate the market, owing to strong livestock industries, rising feed consumption, and continued investments.

Key Trends and Sustainability Outlook:

-

Protein Customization: There is a growing need for protein formulas tailored to certain species and stages.

-

Sustainable Sourcing: Consumer and regulatory expectations put pressure on producers to source maize and soy in a sustainable manner.

-

Smart Agriculture Integration: IoT, data analytics, and blockchain technology are being combined to improve transparency in sourcing and quality control.

-

Demand Forecasting: Data-driven insights help producers forecast market demand and improve inventories and distribution networks.

-

Environmental Compliance: A strong emphasis on minimizing environmental effect through fewer emissions, waste reduction, and better resource management.

Growth Drivers:

-

Global Protein Demand: The expanding meat and aquaculture sectors are driving up demand for high-protein feed ingredients.

-

Nutritional Efficiency: The growing emphasis on feed conversion ratios is generating interest in maize gluten and soybean meal as efficient protein sources.

-

Sustainability Restrictions: Tightening environmental restrictions encourage the use of traceable, sustainable inputs.

-

Feed Automation: Automation in feed mills increases formulation accuracy and operating throughput.

-

Trade Expansion: Globalization and lower trade barriers are creating new markets and speeding up cross-border distribution.

Overview of Market Intelligence Services for the Maize Gluten Protein and Soybean Meal Market:

Recent market evaluations have highlighted important problems such as variable commodity costs, irregular supply quality, and the necessity for adaptable procurement methods based on changing nutritional and sustainability requirements. Procurement intelligence reports are proven useful in delivering actionable information, allowing firms to find cost-saving possibilities, better monitor supplier performance, and improve sourcing results.

Procurement Intelligence for Maize Gluten Protein and Soybean Meal: Category Management and Strategic Sourcing

To remain competitive in the high-protein feed ingredient industry, businesses are improving procurement processes through strong category management and smart sourcing strategies. This involves identifying inefficiencies, minimizing wasteful spending, and reallocating budgets to optimize value across sourcing categories, as well as monitoring supplier reliability, delivery timeliness, and quality consistency to establish robust supply chains. Leveraging using real-time market data to improve negotiating positions and win advantageous contract terms for maize gluten protein and soybean meal purchases.

Pricing Outlook for Maize Gluten Protein and Soybean Meal: Spend Analysis

The pricing outlook for maize gluten protein and soybean meal is projected to continue variable, influenced by a mix of global economic, environmental, and industry-specific factors. Key drivers of price fluctuation include technical breakthroughs in feed composition, rising demand for high-protein feed across the livestock, poultry, and aquaculture industries, and regional supply and trade dynamics.

Graph shows general upward trend pricing for Maize Gluten Protein and Soybean Meal and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To negotiate these price fluctuations, procurement professionals are improving their tactics by emphasizing process efficiency and supplier performance management. Streamlining procurement contracts with transparent pricing, volume flexibility, and logistical assistance to decrease administrative complexity and ensure compliance. Tailoring purchases based on nutritional value and formulation requirements helps to minimize over-specification and successfully control input prices.

Partnering with dependable, innovation-driven suppliers may give access to higher-quality protein inputs as well as value-added services like nutritional consultation and on-site quality control. bargaining multi-season or multi-year contracts to assure consistent pricing and buffer against market volatility and employing supplier diversity methods to decrease reliance and increase bargaining leverage.

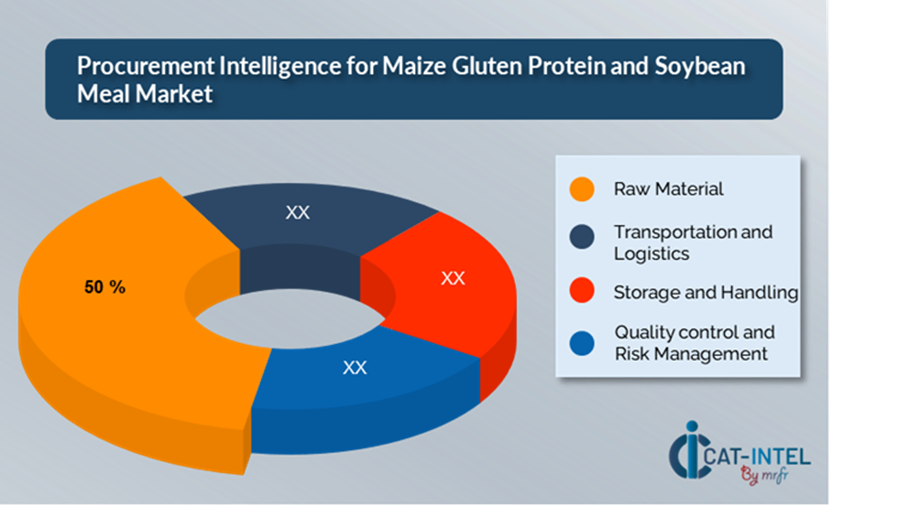

Cost Breakdown for Maize Gluten Protein and Soybean Meal: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Material: (50%)

-

Description: Raw material prices include the purchasing price of maize gluten protein and soybean meal. These prices are determined by global commodities markets, which include supply-demand dynamics, climatic conditions, and geopolitical issues.

-

Trend: Crop output changes, especially for maize and soybeans, have a direct influence on pricing. Weather-related interruptions and supply chain issues have recently resulted in increasing volatility.

- Transportation and Logistics: (XX%)

- Storage and Handling: (XX%)

- Quality control and Risk Management: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the competitive world of agricultural commodity sourcing, streamlining procurement procedures and using smart negotiating strategies may result in significant cost savings and increased supply chain efficiency. Long-term supply agreements with reputable protein meal suppliers, particularly those with consistent production capabilities and regional sourcing flexibility, can lead to more favourable pricing structures, such as volume-based discounts, bundled logistics services, and seasonal rate stabilization.

Working with suppliers who invest in product innovation, nutritional customisation, and sustainable production offers long-term operational advantages. These partners frequently provide improved protein consistency, digestibility, and access to value-added services like as nutrition analytics and traceability systems, allowing farmers to satisfy regulatory criteria and maximize feed performance. Leading firms are installing digital contract management systems, undertaking use analytics, and integrating real-time market monitoring technologies to simplify procurement procedures even further.

Supply and Demand Overview for Maize Gluten Protein and Soybean Meal: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global maize gluten protein and soybean meal market is growing steadily, driven by expanding protein demand in the livestock, poultry, aquaculture, and pet food industries. Sustainability demands and technology advances are increasingly influencing market dynamics feed in formulation and shifting global trade patterns.

Demand Factors:

-

Rising Global Protein Demand: As populations grow and meat consumption rises, there is a greater demand for high-protein feed components and low-cost protein sources to enhance feed efficiency.

-

Sustainable and High Efficiency Feeding: Pressure to decrease environmental impact is driving the development of improved feed formulations with high digestibility and balanced amino acid profiles.

-

Customized Nutrition Requirements: Feed mills and integrators are demanding more species-specific and lifecycle-specific mixes, necessitating bespoke protein solutions that meet changing nutritional requirements.

-

Traceability and Quality Assurance: End-users are putting more emphasis on sourcing transparency, safety, and compliance, especially in export-oriented activities.

Supply Factors:

-

Agri-Tech Advancements: Advances in crop breeding, processing technology, and nutrient extraction improve the quality and availability of maize gluten protein and soybean meal.

-

Diverse Supplier Landscape: The market includes a mix of global manufacturers, regional processors, and specialized feed component suppliers, providing purchasers with a variety of sourcing options across geographies and price ranges.

-

Global Economic and Trade Conditions: Currency fluctuations, export limitations, freight costs, and climatic influences on harvests all have an impact on product supply and prices in international markets.

-

Scalability and Supply Flexibility: Modern suppliers are increasingly capable of scaling output, providing variable contract terms, and customizing nutritional content, making it easier for purchasers to align procurement with operational and seasonal requirement

Regional Demand-Supply Outlook: Maize Gluten Protein and Soybean Meal

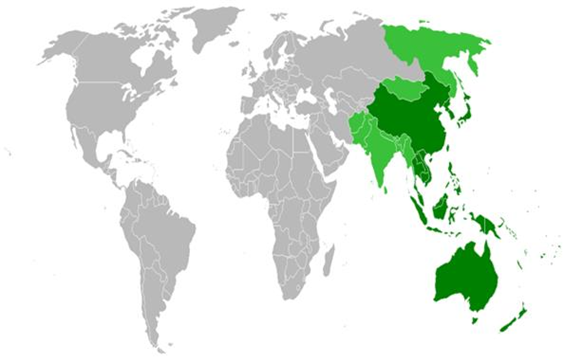

The Image shows growing demand for Maize Gluten Protein and Soybean Meal in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Maize Gluten Protein and Soybean Meal Market

Asia Pacific is a dominant force in the global Maize Gluten Protein and Soybean Meal market due to several key factors:

-

High Demand from Livestock: The Asia-Pacific area is home to some of the world's largest livestock and aquaculture sectors. Maize gluten and soybean meal are essential ingredients in animal feed for chickens, pigs, cattle, and fish husbandry.

-

Expanding Middle Class and Meat Consumption: The rapidly increasing middle class in China, India, and Southeast Asia is pushing up demand for meat and dairy products.

-

Proximity to Major Suppliers: Asia-Pacific has easy access to major global maize and soybean producers. Because of their closeness, nations in the area may source these materials at a lower cost and with more logistical efficiency.

-

Advancements in Agricultural Technology: The region has seen substantial improvements in agricultural techniques, such as the use of precision farming and new feed formulations.

-

Government Support and Trade Policies: Many Asia-Pacific nations, particularly China and India, have policies in place to promote agricultural growth and feed ingredient self-sufficiency.

Asia Pacific Remains a key hub Maize Gluten Protein and Soybean Meal Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment for maize gluten protein and soybean meal is diversified and competitive, with a mix of global agribusiness leaders, regional farmers, and specialist feed component sources. These vendors have a significant impact on pricing dynamics, product customization, quality assurance, and logistics efficiency. The market is dominated by well-established agricultural processors and grain exporters that provide stable quantities and integrated supply chain services. At the same time, specialized providers are gaining popularity by emphasizing value-added services such as improved digestibility, non-GMO certification, traceable sourcing, and customized nutritional profiles for certain species or production methods.

As the global animal nutrition industry gets more complex, providers are expanding processing capacity, investing in R&D, and providing improved technical assistance to satisfy the changing needs of feed makers, integrators, and commercial livestock operations. Buyers will emphasize supply chain resilience, traceability, and cost-efficiency, making the capacity to proactively connect with both global and regional suppliers important for securing long-term value and meeting nutritional performance benchmarks in the evolving protein feed landscape.

Key Suppliers in the Maize Gluten Protein and Soybean Meal Market Include:

- Wilmar International Limited

- Olam International

- The Louis Dreyfus Company

- CHS Incorporated

- Soja Austria

- Tate & Lyle Plc

- Ingredion Inc

- Cargill Inc

- Archer Daniel Midland Company

- Bunge Limited

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The worldwide maize gluten protein and soybean meal market is expanding rapidly, driven by increased demand for high-protein feed ingredients in the poultry, cattle, aquaculture, and pet food industries—particularly in emerging economies. |

Cloud Adoption |

Buyers are increasingly looking for sustainably sourced and verified protein meals (for example, non-GMO, organic, or ProTerra-certified). |

Product Innovation |

Suppliers are increasing their offers to include nutrient-enhanced blends, increased digestibility, and species-specific formulas targeted to feed conversion efficiency and growth performance. |

Technological Advancements |

The combination of precision agriculture, real-time analytics, and digital traceability systems improves supply chain transparency and nutritional uniformity. |

Global Trade Dynamics |

Export-import rules, tariffs, climate-related disruptions, and geopolitical events all have a substantial impact on price volatility and availability in important exporting regions (such as South America, the United States, and Ukraine). |

Customization Trends |

The growing need for tailored feed solutions based on lifecycle stage, species, and local nutrition criteria is changing how providers make and supply maize gluten and soybean meal products. |

|

Maize Gluten Protein and Soybean Meal Attribute/Metric |

Details |

Market Sizing |

The global Maize Gluten Protein and Soybean Meal market is projected to reach USD 26.31 billion by 2035, growing at a CAGR of approximately 3.42% from 2025 to 2035. |

Maize Gluten Protein and Soybean Meal Technology Adoption Rate |

Approximately 60% of large feed manufacturers currently use digital tools for market forecasts, supplier tracking, and nutritional analytics when obtaining protein meals. |

Top Maize Gluten Protein and Soybean Meal Industry Strategies for 2025 |

Key measures include diversifying supplier bases, getting multi-year contracts to provide pricing stability, procuring region-specific mixes, and using sustainable buying procedures. |

Maize Gluten Protein and Soybean Meal Process Automation |

Approximately 50% of large-scale integrators and feed producers are automating inventory planning, formulation processes, and quality checks to improve throughput and cost effectiveness. |

Maize Gluten Protein and Soybean Meal Process Challenges |

Key issues include raw material price volatility, logistical impediments, uneven supplier quality, and traceability compliance. |

Key Suppliers |

Leading worldwide and regional players include ADM (USA), Cargill (USA), Bunge, and Wilmar and regional cooperatives in Latin America and Asia. |

Key Regions Covered |

Major production and consumption regions include Asia-Pacific, North America, South America and parts of Europe. Asia-Pacific continues to lead in demand due to its thriving cattle industry.

|

Market Drivers and Trends |

Demand for cost-effective protein inputs, sustainable feed solutions, increased feed conversion efficiency, and data-driven procurement strategies all contribute to growth.

|