Summary Overview

Maintenance Services Market Overview:

The global maintenance services market is growing steadily, driven by increased demand in major industries such as manufacturing, healthcare, transportation, and energy. This dynamic market offers a variety of service types (scheduled, reactive, predictive, and condition-based) designed to enhance asset lifetime and operational continuity. Our report delves deeply into maintenance procurement trends, highlighting cost-cutting measures, risk-reduction tactics, and the use of modern digital technologies to improve maintenance planning and execution.

Organizations confront several crucial problems, including managing rising service costs, guaranteeing scalability across multi-site operations, protecting data integrity in digitally managed assets, and integrating contemporary maintenance solutions with old systems. To remain competitive, businesses are turning to data-driven sourcing methods and next-generation digital tools such as IoT-enabled monitoring and mobile work order systems, and AI-driven analytics to boost efficiency, extend asset lifecycles, and drive smarter decision-making.

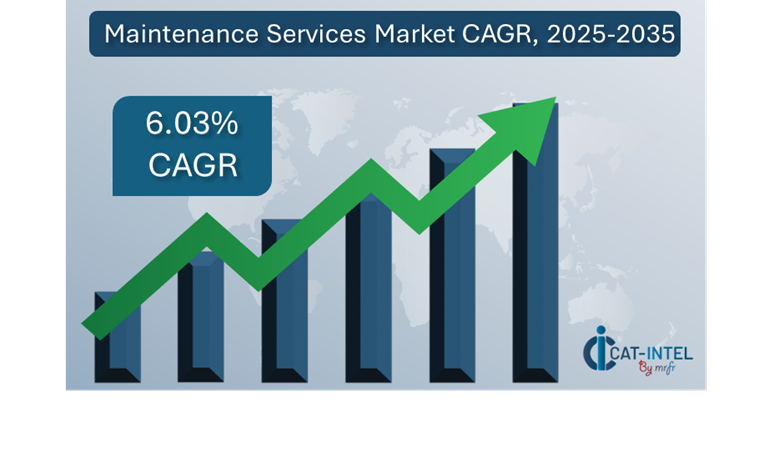

Market Size: The global Maintenance Services market is projected to reach USD 109.23 billion by 2035, growing at a CAGR of approximately 6.03% from 2025 to 2035.

Growth Rate: 6.03%

Sector Contributions: Growth in the market is driven by:

-

Manufacturing and Supply Chain Optimization: Organizations are focusing on real-time data visibility and process integration to improve asset performance, decrease downtime, and increase overall operational efficiency.

-

Retail and Logistics Expansion: The expansion of e-commerce and omnichannel retail models is increasing need for fast maintenance services to maintain continuous warehouse operations and delivery networks.

-

Technological Advancements: AI and machine learning are revolutionizing how firms foresee problems, allocate resources, and automate mundane service operations.

-

Innovations: Customizable maintenance plans allow businesses to select only the services they want, reducing costs and operational complexity.

-

Cloud-Based Maintenance Platforms: Companies are investing in cloud-based products to decrease IT overhead, provide remote diagnostics, and enable centralized administration.

-

Regional Trends: Asia Pacific and North America continue to dominate due to strong digital infrastructure, more industrialization, and a greater emphasis on proactive asset management.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Cloud-managed maintenance solutions are gaining popularity due to their scalability, cost effectiveness, and ability to access asset data from anywhere.

-

Smart Tech Integration: IoT sensors, artificial intelligence, and blockchain are increasingly being used to improve transparency, automation, and real-time condition monitoring.

-

Sustainability Focus: Maintenance services are now essential for resource efficiency, emissions tracking, and environmental compliance.

-

Customization Demand: Industries such as healthcare, energy, and heavy manufacturing are generating demand for industry-specific services.

-

Data-Driven Insights: Advanced diagnostics and reporting technologies let firms foresee problems, measure KPIs, and make faster, more informed choices.

Growth Drivers:

-

Digital Transformation: The increased requirement to digitize operations is driving the use of smart maintenance platforms.

-

Process Automation: Automated procedures assist organizations decrease human error and enhance maintenance response times.

-

Scalability Requirements: As organizations grow, they want for adaptable maintenance solutions that can adjust to changing operating demands.

-

Regulatory Compliance: Using automated documentation and auditing systems, maintenance providers assist verify that equipment and procedures comply with industry rules.

-

Global Operations: Businesses expect consistent service delivery across geographies, which increases demand for maintenance partners with global reach and regional experience.

Overview of Market Intelligence Services for the Maintenance Services Market:

Recent research has identified important problems in the maintenance services industry, such as high implementation costs and the requirement for customized solutions. Market intelligence studies give practical insights into procurement prospects, enabling businesses uncover cost-saving methods and enhance supplier relationships and improve service delivery effectiveness. These insights also help to assure industry standard compliance and high-quality operational operations, all while successfully controlling expenses.

Procurement Intelligence for Maintenance Services: Category Management and Strategic Sourcing

To remain competitive in the maintenance services industry, businesses are optimizing procurement procedures by doing expenditure analysis and analysing vendor performance. Effective category management and strategic sourcing are critical for lowering procurement costs while maintaining a consistent supply of high-quality maintenance solutions. Businesses may use actionable market knowledge to optimize procurement strategy, negotiate better terms with service providers, and increase the total value of their maintenance contracts.

Pricing Outlook for Maintenance Services: Spend Analysis

The pricing outlook for maintenance services is projected to be somewhat dynamic, impacted by several major factors. These include technological developments, increased demand for cloud-based solutions, the requirement for tailored maintenance packages, and regional pricing differences.

Graph shows general upward trend pricing for Maintenance Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement procedures, improve vendor management, and implement modular maintenance solutions are critical for cost control. Leveraging digital technologies for market monitoring, pricing forecasting using analytics, and smart contract management may considerably reduce costs.

Partnering with reputable maintenance service providers, negotiating long-term contracts, an investigating subscription-based pricing structures are all important techniques for efficiently controlling maintenance service costs. Despite these hurdles, concentrating on scalability, assuring robust service delivery, and implementing cloud-based platforms will be critical to sustaining cost-effectiveness and operational excellence in the future.

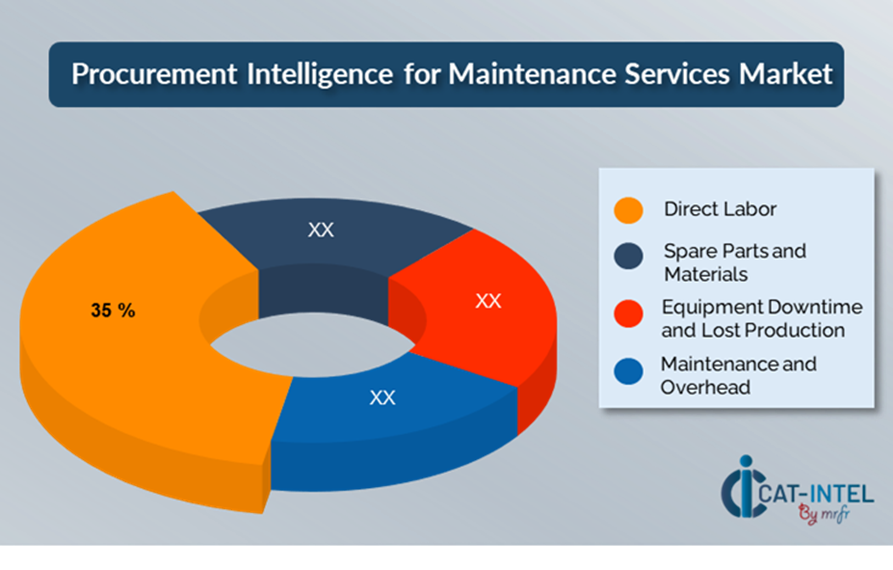

Cost Breakdown for Maintenance Services: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Direct Labour: (35%)

-

Description: Direct labor costs include pay, benefits, and training fees for the personnel doing maintenance activities.

-

Trend: Remote monitoring and predictive maintenance solutions are becoming increasingly popular for minimizing downtime manual intervention, reducing the need for large on-site labor forces.

- Spare Parts and Materials: (XX%)

- Equipment Downtime and Lost Production: (XX%)

- Maintenance and Overhead: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the maintenance services market, streamlining procurement procedures and implementing strategic negotiating strategies may result in significant cost savings and increased operational efficiency. Creating long-term agreements with maintenance service providers, especially those who provide cloud-based solutions, can assist in obtaining better pricing structures and attractive conditions, such as volume-based discounts and bundled service packages. Subscription-based approaches and multi-year contracts provide opportunity to lock in reduced rates while mitigating future price increases over time.

Collaboration with service providers who value innovation and scalability provides additional benefits, such as access to sophisticated analytics, AI-driven maintenance, and modular solutions, all of which assist to lower long-term operating expenses. Implementing digital procurement technologies, such as contract management platforms and use analytics, improves transparency, reduces overprovisioning, and maximizes service consumption. Diversifying vendor alternatives and implementing multi-vendor techniques can help to minimize reliance on a single source, manage risks such as service disruptions, and increase negotiation strength.

Supply and Demand Overview for Maintenance Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The maintenance services market is gradually growing, driven by the pace of digital transformation across sectors, examples include manufacturing, logistics, retail, and healthcare. Technological innovation, sector-specific service demands, and global economic trends all have a growing impact on supply and demand dynamics.

Demand Factors:

-

Digital Transformation Efforts: Organizations are prioritizing centralized asset management and automated service processes, which is increasing demand for intelligent, technology-powered maintenance solutions.

-

Shift to Predictive Maintenance: Businesses are shifting from reactive to predictive and condition-based maintenance, boosting the demand for data-driven, scalable services.

-

Sector-Specific Compliance and Needs: Specialized maintenance routines are required in industries like as healthcare and food processing to fulfill stringent regulatory and operational standards.

-

Integration with Smart Technologies: There is an increasing need for maintenance services that interface with IoT platforms, SCADA systems, and business applications, allowing for real-time monitoring and speedier decision-making.

Supply Factors:

-

Technological Advancements: AI, remote diagnostics, and cloud-based service platforms are transforming maintenance companies' capabilities and competitiveness.

-

Expanding Vendor Landscape: The market includes a diversified mix of specialist vendors, global service businesses, and tech-driven startups that provide a variety of service models and pricing alternatives.

-

Economic Influences: Labor expenses, regional inflation, and energy prices all have an influence on service delivery costs and contract pricing structures.

-

Service Scalability and Customization: Modern maintenance providers provide modular service packages, allowing clients to customize solutions depending on asset criticality, operational size, and budget.

Regional Demand-Supply Outlook: Maintenance Services

The Image shows growing demand for Maintenance Services in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Maintenance Services Market

Asia Pacific, particularly East Asia, is a dominant force in the global Maintenance Services market due to several key factors:

-

Rapid Industrialization and Urbanization: The expansion of infrastructure, manufacturing, and utilities has considerably raised the requirement for maintenance to assure constant operations and minimize costly downtimes.

-

Expanding Industrial Base: Asia-Pacific is home to some of the world's major industrial centres, which require dependable, scalable maintenance services to ensure machinery uptime, efficiency, and safety compliance.

-

Strong Adoption of Smart Technologies: The area is seeing increased investment in Industry 4.0 technologies, which allow predictive maintenance and drive demand for digital-first maintenance service providers.

-

Government Initiatives and Infrastructure Investments: Governments around the area are substantially investing in public infrastructure projects and smart city development, which is driving up demand for coordinated and tech-driven maintenance services.

-

Cost-Effective Trained Labor: Asia-Pacific has a significant pool of technically trained but low-cost labor, making it an appealing destination for international corporations looking to outsource maintenance operations.

North America Remains a key hub Maintenance Services Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the maintenance services market is broad and highly competitive, with a combination of global industry heavyweights and regional players that have a considerable impact on market dynamics. These vendors have an influence on key elements such as pricing models, service customisation, and service quality. While well-established service businesses dominate the market with comprehensive maintenance solutions, smaller, specialist players focus on certain industrial verticals or provide specialized features like predictive analytics and AI-powered maintenance.

The maintenance services supplier ecosystem encompasses important technological regions, including both well-known global firms and creative local suppliers who cater to industry-specific requirements. As enterprises prioritize digital transformation and operational efficiency, maintenance service providers are expanding their cloud capabilities, integrating sophisticated technologies, and providing flexible subscription models to meet the changing demands of businesses.

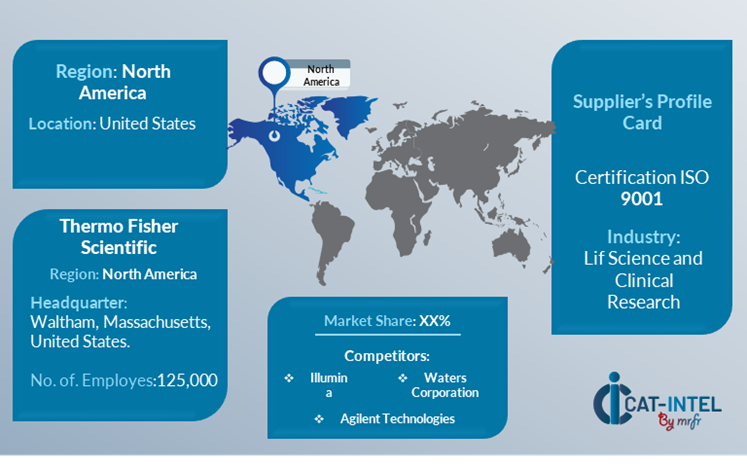

Key Suppliers in the Maintenance Services Market Include:

- Mitsubishi Electric

- Siemens AG

- Schneider Electric

- Honeywell International

- ABB Ltd

- Emerson Electric Co

- GE Digital

- Rockwell Automation

- Caterpillar Incorporated

- Thyssen-Krupp AG

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The maintenance services market is expanding rapidly, driven by a greater emphasis on asset uptime, preventative care, and operational reliability—particularly in fast-developing economies and infrastructure-intensive sectors. |

Cloud Adoption |

A considerable move toward cloud-based maintenance solutions is taking place, driven by the requirement for remote access, centralized data tracking, and support for hybrid work styles. |

Product Innovation |

AI-powered diagnostics, mobile access to maintenance records, and bespoke service plans geared to industries like as energy, manufacturing, and healthcare are among the enhancements offered by providers.

|

Technological Advancements |

The integration of IoT sensors, machine learning, and robotic process automation (RPA) is altering how maintenance is scheduled, delivered, and optimized, allowing for predictive and proactive solutions.

|

Global Trade Dynamics |

Changes in safety standards, environmental legislation, and international compliance frameworks are impacting how maintenance plans are designed, particularly for multinational companies. |

Customization Trends |

There is an increasing need for flexible, modular service contracts and connectivity with enterprise software systems, which allow firms to adjust maintenance techniques to individual operating needs. |

|

Maintenance Services Attribute/Metric |

Details |

Market Sizing |

The global Maintenance Services market is projected to reach USD 109.23 billion by 2035, growing at a CAGR of approximately 6.03% from 2025 to 2035.

|

Maintenance Services Technology Adoption Rate |

Over 60% of businesses have used digital maintenance solutions, with an increasing interest in predictive maintenance platforms and remote monitoring systems.

|

Top Maintenance Services Industry Strategies for 2025 |

Adoption of IoT-based maintenance, integration of AI for fault prediction, emphasis on mobile-enabled service delivery, and implementation of sustainability-focused asset strategies are among the key focal areas. |

Maintenance Services Process Automation |

Around 50% of maintenance operations now use automation for functions like as work order administration, compliance reporting, and inventory monitoring, which improves responsiveness and cost control.

|

Maintenance Services Process Challenges |

High implementation and equipment costs, worker skill gaps, legacy system integration, and data harmonization concerns are all significant impediments.

|

Key Suppliers |

Notable companies include Mitsubishi Electric, Siemens AG, and Emerson Electric, as well as specialty suppliers that provide sector-specific maintenance solutions.

|

Key Regions Covered |

Strong adoption is found in Asia-Pacific and North America, owing to industrial digitalization, infrastructure expenditures, and regulatory obligations.

|

Market Drivers and Trends |

The desire for real-time asset insights, cost optimization, compliance with safety requirements, and the need to extend equipment lifespan through smarter maintenance techniques all drive growth.

|