Summary Overview

Magnesium Chloride Market Overview:

The global Magnesium Chloride (MgCl₂) market is steadily growing, driven by increased demand in major industries like construction, pharmaceuticals, agriculture, and chemical processing. This market includes a variety of product forms, including flakes, pellets, and liquid solutions, each serving a specific industrial use. Our paper delves deeply into procurement trends, emphasizing cost-cutting methods and the use of innovative supply chain tools to improve sourcing and operational performance.

Key future procurement problems include controlling variable raw material costs, maintaining supply chain resilience, adhering to regulatory compliance, and incorporating sustainable sourcing techniques. Digital procurement platforms and data-driven decision-making are crucial for improving supply chains and ensuring long-term competitiveness. As worldwide demand of Magnesium Chloride continues to climb, organisations are utilizing market intelligence to boost operational efficiency, enhance product quality, and mitigate supply-side risks.

Market Size: The global Magnesium Chloride market is projected to reach USD 1.23 billion by 2035, growing at a CAGR of approximately 5.34% from 2025 to 2035.

Growth Rate: 5.34%

-

Manufacturing and Supply Chain Optimization: As demand for real-time logistics data and integrated processing grows, manufacturers and distributors are focusing on optimizing supply chain operations.

-

Construction and Industrial Applications Expansion: Industries are implementing advanced inventory and forecasting systems to efficiently manage material flow and ensure continuous supply. -

Technological Transformation: Emerging technologies like as automation, smart logistics, and data analytics are improving supply chain management and resource allocation.

-

Product Innovations: The development of value-added Magnesium Chloride products enables businesses to service specific industrial and agricultural markets while reducing costs and complexity. -

Investment Initiatives: Organizations are investing in updating manufacturing facilities, as well as expanding storage and distribution capacities, in order to fulfill global demand and lower logistics costs. -

Regional Insights: Asia Pacific and North America continue to drive market growth, owing to strong infrastructure, industrial expansion, and a greater emphasis on sustainable road treatment and agriculture practices.

Key Trends and Sustainability Outlook:

-

Sustainable Sourcing: Companies are pursuing ecologically friendly extraction and processing processes that adhere to global sustainability standards. -

Technological Integration: The application of IoT, real-time monitoring, and sophisticated tracking systems to increase quality control, traceability, and compliance. -

Focus on the Circular Economy: Initiatives for the reuse and recycling of chemical byproducts are gaining pace. -

Customization Demands: Product development strategies are driven by industry-specific grades and formulas. -

Data-Driven Decisions: Market information and analytics aid in the optimization of procurement, demand forecasting, and supply chain performance management

Growth Drivers:

-

Infrastructure Development: Global investment in road safety, building, and public infrastructure is increasing Magnesium Chloride use, notably for de-icing and concrete acceleration. -

Agricultural Demand: MgCl₂ is being used as a magnesium supplement in soil and animal feed, driving market growth. -

Environmental Regulations: Magnesium Chloride's ecologically safer profile as compared to alternatives enhances its competitive position. -

Global Trade Expansion: As global industrialization and climate response activities continue, there is a growing demand for dependable, international-grade supply chains. -

Compliance and Quality Standards: Premium-grade magnesium chloride helps industries achieve regulatory and product quality standards.

Overview of Market Intelligence Services for the Magnesium Chloride Market:

Recent market evaluations have identified procurement issues such as shifting raw material costs and supplier capacity restrictions. Market intelligence services include extensive cost breakdowns, supplier benchmarking, and risk management measures. These insights help businesses save expenditure and assure supply continuity and align sourcing practices with ESG objectives.

Procurement Intelligence for Magnesium Chloride: Category Management and Strategic Sourcing

Businesses are improving procurement techniques to remain competitive in the Magnesium Chloride market, including expenditure analysis, supplier audits, and contract optimization. Strategic sourcing is critical for ensuring high-quality commodities at stable pricing, managing volatility, and meeting changing end-user demands. Market intelligence enables procurement teams to make data-driven choices, increase productivity, and build stronger supplier relationships.

Pricing Outlook for Magnesium Chloride: Spend Analysis

The pricing outlook of magnesium chloride (MgCl₂) prices are predicted to fluctuate substantially due to several variables. Raw material and energy cost changes, demand from essential sectors such as construction and agriculture, grade-specific customisation, and regional supply chain variances are all significant factors.

Graph shows general upward trend pricing for Magnesium Chloride and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To deal with pricing volatility, businesses are stepping up efforts to simplify procurement procedures, improve supplier relationships, and diversify sourcing options. The use of digital technologies for real-time market monitoring, predictive pricing forecasting, and strategic contract management is becoming increasingly important for cost optimization.

Partnering with reputable suppliers, establishing long-term agreements, and investigating volume-based or flexible pricing structures are all useful techniques for minimizing Magnesium Chloride costs. Despite continued problems, securing supply chain resilience, maintaining product quality, and utilizing analytics-driven procurement will be critical to preserving cost efficiency and operational continuity

Cost Breakdown for Magnesium Chloride: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Material and Production: (45%)

-

Description: This comprises costs for magnesium-rich raw materials (e.g., carnallite, bischofite, seawater/brine), energy usage during extraction and processing, labour, and plant operations. -

Trend Insight: Producers are investing in more energy-efficient and environmentally friendly technology, which may steady or slightly lower long-term production costs.

- Transportation and Logistics: (XX%)

- Packaging and Storage: (XX%)

- Regulatory and Compliance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

Optimizing procurement procedures and implementing strategic negotiating approaches in the Magnesium Chloride (MgCl₂) business can result in significant cost savings and improved supply chain efficiency. Establishing long-term arrangements with dependable suppliers, particularly those that provide constant quality and scalable delivery, allows buyers to negotiate more attractive price structures, such as volume-based discounts and bundled logistics or warehousing services. Engaging with suppliers who embrace innovation and sustainability adds value by allowing access to high-purity formulations, environmentally friendly alternatives, and supply chain transparency. These upgrades can help to reduce long-term operational and regulatory compliance costs.

The use of digital procurement technologies, such as contract lifecycle management platforms, supplier performance analytics, and demand forecasting systems, increases visibility, reduces overstocking or underutilization, and assures optimal purchase cycles. Using a multi-supplier sourcing approach helps to diversify risk, minimize reliance on a single provider, and increase negotiation leverage. This technique is especially important for managing interruptions caused by raw material shortages, transportation constraints, and geopolitical issues. Supply and Demand Overview for Magnesium Chloride: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

Supply and Demand Overview for Magnesium Chloride: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Magnesium Chloride (MgCl₂) market is growing steadily due to increasing demand in key areas including construction, agriculture, medicines, and environmental management. Market dynamics are influenced by changing industrial uses, technical advancements in manufacturing, and global economic trends.

Demand Factors:

-

Infrastructure and Road Safety Initiatives: Increased demand for de-icing and dust management in transportation and municipal infrastructure is a significant growth driver, especially in colder countries. -

Agricultural Applications: Magnesium chloride is commonly used as a magnesium supplement for soil conditioning and cattle nutrition, which contributes to its popularity in sustainable farming techniques. -

Environmental and Industrial Use: MgCl₂ is becoming a safer choice for wastewater treatment, cement acceleration, and flue gas desulfurization due to greater environmental consciousness -

Customization for Industry Needs: Industries including medicines and food processing require high-purity MgCl₂, leading to customized product compositions and tight regulatory compliance.

Supply Factors:

-

Technological Advancements in Production: Innovation in extraction and purification technologies is increasing efficiency while also improving the quality and consistency of Magnesium Chloride. -

Supplier Ecosystem Growth: An expanding worldwide network of manufacturers and distributors—including vertically integrated suppliers—increases competition and provides buyers with more options. -

Global Economic Conditions: Variables including energy prices, raw material availability, labor costs, and currency volatility all have a direct influence on manufacturing costs and international pricing structures. -

Scalability and Distribution Flexibility: Suppliers are increasingly providing scalable supply agreements and logistical support to both high-volume industrial purchasers and smaller, more specialized consumers.

Regional Demand-Supply Outlook: Magnesium Chloride

The Image shows growing demand for Magnesium Chloride in both Asia Pacific and North America, with potential price increases and increased Competition.

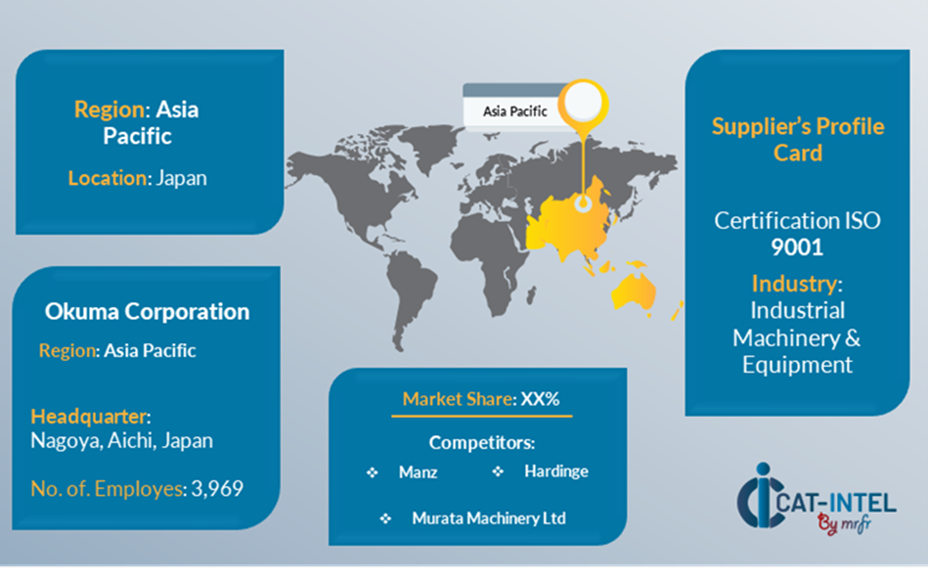

Asia Pacific: Dominance in the Magnesium Chloride Market

Asia Pacific, particularly China, is a dominant force in the global Magnesium Chloride market due to several key factors:

-

Abundant Raw Material Availability: Asia Pacific, notably China and India, contains large quantities of magnesium-bearing minerals (such as carnallite and bischofite) and easy access to brine sources -

Expanding Industrial and Agricultural Sectors: MgCl₂ usage is high in the region due to rapid industrialization and increased demand for soil conditioning and animal feed. -

Cost-Competitive Production Base: Asia Pacific's low labor costs, favourable energy prices, and government backing for chemical production enable it to dominate both local and export markets. -

Strong Export Capabilities: Asia Pacific nations have well-established export networks and port facilities, allowing for effective worldwide distribution of Magnesium Chloride at reasonable prices. -

Regulatory and Environmental Adaptability: Regional producers are increasingly aligning with global environmental and safety norms while retaining operational flexibility.

Asia Pacific Remains a key hub Magnesium Chloride Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The Magnesium Chloride (MgCl₂) supply environment is diversified and more competitive, with a mix of major chemical manufacturers and regional producers shaping market dynamics. These vendors play a vital role in determining pricing structures, product quality, delivery capabilities, and compliance with industry-specific standards. The market is dominated by established chemical corporations with substantial worldwide distribution networks and vertically integrated businesses. These vendors generally provide a diverse selection of Magnesium Chloride grades and forms for large-scale industrial applications.

Smaller providers specialize in specific markets, such as high-purity pharmaceutical or food-grade MgCl₂ and provide customized formulations and value-added services to fulfill regulatory and performance standards. Across important production and consumption regions, such as North America, Asia Pacific, and Europe, the supplier ecosystem includes both bulk commodities providers and nimble local producers. These regional companies offer logistical flexibility, faster reaction times, and localized assistance, making them ideal strategic partners for customers with specialized sourcing requirements.

Key Suppliers in the Magnesium Chloride Market Include:

- Hongyuan Chemicals

- Xiang Jiang

- Compass Minerals

- Dead Sea Works

- NedMag

- Alkim

- Huitai Group

- Chang Sheng

- Dongyuan Lianhai

- Winfast Plastic

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The market for magnesium chloride is seeing substantial expansion, driven by increased demand in construction, agriculture, de-icing, and industrial applications globally. |

Cloud Adoption |

MgCl₂ is emerging as a sustainable and ecologically acceptable alternative to salts for de-icing and dust management.

|

Product Innovation |

Manufacturers are offering high-purity, low-moisture and application-specific MgCl₂ formulations targeted for areas including medicines, food, and water treatment. |

Technological Advancements |

Advances in extraction, refining, and logistics technologies are increasing yield efficiency, product uniformity, and lowering environmental impacts. |

Global Trade Dynamics |

Global pricing and sourcing methods for MgCl₂ are influenced by changing trade legislation, export-import tariffs, and regional raw material availability. |

Customization Trends |

Industrial buyers are increasingly demanding bespoke grades and packaging alternatives to meet specific operational, regulatory, and seasonal needs.

|

Magnesium Chloride Attribute/Metric |

Details |

Market Sizing |

The global Magnesium Chloride market is projected to reach USD 1.23 billion by 2035, growing at a CAGR of approximately 5.34% from 2025 to 2035.

|

Magnesium Chloride Technology Adoption Rate |

Approximately 70% of large-scale infrastructure and industrial activities use MgCl₂ for de-icing, dust management, and process-specific purposes.

|

Top Magnesium Chloride Industry Strategies for 2025 |

Supplier diversity, the use of sustainable sourcing procedures, and long-term procurement contracts are all important cost-control strategies.

|

Magnesium Chloride Process Automation |

Approximately 60% of big purchasers use digital procurement tools to simplify sourcing, inventory tracking, and vendor performance monitoring.

|

Magnesium Chloride Process Challenges |

Price fluctuation, seasonal supply limits, logistical interruptions, and varying product quality requirements are all common challenges. |

Key Suppliers |

The leading suppliers are Hongyuan Chemicals, Giles Chemical, Shouguang Tiancheng Chemical, and Intrepid Potash.

|

Key Regions Covered |

Asia-Pacific, North America and the Middle East are major consumers and producers of dust control and agriculture products.

|

Market Drivers and Trends |

The push for eco-friendly solutions, development of infrastructure projects, increased usage in agriculture, and custom-grade advancements all contribute to growth.

|