Summary Overview

Machining Market Overview:

The global machining market is steadily expanding, supported by increased demand in major industries such as aerospace, automotive, medical devices, and industrial production. This dynamic industry encompasses a wide range of machining solutions, including precision CNC and multi-axis systems, additive manufacturing, and sophisticated automation technologies. Our report provides a detailed examination of machining procurement trends, with a particular emphasis on cost-efficiency, supplier optimization, and the use of cutting-edge digital technologies to expedite production and supply chain activities.

Key issues in machining procurement include managing large capital investments, assuring scalability, maintaining strict tolerances and quality standards, and integrating new technology with old systems. To remain competitive, businesses are turning to data-driven sourcing strategies and smart manufacturing solutions that increase productivity and decrease operational hazards. As global demand rises, businesses are using real-time market intelligence to increase efficiency, make better sourcing decisions, and future-proof their operations in an increasingly competitive environment.

Market Size: The global Machining market is projected to reach USD 808.53 billion by 2035, growing at a CAGR of approximately 6.9% from 2025 to 2035.

Growth Rate: 6.9%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing & Supply Chain Optimization: Real-time production data and seamless integration of machining processes are becoming increasingly important in order to improve operations and remove inefficiencies.

-

Retail and E-Commerce Growth: Increased customer demand and customisation is driving manufacturers to implement sophisticated machining solutions that increase inventory accuracy and enable flexible production models.

-

Technological Advancements: AI, machine learning, and industrial automation are transforming machining. and real-time quality monitoring, which significantly improves productivity.

-

Innovations: Modular machining systems and flexible automation platforms enable manufacturers to invest only in the capabilities they require, lowering capital investment and operating complexity.

-

Investment Initiatives: Companies are spending more in smart machining centers and cloud-connected equipment to decrease infrastructure costs and allow remote monitoring and diagnostics.

-

Regional Insights: Asia-Pacific and North America are leading the way thanks to strong digital infrastructure, a strong manufacturing base, and rapid adoption of Industry 4.0 technology.

Key Trends and Sustainability Outlook:

-

Smart Integration: Manufacturers are implementing linked machining technologies to create scalable, efficient, and highly responsive production environments.

-

Advanced Features: The integration of AI, IoT, and blockchain into machining systems enables automated decision-making, equipment traceability, and transparent supply chains.

-

Focus on Sustainability: Next-generation machining solutions decrease material waste, improve energy efficiency, and ensure regulatory compliance, all of which contribute to long-term ESG goals.

-

Customization Trends: Demand for industry-specific machining solutions is increasing, particularly in high-precision industries such as aerospace, automotive, and medical devices.

-

Data-Driven Insights: Advanced analytics give manufacturers real-time visibility into equipment performance, production trends, and operational bottlenecks.

Growth Drivers:

-

Digital Transformation: Rapid adoption of digital manufacturing equipment improves shop floor visibility, accuracy, and throughput.

-

Demand for Process Automation: Machining centers equipped with automated tool changes, robots, and AI-powered feedback loops assist to minimize manual mistakes and shorten cycle times.

-

Scalability Needs: Manufacturers require machining solutions that can scale with production demands while maintaining speed and quality.

-

Regulatory Compliance: Precision machining technologies help to meet high industrial requirements by ensuring consistent quality and traceability in operations. -

Globalization: Multinational corporations demand machining systems that can handle a wide range of manufacturing requirements, quality certifications, and export norms.

Overview of Market Intelligence Services for the Machining Market:

Recent publications highlight important procurement difficulties, such as rising capital expenditures and an increasing need for equipment customisation. Market intelligence services provide detailed insights into cost savings potential, supplier benchmarking, and lifetime cost optimization, allowing manufacturers to make educated buying decisions while maintaining operational excellence.

Procurement Intelligence for Machining: Category Management and Strategic SourcingTo remain competitive, manufacturers optimize their sourcing through rigorous expenditure analysis, performance benchmarking, and supplier partnership. Strategic sourcing and category management are increasingly critical for lowering procurement costs, assuring quality equipment supply, and decreasing downtime. Leveraging market intelligence allows for more effective negotiations, risk minimization, and long-term value development.

Pricing Outlook for Machining: Spend Analysis

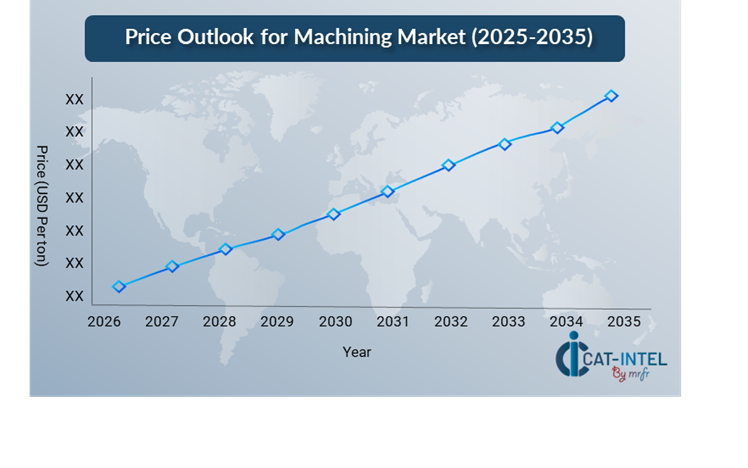

The pricing environment for machining equipment is projected to remain relatively volatile, affected by several important market factors. Price unpredictability is driven by technological progress, rising demand for automated and smart machining systems, industry-specific customisation requirements, and regional supply chain variables. Furthermore, the growing use of AI, IoT, and real-time analytics in machining processes, together with increased expectations for data security, traceability, and regulatory compliance, is putting upward pressure on equipment and solution cost.

Graph shows general upward trend pricing for Machining and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To offset growing costs, businesses are focusing on simplifying procurement, enhancing supplier relationships, and choosing modular machining systems that allow for gradual updates rather than complete equipment overhauls. This technique minimizes both complexity and capital expenditure. Companies are increasingly using digital procurement systems to monitor market swings, anticipate equipment pricing trends, and manage contracts more effectively.

Partnering with respected machining solution suppliers to ensure consistent quality and after-sales support; arranging multi-year service or equipment agreements to lock in cost and reduce market volatility. Despite price obstacles, success depends on concentrating on scalability, consistent execution, and technology-forward strategies all critical to maintaining cost-effectiveness while driving operational excellence in an increasingly competitive manufacturing landscape.

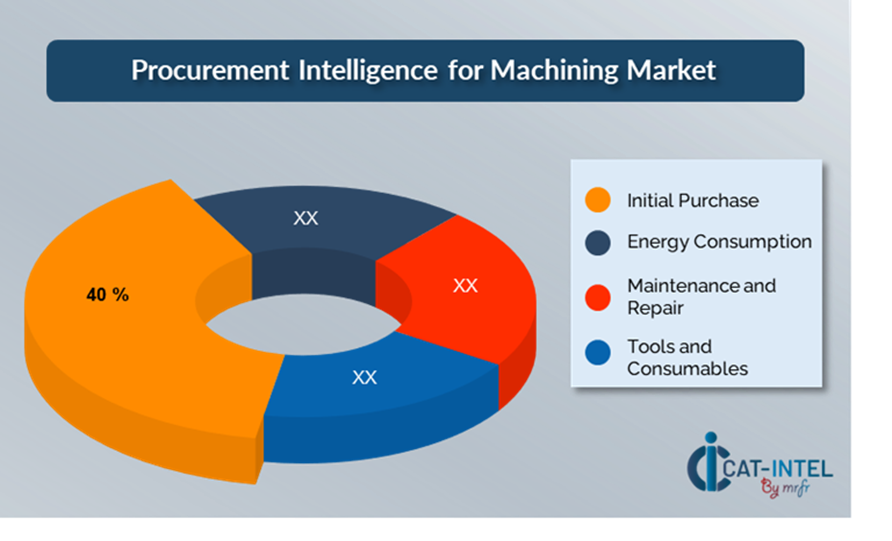

Cost Breakdown for Machining: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Initial Purchase: (40%)

-

Description: The initial purchase cost is the upfront capital investment necessary to buy machining equipment, which includes the cost of the machine tool, accessories, installation, and training.

-

Trend Point: As the manufacturing industry strives for high-performance equipment and new technologies such as automation and AI integration, the initial cost of machinery increases.

- Energy Consumption: (XX%)

- Maintenance and Repair: (XX%)

- Tools and Consumables: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the machining industry, streamlining procurement procedures and implementing strategic bargaining methods may result in considerable cost savings and increased operational efficiency. Long-term relationships with machining equipment suppliers, particularly those that provide automated, cloud-integrated, or service-based solutions, can result in more competitive pricing and terms, such as volume discounts and bundled maintenance packages. Leasing arrangements, subscription-based service plans, and multi-year equipment contracts all provide chances to lock in reduced rates and safeguard against future price increases, particularly as technology evolves fast.

Collaborating with forward-thinking machining solution suppliers, who stress innovation, scalability, and system compatibility, results in increased long-term value. Access to sophisticated features including real-time analytics. Using multi-vendor procurement techniques reduces reliance on a single supplier, increasing supply chain resilience and negotiating strength. Diversifying suppliers for machining tools, components, and support services reduces the risk of downtime, price volatility, and service interruptions while encouraging innovation from many partners.

Supply and Demand Overview for Machining: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The machining market is expanding steadily, propelled by the increasing adoption of digital manufacturing technologies and automation in industries such as aerospace, automotive, and medical devices. Technological innovation, the need for industry-specific solutions, and shifting global economic conditions all influence the supply-demand balance.

Demand Factors:

-

Demand Factors in the Machining Industry: Digital Manufacturing Initiatives. As industries rapidly adopt Industry 4.0 technologies, the demand for advanced data management and automation systems grows.

-

Cloud Adoption Trends: The advent of cloud-based manufacturing platforms and remote monitoring systems is driving up demand for scalable, subscription-based models that provide real-time machine data analysis.

-

Industry-Specific Requirements: Medical device production and aerospace have unique machining requirements that necessitate equipment that meets strict regulatory standards and particular operating processes.

-

Integration Capabilities: Manufacturers are increasingly looking for machining solutions that can interact seamlessly with other business applications to improve workflows and overall operational efficiency

Supply Factors:

-

Technological Advancements: AI, machine learning, and sophisticated robotics are transforming machining system capabilities, increasing supplier competitiveness.

-

Vendor Ecosystem: The market is seeing an increase in the number of machining solution providers, ranging from tiny manufacturers to large-scale vendors that offer entire manufacturing solutions.

-

Global Economic Factors: Exchange rates, shifting labor prices, and regional adoption of new manufacturing technology all influence the cost and availability of machining equipment.

-

Scalability and Flexibility: Modern machining systems are becoming more modular, allowing providers to serve enterprises of different sizes and complexity.

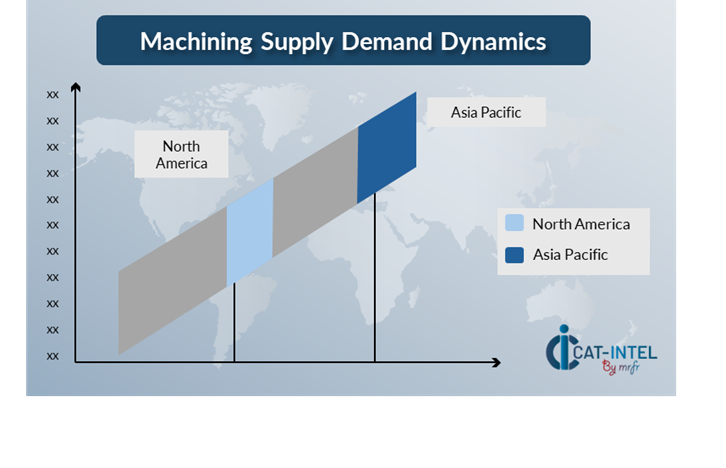

Regional Demand-Supply Outlook: Machining

The Image shows growing demand for Machining in both Asia Pacific and North America, with potential price increases and increased Competition

Asia Pacific: Dominance in the Machining Market

Asia Pacific, particularly East Asia, is a dominant force in the global Machining market due to several key factors:

-

Manufacturing Hub and Industrial Growth: Asia-Pacific is home to some of the world's major manufacturing economies, with robust industrial sectors that rely significantly on modern machining technology for high-precision production.

-

Cost-Effective Production and Labor: The availability of low-wage labor in several APAC nations has made the area an appealing location for industrial operations.

-

Technical Advancements and Innovation: The Asia-Pacific area is a technical innovation leader, with automation, robots, and smart manufacturing technologies being incorporated into machining processes.

-

Increased Adoption of Automation and Industry 4.0: Manufacturers in the Asia-Pacific area are investing in automated machining systems, robotic arms, and smart factories.

-

Strong Government Assist and Investments: Governments around APAC are investing extensively in infrastructure, manufacturing modernization, and technical advancements to assist industrial growth.

Asia Pacific Remains a key hub Machining Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The machining market's supplier environment is diversified and highly competitive, with global leaders and regional suppliers affecting critical elements such as price structures, equipment modification, and service quality. Established manufacturers dominate the industry, offering full machining solutions, while smaller, niche companies focus on specialty machines or unique technologies like AI-powered robots or sophisticated automation systems.

The machining supplier ecosystem includes significant worldwide vendors as well as creative local firms that cater to industry-specific requirements. As manufacturers prioritize digital transformation, precision, and efficiency, machining suppliers are improving their offerings by incorporating cutting-edge technologies, expanding cloud capabilities for remote monitoring, and providing more flexible purchasing models such as subscription-based services or leasing options to meet changing business needs.

Key Suppliers in the Machining Market Include:

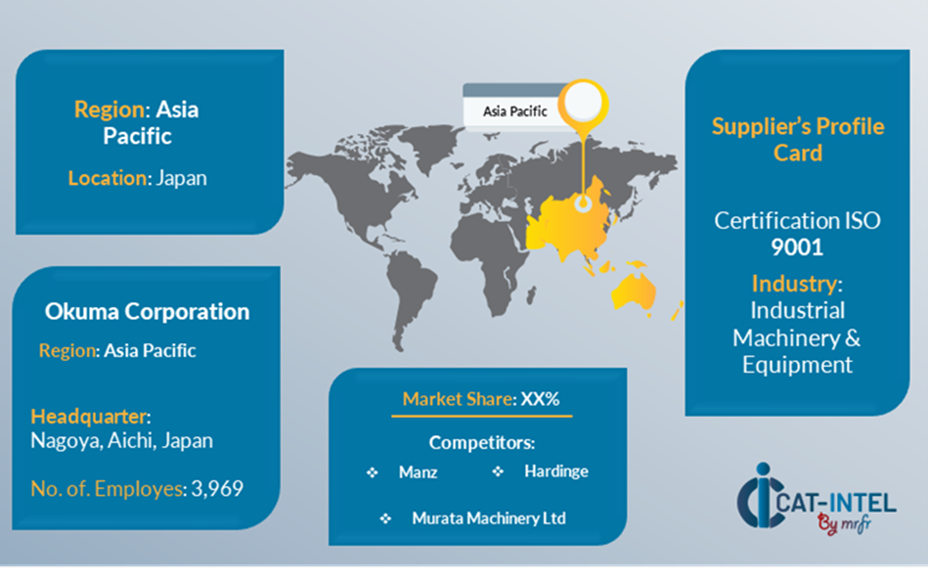

- Okuma Corporation

- Mazak Corporation

- DMG Mori

- Haas Automation

- Siemens AG

- Fanuc Corporation

- Hurco Companies Inc

- Kuka Robotics

- Makino Milling Machine Company, Ltd.

- Trumpf

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The machining industry is expanding rapidly, fueled by rising demand for precise production, automation, and smart manufacturing solutions, particularly in emerging regions.

|

Cloud Adoption |

There is a rising trend toward cloud-connected machining systems that provide remote monitoring, data-driven insights, and scalability, with many businesses embracing cloud-based platforms to boost productivity and accessibility.

|

Product Innovation |

Machining equipment manufacturers are increasing their products to include AI-powered diagnostics, real-time performance monitoring, and industry-specific tools for aerospace, automotive, and medical device manufacturing. |

Technological Advancements |

Machine learning, IoT integration, and robotic process automation (RPA) are boosting machining capabilities, predicting maintenance, and automating repetitive processes to increase productivity. |

Global Trade Dynamics |

Changes in trade legislation, compliance requirements, and regional economic policies all have an impact on machining industry trends, particularly for multinational businesses with worldwide supply networks. |

Customization Trends |

Customized machining solutions, such as modular equipment, bespoke tooling, and connection with third-party automation tools, are becoming increasingly popular among producers seeking flexibility and specific performance. |

Machining Attribute/Metric |

Details |

Market Sizing |

The global Machining market is projected to reach USD 808.53 billion by 2035, growing at a CAGR of approximately 6.9% from 2025 to 2035. |

Machining Technology Adoption Rate |

Approximately 60% of firms worldwide have used automated machining technology, with a substantial move toward cloud-connected systems for increased efficiency and data-driven decision-making.

|

Top Machining Industry Strategies for 2025 |

Key initiatives include incorporating AI-driven optimization tools, boosting automation with modular equipment, prioritizing cybersecurity in smart systems, and using mobile machine monitoring for greater accessibility.

|

Machining Process Automation |

To increase total efficiency, over 50% of machining processes now automate routine functions such as tool management, quality inspection, and inventory monitoring.

|

Machining Process Challenges |

Major hurdles include a large capital investment, personnel training on sophisticated systems, integration concerns with outdated machinery, and the requirement for ongoing system updates and maintenance.

|

Key Suppliers |

Leading machining equipment companies include Okuma Corporation, Mazak, DMG Mori and Haas Automation, who provide complete solutions across several sectors.

|

Key Regions Covered |

Asia-Pacific and North America are critical regions for machining adoption, with high demand from the automobile, aerospace, and medical device production industries.

|

Market Drivers and Trends |

The growing requirement for increased accuracy, the increasing acceptance of smart machining solutions, the demand for real-time machine data, and the integration of cutting-edge technologies such as AI, IoT, and robotic automation are all driving growth.

|