Summary Overview

Lubricants Market Overview:

The lubricant industry is steadily expanding, fuelled by demand from industries such as automotive, industrial, energy, and construction. This market contains a variety of lubricants, including mineral-based, synthetic, and bio-based products. Our research includes a detailed examination of procurement trends, with an emphasis on cost-effective tactics and the use of innovative technology to improve procurement and operations.

The lubricant market has several future problems, including managing fluctuating raw material costs, assuring product performance consistency, maintaining environmental sustainability, and integrating novel innovations into existing manufacturing systems. Digital technologies and strategic sourcing are critical for improving lubricant uptake, maintaining long-term competitiveness, and meeting changing customer demands. As demand continues to climb, organizations are leveraging market intelligence to improve operational efficiency and decrease risks.

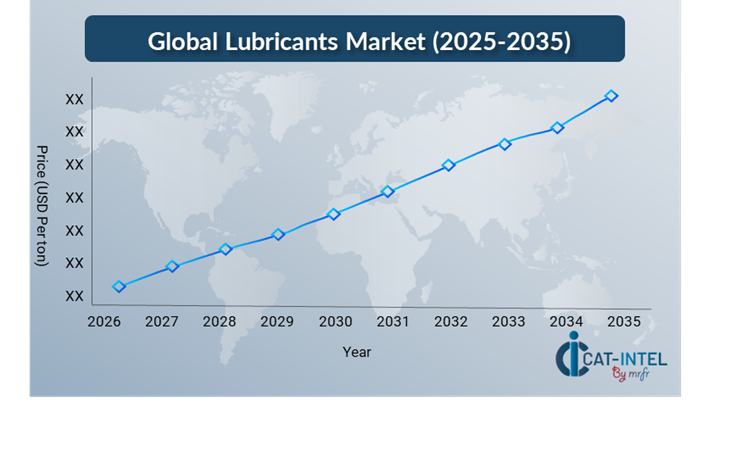

Market Size: The Lubricants market is projected to reach USD 225.42 billion by 2035, growing at a CAGR of approximately 4.02 % from 2025 to 2035.

Growth Rate: 4.02%

Growth Rate: 4.02%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: The growing requirement for real-time data and process integration is driving demand for lubricants in industries, which help to streamline processes and improve efficiency.

Retail and E-Commerce Growth: The expansion of the e-commerce and retail industries is driving the adoption of advanced lubricant solutions for inventory management, demand forecasting, and CRM.

Technological Transformation: Predictive analytics and automation are being used to improve lubricant performance, minimize downtime, and increase efficiency in several sectors.

Innovations: Modular lubrication solutions enable organizations to choose and integrate only the products they require, lowering costs and complexity.

Investment Initiatives: The emergence of eco-friendly and bio-based lubricants not only reduces environmental effect but also assists businesses in lowering overall production and infrastructure expenses.

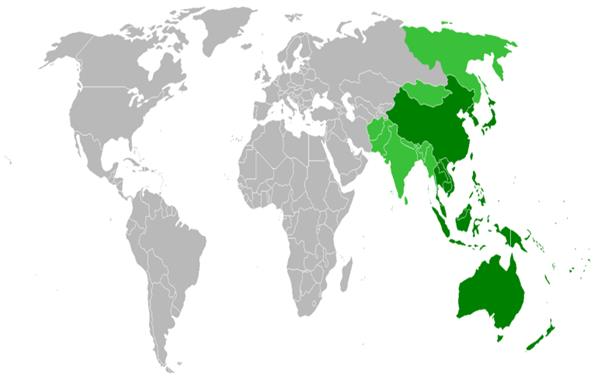

Regional Insights: Asia Pacific and North America continue to dominate the worldwide lubricant market, owing to solid industrial expansion, strong digital infrastructure, and increased usage of innovative and environmentally friendly lubricants.

Key Trends and Sustainability Outlook:

Cloud Integration: The increased usage of cloud-based lubricant systems is allowing for better data access, scalability, and cost efficiency in lubricant production and distribution.

Advanced Features: Integrating AI, IoT, and blockchain technologies into lubricant solutions improves decision-making, performance monitoring, and supply chain transparency.

Focus on Sustainability: Lubricants that minimize energy consumption and improve operational longevity are becoming increasingly important for businesses seeking to satisfy sustainability targets.

Customization Trends: As industries such as automotive, manufacturing, and energy require specialized solutions, lubricant companies are developing industry-specific products that solve the unique needs of each sector.

Data-Driven Insights: The lubricant market uses advanced analytics to predict demand, optimize inventory, eliminate waste, and improve operational performance through precise lubrication scheduling.

Growth Drivers:

Digital Transformation: As businesses throughout the world adopt digital technology, there is a growing demand for improved lubrication solutions that increase productivity, minimize friction, and extend machinery lifespan.

Demand for Process Automation: As manufacturing and production facilities become more automated, the necessity for dependable, high-performance lubricants that assure smooth operation grows.

Scalability requirements: Industries are looking for scalable lubrication solutions that can grow with their operations, ensuring that equipment and machines continue to work ideally as organizations expand.

Regulatory Compliance: Lubricant solutions that help businesses comply with environmental regulations and compliance standards are becoming increasingly critical, especially as sustainability requirements increase.

Globalization: As organizations develop globally, there is an increased demand for lubricants that can support multinational operations, including multi-currency and multi-regulatory compliance.

Overview of Market Intelligence Services for the Lubricants Market:

Recent research has identified important problems in the lubricant business, including fluctuating raw material costs, regulatory compliance, and the need for environmentally friendly product solutions. Market intelligence reports provide useful insights into procurement opportunities, enabling businesses to identify cost-cutting methods, optimize supplier relationships, and enhance overall procurement strategies. These insights also ensure that firms meet industry requirements and maintain high-quality operations while successfully controlling costs.

Procurement Intelligence for Lubricants: Category Management and Strategic Sourcing

To stay competitive in the lubricant market, businesses are improving their procurement procedures through spend monitoring and supplier performance tracking. Effective category management and smart sourcing play a crucial role in lowering procurement costs and ensuring a reliable supply of high-performance lubricants. Businesses that use actionable market intelligence can improve their procurement strategy, negotiate better deals, and get the most effective lubricant solutions adapted to their operational needs. This method contributes to risk mitigation, efficiency improvement, and long-term sustainability goals in an increasingly competitive market.

Pricing Outlook for Lubricants: Spend Analysis

The pricing outlook for the lubricant market is projected to remain moderately dynamic, with potential variations caused by several major factors. Advancements in lubricant technology, rising demand for sustainable and bio-based lubricants, the requirement for customization across industries, and regional pricing discrepancies all have an impact on pricing.

Graph shows general upward trend pricing for Lubricants and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To efficiently manage costs, businesses are refining procurement procedures, enhancing vendor management, and implementing modular lubrication solutions. Businesses can improve the cost efficiency of their lubricant procurement strategies by leveraging digital tools for market monitoring, applying sophisticated analytics to forecast prices, and implementing efficient contract management processes.

Partnering with reputable lubricant suppliers, negotiating long-term contracts, and investigating bulk pricing or subscription-based models can all help firms efficiently manage lubricant costs. Despite pricing issues, prioritizing sustainability, guaranteeing efficient product performance, and implementing eco-friendly lubrication solutions will be crucial to sustaining cost-effectiveness and operational excellence.

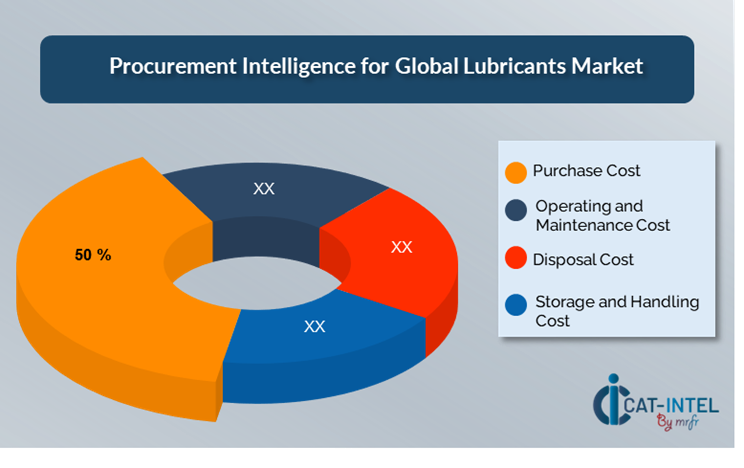

Cost Breakdown for Lubricants: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Purchase Cost (50%)

Description: This covers the initial costs of purchasing lubricants. It is frequently the greatest component of the TCO, comprising the cost paid to vendors for the lubricant goods themselves.

Trends: Companies are sourcing high-performance lubricants that last longer, decreasing the need for frequent replacements and lowering total purchasing costs.

Operating and Maintenance Cost: (XX%)

Disposal Cost: (XX%)

Storage and Handling Cost: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the lubricant sector, streamlining procurement processes and implementing strategic bargaining methods can result in significant cost savings and increased operational efficiency. Long-term partnerships with dependable lubricant suppliers, particularly those that provide sustainable and high-performance lubricants, can result in more advantageous price structures, such as volume-based discounts and bundled service packages. Subscription-based arrangements and multi-year contracts allow you to lock in reduced rates while reducing the impact of pricing variations over time.

Working with lubricant suppliers who value innovation and scalability can bring additional benefits, such as access to cutting-edge formulations, environmentally friendly products, and sophisticated lubricants that save long-term operational costs. Suppliers who combine AI, IoT, and predictive analytics may provide solutions that improve machine performance, extend equipment life, and optimize resource utilization implementing digital tools like contract management platforms, usage analytics, and market monitoring tools can enhance procurement transparency, optimize inventory levels, and prevent over-purchasing.

Supply and Demand Overview for Lubricants: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lubricant industry is steadily expanding, propelled by technical improvements and the changing needs of industries including as automotive, industrial, energy, and construction. Advancements in lubricating technology, industry-specific requirements, and economic conditions all have an impact on the lubricant market's supply and demand dynamics.

Demand Factors:

Sustainability and Environmental Regulations: Growing environmental consciousness and severe laws are fuelling demand for eco-friendly and bio-based lubricants.

Technological Advancements in Machinery: As companies adopt more advanced machinery and equipment, the demand for specialized lubricants that ensure high performance, durability, and low downtime grows.

Industry-Specific Requirements: Custom formulations are in high demand to address certain industries' special problems, such as high-temperature resistance and energy efficiency.

Demand for Performance: Demand for lubricants that extend equipment life, save maintenance costs, and increase operational efficiency is increasing across industries.

Supply Factors:

Technological Advancements: In lubricant compositions, such as synthetic and bio-based lubricants, which improve product performance.

Vendor ecosystem: A rising number of lubricant suppliers, including both huge worldwide names and smaller specialty makers, is keeping the industry competitive.

Economic Factors: Include exchange rates, geopolitical difficulties, and labour expenses, which all have an impact on lubricant pricing and supply. Furthermore, changes in trade rules and energy costs might impact the cost and availability of raw materials used in lubricant production.

Scalability and Customization: Modern lubricant solutions are becoming more modular and adaptable, allowing vendors to cater to businesses of varying sizes and complexity.

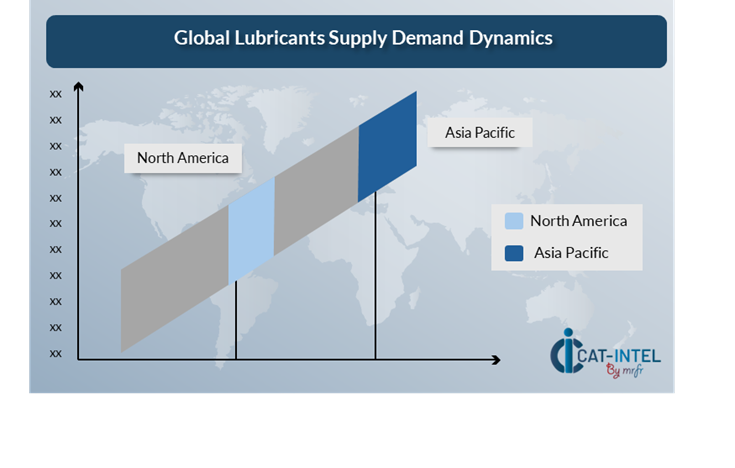

Regional Demand-Supply Outlook: Lubricants

The Image shows growing demand for Lubricants in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Lubricants Market

Asia Pacific, particularly China, is a dominant force in the Lubricants market due to several key factors:

Rapid industrialization and Economic Growth: The rising manufacturing, automotive, and energy industries have greatly increased demand for high-performance lubricants, propelling the market forward.

Expanding the Automotive Sector: With increased vehicle production and customer demand, particularly for passenger cars and commercial vehicles, the automotive sector is a key driver of regional lubricant consumption.

Large Manufacturing Base: Includes heavy machinery, electronics, and steel manufacturing. These industries require high-quality lubricants to maintain the smooth functioning and longevity of machinery, which drives up lubricant demand in the region.

Expanding Infrastructure Development: Continuous infrastructure development, particularly in emerging nations, drives up the demand for lubricants in the construction, mining, and transportation industries.

Cost-Effective Production and Localized Supply Chain: The presence of established lubricant manufacturers and strong local supply chains makes the region an attractive market for both consumers and suppliers.

Asia Pacific Remains a key hub Lubricants Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The lubricant market is similarly varied and intensely competitive, with a mix of large international suppliers and regional businesses influencing important market dynamics. These vendors influence key elements such as pricing models, product innovation, and service quality. Well-established worldwide brands dominate the market, offering comprehensive lubricant solutions, while smaller, specialized providers focus on specialty products customized to certain industries or advanced features like eco-friendly formulations and high-performance additives. Large, established vendors dominate the lubricant market by providing a diverse selection of lubricants suitable for a variety of industrial applications, including automotive and heavy machinery.

These companies drive innovation in product formulas and have a significant presence, which influences pricing and availability. As demand for high-performance and ecological lubricants increases, Businesses must carefully consider their supplier selections while balancing cost, quality, and innovation. Companies may improve their lubricant procurement strategy by analysing the supplier environment and adopting technology-driven solutions to ensure long-term operational success.

Key Suppliers in the Lubricants market include:

Sinopec

Shell

ExxonMobil

Chevron

Total Energy

BP (British Petroleum)

Fuchs Petrolub

Lukoil

Castrol (a BP subsidiary)

Shaanxi Yanchang Petroleum

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The lubricant industry is expanding significantly, driven by rising demand in industries such as automotive, industrial, and energy, as companies prioritize efficiency and sustainability in their operations. This expansion is especially evident in emerging markets, which are experiencing industrialization and technological advancements.

|

Cloud Adoption |

The demand for greater environmental responsibility, regulatory compliance, and energy efficiency has prompted an increasing trend toward sustainable and eco-friendly lubricant options. Eco-friendly lubricants, such as bio-based and synthetic oils, are gaining popularity in businesses that value lowering carbon emissions.

|

Product Innovation |

Lubricant providers are diversifying their product offerings to satisfy the changing needs of industries. Lubricant formulation innovations, such as high-performance synthetic oils, specialist additives, and lubricants that can withstand extreme temperatures and heavy machinery, are in high demand. |

Technological Advancements |

Smart lubricants that interact with IoT devices enable organizations to monitor machinery performance in real time, optimize lubrication cycles, and predict maintenance requirements, lowering downtime and operational expenses.

|

Trade Dynamics |

Changes in international trade rules, such as stronger environmental standards and shifting tariff policies, are hurting the lubricant sector, particularly multinational corporations that manage complicated worldwide supply chains. economic policies, as well as swings in raw material prices, have a considerable impact on pricing. |

Customization Trends |

Companies seek flexible and customized lubrication solutions that interface seamlessly with their machinery, meeting unique specifications and contributing to operational efficiency. the ability to create bespoke formulations for specific industry applications is becoming a critical factor for lubricant suppliers. |

|

Lubricants Attribute/Metric |

Details |

Market Sizing |

The Lubricants market is projected to reach USD 225.42 billion by 2035, growing at a CAGR of approximately 4.02 % from 2025 to 2035.

|

Lubricants Technology Adoption Rate |

Approximately 64% of lubricant manufacturers have implemented innovative technological solutions to optimize their processes, with a noticeable move toward sustainable and high-performance lubricant formulas.

|

Top Lubricants Industry Strategies for 2025 |

The emphasis is on developing eco-friendly, bio-based lubricants to fulfil increasing environmental laws and consumer demand for sustainable products. Companies are introducing smart lubricants that connect with IoT devices, allowing for real-time data collecting and predictive analytics to improve maintenance scheduling and performance.

|

Lubricants Process Automation |

Approximately 55% of lubricant firms are automating regular processes such as inventory management, ordering systems, and quality control checks. This increases operating efficiency, lowers human error, and enhances supply chain management.

|

Lubricants Process Challenges |

The creation of high-performance and environmentally friendly lubricants frequently comes with high production costs, which can be a difficulty for producers. Sourcing high-quality components for innovative lubricant formulations can be difficult, especially given volatile supply chains and economic situations.

|

Key Suppliers |

Prominent lubricant suppliers include Sinopec, Shell and ExxonMobil, providing comprehensive lubricant solutions across various sectors, including automotive, industrial manufacturing, and energy.

|

Key Regions Covered |

Key regions for lubricant adoption include Asia Pacific, North America, and Europe, with strong demand in automotive manufacturing, heavy machinery, and energy sectors.

|

Market Drivers and Trends |

The growing demand for eco-friendly lubricants and adherence to strict environmental standards. Integration of IoT and AI technology in lubrication systems to provide continuous performance evaluation and predictive maintenance. The demand for high-performance lubricants that minimize downtime, increase machine longevity, and lower maintenance costs. |