Summary Overview

LPG Market Overview:

The global LPG (Liquefied Petroleum Gas) market is steadily expanding, propelled by rising demand in industries such as residential, commercial, automotive, and industrial. This market covers a variety of LPG solutions, such as bulk deliveries, cylinder distribution, and CNG replacements. Our paper provides a detailed examination of procurement trends, emphasizing cost-cutting techniques and the use of digital tools to optimize supply chain and operational procedures.

Key future issues in LPG procurement include managing price variations, ensuring supply chain resilience, upholding safety standards, and incorporating new technology for improved monitoring and efficiency. Advanced procurement tools and strategic sourcing are crucial to increasing LPG use and maintaining long-term market competitiveness. As global demand rises, organizations are leveraging market intelligence to improve operational efficiency, enhance delivery networks, and mitigate supply risks.

Market Size: The global LPG market is projected to reach USD 191.95 billion by 2035, growing at a CAGR of approximately 4.57% from 2025 to 2035.

Growth Rate: 4.57%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: The increasing demand for real-time data and process integration is critical to optimizing LPG production, distribution, and logistics.

-

Retail and E-Commerce Growth: As the retail and e-commerce industries rise, so does the demand for dependable and efficient LPG supply systems.

-

Technological Transformation: The use of AI, machine learning, and data analytics in the LPG industry is altering operations, increasing operational efficiency and consumer happiness.

-

Innovations: The transition to modular solutions in LPG distribution, such as flexible storage and transportation systems, enables firms to respond to market demands while lowering operational costs and complexity.

-

Investment Initiatives: Businesses are rapidly investing in digital technologies that improve LPG management, accessibility, and real-time decision-making, resulting in more flexible and robust operations.

-

Regional Insights: Asia Pacific and North America continue to be significant drivers of LPG market growth, owing to strong digital infrastructure and growing adoption of cloud-based solutions.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Cloud solutions' scalability, cost efficiency, and better data accessibility enable enterprises to handle fluctuating demand, streamline operations, and improve customer service.

-

Advanced Features: Integrating technologies such as IoT and blockchain into LPG supply systems improves decision-making by delivering real-time data and increasing transparency across the supply chain.

-

Focus on Environmental: The LPG market is increasingly aligned with environmental goals, offering solutions that improve resource management and lower carbon footprints.

-

Customization Trends: Tailored products enable organizations fulfill specific requirements and maintain the efficient delivery of LPG in various conditions, such as remote areas or large-scale industrial plants.

-

Data-Driven Insights: Advanced analytics in the LPG market allow firms to optimize inventory levels, estimate demand, and monitor critical performance metrics.

Growth Drivers:

-

Digital Transformation: The increasing digitalization of the LPG industry enables firms to optimise operations, cut costs, and improve customer experiences.

-

Demand for Process Automation: From distribution to invoicing, automation lowers human error, speeds up procedures, and enhances operational efficiency in LPG supply chains.

-

Scalability Requirements: Businesses are investing in flexible systems that can manage both small and large-scale activities, providing peak performance regardless of growth or market volatility.

-

Regulatory Compliance: As environmental laws tighten, LPG firms are turning to modern IT solutions to ensure compliance.

-

Globalization: The need for LPG solutions that facilitate multi-region, multi-currency, and multi-regulatory compliance is growing as the market becomes more globalized.

Overview of Market Intelligence Services for the LPG Market:

Recent evaluations have highlighted important problems in the LPG business, such as high implementation costs and the need for customized solutions to fulfill various operational requirements. Market intelligence studies provide significant information that help businesses identify cost-cutting opportunities, optimize supplier relationships, and improve the success of system deployment. These insights also help to assure compliance with industry standards, maintain high-quality operational processes, and effectively control costs throughout the supply chain.

Procurement Intelligence for LPG: Category Management and Strategic Sourcing

To stay competitive in the LPG market, businesses are improving their procurement processes through spend analysis and supplier performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs while guaranteeing a consistent supply of high-quality LPG solutions. Businesses can use actionable market knowledge to refine their procurement strategies, maximize supplier negotiations, and secure favorable terms for LPG-related services, whether for distribution, storage, or transportation.

Pricing Outlook for LPG: Spend Analysis

The pricing prognosis for LPG solutions is projected to remain moderately dynamic, with changes caused by a variety of variables. Technological developments, rising demand for sustainable and energy-efficient solutions, and regional pricing disparities due to infrastructure and logistics are all key drivers.

Graph shows general upward trend pricing for LPG and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Streamlining the procurement process with proper contract management and performance tracking leads to long-term savings. Businesses may explore multi-year contracts with suppliers to obtain better pricing and a consistent supply of LPG.

Establishing good partnerships with dependable LPG providers assures constant supply, better terms, and an emphasis on sustainability, which is becoming increasingly crucial in today's market. With an increased emphasis on environmental standards and regulations, implementing energy-efficient solutions and ensuring compliance with sustainability goals will be critical to balancing cost and environmental impact.

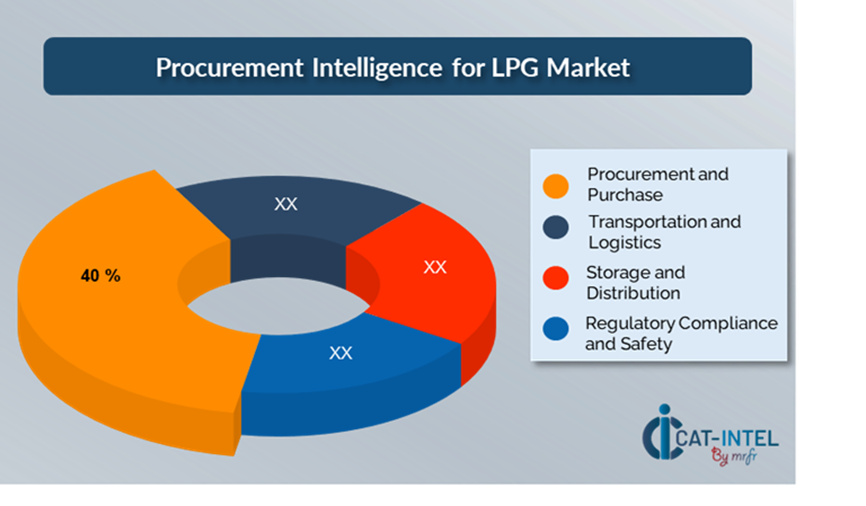

Cost Breakdown for LPG: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Procurement and Purchase: (40%)

-

Description: Procurement costs include transportation and storage fees when acquiring LPG from suppliers.

-

Trend Point: Price volatility has increased in recent years because of disruptions such as COVID-19 and changes to trading laws.

- Transportation and Logistics: (XX%)

- Storage and Distribution: (XX%)

- Regulatory Compliance and Safety: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the LPG business, streamlining procurement processes and employing smart negotiation strategies can result in significant cost savings and increased operational efficiency. Long-term relationships with reputable LPG suppliers, particularly those that offer flexible and scalable solutions like as smart tank monitoring or bulk delivery systems, can result in more attractive pricing structures and conditions. Entering multi-year contracts or subscription-based pricing structures with suppliers can help you secure more competitive rates, lessen the impact of price volatility, and deliver more predictable expenses over time.

Businesses can decrease long-term operational expenses by partnering with LPG providers who value innovation, such as those who offer IoT-enabled monitoring systems, real-time delivery tracking, and environmentally friendly options. These solutions provide better supply chain management, waste reduction, and increased efficiency in LPG usage and distribution. Choosing LPG suppliers who provide scalable solutions that can adapt to changing business needs allows businesses to expand without facing bottlenecks or wasteful resource allocation. Scalable infrastructure, such as modular storage and transportation alternatives, enables businesses to adapt their LPG supply as their operations grow or shrink.

Supply and Demand Overview for LPG: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The LPG market is steadily expanding, driven by a combination of technological breakthroughs, increased demand for greener energy solutions, and the ongoing transformation of industries like as manufacturing, residential, and automotive.

Demand Factors:

-

Energy Transition and Sustainability Goals: As industry and governments prioritize sustainability, the need for cleaner energy sources such as LPG rises.

-

Technological Integration: With the advent of IoT and smart technologies, there is a greater demand for modern LPG systems that integrate with monitoring devices and automated delivery solutions.

-

Industry-Specific Needs: Industries like as automotive and logistics require tailored LPG solutions. Fuel management systems designed for fleet vehicles or industrial machinery, for example, can boost demand in a certain sector.

-

Regulatory Compliance: Governments around the world are enforcing higher environmental standards and energy laws, encouraging businesses to use more sustainable energy sources such as LPG.

Supply Factors:

-

Technological Advancements: Innovations in LPG storage, transportation, and distribution systems are improving supply chain efficiency and reliability, resulting in more cost-effective services.

-

Vendor Ecosystem: The LPG market is experiencing a diversification of suppliers, including huge worldwide companies and smaller, more regional players, as well as a wide range of service offerings for businesses to choose from.

-

Global Economic Factors: Fluctuating oil prices, geopolitical concerns, and trade regulations all have an impact on LPG pricing and supply.

-

Scalability and Flexibility: Suppliers provide modular systems that appeal to enterprises of all sizes and can fulfil the needs of a wide range of customers.

Regional Demand-Supply Outlook: LPG

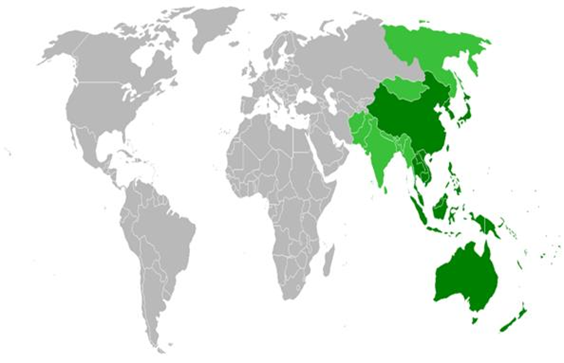

The Image shows growing demand for LPG in both Asia Pacific and North America, with potential price increases and increased Competition.Asia Pacific: Dominance in the LPG Market

Asia Pacific, particularly East Asia, is a dominant force in the global LPG market due to several key factors:

-

Expanding LPG Infrastructure: Asia-Pacific countries are making significant investments in LPG infrastructure, such as storage facilities, distribution networks, and refueling stations.

-

Increased Foreign Investment: The region's strategic location, combined with investments in refining and distribution, positions it as a leading player in the LPG industry.

-

Rapid industrialization: As industries expand and urban populations grow, LPG demand rises in the residential, commercial, and industrial sectors.

-

Growing Demand for Clean Energy Solutions: In response to environmental concerns, governments and businesses in the Asia-Pacific region are turning to cleaner, more sustainable energy sources.

-

Strong Government Support: Many Asia-Pacific countries have implemented policies that encourage LPG usage, including as subsidies, tax breaks, and infrastructure improvements.

Asia Pacific Remains a key hub LPG Price Drivers Innovation and Growth.

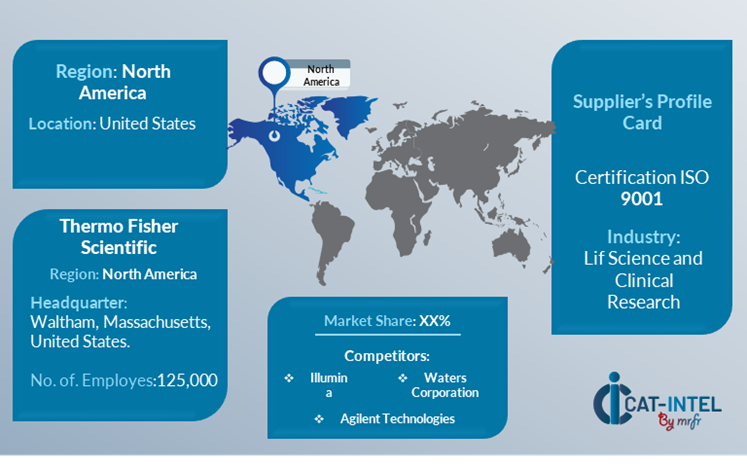

Supplier Landscape: Supplier Negotiations and Strategies

The LPG supply environment is similarly diversified and competitive, with a combination of global and regional players defining the market. These suppliers have a significant impact on pricing, product offerings, service quality, and the ability to meet specific industry needs. The LPG industry is controlled by well-known multinational energy firms that provide full supply solutions, while smaller, niche businesses focus on specialized services like eco-friendly alternatives or innovative logistical technology.

Service quality in the LPG industry is significantly determined by suppliers' capacity to provide dependable delivery, safe storage solutions, and compliance with environmental requirements. LPG suppliers are increasingly providing specialized solutions for a variety of sectors. The LPG sector is experiencing increased demand for customized services geared to businesses such as manufacturing, logistics, and healthcare. The market is becoming more competitive as both global energy giants and smaller, agile suppliers adapt to suit changing market demands by providing more flexible solutions and higher-quality services

Key Suppliers in the LPG Market Include:

- China National Petroleum Corporation

- Exxon

- Royal Dutch

- Shell

- British Petroleum

- Chevron

- TotalEnergies

- Phillips 66

- SABIC

- Reliance Industries Ltd.

- PetroChina

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The LPG market is rapidly expanding, driven by rising demand for greener energy solutions in sectors such as residential, commercial, and industrial applications. |

Cloud Adoption |

A move to cloud-based LPG management solutions is occurring. These solutions offer greater scalability, real-time monitoring of LPG consumption, and remote access, allowing organizations to manage energy usage and increase logistics efficiency. |

Product Innovation |

LPG suppliers are developing with smart technologies like IoT-enabled tanks, automatic refilling systems, and enhanced tracking solutions to improve energy management and service delivery. |

Technological Advancements |

AI-powered analytics for consumption forecasts, IoT integration for tank monitoring, and automated delivery systems are increasing efficiencies and lowering operational costs in the LPG supply chain. |

Global Trade Dynamics |

Changes in global trade policy, such as tariffs and supply chain regulations, are altering the LPG industry. Multinational corporations, in particular, are adapting their LPG procurement strategy to suit local legislation, assure compliance, and manage regional price volatility. |

Customization Trends |

The demand for tailored LPG solutions is growing, especially among major industrial operations and specialist markets. Tailored solutions such as fuel management systems, real-time consumption tracking, and modular storage options enable businesses to better meet specific operational needs. |

|

LPG Attribute/Metric |

Details |

Market Sizing |

The global LPG market is projected to reach USD 191.95 billion by 2035, growing at a CAGR of approximately 4.57% from 2025 to 2035. |

LPG Technology Adoption Rate |

Around 70% of enterprises in industries including as manufacturing, shipping, and residential heating have implemented advanced LPG management systems, with a growing interest in IoT-enabled monitoring and automated supply solutions.

|

Top LPG Industry Strategies for 2025 |

Key initiatives include using eco-friendly LPG alternatives (such as LPG blends), investing in smart monitoring systems to collect real-time usage data, optimizing logistics with AI-driven route planning, and ensuring regulatory compliance with sustainable energy regulations.

|

LPG Process Automation |

Approximately 50% of LPG suppliers have automated their operations, with a focus on automated refueling, tank monitoring, and predictive maintenance to reduce downtime and increase efficiency.

|

LPG Process Challenges |

Major problems include fluctuating fuel prices, supply chain interruptions, regulatory hurdles, and the need for constant innovation to fulfill environmental and sustainability objectives.

|

Key Suppliers |

Leading LPG providers include China National Petroleum Corporation, ExxonMobil, Shell, and BP, along with regional companies providing specialized services for both residential and industrial applications.

|

Key Regions Covered |

Asia Pacific and North America are key regions for LPG adoption, with strong demand from residential sectors as well as industries such as transportation and power generation.

|

Market Drivers and Trends |

Growth is being driven by expanding demand for clean energy alternatives, technology breakthroughs in fuel management, stronger environmental restrictions, and a greater emphasis on energy efficiency and sustainability. |