Summary Overview

Loyalty Programs Market Overview:

The global loyalty program market is growing steadily, owing to increased use in areas such as retail, hotels, financial services, and e-commerce. This industry offers a diverse range of solutions, from basic point-based systems to sophisticated AI-powered platforms that provide individualized client experiences. Our report provides a detailed examination of procurement trends in loyalty solutions, focusing on cost-effectiveness, customer interaction, and the use of digital technologies to improve customer retention and brand loyalty.

Key problems include controlling deployment and operational expenses, guaranteeing program scalability, protecting client data privacy, and integrating loyalty schemes into existing digital ecosystems. To stay competitive in a fast-changing world, firms are increasingly relying on data-driven insights, strategic vendor collaborations, and creative compensation structures. As the worldwide need for customer-centric engagement strategies grows, businesses are using market information to create loyalty programs that not only generate repeat business but also provide demonstrable long-term value.

Market Size: The global Loyalty Programs market is projected to reach USD 60 billion by 2035, growing at a CAGR of approximately 16.23% from 2025 to 2035.

Growth Rate: 16.23%

- Sector Contributions: Growth in the market is driven by:

- Manufacturing and Supply Chain Optimization: Loyalty solutions are widely used in B2B settings, particularly in manufacturing and supply chains.

- Retail and E-Commerce Growth: The fast development of retail and online commerce is encouraging the use of enhanced loyalty programs to improve client retention.

- Technological Transformation: AI and machine learning are revolutionizing loyalty programs by allowing for hyper-personalized incentives, predictive behaviour analysis, and dynamic engagement techniques.

- Innovations: Modular loyalty program structures enable organizations to pick only the components they want, such as referral tracking, tiered incentives, or gamification, providing better flexibility and cost management.

- Investment Initiatives: Businesses are progressively investing in cloud-based loyalty platforms to increase scalability, enhance consumer data access across channels, and facilitate remote program management.

- Regional Insights: North America and Asia Pacific have the highest levels of loyalty program acceptance due to sophisticated digital infrastructure, high consumer expectations, and a rising emphasis on customized interaction.

Key Trends and Sustainability Outlook:

- Cloud Integration: Cloud-native loyalty programs are popular because of their simplicity of implementation, scalability, and real-time data access across client touchpoints.

- Advanced Features: The integration of AI, IoT, and blockchain technology improves loyalty program security, customization, and transparency, altering how organizations foster trust and long-term consumer connections.

- Focus on Sustainability: Brands are integrating loyalty programs with sustainability goals, providing eco-friendly rewards, and use analytics to track and drive sustainable consumer habits.

- Customization Trends: There is an increasing desire for industry-specific loyalty programs targeted to industries such as healthcare, travel, and B2B services, which allow for more relevant and meaningful involvement.

- Data-Driven Insights: Advanced analytics enable companies to better analyse customer behaviour, estimate attrition, optimize engagement tactics, and calculate the actual ROI of loyalty programs

Growth Drivers:

- Digital Transformation: The growing trend of digital consumer involvement is driving the use of intelligent loyalty programs.

- Demand for Personalization and Automation: Businesses are looking for technologies that can automate engagement flows and provide individualized experiences at scale.

- Scalability Requirements: Loyalty systems must be adaptable to rising user bases, cross-border operations, and changing consumer expectations.

- Regulatory Compliance: Complying with privacy requirements (e.g., GDPR, CCPA) is a major responsibility, and loyalty systems may assist assure secure consumer data processing.

- Globalization: Brands expanding abroad require multilingual, multi-currency loyalty networks that retain consistency while responding to regional tastes.

Overview of Market Intelligence Services for the Loyalty Programs Market:

Recent market insights have indicated important difficulties such as increased implementation costs and a growing desire for bespoke program design. Market intelligence services give firms with data-driven advice on how to optimize spending, analyse vendor capabilities, and efficiently execute loyalty solutions while reducing risk and expense.

Procurement Intelligence for Loyalty Programs: Category Management and Strategic Sourcing

Companies are optimizing procurement strategies through rigorous category management and performance tracking to enhance the ROI on loyalty spending. Strategic sourcing, when paired with market information, enables businesses to negotiate better contracts, benchmark vendor products, and assure long-term alignment with engagement objectives. This strategy enables firms to implement high-performing, cost-effective loyalty solutions that provide demonstrable business results.

Pricing Outlook for Loyalty Programs: Spend Analysis

The pricing outlook for loyalty program solutions is likely to be somewhat dynamic, impacted by a variety of variables. Continuous technological innovation, increased demand for cloud-based and mobile-first systems, customisation needs, and regional cost heterogeneity are all significant pricing factors.

Graph shows general upward trend pricing for Loyalty Programs and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To efficiently control costs, companies are adopting streamlined procurement strategies, improved vendor management, and the implementation of modular loyalty solutions that allow them to pay only for services that are relevant to their engagement goals. Utilizing digital technologies for market monitoring, pricing forecasting, and automated contract administration can help to improve cost efficiency and procurement transparency.

Companies are increasingly collaborating with respected loyalty platform providers, negotiating multi-year contracts, and investigating subscription-based or usage-based pricing structures in order to control costs and secure long-term value. These tactics build stronger vendor relationships and implementation assistance, in addition to reducing financial instability. Businesses may implement loyalty programs that generate high ROI and significant consumer engagement by balancing innovation and smart procurement efforts.

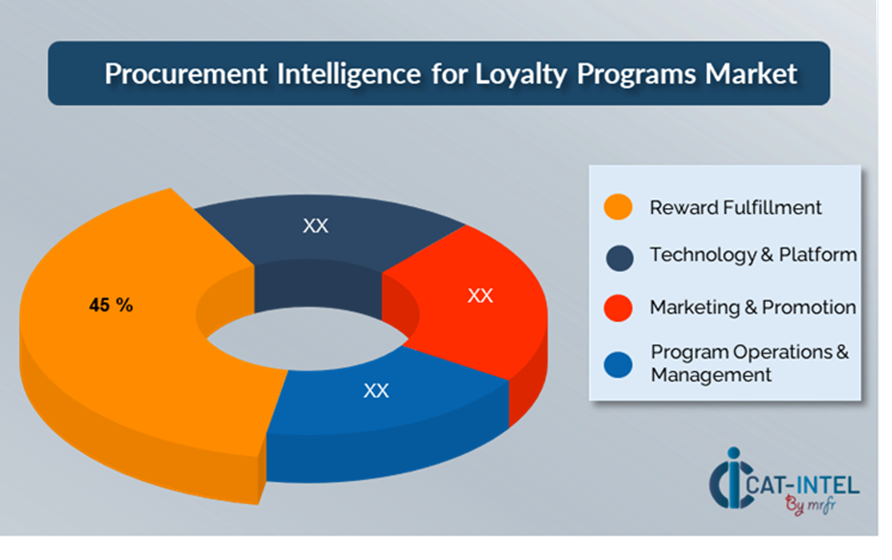

Cost Breakdown for Loyalty Programs: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Reward Fulfilment: (45%)

- Description: These are the direct expenses of offering incentives, both monetary (e.g., discounts, rebates) and non-monetary (e.g., gifts, experiences, travel). This includes product purchase, shipping, and redemption handling.

- Trend: Digital incentives, such as e-gift cards and subscriptions, are becoming more popular due to their cheaper logistics costs and rapid delivery. This helps control fulfilment charges and improves user experience.

- Technology & Platform: (XX%)

- Marketing and Promotion: (XX%)

- Program Operations & Management: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the loyalty program sector, streamlining procurement procedures and using strategic bargaining strategies may result in significant cost savings and improved program effectiveness. Long-term collaborations with loyalty platform providers, particularly those who provide cloud-based, scalable solutions, can lead to more attractive pricing arrangements, such as volume-based discounts and bundled service packages. Adopting subscription-based models or multi-year agreements can assist companies in obtaining lower long-term rates, reducing susceptibility to market-driven price hikes, and improving budget predictability.

Collaboration with loyalty solution providers who focus innovation and scalability provide extra value, such as access to advanced data for customer behaviour insights and Modular designs enable enterprises to pay for only the features they require. Exploring multi-vendor methods and keeping a diverse supplier base can assist reduce risks like service outages, integration difficulties, and vendor lock-in. This also increases bargaining leverage, providing businesses more freedom to adjust their loyalty initiatives as business demands change.

Supply and Demand Overview for Loyalty Programs: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The loyalty program industry is expanding steadily, fueled by increased digital transformation initiatives and growing demand for tailored, data-driven consumer interaction methods. Technological improvements, industry-specific engagement demands, and macroeconomic situations all have an impact on platform pricing and implementation tactics.

Demand Factors:

- Digital Customer Engagement Initiatives: Businesses prioritize loyalty solutions that centralize customer data, automate interaction activities, and provide consistent experiences across all channels.

- Cloud-Based Adoption: The market is quickly transitioning to cloud-native loyalty programs that provide scalability, flexibility, and subscription-based pricing structures ideal for organizations of all sizes.

- Industry-Specific Engagement Requirements: Industries such as retail, travel, and healthcare require tailored loyalty programs that adhere to industry standards, consumer habits, and brand strategy.

- Integration Requirements: There is an increasing need for loyalty programs to seamlessly link with CRM systems, POS systems, and even IoT-enabled devices to provide omnichannel experiences.

Supply Factors:

- Technological Advancements: Providers are improving their loyalty solutions with AI, machine learning, and real-time data, allowing companies to tailor offers and maximize program effectiveness.

- Expanding Vendor Ecosystem: A broad mix of rising innovators and established global suppliers provides purchasers with a wide selection of options, including plug-and-play platforms and highly configurable business suites.

- Global Economic Conditions: Currency variations, regional labor costs, and variable digital infrastructure all have an impact on pricing strategies and market availability.

- Scalability and Modularity: Modern loyalty platforms are becoming more modular and scalable, allowing vendors to provide flexible, cost-effective solutions to startups and major enterprises alike.

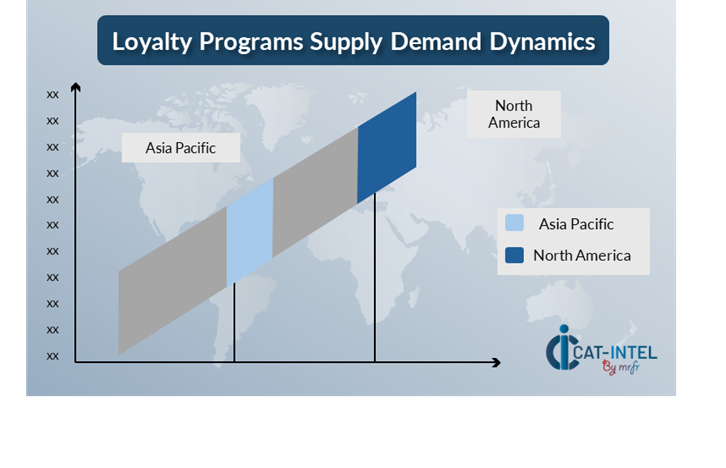

Regional Demand-Supply Outlook: Loyalty Programs

The Image shows growing demand for Loyalty Programs in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Loyalty Programs Market

North America, particularly the United States, is a dominant force in the global Loyalty Programs market due to several key factors:

- High Consumer Spending Power: North America has one of the world's highest levels of consumer purchasing power, making loyalty programs an essential component of their customer engagement and retention strategy.

- Mature Retail and E-Commerce Ecosystem: The region has a well-established retail infrastructure and a thriving e-commerce sector.

- Early Adoption of Digital Technologies: North American organizations are pioneers in the use of AI, big data, CRM integration, and mobile-first loyalty programs.

- Presence of Global Loyalty Program Providers: North America is home to several of the world's leading loyalty solution providers, which boosts the region's innovation cycle.

- Customer Experience Strategies: Brands in North America prioritize customer engagement, brand loyalty, and CX (customer experience). As a result, loyalty programs are now viewed as strategic rather than transactional.

North America Remains a key hub Loyalty Programs Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The loyalty program supplier environment is diversified and highly competitive, with a mix of global technological titans and regional innovators. These providers' pricing tactics, platform customization choices, and service delivery standards all have a significant impact on the market's trajectory. Established loyalty platform vendors lead the industry, delivering end-to-end, omnichannel engagement solutions. At the same time, specialized and emerging providers are gaining popularity by focusing on industry-specific capabilities such as AI-driven personalization, advanced gamification, or blockchain-based reward tracking.

Across major technology markets, the loyalty program ecosystem includes a combination of prominent global vendors with scalable, cloud-based platforms used by enterprise brands worldwide, and regional and local providers who deliver tailored solutions aligned with cultural nuances, customer preferences, and regulatory compliance. As enterprises increasingly focus on digital transformation and customer-centric engagement, loyalty program providers are developing cloud-native capabilities for scalability and real-time data access. Providing flexible subscription models and modular architectures to meet different budget and functionality needs

Key Suppliers in the Loyalty Programs Market Include:

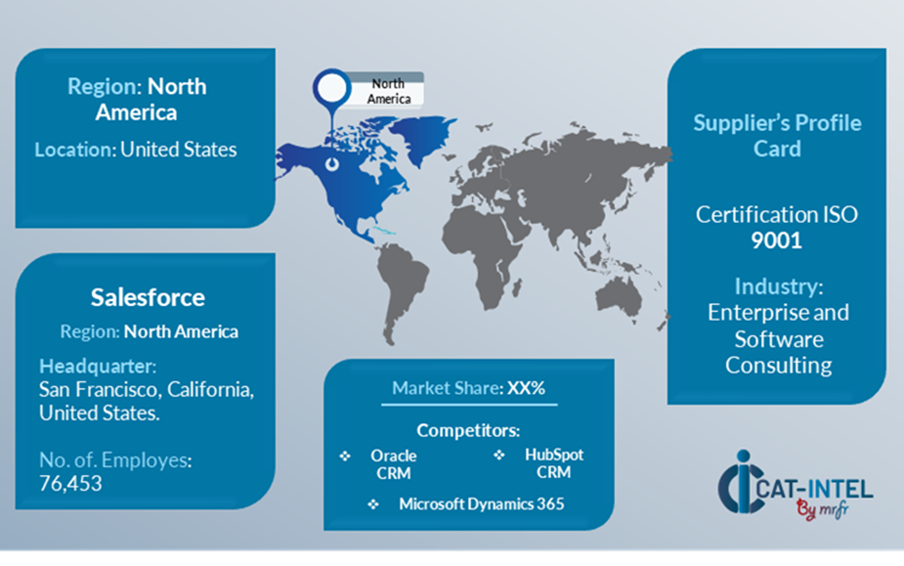

- Salesforce

- Oracle CrowdTwist

- Comarch

- LoyaltyOne

- Antavo

- Epsilon

- Bond Brand Loyalty

- One

- Capillary Technologies

- Annex Cloud

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The loyalty programs market is expanding rapidly, driven by rising need for customer retention tactics, personalized interaction, and brand loyalty particularly in emerging digital economies.

|

Cloud Adoption |

There is a significant trend toward cloud-based loyalty programs, driven by the demand for scalability, cost-effectiveness, and real-time accessibility, especially in omnichannel and hybrid commerce environments. |

Product Innovation |

Loyalty solution providers are improving platforms with AI-powered customization, real-time behavioral insights, and industry-specific engagement capabilities geared to industries like retail, travel, and finance. |

Technological Advancements |

The convergence of machine learning, IoT, blockchain, and automated consumer segmentation is improving loyalty program capabilities, allowing for predictive insights and seamless interaction. |

Global Trade Dynamics |

Changing data privacy rules (e.g., GDPR, CCPA), cross-border e-commerce expansion, and shifting customer expectations all shape global loyalty program tactics and influence regional uptake. |

Customization Trends |

Growing need for modular loyalty solutions, flexible incentive systems, and API-first design allows organizations to customize programs to their own business models and consumer preferences. |

Loyalty Programs Attribute/Metric |

Details |

Market Sizing |

The global Loyalty Programs market is projected to reach USD 60 billion by 2035, growing at a CAGR of approximately 16.23% from 2025 to 2035.

|

Loyalty Programs Technology Adoption Rate |

Over 70% of mid-to-large businesses worldwide have deployed loyalty programs, with an increasing preference for cloud-based and omnichannel platforms.

|

Top Loyalty Programs Industry Strategies for 2025 |

Key tactics include using AI for customization, developing mobile-first loyalty applications, connecting loyalty with e-commerce and CRM systems, and promoting sustainable and experiential incentives. |

Loyalty Programs Process Automation |

Approximately 60% of loyalty programs now offer automation for incentive issuance, segmentation, and interaction workflows, which improves operational efficiency and customer retention.

|

Loyalty Programs Process Challenges |

Data integration complexity, long-term consumer engagement, incentive weariness, and compliance with regional privacy regulations are among the primary concerns.

|

Key Suppliers |

Salesforce (USA), Oracle CrowdTwist (USA), Comarch (Poland), Antavo (UK), and LoyaltyLion (UK) are among the top loyalty technology providers, with each offering specialized solutions across many industries. |

Key Regions Covered |

Major markets include North America and Asia-Pacific, with strong demand in retail, hotel, BFSI, and consumer products.

|

Market Drivers and Trends |

Data-driven engagement increased mobile and e-commerce use, customer need for personalization, and the incorporation of future technologies like as AI and blockchain are all driving growth. |