Summary Overview

Liquid Chromatography Market Overview:

The global liquid chromatography market is expanding steadily, driven by increased demand in major industries such as pharmaceuticals, biotechnology, environmental testing, and food safety. This market offers a diverse variety of chromatography solutions, such as high-performance liquid chromatography (HPLC), ultra-high-performance liquid chromatography (UHPLC), and preparative systems designed to meet specific analytical requirements.

Our paper provides a detailed examination of procurement trends, with a particular emphasis on cost-cutting methods and the use of next-generation digital technologies to improve laboratory operations and analytical precision. Procurement will face several critical challenges in the coming years, including managing the high cost of advanced instrumentation, ensuring system scalability to meet changing research needs, maintaining rigorous data integrity, and achieving seamless integration with laboratory information management systems.

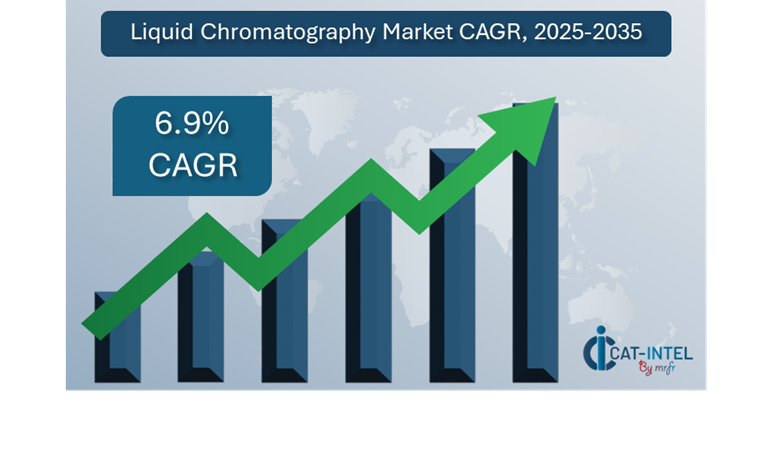

Market Size: The global Liquid Chromatography market is projected to reach USD 20.25 billion by 2035, growing at a CAGR of approximately 6.9% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: Liquid chromatography technologies are being used to improve real-time process monitoring, quality control, and compliance, resulting in faster production and less downtime.

-

Pharmaceutical and Life Sciences Expansion: The fast expansion of the pharmaceutical, biotech, and clinical research industries is pushing the use of sophisticated chromatography systems.

-

Technological Transformation: Advancements in artificial intelligence and machine learning are transforming liquid chromatography, greatly increasing laboratory throughput and decision accuracy.

-

System Design Innovations: With the change to modular chromatography systems, laboratories may create bespoke configurations based on individual application requirements, lowering acquisition costs and operating complexity.

-

Strategic Investment Initiatives: Companies are targeting cloud-connected chromatography systems that provide remote monitoring, centralized data administration, and improved collaboration.

-

Regional Insights: North America and Asia Pacific are major growth markets, thanks to strong R&D infrastructure, increased government financing, and a growing emphasis on precision medicine and environmental monitoring.

Key Trends and Sustainability Outlook:

-

Cloud Integration: The emergence of cloud-based chromatographic data systems (CDS) allows for scalable, cost-effective solutions that improve data accessibility and regulatory traceability.

-

Advanced Features: Integration with IoT, AI, and blockchain enhances automation, decision-making, and data transparency across analytical processes.

-

Sustainability Focus: Modern chromatography systems contribute to green chemistry programs by lowering solvent usage, minimizing energy consumption, and providing compliance waste disposal monitoring.

-

Customization Trends: There is a growing need for application-specific systems adapted to industries such as pharmaceuticals, food testing, and environmental analysis.

-

Data-Driven Insights: Advanced analytics enable laboratories to maximize sample throughput, maintain reproducibility, and monitor performance indicators in real time.

Growth Drivers:

-

Digital Transformation: As analytical laboratories become more digital, the use of intelligent chromatography technologies to improve operational efficiency is accelerated.

-

Automation Demand: Laboratories are increasingly depending on automated chromatography platforms to manage large sample volumes, decrease mistakes, and increase consistency.

-

Scalability Requirements: There is an increasing demand for systems that can scale to meet expanding testing demands, assuring long-term value and easy interaction with changing laboratory infrastructure.

-

Regulatory Compliance: By providing rigorous data integrity and reporting capabilities, chromatography systems help to ensure compliance with FDA, EMA, and worldwide standards. -

Globalization of Testing Needs: The requirement for uniform, high-performance analytical systems across regions is increasing demand for chromatography platforms.

Overview of Market Intelligence Services for the Liquid Chromatography Market:

Recent market evaluations have found persisting problems in the liquid chromatography business, including high capital investment needs and rising demand for system customization to meet specialized application needs. To help overcome these challenges, market intelligence reports provide laboratory and procurement teams with relevant information regarding sourcing options. These insights allow firms to uncover cost-saving initiatives while also improving implementation efficiency and user acceptance.

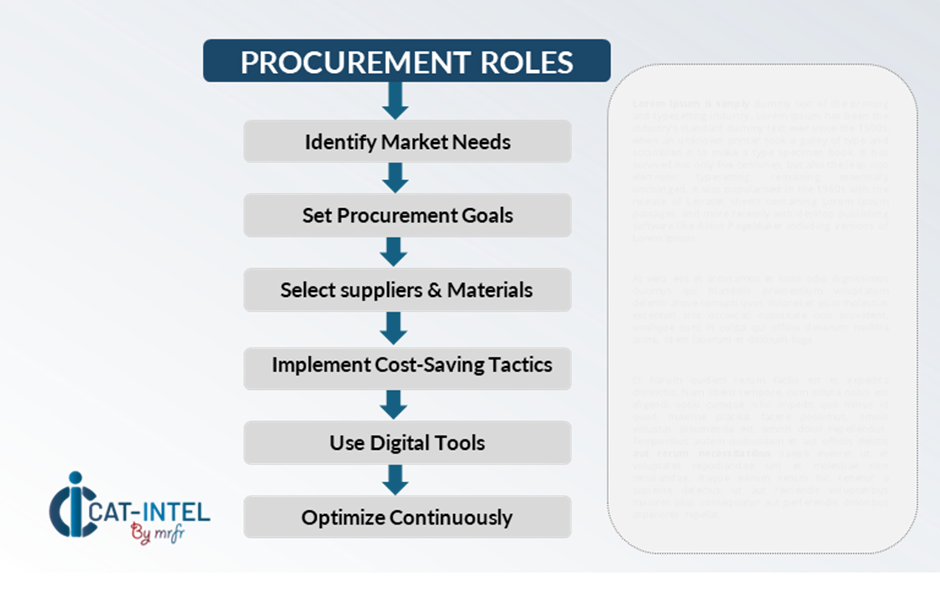

Procurement Intelligence for Liquid Chromatography: Category Management and Strategic Sourcing

To preserve a competitive advantage, firms are simplifying their procurement of chromatography equipment and consumables through category management, expenditure analysis, and vendor performance ratings. These measures are critical for lowering procurement costs, eliminating supply chain risks, and guaranteeing reliable availability to high-quality equipment, columns, and reagents. By using strategic sourcing frameworks, laboratories may ensure that their investments in chromatography technology promote both scientific innovation and financial sustainability.

Pricing Outlook for Liquid Chromatography: Spend Analysis

The price environment for liquid chromatography systems is projected to remain somewhat dynamic, impacted by a variety of significant variables. Technological improvements such as automation and AI-assisted analytics, desire for compact and cloud-connected devices, and regional pricing variations due to distribution strategies and regulatory settings are key drivers.

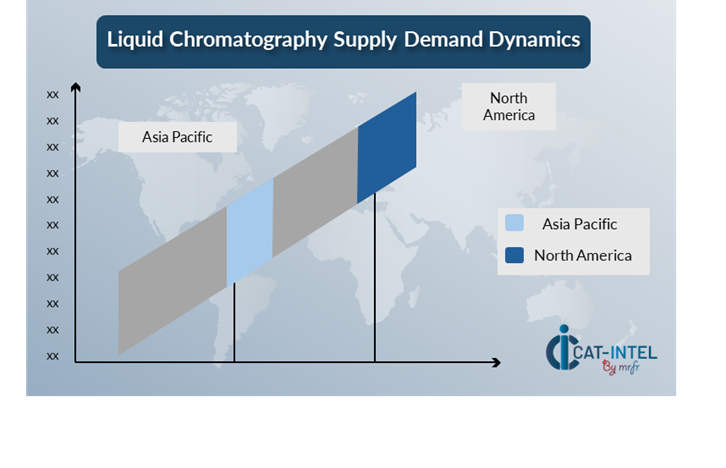

Graph shows general upward trend pricing for Liquid Chromatography and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To combat escalating costs, laboratories are using strategic procurement strategies that prioritize cost management and long-term value. Contract tactics like as multi-year agreements, bundled service packages, and subscription-based pricing structures (particularly for software components like CDS or remote access platforms) are proven beneficial in terms of total cost of ownership.

Despite price issues, laboratories may retain cost-effectiveness and good performance by concentrating on scalable system investments that keep up with changing testing volumes and loud-compatible systems that enable remote collaboration and data access. As the chromatography market continues to grow, the firms who successfully link procurement strategy with technical innovation and operational goals will be best positioned for long-term success.

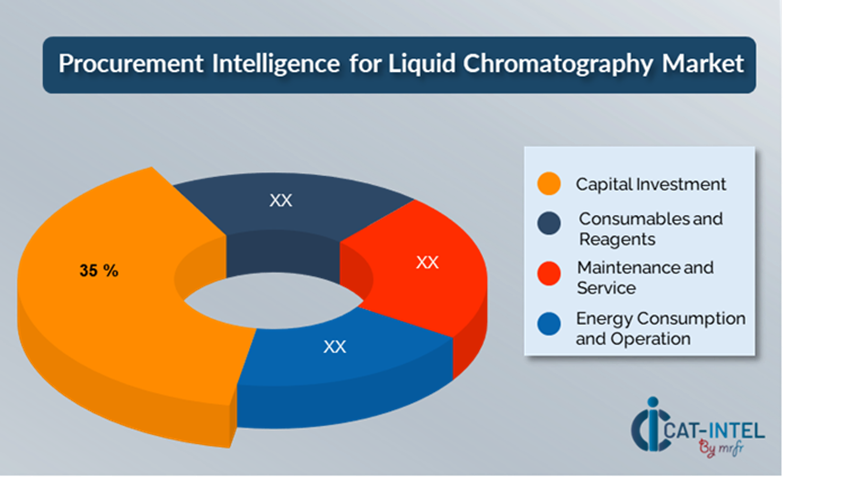

Cost Breakdown for Liquid Chromatography: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Capital Investment: (35%)

-

Description: This comprises the original cost of the liquid chromatography system, which includes hardware, software, and other essential components.

-

Trend: Cloud-Based and Modular Systems are lowering initial capital expenditure as suppliers provide more flexible, scalable, and customized solutions to fulfill unique requirements.

- Consumables and Reagents: (XX%)

- Maintenance and Service Contracts: (XX%)

-

Energy Consumption and Operation: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the liquid chromatography industry, simplifying procurement procedures and using smart bargaining strategies can result in significant cost savings and increased laboratory efficiency. Long-term relationships with chromatography suppliers, particularly those that provide cloud-enabled systems and scalable service models, can result in more advantageous pricing, such as volume discounts, bundled maintenance packages, and extended warranty periods. Adopting subscription-based service models and multi-year contracts ensures cost stability, safeguards against market-driven pricing hikes, and allows laboratories to better control total cost of ownership.

Collaborating with chromatography providers who prioritize innovation and system scalability provides numerous benefits, including access to advanced analytical software, such as AI-enhanced data interpretation, and integration-ready systems with modular architecture to reduce upfront costs and future-proof investments. Utilizing digital procurement systems, including contract administration tools, use monitoring statistics, and pricing benchmarking dashboards. enhances visibility, reduces over-specification, and ensures systems are utilized efficiently.

Supply and Demand Overview for Liquid Chromatography: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM).

The liquid chromatography market is rising steadily, driven by the increasing need for high-precision analytical procedures in sectors such as pharmaceuticals, biotechnology, environmental testing, and food safety. Technological innovation, application-specific needs, and global economic conditions all have an impact on supply and demand in this industry.

Demand Factors:

-

Analytical Quality Demands: The growing demand for accurate, repeatable, and high-throughput testing is driving investment in sophisticated chromatography systems in both research and quality control contexts.

-

Regulatory Compliance and Traceability: Industries such as pharmaceuticals and environmental sciences require chromatography systems that meet high compliance criteria.

-

Adoption of Compact and Cloud-Connected Systems: Labs are moving toward cloud-integrated and modular chromatographic systems that provide remote access, faster scaling, and better collaboration.

-

Multi-Technique Integration: There is rising interest in systems that combine with other analytical technologies, such as mass spectrometry (LC-MS) and automated sample preparation, to improve workflow efficiency.

Supply Factors:

-

Technological Innovation: Advances in AI-driven data analysis, automated diagnostics, and compact system design are improving chromatography systems' performance and value proposition.

-

Diverse Vendor Landscape: A competitive ecosystem of worldwide vendors, from minor manufacturers to large-scale instrumentation providers, offers a diverse selection of goods.

-

Global economic Variables: Include currency rates, import/export taxes, and regional manufacturing prices, which all have an influence on system pricing, availability, and lead times. -

Modularity and Scalability: Suppliers are increasingly providing modular chromatography solutions, allowing laboratories to scale capabilities in response to application needs and budget restrictions.

Regional Demand-Supply Outlook: Liquid Chromatography

The Image shows growing demand for Liquid Chromatography in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Liquid Chromatography Market

North America, particularly the United States, is a dominant force in the global Liquid Chromatography market due to several key factors:

-

Robust Healthcare and Clinical Testing Market: Liquid chromatography is frequently utilized for patient testing, drug screening, and biomarker identification, which drives demand in hospitals, diagnostic labs, and clinical research institutions.

-

Strong Regulatory Framework: Liquid chromatography is widely employed in analytical testing to assure product safety and regulatory compliance, which drives its use in a variety of sectors such as food, pharmaceuticals, and environmental monitoring.

-

Investment in R&D and Innovation: The availability of funds and resources guarantees that chromatography technology advances continuously, reinforcing the region's market supremacy.

-

Strong Pharmaceutical and Biotechnology Industries: Because of the region's considerable R&D spending, LC is an important technique for discovering and analysing novel medications and therapies. -

Widespread Use of Advanced Analytical Technologies: The region's well-established research laboratories, healthcare settings, and analytical testing facilities generate demand for novel and high-precision chromatography systems.

North America Remains a key hub Liquid Chromatography Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The liquid chromatography market's supplier environment is varied and highly competitive, with both worldwide instrumentation leaders and specialized regional vendors. These vendors have a considerable impact on critical elements such as system cost, technical innovation, customization choices, and service quality. Leading the way are well-known analytical instrument manufacturers who provide extensive chromatography platforms that are frequently coupled with modern detection technologies (e.g., MS, UV-VIS, fluorescence).

In addition to them, niche vendors are carving out market space by concentrating on application-specific solutions including bioanalytical processes, green chemical designs, and AI-enhanced data processing. As laboratories prioritize digital transformation, compliance, and operational agility, chromatography providers are reacting by improving cloud and remote-monitoring capabilities to enable real-time data access and centralized quality management.

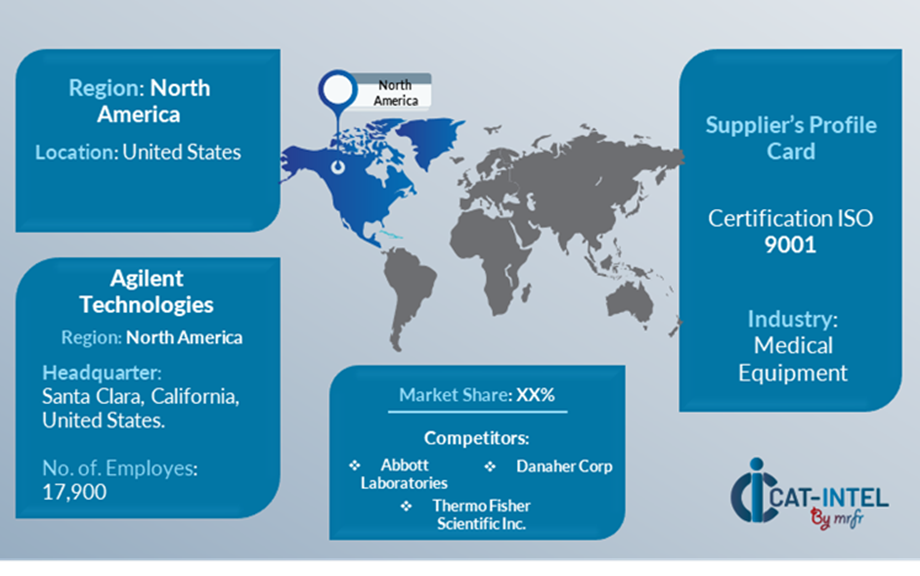

Key Suppliers in the Liquid Chromatography Market Include:

- Agilent Technologies

- Thermo Fisher Scientific

- Shimadzu Corporation

- Waters Corporation

- PerkinElmer

- SAB/Agilent Technologies

- Jasco Incorporated

- Hitachi High-Technologies Corporation

- Knauer Wissenschaftliche Geräte

- Bio-Rad Laboratories

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The liquid chromatography market is expanding rapidly, driven by increased demand for high-precision analytical instruments in the pharmaceutical, biotechnology, environmental, and food safety industries, particularly in emerging regions |

Cloud Adoption |

The industry is moving toward cloud-integrated chromatographic solutions that provide remote access, real-time monitoring, and centralized data management to enable hybrid lab operations and worldwide collaborations. |

Product Innovation |

Vendors are introducing sophisticated systems with AI-enhanced data interpretation, ultra-fast run times, and application-specific settings (e.g., bioanalysis, forensic testing). |

Technological Advancements |

The integration of machine learning, IoT-enabled diagnostics, and automated processes enhances system efficiency, predictive maintenance, and throughput. |

Global Trade Dynamics |

Changes in compliance requirements and international quality standards (e.g., FDA, EMA, ISO) are impacting procurement patterns, especially for firms with global supply chains.

|

Customization Trends |

There is an increasing need for modular and flexible chromatography solutions that can be integrated with mass spectrometry, LIMS, and bespoke detection systems, providing greater flexibility and lab-specific optimization. |

Liquid Chromatography Attribute/Metric |

Details |

Market Sizing |

The global Liquid Chromatography market is projected to reach USD 20.25 billion by 2035, growing at a CAGR of approximately 6.9% from 2025 to 2035.

|

Liquid Chromatography Technology Adoption Rate |

Liquid chromatography systems are used in over 70% of analytical laboratories worldwide, with UHPLC and LC-MS platforms becoming increasingly popular for high-throughput, high-sensitivity applications. |

Top Liquid Chromatography Industry Strategies for 2025 |

Key initiatives include increasing cloud-compatible software, adding AI for automated data processing, providing energy-efficient and environmentally friendly chromatographic solutions, and improving compliance features for worldwide markets.

|

Liquid Chromatography Process Automation |

Over 50% of current chromatography systems have automated sample prep, injection, and data management, which streamlines processes and reduces human error.

|

Liquid Chromatography Process Challenges |

Major hurdles include expensive capital expenditures, integration difficulty with current lab systems, training requirements, and high-end equipment maintenance requirements.

|

Key Suppliers |

Top providers include Agilent Technologies (USA), Thermo Fisher Scientific (USA), Shimadzu Corporation (Japan), Waters Corporation (USA), and PerkinElmer (USA). |

Key Regions Covered |

North America, Europe, and Asia-Pacific are key growth markets, with rising demand for pharmaceutical production, clinical research, and environmental monitoring. |

Market Drivers and Trends |

The demand for high-sensitivity testing, regulatory-driven quality control, increased biopharmaceutical R&D, and the integration of AI, cloud platforms, and real-time analytics into laboratory processes are all driving market expansion. |