Summary Overview

Liquefied Natural Gas Market Overview:

The global liquefied natural gas (LNG) market is growing steadily, driven by rising demand in power production, transportation, industrial uses, and household energy consumption. This market offers a variety of LNG supply arrangements, including long-term contracts, spot trading, and integrated infrastructure development. Our paper provides a thorough examination of procurement trends, emphasizing cost-cutting methods and the use of digital technologies to expedite sourcing and distribution operations.

The market has numerous significant issues, including controlling infrastructure and transportation costs, assuring supply chain scalability, preserving energy security, and integrating LNG into current energy systems. Advanced analytics and strategic sourcing are critical for maximizing LNG procurement and guaranteeing long-term competitiveness in today's changing global energy market.

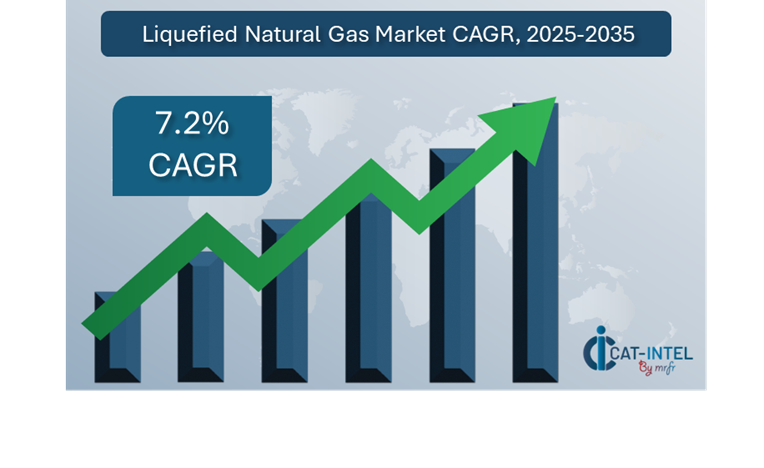

Market Size: The global Liquefied Natural Gas market is projected to reach USD 584.14 billion by 2035, growing at a CAGR of approximately 7.2% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: The increasing demand for real-time monitoring and logistical coordination is driving the need for integrated LNG supply chain solutions to simplify operations.

-

Power Generation and Industrial Demand:LNG is gaining popularity as a greener alternative to coal and oil, facilitating energy transition and ensuring steady supply for industrial operations.

-

Technological Transformation: Advancements in liquefaction, regasification, and transportation are reducing costs and increasing efficiency in the LNG industry.

-

Modular Infrastructure: Small-scale LNG units enable flexible deployment in remote areas, eliminating investment hurdles and increasing access to clean energy.

-

Investment Momentum: Companies are investing in floating LNG terminals and digital pipeline networks to improve operational agility and meet global demand.

-

Regional Insights: Asia Pacific and North America are significant growth markets with strong export infrastructure, rising energy demand, and regulatory backing for greener fuels.

Key Trends and Sustainability Outlook:

-

Global LNG Trade Expansion: Expanding cross-border LNG trading through flexible contracts and diverse supplier portfolios.

-

Digital Integration:utilizes AI, IoT, and blockchain to enhance fleet management, trade efficiency, and regulatory transparency.

-

Sustainability Focus: LNG serves as a transitional fuel in decarbonization plans, reducing emissions and promoting a cleaner energy mix.

-

Customized Solutions: Rising need for customized LNG infrastructure, including bunkering and off-grid energy solutions, particularly in emerging nations.

-

Data-Driven Insights: Advanced analytics offer insights into demand forecasting, pricing volatility, and route optimization, improving risk management and supply planning.

Growth Drivers:

-

Energy Transition: As the world transitions to lower-carbon energy sources, LNG is becoming a popular bridging fuel.

-

Automation & Efficiency: Automation in LNG handling improves safety and efficiency by decreasing manual involvement.

-

Scalability of Infrastructure: Stakeholders want scalable infrastructure solutions to meet changing consumption patterns and regional energy demands.

-

Regulatory Compliance: LNG infrastructure promotes environmental compliance by reducing emissions and meeting maritime fuel standards. -

Global Connectivity: The growing interconnection of global markets necessitates flexible and responsive LNG supply infrastructure to fulfill demand across regions.

Overview of Market Intelligence Services for the Liquefied Natural Gas Market:

Recent evaluations have highlighted major obstacles in the LNG business, such as high infrastructure development costs and the requirement for project-specific customisation. Market intelligence studies are becoming key tools for spotting procurement possibilities, enabling energy businesses to discover cost-saving strategies, streamline supplier engagement to improve project execution success. These insights also help with regulatory compliance and operational excellence, while keeping costs under control.

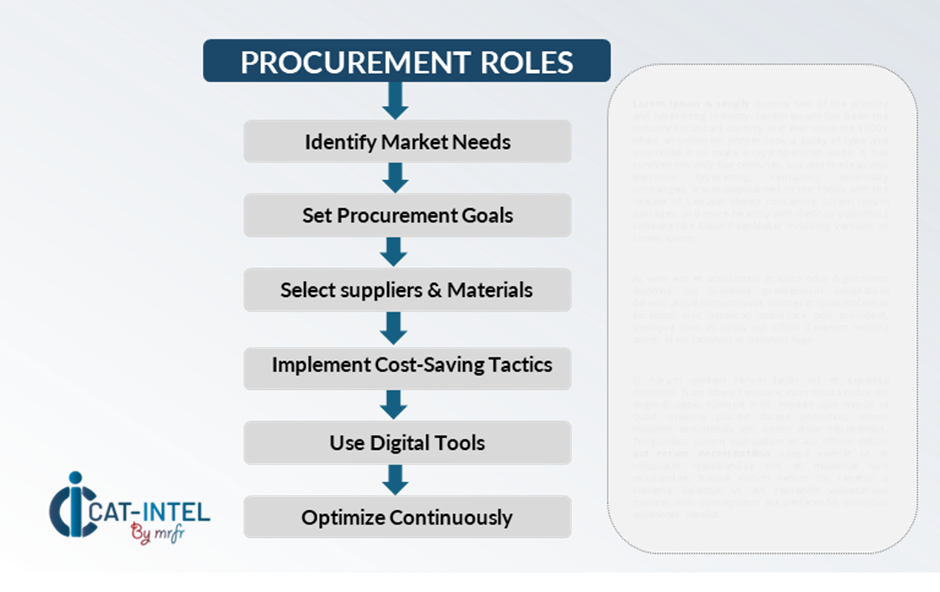

Procurement Intelligence for Liquefied Natural Gas: Category Management and Strategic Sourcing

To remain competitive in a rapidly changing LNG market, industry leaders are improving procurement processes through rigorous expenditure analysis and performance-based supplier assessment. Strategic sourcing and effective category management are increasingly critical to lowering procurement costs while ensuring a consistent supply of high-quality LNG services and equipment. Leveraging real-time market knowledge allows for better informed decision-making, stronger contract negotiations, and alignment with long-term business objectives.

Pricing Outlook for Liquefied Natural Gas: Spend Analysis

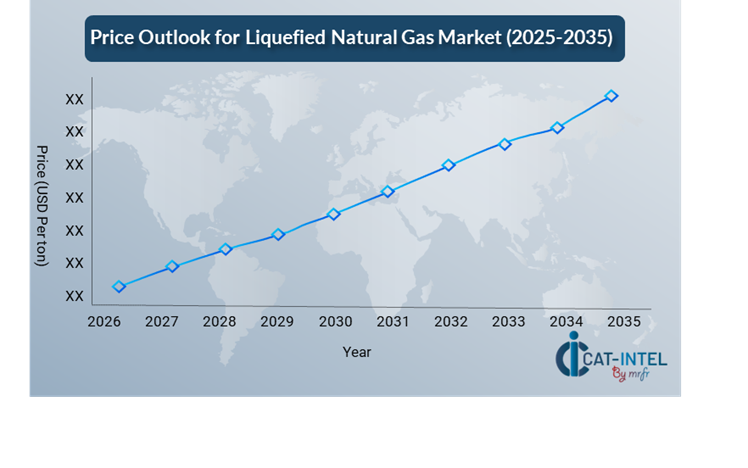

The LNG pricing environment is projected to remain somewhat volatile, affected by several global and regional variables. Innovations in liquefaction, regasification, and transport logistics are key pricing drivers that continue to influence cost structures and investment in floating terminals and small-scale LNG plants is changing the supply environment.

Graph shows general upward trend pricing for Liquefied Natural Gas and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To control costs and improve resilience, energy corporations prioritize using analytics for market surveillance, price forecasting, and risk analysis. Creating KPIs and service-level agreements to promote accountability and Multi-year contracts and volume-based pricing discussions ensure consistency and cost savings.

Emerging commercial forms provide flexibility and little initial investment. Despite increased complexity, businesses may retain operational and financial efficiency by concentrating on scalable infrastructure that adapts to future demand. and guaranteeing a strong project implementation through skilled EPC contractors and technical partners.

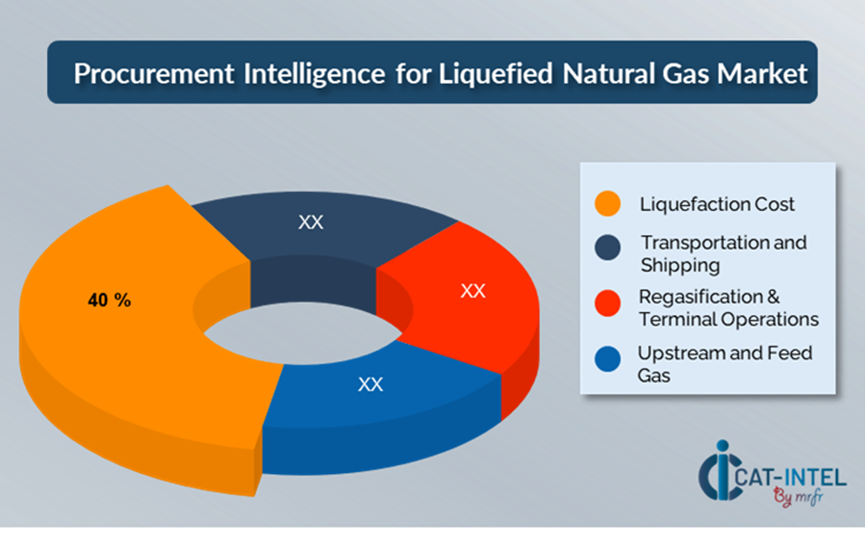

Cost Breakdown for Liquefied Natural Gas: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Liquefaction Cost: (40%)

-

Description: This covers expenditures for natural gas processing into LNG, such as compression, cooling, and dehydration. These are the stages of the LNG lifecycle that need the most money and energy.

-

Trend: Efficiency increases from next-generation liquefaction technologies (e.g., modular plants, AI-optimised cooling cycles)

- Transportation and Shipping: (XX%)

- Regasification & Terminal Operations: (XX%)

- Upstream and Feed Gas Cost: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the LNG sector, streamlining procurement techniques and implementing sophisticated negotiating tactics can result in significant cost savings and increased operational efficiency. Established relationships with LNG suppliers, particularly those that provide integrated infrastructure and logistical services, can result in more attractive price structures, such as volume discounts and bundled service arrangements. Multi-year contracts and flexible offtake agreements assist to ensure pricing stability and protect against market volatility.

Partnering with LNG providers who promote innovation and scalability provides extra value by allowing access to cutting-edge technology such as digital twins, enhanced analytics, and flexible terminal infrastructure. These skills help to reduce long-term costs and increase operational agility. Digital procurement solutions, such as contract management systems and use monitoring platforms, improve transparency, decrease supply gaps, and optimize resource allocation throughout the LNG supply chain.

Supply and Demand Overview for Liquefied Natural Gas: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global LNG industry is expanding steadily, driven by the global energy shift and rising demand for cleaner, more flexible fuel choices. Market dynamics are continually changing, impacted by technological breakthroughs, regional infrastructural demands, and fluctuating economic situations.

Demand Factors:

-

Energy Transition Initiatives: LNG is being used as a bridging fuel to replace coal and heavy fuel oil in power generation and industries as part of the low-carbon energy transition initiative.

-

Rising Demand for Flexible Supply: The transition from long-term fixed contracts to spot and short-term LNG trading has led to an increase in demand for flexible supply solutions that can be scaled.

-

Sector-Specific Requirements: industries including shipping, heavy manufacturing, and distant power production require specific LNG supply methods and infrastructure.

-

Integration with Emerging Technologies: Demand is increasing for LNG systems that interact with digital platforms, emissions monitoring technologies, and renewable energy sources.

Supply Factors:

-

Technological Innovation: Technological advancements in liquefaction, regasification, and storage are resulting in more efficient and cost-effective LNG supply networks.

-

Expanding Supplier Base: As the number of manufacturers grows, including both established and developing exporters, the global market becomes more competitive.

-

Global Economic Influences: Currency fluctuations, labour costs, and infrastructure investments continue to influence LNG pricing and supply. -

Modular and Scalable Infrastructure: Suppliers are increasingly proposing modular LNG systems that can service large-scale utilities as well as smaller, dispersed consumers efficiently.

Regional Demand-Supply Outlook: Liquefied Natural Gas

The Image shows growing demand for Liquefied Natural Gas in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Liquefied Natural Gas Market

Asia Pacific, particularly Southeast Asia, is a dominant force in the global Liquefied Natural Gas market due to several key factors:

-

High Energy Need: Due to fast industrial expansion, expanding urban populations, and infrastructural development, LNG provides a cleaner and more flexible energy source to fulfill this increasing need.

-

Transition from Coal to Cleaner Fuels: Governments around the area are aggressively pursuing decarbonization policies and transitioning from coal to natural gas to cut carbon emissions.

-

Lack of Domestic Natural Gas Reserves: Many Asia Pacific nations have limited natural gas resources, forcing them to rely largely on LNG imports to meet their domestic energy needs.

-

Strong Infrastructure Investment: Asia Pacific is the leader in LNG infrastructure development, including regasification terminals and floating storage units (FSRUs), and small-scale LNG projects. -

Strategic Long-Term Contracts: Major exporters, such as Qatar, Australia, and the United States, have negotiated long-term LNG supply contracts with regional purchasers, mainly Japan, South Korea, and China.

Asia Pacific Remains a key hub Liquefied Natural Gas Price Drivers Innovation and Growth.

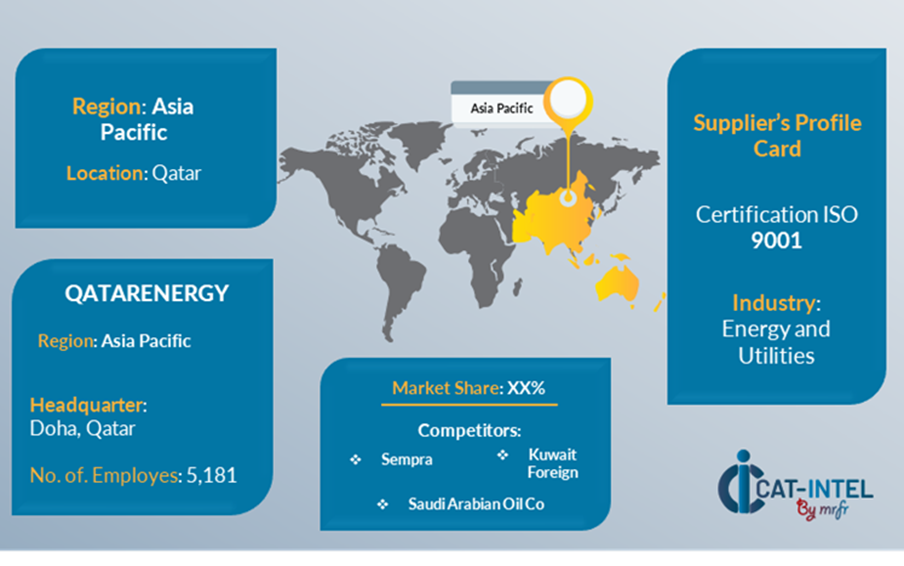

Supplier Landscape: Supplier Negotiations and Strategies

The global LNG market's supplier environment is diversified and competitive, with a mix of established multinational businesses and dynamic regional suppliers. These vendors have a considerable impact on critical areas such as price strategies, infrastructure modification, delivery flexibility, and service quality. The market is headed by significant energy firms and integrated LNG producers with worldwide export capabilities, providing end-to-end services that includes production, liquefaction, transportation, and regasification.

At the same time, an increasing number of specialized, niche providers focus on specific applications—such as small-scale LNG, maritime bunkering, or off-grid power—to meet industry-specific energy requirements and geographic restrictions. The LNG supplier ecosystem spans key energy-producing and consuming areas, and it comprises both established global exporters and new regional operators. These companies are reacting to increased demand by investing in modular infrastructure, increasing floating storage and regasification units (FSRUs), and improving last-mile delivery networks.

Key Suppliers in the Liquefied Natural Gas Market Include:

- Qatar Energy

- Shell plc.

- Cheniere Energy

- TotalEnergies SE

- Chevron Corporation

- Petronas

- ExxonMobil Corporation

- Novatek

- Woodside Energy

- Eni SpA.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The LNG industry is expanding rapidly, propelled by global energy transition programs, growing industrial demand, and increased LNG use in transportation and power generation—particularly in emerging nations.

|

Cloud Adoption |

There is a huge effort to build LNG infrastructure, particularly liquefaction plants regasification terminals and small-scale LNG networks will be built to accommodate expanding and diverse demand.

|

Product Innovation |

LNG producers and suppliers are developing novel solutions like as floating LNG (FLNG), modular terminals, and LNG bunkering services for the maritime, industrial, and distant energy sectors. |

Technological Advancements |

The integration of digital solutions like as AI-powered predictive maintenance, IoT-based monitoring systems, and blockchain for supply chain transparency improves operational dependability and efficiency. |

Global Trade Dynamics |

Evolving trade restrictions, changes in global energy policy, and supply diversification initiatives are redefining LNG trading channels and impacting procurement methods, particularly in import-dependent countries.

|

Customization Trends |

Energy purchasers and utility providers are increasingly looking for customisable LNG solutions, including flexible contract terms, scalable infrastructure, and region-specific delivery methods.

|

Liquefied Natural Gas Attribute/Metric |

Details |

Market Sizing |

The global Liquefied Natural Gas market is projected to reach USD 584.14 billion by 2035, growing at a CAGR of approximately 7.2% from 2025 to 2035. |

Liquefied Natural Gas Technology Adoption Rate |

Approximately 70% of LNG operators use digital and automation technology into their operations, with a noticeable move toward smart terminals and real-time analytics solutions. |

Top Liquefied Natural Gas Industry Strategies for 2025 |

Key measures include investing in small-scale and floating LNG infrastructure, establishing long-term offtake agreements, employing digital technologies for predictive maintenance, and increasing ESG transparency.

|

Liquefied Natural Gas Process Automation |

To maximize efficiency, over 60% of new LNG plants automate crucial activities such as cargo tracking, boil-off gas recovery, pollution monitoring, and port scheduling.

|

Liquefied Natural Gas Process Challenges |

High capital investment costs, geopolitical supply concerns, regulatory complexity, and the necessity for specialized workforce and sophisticated technology integration are all significant hurdles.

|

Key Suppliers |

Leading worldwide LNG providers include QatarEnergy, Shell, Chevron, and Cheniere Energy, all of which have large-scale and flexible LNG supply capabilities.

|

Key Regions Covered |

Asia-Pacific, North America and Europe as a major exporter are among the regions seeing rapid expansion.

|

Market Drivers and Trends |

The growing need for cleaner fuels, rising energy consumption in developing nations, increased expenditures in LNG infrastructure, and digital transformation across the supply chain are all driving market growth.

|