Summary Overview

Lime Market Overview:

The worldwide lime market is growing steadily, driven by increased demand in major industries such as building, agriculture, steel manufacture, and environmental services. This dynamic industry encompasses a diverse variety of lime products, including as quicklime, hydrated lime, and lime-based derivatives, all of which play important roles in industrial and environmental applications. Our paper analyses procurement trends in depth, focusing on strategic cost management techniques and the growing use of data-driven insights to improve sourcing and supply chain operations.

Looking ahead, procurement professionals will confront several significant issues, including controlling volatile raw material costs, ensuring a dependable and scalable supply chain, maintaining environmental compliance, and incorporating sustainable sourcing methods into operations. Adopting sophisticated procurement practices and focusing on supplier partnerships are crucial to optimizing value, reducing operational risks, and driving long-term competitiveness in the lime sector.

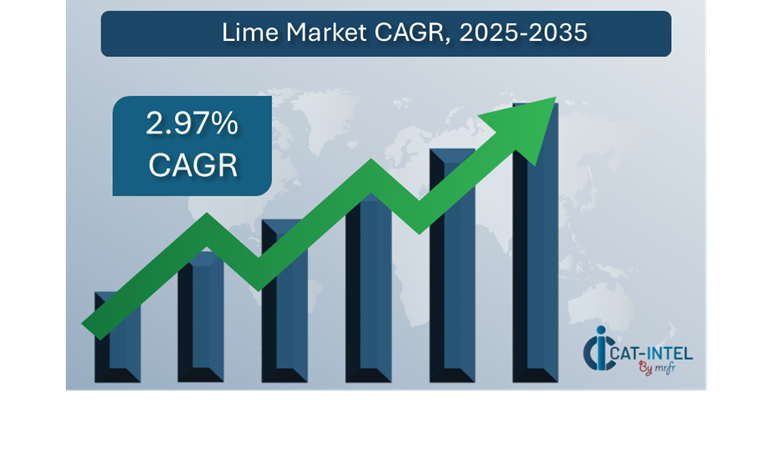

Market Size: The global Lime market is projected to reach USD 50.95 billion by 2035, growing at a CAGR of approximately 2.97% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: Real-time data and process integration are becoming increasingly important in lime production and distribution to simplify operations and improve responsiveness.

-

Retail and E-Commerce Growth: To remain competitive, lime producers and distributors are updating inventory management, demand forecasting, and consumer interaction tactics.

-

Technological Transformation: Advances in AI, automation, and process analytics are revolutionizing the lime industry and allowing improved decision-making across all processes.

-

Innovations: Modular supply chain solutions enable lime manufacturers to implement just the capabilities required, reducing complexity and operational expenses.

-

Investment Initiatives: Companies are investing strategically in digital infrastructure, automation technology, and remote monitoring systems to cut overhead and fulfill expanding worldwide demand.

-

Regional Insights: Asia Pacific and North America continue to be high-growth areas, underpinned by significant infrastructure development, environmental regulations that require lime-based solutions.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Lime producers are implementing cloud-based inventory and supply chain systems to improve scalability, reduce costs, and provide real-time access to operational data.

-

Advanced Features: The integration of AI, IoT sensors, and blockchain is gaining pace, enhancing sourcing traceability, logistics automation, and supply chain transparency.

-

Focus on Sustainability: Sustainable production methods and eco-friendly lime varieties are becoming increasingly important to meet global climate commitments.

-

Customization Trends: There is an increasing need for industry-specific lime formulations and packaging designed for industries such as water treatment, steelmaking, and agriculture. -

Data-Driven Insights: Advanced analytics help lime producers and buyers estimate demand, manage procurement cycles, and track important performance parameters like carbon footprint and energy use.

Growth Drivers:

-

Digital Transformation: Rapid digitization increases productivity, improves quality control, and creates new efficiencies in lime production and delivery.

-

Demand for Process Automation: Automation is helping to reduce repetitive operations like packing, loading, and quality checks, resulting in considerable reductions in operational bottlenecks.

-

Scalability Needs: As worldwide demand grows, lime producers look for systems and processes that can expand smoothly across markets and locations.

-

Regulatory Compliance: Lime producers are investing in compliance technologies to ensure they meet environmental rules, safety requirements, and regional quality certifications. -

Globalization: Lime suppliers must adapt to new regulatory, logistical, and financial frameworks that allow multi-currency transactions, regional certifications, and complicated delivery networks.

Overview of Market Intelligence Services for the Lime Market:

Recent assessments have found several significant issues in the lime business, including high manufacturing and shipping costs, as well as the necessity for product modification to satisfy specific industrial requirements. Market intelligence studies give practical insights into procurement prospects, allowing businesses to uncover cost-cutting measures, strengthen supplier relationships, and achieve better overall sourcing results.

Procurement Intelligence for Lime: Category Management and Strategic Sourcing

To remain competitive in the global lime market, businesses are increasingly focusing on optimizing procurement procedures through rigorous expenditure analysis and ongoing supplier performance tracking. Effective category management and strategic sourcing are critical for reducing procurement costs while guaranteeing a consistent supply of high-quality lime products and raw materials. Businesses that use data-driven market knowledge may improve their procurement strategy, manage risk more efficiently, and achieve advantageous supplier agreements.

Pricing Outlook for Lime: Spend Analysis

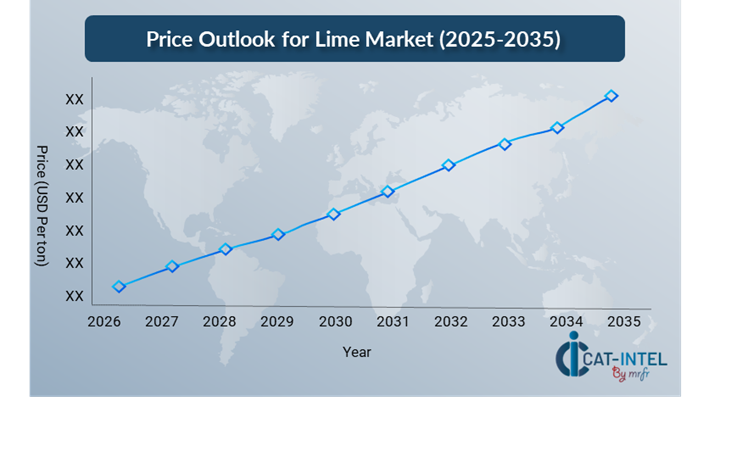

The price prognosis for lime products is projected to continue volatile, with swings affected by several major variables. The primary drivers include technological improvements, rising demand for high-purity and application-specific lime, customisation needs based on end-use industries, and geographical variances in raw material and shipping costs.

Graph shows general upward trend pricing for Lime and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To address these problems, businesses are increasing their efforts to streamline procurement processes, improve vendor management, and implement modular procurement strategies that focus on procuring just what is required, when it is needed. Leveraging digital technologies for market monitoring, pricing trend forecasts, and effective contract lifecycle management is critical to establishing cost stability.

Partnering with dependable lime suppliers, negotiating long-term contracts, and investigating volume-based or dynamic pricing models are all effective techniques for controlling costs while ensuring constant quality and availability. Regardless of price challenges, firms that prioritize scalability, engage in creative sourcing, and commit to process efficiency will be better positioned to retain cost-effectiveness and operational resilience.

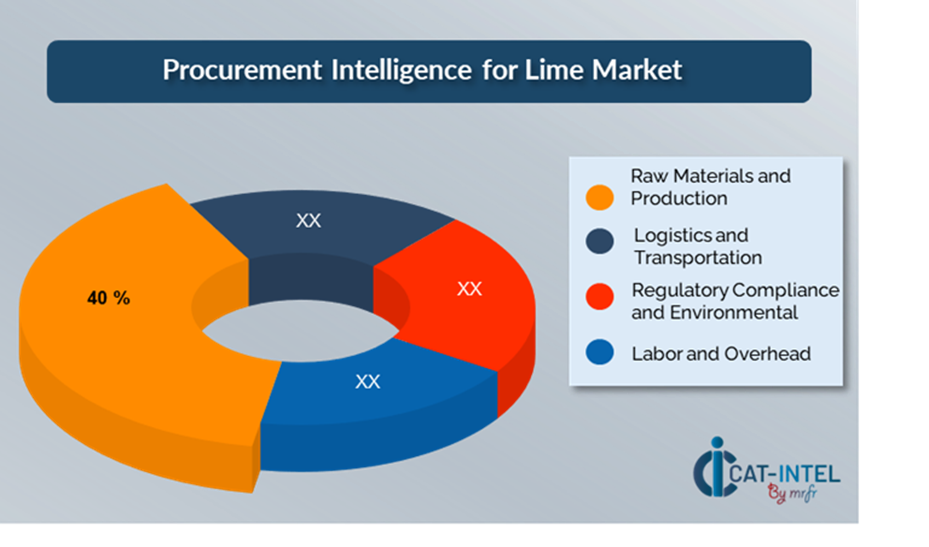

Cost Breakdown for Lime: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Materials and Production: (40%)

-

Description: This covers expenditures for mining, shipping, and processing. The production process itself, which includes energy-intensive calcination, raises the cost.

-

Trend: Producers are turning to low-carbon lime manufacturing processes and alternative energy sources to save costs and emissions.

- Logistics and Transportation: (XX%)

- Regulatory Compliance and Environmental: (XX%)

- Labor and Overhead: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the lime industry, simplifying procurement procedures and implementing effective bargaining strategies may result in significant cost savings and increased operating efficiency. Long-term agreements with lime suppliers, particularly those with scalable supply capabilities and diverse product portfolios, can result in more favourable pricing structures, including volume-based discounts and bundled service options like logistics, packaging, and technical support.

Partnering with innovative, growth-oriented lime producers provides additional benefits, including access to value-added services, process optimization support, and sustainable product alternatives, all of which help to reduce long-term operational costs. To enhance supply chain resilience, organizations are increasingly using multi-vendor sourcing techniques to decrease reliance on a single supplier, mitigate the effect of possible interruptions, and increase negotiation leverage by diversifying vendor relationships.

Supply and Demand Overview for Lime: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lime market is expanding steadily, driven by increased infrastructure development, environmental applications, and industrial demand in industries such as building, agriculture, and steel manufacture. Technological advances, industry-specific application needs, and global economic conditions all have an impact on supply and demand.

Demand Factors:

-

Infrastructure and Industrial Growth: Continued development in industries such as construction, steel, and wastewater treatment is fuelling high demand for lime, which is utilized in a variety of applications ranging from soil stabilization to pH management.

-

Environmental Regulations: Growing environmental compliance requirements are driving companies to use lime in air and water treatment processes, increasing market demand.

-

Agricultural Sector Needs: Agricultural uses are driving increasing lime demand, particularly in countries focused on enhancing crop yields and soil health.

-

Customized Lime Solutions: The growing demand for bespoke lime products for specific industrial applications necessitates the development of specialized manufacturing and delivery capabilities.

Supply Factors:

-

Advances in Production Technology: Innovations in lime kiln design, automation, and emission control are increasing efficiency and sustainability, allowing providers to compete internationally.

-

Diverse Supplier Landscape: The market has a diverse ecosystem of manufacturers, ranging from global suppliers to regional experts, giving buyers flexibility and competitive sourcing alternatives.

-

Global Economic Conditions: Energy prices, transportation rates, labour availability, and global commodities market variations all have an impact on lime supply and pricing. -

Scalability and Logistics Infrastructure: Suppliers are increasingly providing modular logistics and supply solutions, ensuring constant supply to both large-scale industrial purchasers and localized agriculture clients.

Regional Demand-Supply Outlook: Lime

The Image shows growing demand for Lime in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Lime Market

Asia Pacific, particularly China, is a dominant force in the global Lime market due to several key factors:

-

Agricultural Growth: Lime is essential for soil conditioning, increasing crop yields, and controlling pH levels in agricultural soils, which drives demand for lime in this industry.

-

Lime Demand in Pollution Control: Lime is increasingly being utilized in air and water treatment operations to reduce sulphur dioxide emissions in coal power plants and cleanse water.

-

Competitive and Expanding Supply Chain: Asia-Pacific has a robust and varied supply chain, with multiple large-scale lime producers and suppliers making it an appealing base for global procurement.

-

Rapid Industrialization and Urbanization: These nations' continued industrialization and fast urbanization provide a significant demand for lime in the building, infrastructure development, and manufacturing sectors. -

Growing Infrastructure Development: Governments around Asia-Pacific are actively investing in infrastructure projects such as roads, bridges, and buildings, making lime a key component of these large-scale projects.

Asia Pacific Remains a key hub Lime Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The lime supplier environment is diversified and more competitive, with a mix of global producers and regional manufacturers influencing important market aspects such as price structures, product specialization, and service reliability. Major multinational suppliers dominate the market due to their extensive production capacities and complete service offerings, whilst smaller, specialist manufacturers specialize in certain industrial segments such as high-purity lime for steelmaking or customized mixes for agricultural and environmental remediation.

The lime supplier ecosystem spans key production locations and comprises both established global leaders and new regional firms that meet local market demands and sector-specific applications. These vendors differ in their capacity to provide customized items, sustainable practices, and responsive logistics. As industries prioritize efficiency, environmental compliance, and supply chain resilience, lime producers are innovating in crucial areas including low-emission production methods, digital logistics, and modular service offerings to better meet changing client demands.

Key Suppliers in the Lime Market Include:

- China National Chemical Corporation

- Carmeuse

- Lhoist Group

- Graymont

- Mississippi Lime Company

- Quicklime & Hydrated Lime Ltd

- Nittetsu Mining Company Limited

- Shaanxi Qiyuan Lime Co., Ltd

- Omya AG

- Imerys

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The lime business is enjoying consistent global expansion, driven by rising demand from industries such as building, agriculture, water treatment, and steel manufacture. |

Cloud Adoption |

There has been a noticeable trend toward sustainable and low-emission lime production, driven by stronger environmental rules, ESG goals, and growing pressure on enterprises to decrease their carbon footprint. |

Product Innovation |

Lime manufacturers are developing specialized formulations, including high-purity lime and blended products, to meet industry-specific requirements such as soil stabilization, flue gas treatment, and metallurgy. |

Technological Advancements |

Advances in kiln technology, process automation, and real-time monitoring are increasing production efficiency, lowering energy usage, and allowing predictive maintenance in lime facilities. |

Global Trade Dynamics |

Changes in trade rules, transportation costs, and regional tariffs have an influence on lime exports and imports, notably pricing, supply chain reliability, and sourcing strategies for multinational customers.

|

Customization Trends |

Customized lime products and packaging solutions are in high demand, with clients looking for flexible delivery choices, consistent quality, and integration with just-in-time inventory and logistics systems.

|

Lime Attribute/Metric |

Details |

Market Sizing |

The global Lime market is projected to reach USD 50.95 billion by 2035, growing at a CAGR of approximately 2.97% from 2025 to 2035. |

Lime Technology Adoption Rate |

Approximately 70% of industrial sectors (e.g., metallurgy, water treatment, and agriculture) rely on lime products for essential operating operations, with a rising need for customized formulations.

|

Top Lime Industry Strategies for 2025 |

Leading initiatives include investing in low-emission manufacturing technology, creating application-specific lime products, increasing logistical efficiency, and diversifying sourcing and supply alliances.

|

Lime Process Automation |

To improve efficiency and uniformity, over half of large-scale lime manufacturers are using automated process controls, such as kiln operations, quality monitoring, and bulk handling systems.

|

Lime Process Challenges |

Key issues include energy-intensive production, supply chain interruptions, raw material instability, emissions compliance, and transportation limitations.

|

Key Suppliers |

China National Chemical Corporation and Carmeuse regional leaders in Asia-Pacific and Latin America provide both specialist and bulk lime products.

|

Key Regions Covered |

Asia-Pacific and North America are prominent regions, with emerging markets in Africa and South America experiencing strong expansion as infrastructure develops and agricultural demand expands.

|

Market Drivers and Trends |

The development of infrastructure projects, environmental legislation mandating lime-based treatment, increased usage of precision agriculture, and improvements in energy-efficient lime production technology all contribute to growth.

|