Summary Overview

Lighting Services Market Overview:

The global lighting services market is expanding steadily, driven by rising demand in industries such as commercial real estate, healthcare, industrial facilities, and public infrastructure. This market encompasses a wide range of options, from energy-efficient retrofits and smart lighting systems to long-term maintenance and lighting-as-a-service (LaaS) models. Our paper provides an in-depth examination of procurement patterns, emphasizing measures that produce cost savings and encourage the use of intelligent lighting solutions to improve operational performance.

Looking ahead, important difficulties in lighting services procurement include controlling installation and maintenance costs, assuring scalability for changing facility demands, protecting system integrity, and integrating innovative technologies with legacy infrastructure. To stay competitive and resilient, firms are adopting data-driven sourcing strategies and using digital lighting controls to maximize performance and energy consumption.

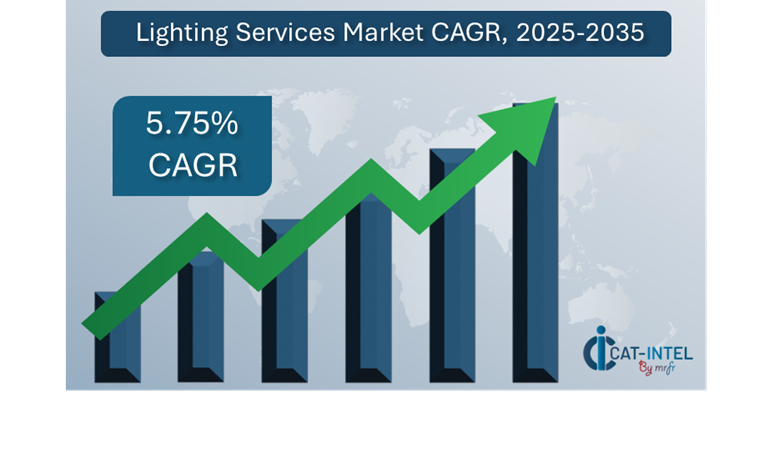

Market Size: The global Lighting Services market is projected to reach USD 254.58 billion by 2035, growing at a CAGR of approximately 5.75% from 2025 to 2035.

Growth Rate: 5.75%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: There is an increasing demand for real-time monitoring and integrated lighting systems in manufacturing and logistics settings.

-

Retail and E-Commerce Expansion: Businesses are investing in smart lighting solutions to improve the customer experience, save energy, and match lighting strategy with demand cycles.

-

Technological Advancements: AI, IoT, and machine learning are transforming the lighting services environment, drastically increasing operating efficiency and lowering costs.

-

Innovative Offerings: The proliferation of modular lighting solutions enables organizations to design customized systems based on individual facility requirements. This minimizes complexity while increasing performance and ROI.

-

Strategic Investment Initiatives: Organizations are progressively investing resources to cloud-connected lighting systems and LaaS models (Lighting as a Service) to save capital expenses.

-

Regional Insights: Asia Pacific and North America continue to dominate market adoption, thanks to robust digital infrastructure, energy-efficiency legislation, and rising demand for smart cities and sustainable construction projects.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Cloud-based lighting management solutions are being used for real-time control, data access, and remote monitoring.

-

Advanced Technologies: The integration of AI, IoT, and blockchain is enabling automation, transparency, and intelligent energy use tracking.

-

Sustainability Focus: Lighting services are crucial to energy efficiency and ESG initiatives, as they assist firms in meeting regulatory standards and lowering their carbon footprint.

-

Customization Trends: There is a growing need for industry-specific lighting solutions designed for healthcare, industrial, retail, and hospitality settings.

-

Data-Driven Insights: Smart lighting solutions offer actionable insights into energy use, occupancy patterns, and system performance.

Growth Drivers:

-

Digital Transformation: Infrastructure modernization is accelerating the deployment of smart and connected lighting solutions across industries.

-

Automation Demand: Businesses are using automation in lighting to eliminate manual intervention, save energy, and improve building intelligence.

-

Scalability Needs: Organizations require adaptable lighting systems that can accommodate facility growth and changing operating demands.

-

Regulatory Compliance: Green building norms and energy-efficiency criteria are promoting the use of new lighting systems.

-

Globalization: The growth of multinational enterprises and smart city projects is driving up demand for flexible, intelligent lighting solutions.

Overview of Market Intelligence Services for the Lighting Services Market:

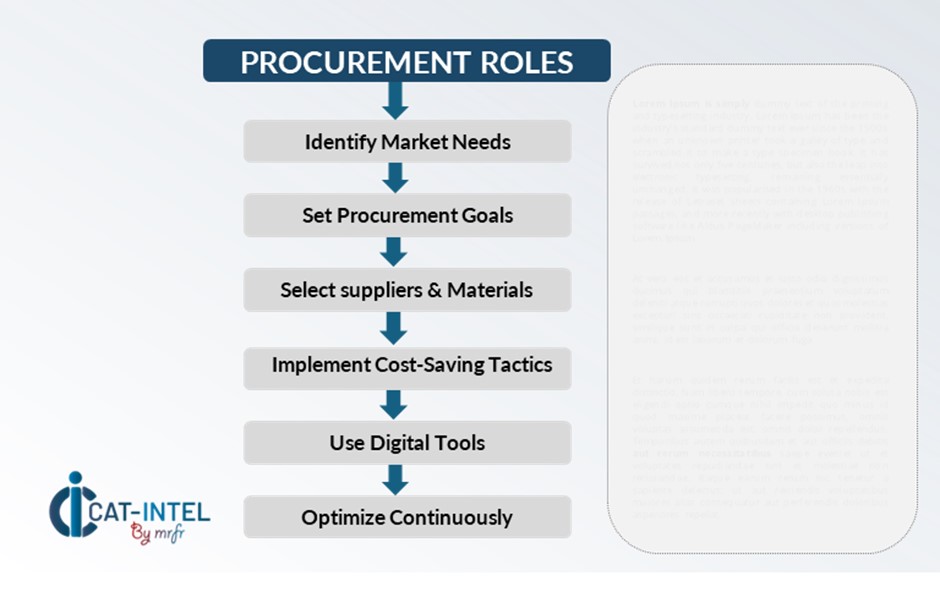

Recent market evaluations highlight important problems in the lighting services industry, such as high installation costs and an increasing need for bespoke lighting solutions adapted to different building types and operating goals. Procurement intelligence helps companies overcome these difficulties by providing actionable information about sourcing options, supplier capabilities, and cost structures. This enables enterprises to find cost-cutting methods, improve vendor relationships, and ensure the effective adoption of advanced lighting systems.

Procurement Intelligence for Lighting Services: Category Management and Strategic Sourcing

To remain competitive, firms are increasingly implementing strategic sourcing and category management strategies in lighting service procurement. Businesses may use expenditure analysis and supplier performance tracking to optimize procurement processes, assure consistent access to high-quality lighting solutions, and negotiate better terms. These insights also help to ensure regulatory compliance and maintain high standards for energy efficiency, operational performance, and sustainability. With an emphasis on smart procurement techniques, companies may better integrate lighting programs with overall operational and ESG goals.

Pricing Outlook for Lighting Services: Spend Analysis

The pricing environment for lighting services is projected to remain somewhat dynamic, with variations affected by several major factors. These include technical developments, rising demand for smart and linked lighting systems, increased customisation requirements, and regional price discrepancies. The industry is also seeing higher pricing pressure due to increased integration of AI, IoT, and sophisticated control systems, as well as a greater emphasis on data security, sustainability, and regulatory compliance.

Graph shows general upward trend pricing for Lighting Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To control costs in this dynamic pricing environment, businesses are optimizing procurement processes by implementing structured sourcing strategies and category management, improving vendor management through performance monitoring and relationship consolidation, and implementing modular lighting service offerings, which allow organizations to pay only for what they require while maintaining operational flexibility.

Partnering with dependable lighting service providers with proven capabilities and long-term value, negotiating multi-year service agreements to secure favourable pricing and reduce risk, and looking into subscription-based and Lighting-as-a-Service (LaaS) models to shift capital expenses to predictable operating costs.

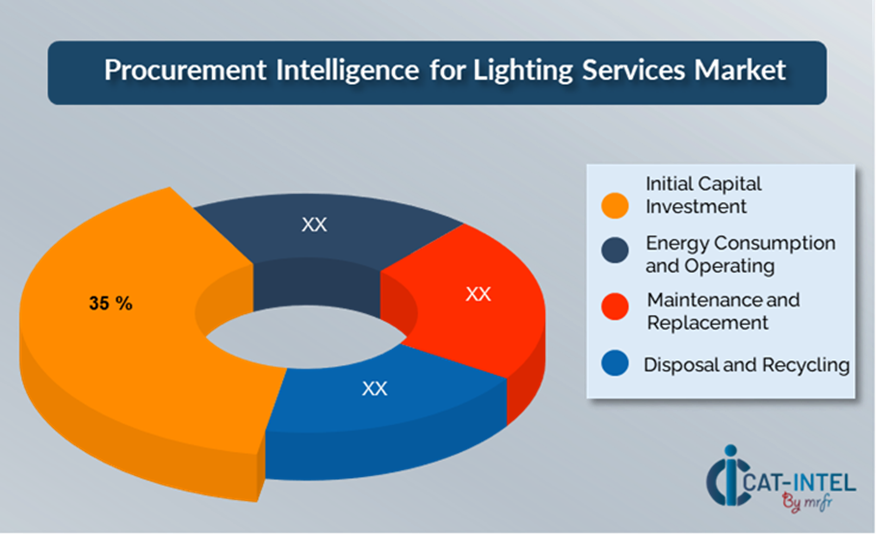

Cost Breakdown for Lighting Services: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Initial Capital Investment: (35%)

-

Description: This refers to the initial price of acquiring lighting equipment, including fixtures, lights, bulbs, and installation fees. These expenses might vary greatly depending on the type of lighting system used.

-

Trend: LED and smart lighting systems may need a greater initial investment than traditional solutions but offer long-term benefits such as energy savings and durability, making them a preferred choice.

- Energy Consumption and Operating: (XX%)

- Maintenance and Replacement: (XX%)

- Disposal and Recycling: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

Optimizing procurement procedures and employing smart negotiating methods can result in considerable cost savings and increased operational efficiency in the lighting services industry. Long-term partnerships with lighting service providers, particularly those providing smart, cloud-enabled, or Lighting-as-a-Service (LaaS) solutions, can lead to more advantageous pricing structures, such as volume-based discounts and bundled service packages. Subscription-based and multi-year contracts provide chances to assure consistent pricing while protecting against potential cost hikes.

Collaborating with lighting providers who promote innovation, energy efficiency, and scalability provides additional benefits. These partners typically provide access to advanced analytics for energy use and occupancy trends, as well as modular service packages that enable flexible, need-based deployment using a multi-vendor approach helps enterprises to lessen their reliance on a single service provider and mitigate risks associated with service outages or technological restrictions. Smart procurement combined with forward-thinking vendor tactics may lead to cost-effective, robust, and sustainable lighting systems that meet changing business and operational demands.

Supply and Demand Overview for Lighting Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lighting services market is growing steadily, driven by extensive digital transformation, a greater emphasis on sustainability, and higher demand in industries such as manufacturing, retail, and healthcare. Technological innovation, sector-specific demands, and global economic conditions all have an impact on the developing environment.

Demand Factors:

-

Smart Infrastructure and Digital Transformation: Organizations are upgrading their buildings with intelligent lighting systems to promote energy efficiency, automation, and centralized control.

-

Cloud-connected Lighting Solutions: The adoption of cloud-based platforms and Lighting-as-a-Service (LaaS) is increasing demand for scalable, subscription-based models that provide remote control and analytics.

-

Industry-specific Customization: Healthcare and manufacturing industries demand specialized lighting solutions to satisfy regulatory standards, enhance operations, and support health and safety regulations.

-

System Integration and Interoperability: There is a growing need for lighting systems that interface seamlessly with building management systems (BMS), IoT platforms, and energy dashboards to enhance operations.

Supply Factors:

-

Technological Advancements: AI-powered lighting automation, IoT-enabled fixtures, and energy analytics are improving service offerings and increasing supplier competition.

-

Expanding Vendor Ecosystem: The industry is backed by a vast spectrum of providers—from specialist lighting experts to full-service energy firms—with varying price, technology, and service delivery strategies.

-

Global Economic Influence: Exchange rates, labour costs, raw material availability, and regional acceptance of smart technologies all have an influence on price, supply schedules, and solution accessibility.

-

Modularity and Flexibility: Suppliers are providing modular lighting solutions to enterprises of different sizes and operational complexities, allowing for more deployment and scaling flexibility.

Regional Demand-Supply Outlook: Lighting Services

The Image shows growing demand for Lighting Services in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Lighting Services Market

Asia Pacific, particularly East Asia, is a dominant force in the global Lighting Services market due to several key factors:

-

Large Customer Base: The Asia-Pacific area has a sizable customer base, as well as an emerging middle class that is demanding advanced lighting solutions.

-

Rapid Urbanization and Development: The Asia-Pacific area is rapidly urbanizing, with cities such as Shanghai, Tokyo, Delhi, and Sydney expanding significantly.

-

Government Initiatives and Sustainability Policies: To reduce energy usage, governments around Asia-Pacific are putting in place strict sustainability rules and energy efficiency standards.

-

Adoption of Smart Lighting Solutions: Countries in the region are leading the way in integrating connected lighting solutions into homes, businesses, public spaces, and industrial locations.

-

Manufacturing Hub and Cost-Effective Production: The region's competitive labour prices, innovative manufacturing capabilities, and extensive supply networks give a cost-effective environment, further solidifying its market dominance.

Asia Pacific Remains a key hub Lighting Services Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The lighting services provider environment is diversified and highly competitive, with both global market giants and regional experts guiding the industry's progress. These vendors have a significant impact on critical elements including price strategies, solution customisation, technical innovation, and service quality. Well-established lighting and energy management firms dominate the market, providing comprehensive solutions such as smart lighting systems, maintenance, energy audits, and analytics, while smaller, niche providers specialize in specific industry verticals or advanced features such as AI-driven automation, IoT-enabled devices, and sustainability consulting.

Lighting suppliers are expanding their offerings as organizations prioritize energy efficiency, digital transformation, and workplace wellbeing. This includes expanding cloud-connected lighting platforms for centralized control and real-time performance monitoring, integrating AI, machine learning, and predictive analytics into service models, and providing flexible pricing structures, such as subscription-based or Lighting-as-a-Service (LaaS).

Key Suppliers in the Lighting Services Market Include:

- Panasonic

- Signify (Philips Lighting)

- Acuity Brands

- Osram

- Zumtobel Group

- Schneider Electric

- Legrand

- GE Lighting

- Hubbell Lighting

- Cree Lighting

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The lighting services industry is expanding rapidly, fuelled by rising demand for energy efficiency, smart building improvements, and sustainability standards, particularly in emerging economies and metropolitan centres. |

Cloud Adoption |

Cloud-based lighting management solutions are rapidly gaining popularity, driven by the demand for scalable, cost-effective, and remotely accessible lighting systems that enable hybrid work environments and multi-site operations.

|

Product Innovation |

Leading suppliers are diversifying their offerings with AI-powered automation, dynamic lighting control, and industry-specific lighting solutions for industries such as healthcare, retail, and manufacturing. |

Technological Advancements |

Emerging technologies including IoT-enabled lighting, machine learning for energy analytics, and automatic maintenance alerts are changing the way lighting services are supplied and optimized.

|

Global Trade Dynamics |

Evolving environmental legislation, energy efficiency requirements, and import/export policies are affecting procurement decisions and creating global lighting service plans, particularly for multinational corporations. |

Customization Trends |

There is a growing need for modular lighting solutions and bespoke service packages that work with building management systems (BMS) and third-party applications to provide customizable performance and efficiency. |

Lighting Services Attribute/Metric |

Details |

Market Sizing |

The global Lighting Services market is projected to reach USD 254.58 billion by 2035, growing at a CAGR of approximately 5.75% from 2025 to 2035.

|

Lighting Services Technology Adoption Rate |

Nearly 70% of commercial and industrial establishments have implemented sophisticated lighting systems, with a significant preference for smart, sensor-based, and cloud-connected lighting solutions. |

Top Lighting Services Industry Strategies for 2025 |

Adopting Lighting-as-a-Service (LaaS) models, integrating AI and IoT for automated controls, focusing on sustainability and energy savings, and developing modular lighting systems for flexible deployment are all important tactics.

|

Lighting Services Process Automation |

To improve energy efficiency and save operational costs, around 60% of lighting projects now use automated elements such as daylight harvesting, occupancy sensors, and predictive maintenance.

|

Lighting Services Process Challenges |

Common constraints include initial capital investment, connection with legacy systems, building occupant adaptation, and the requirement for continuous system maintenance and software upgrades.

|

Key Suppliers |

Panasonic, Signify and Schneider Electric are major lighting service providers, with regional companies offering specialized and industry-specific solutions.

|

Key Regions Covered |

Asia-Pacific and North America are the top markets for lighting services, with growing demand in urban infrastructure, healthcare, manufacturing, and commercial real estate.

|

Market Drivers and Trends |

The drive for carbon reduction, energy-saving measures, expanding smart city projects, and the integration of AI, IoT, and cloud-based lighting management systems all contribute to market growth.

|