Summary Overview

Legal Services Market Overview:

The worldwide legal services industry is steadily expanding, driven by increased demand in major industries such as business, healthcare, finance, and technology. This dynamic industry offers a wide range of services, including litigation and regulatory compliance, contract administration, and advising solutions. Our paper provides a detailed examination of procurement trends in the legal sector, highlighting cost-cutting tactics and the use of digital technologies to streamline legal processes and promote efficiency.

Looking ahead, important issues in legal procurement include managing growing service costs, guaranteeing scalability of legal personnel, safeguarding sensitive client data, and incorporating new legal technology into established workflows. Embracing digital legal technologies and strategic sourcing methods are now required to optimize legal service delivery and preserve a competitive advantage. As global demand rises, businesses are looking to market information to improve performance, lower risk, and align legal policies with overall corporate goals.

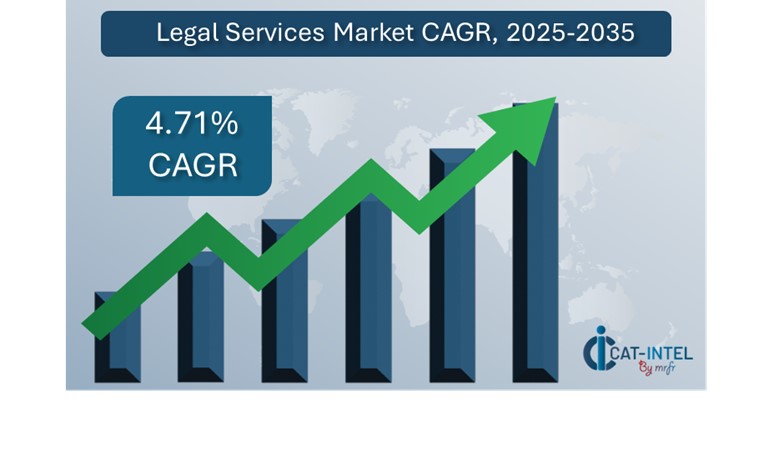

Market Size: The global Legal Services market is projected to reach USD 1627.05 billion by 2035, growing at a CAGR of approximately 4.71% from 2025 to 2035.

Growth Rate: 4.71%

-

Sector Contributions: Growth in the market is driven by: -

Operational Efficiency and Risk Mitigation: The legal profession is seeing an increase in demand for real-time data, process integration, and cross-functional cooperation to enhance service delivery.

-

Corporate and Digital Commerce Growth: As e-commerce and worldwide trade have expanded rapidly, there has been an increase in demand for legal services focusing on contract administration and regulatory compliance.

-

Technological Advancements: New technologies are revolutionizing legal services by providing predictive legal analytics, automated document review, and intelligent risk assessment.

-

Innovation: Firms and in-house legal departments are increasingly embracing flexible legal technology platforms, which allow them to choose solutions to fit their individual operational requirements.

-

Strategic Investments in Legal Technology: Companies are aggressively investing in cloud-based legal platforms to decrease IT costs, provide remote access, and improve workflow visibility.

-

Regional Insights: North America and Asia Pacific continue to be the leading regions for legal technology adoption due to sophisticated digital infrastructure, developing legislation, and high demand for cross-border legal competence.

Key Trends and Sustainability Outlook:

-

Cloud Adoption: Legal teams are turning to cloud-based solutions to better scalability, cost-efficiency, and real-time access to case files, legal research, and collaboration tools.

-

Advanced Legal Tech Integration: Artificial intelligence, Internet of Things, and blockchain technologies are being incorporated into legal systems to increase automation, due diligence, contract validation, and audit transparency.

-

Sustainability and Governance: Legal departments are increasingly assisting firms accomplish ESG obligations by improving compliance tracking and transparent reporting methods.

-

Customized Legal Solutions: There is an increasing need for industry-specific legal services and technologies that handle unique risks and compliance requirements.

-

Data-Driven Legal Insights: Advanced legal analytics solutions help organizations estimate litigation outcomes, optimize legal cost, and track key performance measures across legal operations.

Growth Drivers:

-

Digital Transformation of Legal Operations: Law firms and in-house legal teams are adopting digital technologies to improve case administration, automate low-value duties, and concentrate on strategic advising work.

-

Demand for Legal Automation: Automating repetitive legal activities, such as contract drafting, e-discovery, and compliance workflows, reduces human error and speeds up turnaround times.

-

Scalability of Legal Support: Organizations are looking for scalable legal services and platforms that can expand with their business and meet regulatory requirements.

-

Regulatory Pressures and Compliance: By utilizing real-time compliance monitoring and risk mitigation solutions, legal teams may assist firms in navigating an increasingly complicated regulatory environment.

-

Globalization: Companies operating globally need legal services that provide multi-jurisdictional compliance, multi-language capabilities, and region-specific knowledge.

Overview of Market Intelligence Services for the Legal Services Market:

Recent research has revealed persisting problems in legal services procurement, such as high engagement costs and an increased desire for tailored legal solutions. Market intelligence studies serve an important role in helping firms identify cost-saving possibilities, optimize external counsel selection, and improve the effectiveness of legal service implementation. These insights also help businesses conform to regulatory requirements, assure service quality, and improve operational efficiency—all while keeping strict cost management.

Procurement Intelligence for Legal Services: Category Management and Strategic Sourcing

To remain competitive in today's ever-changing legal world, businesses are rethinking legal procurement by using advanced expenditure analysis, benchmarking legal fees, and constantly monitoring law firm performance. Strategic sourcing and category management are increasingly critical techniques for lowering legal costs while ensuring access to consistent, high-quality legal assistance. Legal departments and sourcing teams may use procurement analytics to improve their vendor strategies, negotiate better engagement terms, and ensure alignment with corporate risk profiles and compliance needs.

Pricing Outlook for Legal Services: Spend Analysis

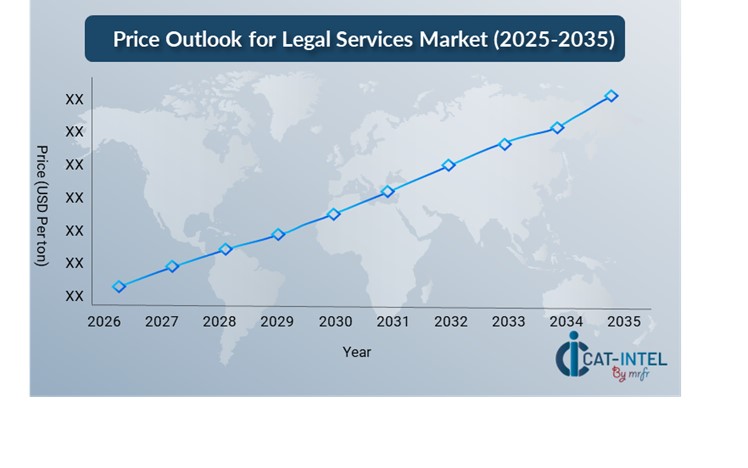

The pricing environment for legal services is projected to remain somewhat flexible, impacted by a variety of changing circumstances. Key factors include technological use in legal operations, rising demand for specialized knowledge, the complexity of legal issues, and geographical differences in service pricing.

Graph shows general upward trend pricing for Legal Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To efficiently control costs, firms optimize legal procurement by fine-tuning vendor selection, strengthening outside counsel management, and using alternative legal service providers (ALSPs). The use of digital technologies for real-time market tracking and predictive pricing modeling, smart contract management is becoming increasingly important for improving transparency and cost-efficiency.

Strategic ways to controlling total legal cost include developing long-term partnerships with trustworthy legal service providers, negotiating volume-based or fixed-fee agreements, and investigating subscription-based legal models. Despite financial constraints, emphasizing scalable legal solutions, comprehensive deployment of legal technology, and cloud-based legal platforms will be critical to maintaining cost management.

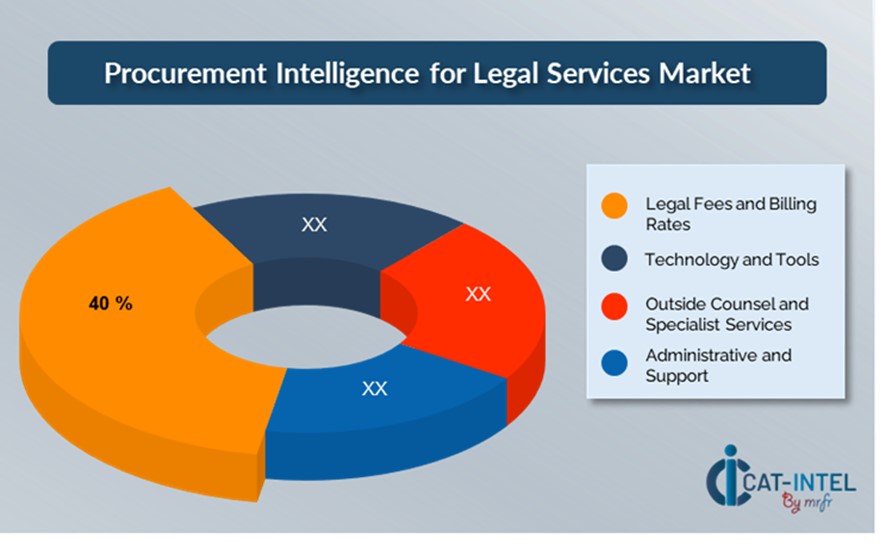

Cost Breakdown for Legal Services: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Legal Fees and Billing Rates: (40%)

-

Description: Legal fees are the most expensive component of legal services. Billing rates vary greatly depending on the legal firm's reputation, location, and area of competence.

-

Trend: An increasing preference for alternative fee arrangements (AFAs), such as fixed costs, success fees, and subscription-based models

- Technology and Tools: (XX%)

- Outside Counsel and Specialist Services: (XX%)

- Administrative and Support: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the legal services industry, refining procurement techniques and employing successful negotiating tactics can result in significant cost savings and increased operational efficiency. Long-term collaborations with law firms or legal service providers can lead to more attractive pricing structures, such as volume discounts and packaged legal services. Multi-year agreements and flat-fee formats give firms with predictable legal expenditure while decreasing price volatility.

Partnering with innovative legal providers who prioritize scalability, legal technology integration, and data-driven services provides additional value, such as real-time analytics, AI-supported legal research, and modular service delivery, resulting in lower long-term operational and compliance costs. Leveraging digital procurement tools. Such as contract lifecycle management platforms, e-billing solutions, and legal cost analytics increases visibility, eliminates over-engagement, and assures the best use of legal resources. Furthermore, using a diverse sourcing architecture that includes a mix of legal firms, ALSPs, and in-house teams reduces reliance on a single supplier and lowers risks.

Supply and Demand Overview for Legal Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The legal services industry continues to develop steadily, owing to broad digital transformation and increased regulatory complexity in areas such as healthcare, banking, and manufacturing. Advances in legal technology, the rising need for specialized expertise, and altering global economic conditions are all influencing supply and demand dynamics.

Demand Factors:

-

Shift to Subscription-Based: In-house legal teams are increasingly looking for adaptable, subscription-based engagement models that provide predictable pricing and scalable service delivery.

-

Industry-Specific Legal Experience: Regulated industries, such as healthcare, energy, and financial services, are boosting demand for legal professionals with extensive industry knowledge and compliance expertise.

-

Integrates Seamlessly with Enterprise: Demand is increasing for legal services and technology that link with larger corporate systems, allowing for more data visibility and workflow efficiency.

-

Digital Transformation in Legal Operations: The increased need for centralized legal procedures, automation, and data-driven decision-making is driving up demand for simplified legal services and technology-enabled legal solutions.

Supply Factors:

-

Legal Technology Advancements: AI-powered contract review, predictive analytics, and e-discovery tools, which are revolutionizing service delivery paradigms and increasing provider competition.

-

Expanding Provider Ecosystem: The legal services market today encompasses a more diverse range of traditional law firms, Alternative Legal Service Providers (ALSPs), legal software companies, and interdisciplinary firms.

-

Economic and Regulatory Variables: Currency rate volatility, labor costs, and developing cross-border regulatory frameworks, which all have an impact on legal pricing, outsourcing patterns, and service availability.

-

Scalability and Customization: Providers are increasingly offering modular legal services that may be adjusted to the unique needs of enterprises of all sizes maturity levels, and industry focuses.

Regional Demand-Supply Outlook: Legal Services

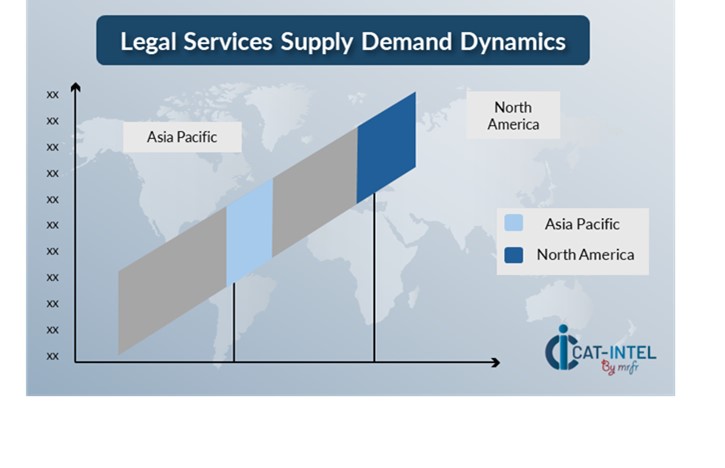

The Image shows growing demand for Legal Services in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Legal Services Market

North America, particularly the United States, is a dominant force in the global Legal Services market due to several key factors:

-

Legal Technology Adoption and Innovation: The area has witnessed the adoption of cutting-edge solutions like as AI-powered legal research, contract management tools, e-discovery platforms, and automation tools, which has prompted more firms to seek legal counsel.

-

Strong Need for Specialized Legal Services: North America's legal environment is diversified and complicated, owing to the presence of several businesses such as banking, healthcare, technology, and energy.

-

Advanced Legal Infrastructure and Ecosystem. The region has a strong legal ecosystem, which includes bar associations, legal education institutions, and regulatory authorities that promote the expansion of the legal services industry.

-

Favourable Regulatory and Political Environment: The United States, in particular, benefits from a stable, transparent, and globally recognized legal system, making it an appealing destination for businesses and legal experts.

-

Strong Economic and Business Environment: North America, notably the United States and Canada, has a well-developed economy with a huge number of enterprises in numerous areas that demand constant legal services.

North America Remains a key hub Legal Services Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the legal services industry is diversified and extremely competitive, with worldwide law firms, regional legal providers, and a developing ecosystem of legal technology startups. These providers influence pricing patterns, service customisation, and the overall customer experience. While the largest multinational firms continue to dominate with full-service legal products, smaller specialty providers and ALSPs are gaining popularity by focusing on certain practice areas, industrial verticals, or technology-driven solutions.

The ecosystem contains a mix of established businesses and nimble innovators addressing the specific legal and regulatory demands of areas such as healthcare, banking, and technology. As legal departments pursue digital transformation and cost efficiency, legal service providers are improving their cloud-based capabilities, implementing sophisticated analytics, and embracing flexible pricing structures to meet the evolving expectations of modern businesses.

Key Suppliers in the Legal Services Market Include:

- Baker McKenzie

- DLA Piper

- Clifford Chance

- Allen and Overy

- Linklaters

- Latham and Watkins

- Evershed & Sutherland

- Kirkland & Ellis

- EY Law

- Elevate Services