Summary Overview

Legal Services Australia Market Overview:

The legal services industry in Australia is expanding steadily, driven by changing client demands in industries such as business, government, healthcare, and infrastructure. This dynamic industry offers a diverse spectrum of legal services, including consulting and litigation, regulatory compliance, and alternative legal service delivery methods. Our paper provides a detailed examination of legal procurement trends, with a heavy emphasis on cost management tactics and the use of digital technologies to improve service delivery and operational procedures.

Looking ahead, key challenges in legal procurement include controlling service delivery costs, guaranteeing the scalability of legal operations, protecting client data, and enabling seamless interaction between internal teams and outside legal suppliers. Legal technology and strategic sourcing techniques are becoming more widely adopted critical for enhancing value, ensuring compliance, and driving long-term competitiveness.

Market Size: The global Legal Services Australia market is projected to reach AUD 20.84 billion by 2035, growing at a CAGR of approximately 5.47% from 2025 to 2035.

Growth Rate: 5.47%

-

Sector Contributions: Growth in the market is driven by: -

Corporate and Government Need: As compliance, risk management, and contract law become more complicated, there is a growing demand for real-time legal insights and integrated legal support throughout supply chains.

-

Regulatory Evolution: The frequent modifications in law force organizations to seek legal partners with deep industry understanding and adaptable tactics.

-

Technological Enablement: Advancements in legal technology, such as AI-powered research tools, e-discovery platforms, and automated document preparation, are improving legal processes and service accuracy.

-

Modular Service Delivery: Law firms and in-house legal teams are increasingly choosing bespoke legal solutions, which allow them to scale support based on demand and focus on strategic goals.

-

Remote Service Models: Investing in cloud-based legal management tools allows for safe, flexible, and remote service delivery, which aligns with developing workplace standards and client expectations.

-

Regional Market Dynamics: New South Wales and Victoria are leaders in legal innovation, owing to robust business ecosystems and advanced digital infrastructure.

Key Trends and Sustainability Outlook:

-

Digital Legal Services: Cloud-based case management systems, virtual consultation platforms, and online dispute resolution tools are increasingly being used to simplify service delivery.

-

Advanced Legal Technology: The integration of AI, natural language processing, and smart contracts improves problem resolution, reduces turnaround times, and increases transparency.

-

Sustainability and ESG Compliance: Legal services are crucial in assisting firms in navigating their environmental, social, and governance (ESG) requirements, as well as providing regulatory counsel.

-

Specialisation and Sector Focus: There is a growing demand for industry-specific legal skills in healthcare, construction, mining, and technology, where sophisticated regulation and risk management are critical considerations.

-

Data-Driven Practice: The application of data in legal operations allows for more accurate risk forecasting, cost projection, and performance tracking.

Growth Drivers:

-

Digital Transformation of Legal Operations: Companies are investing in digital solutions to minimize dependency on manual legal procedures and increase efficiency.

-

Demand for Legal Process Automation: Automating regular legal operations like contract writing and compliance checks reduces administrative load while boosting attention on strategic consulting.

-

Scalable Legal Support: Businesses are looking for legal service models that can expand with their expansion and adapt to changing demands.

-

Regulatory Complexity: As local and international regulations evolve, businesses are seeking consistent, up-to-date legal help.

-

Globalisation of Business: Companies operating across borders require legal services that can handle multi-jurisdictional compliance, cross-border transactions, and international dispute resolution.

Overview of Market Intelligence Services for the Legal Services Australia Market:

Recent analyses of the Australian legal services sector have found significant problems, including high engagement costs and an increased need for bespoke legal solutions. In this complicated context, market intelligence reports are becoming more important tools, providing practical insights into procurement prospects and allowing organizations to make educated, cost-effective decisions. These insights assist firms in identifying cost-saving methods without sacrificing service quality and maintaining compliance with legal and regulatory frameworks.

Procurement Intelligence for Legal Services Australia: Category Management and Strategic Sourcing

To remain competitive and nimble, prominent Australian businesses are rethinking their legal procurement strategies. This involves spending analysis to identify inefficiencies and consolidate legal service categories, as well as reviewing legal providers' performance to ensure alignment with corporate goals and service level expectations. Organizations may use actionable procurement analytics to streamline legal sourcing strategy, improve negotiating outcomes, and fee structures and reduce procurement-related risks.

Pricing Outlook for Legal Services Australia: Spend Analysis

The pricing landscape for legal services in Australia is projected to remain somewhat dynamic, with swings driven by a variety of variables. Rising demand for specialist legal skills, increased complexity in compliance and regulatory requirements, use of legal technology, and variances in regional service delivery are all key factors.

Graph shows general upward trend pricing for Legal Services Australia and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To ensure cost-effectiveness while ensuring high-quality outputs, organizations are implementing a variety of procurement and vendor management practices. Streamlining legal provider panels to increase monitoring, uniformity, and bargaining power. Long-term contracts may be used to lock in price and reduce volatility, while also encouraging greater provider engagement.

Looking at new pricing arrangements to replace billable-hour models with more predictable expenses. Using digital tools and data to track market rates, predict price changes, and evaluate internal performance. Engaging legal support for a project or issue-specific basis, reducing unnecessary overhead

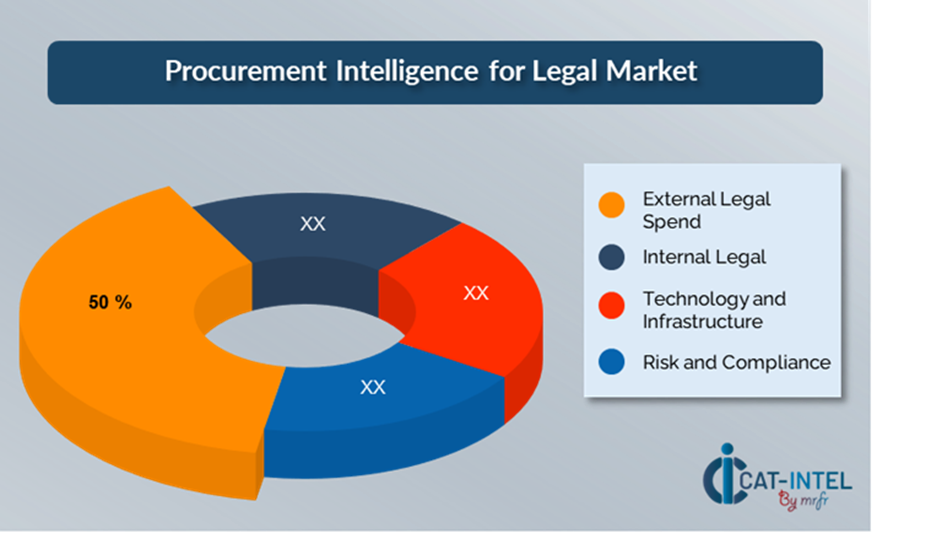

Cost Breakdown for Legal Services Australia: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- External Legal Fees: (40%)

-

Description: These expenses are incurred when organizations engage law firms or individual lawyers to handle litigation, transactional work, consulting services, and other legal matters.

-

Trend: Firms are increasingly moving toward value-based pricing, which bases costs on outcomes rather than hours done, indicating a rising need for cost transparency

- In-house Legal Team: (XX%)

- Legal Technology and Tools: (XX%)

- Regulatory and Compliance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Australian legal services business, refining procurement methods and implementing strategic bargaining strategies can result in considerable cost savings while also improving operational efficiency and legal outcomes. Long-term collaborations with legal service providers, particularly those that provide flexible and tech-enabled service delivery, can result in more competitive cost structures and conditions, such as volume-based pricing, bundled services, or fixed-fee agreements. Moving away from ad hoc legal spending and toward subscription or retainer models ensures predictable pricing, reduces rate rises, and promotes proactive legal participation.

Collaborating with legal providers who value technology, scalability, and process innovation gives access to technologies like as AI-assisted research, document automation, and real-time compliance tracking, lowering costs and response times. Engaging a diverse panel of legal firms and alternative legal service providers (ALSPs) reduces reliance on a single firm, mitigates service delivery risks, and increases negotiating power. Incorporating KPIs into legal contracts allows for transparent benchmarking of provider performance, which helps justify legal cost while also assuring alignment with corporate objectives.

Supply and Demand Overview for Legal Services Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Australian legal services industry is expanding steadily, fuelled by rising regulatory complexity, digital transformation across industries, and increased need for sector-specific legal knowledge. Technological innovation, economic conditions, and changing customer expectations all have an impact on both supply and demand.

Demand Factors:

-

Digital Transformation for Business Operations: As Australian businesses speed their digital transformation, the need for legal services in areas such as data protection, cybersecurity, and digital contracts grows dramatically.

-

Cloud-Enabled Legal Services: Businesses are increasingly looking for cloud-based and remote legal help, fuelling demand for adaptable, subscription-based, and tech-integrated legal solutions.

-

Sector-specific Legal Requirements: Legal services in highly regulated areas, such as healthcare, construction, mining, and financial services, must be adapted to industry standards and compliance demands.

-

Integrated Legal Functionality: Companies choose legal solutions that link with internal tools, procurement systems, and risk management platforms to enable smooth compliance and operational alignment.

Supply Factors:

-

Legal Technology and Innovation: Advances in legal technology, such as AI-assisted research, automated document creation, and e-discovery, are improving legal service delivery and supplier differentiation.

-

Diverse Provider Ecosystem: The Australian market has a growing mix of traditional law firms, alternative legal service providers (ALSPs), and in-house legal teams, giving customers more alternatives.

-

Economic Conditions and Talent Availability: Labor costs, economic cycles, and cross-border service capabilities all have an impact on the pricing and availability of legal services, especially when businesses compete for top personnel.

-

Scalable Service Models: Providers now provide modular, scalable legal services, allowing customers to engage support for everything from one-time compliance checks to enterprise-level legal initiatives.

Regional Demand-Supply Outlook: Legal Services Australia

The Image shows growing demand for Legal Services Australia in both New South Whales and Victoria, with potential price increases and increased Competition.

New South Whales: Dominance in the Legal Services Australia Market

New South Whales, particularly Sydney, is a dominant force in the global Legal Services Australia market due to several key factors:

-

Sydney: The Business Hub: Sydney, the capital city of New South Wales, is Australia's financial and business hub, with major firms' headquarters there, increasing demand for legal services.

-

High Concentration of Legal Companies: Sydney is home to a substantial number of top-tier and boutique law firms, as well as multinational firms with local offices.

-

Strong Regulatory Environment: Legal services are in great demand to negotiate these requirements, financial services, construction, and healthcare are particularly important industries for the state's economy.

-

Legal Tech Innovation: Sydney is a pioneer in the use of legal technology and innovation in Australia. These technologies, such as AI-powered contract review tools and e-discovery platforms, appeal to firms looking to simplify legal processes.

-

Government & Public Sector Contracts: Given its size and the quantity of public sector projects across the state, the NSW government is a large procurer of legal services.

New South Whales Remains a key hub Legal Services Australia Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The legal services supplier environment in Australia is diversified and highly competitive, with a mix of major national law firms, boutique specialists, and rising alternative legal service providers (ALSPs). These vendors have a significant impact on price structures, service models, specialism, and delivery quality. Large full-service companies dominate the high end of the market, delivering integrated legal solutions across many industries and jurisdictions.

At the same time, smaller, specialist firms and legal tech-enabled providers are gaining market share by focusing on certain business verticals or providing novel service models such as AI-enhanced document review, fixed-fee consulting, and virtual legal counsel. Major companies provide complete legal services in areas such as corporate law, regulatory compliance, mergers and acquisitions, and litigation, frequently with cross-border capabilities and long-term collaborations. Specialized businesses serve industries such as healthcare, construction, mining, and technology, where extensive regulatory expertise and specific counsel are critical.

Key Suppliers in the Legal Services Australia Market Include:

- MinterEllison

- Clayton Utz

- Allens

- King and Wood Mallesons

- Herbert Smith Freehills

- Corrs Chambers, Westgarth

- Norton Rose Fulbright

- Baker McKenzie

- Ashurst

- Spotless Legal (ALSP)

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The Australian legal services industry is expanding, driven by increased demand for regulatory compliance, ESG advising, and sector-specific expertise—particularly in healthcare, construction, and technology. |

|

Cloud Adoption |

There is a significant trend toward cloud-enabled legal platforms and virtual consultations, which promote hybrid work arrangements. and enhancing client accessibility throughout metro and regional areas. |

|

Product Innovation |

Law firms and ALSPs are expanding their service offerings with AI-assisted legal research, automated document writing, and online dispute resolution tools, resulting in shorter response times and more customer value. |

|

Technological Advancements |

Machine learning, predictive analytics, and robotic process automation (RPA) are being utilized to automate tedious operations, enhance matter management, and create strategic insights. |

|

Global Trade Dynamics |

Client legal needs are being reshaped by evolving law, a growing emphasis on business transparency, and changing international trade restrictions, particularly for multinational and export-driven organizations. |

|

Customization Trends |

Clients are looking for legal services that are particular to their business models, such as modular legal solutions, industry-specific compliance techniques, and flexible pricing structures that encourage long-term involvement. |

|

Legal Services Australia Attribute/Metric |

Details |

|

Market Sizing |

The global Legal Services Australia market is projected to reach AUD 20.84 billion by 2035, growing at a CAGR of approximately 5.47% from 2025 to 2035.

|

|

Legal Services Australia Technology Adoption Rate |

An estimated 70% of Australian law firms and corporate legal departments have used legal technology solutions such as cloud-based practice management, e-discovery, and AI-powered document automation.

|

|

Top Legal Services Australia Industry Strategies for 2025 |

Key efforts include increasing legal technology integration, implementing alternative fee arrangements (AFAs), improving cybersecurity and data privacy compliance, and providing more client-centric, digital-first services. |

|

Legal Services Australia Process Automation |

To increase productivity and minimize costs, over 50% of mid-to-large organizations are automating legal operations such as contract lifecycle management, compliance monitoring, and document review.

|

|

Legal Services Australia Process Challenges |

Rising expenses, workforce shortages, negotiating complicated legal frameworks, conventional practices' resistance to change, and guaranteeing data security across digital platforms are all significant problems.

|

|

Key Suppliers |

Leading providers include top-tier law firms, MinterEllison and Clayton Utz, boutique specialists, and ALSPs that provide scalable, technology-enabled legal services.

|

|

Key Regions Covered |

The highest demand is focused on New South Wales, Victoria, and Queensland, with significant development in rural and distant legal access, notably via online legal services and virtual counsel.

|

|

Market Drivers and Trends |

Growth is being driven by increased demand for compliance advising, digital transformation of legal operations, ESG and sustainability reporting, and the use of AI and analytics for legal risk forecasting.

|