Summary Overview

Legal Market Overview:

The global legal market is steadily expanding, propelled by rising demand in sectors such as corporate governance, regulatory compliance, litigation, and legal technology. This ever-changing market has a diverse spectrum of participants, including law firms, legal departments, technology suppliers, and alternative legal service models, all of which are responding to changing client expectations and operational demands. Our paper provides an in-depth look at legal procurement trends, highlighting cost-cutting methods as well as the growing significance of digital technologies in reshaping legal workflows and decisions.

Key problems on the horizon include controlling growing operating expenses, assuring scalability of legal services, maintaining tight data security, and integrating new technology with existing legal infrastructure. Digital procurement platforms and strategic sourcing are becoming important instruments for modernizing legal operations, improving agility, and delivering long-term value.

Market Size: The global Legal market is projected to reach USD 23.53 billion by 2035, growing at a CAGR of approximately 7.45% from 2025 to 2035.

Growth Rate: 7.45%

-

Sector Contributions: Growth in the market is driven by: -

Legal Operations and Compliance Optimization: Real-time data access and linked procedures are becoming increasingly important for improving legal operations, compliance workflows, and risk mitigation techniques.

-

Corporate and Regulatory Expansion: The rise of complicated regulatory frameworks and cross-border transactions is increasing need for advanced legal infrastructure to manage documents, deadlines, and changing duties.

-

Technological Transformation: Artificial intelligence and machine learning advancements are changing the way legal teams work, allowing for predictive legal analytics, automated research, and improved case strategy.

-

Modular Innovation in Legal Tools: Flexible, modular legal platforms enable firms to adopt exactly the features they require, therefore simplifying processes, lowering overhead, and boosting focus.

-

Strategic Investments: Firms and corporate legal departments are investing in cloud-native legal solutions to reduce infrastructure costs, improve communication, and enable distant legal work.

-

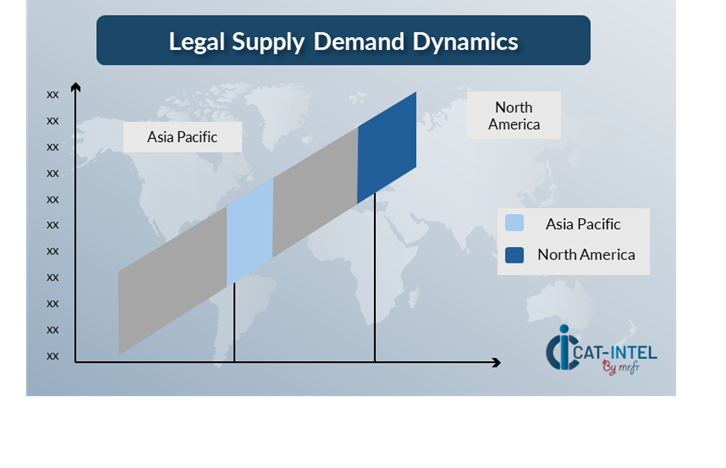

Regional Dynamics: North America and Asia Pacific remain prominent areas, owing to advanced legal frameworks, technical preparedness, and increased use of legal innovation solutions.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Increasing the adoption of cloud-based legal technologies to promote accessibility, scalability, and cross-jurisdictional collaboration.

-

Emerging Technologies: The integration of AI, IoT, and blockchain improves legal procedures by increasing transparency, traceability, and data-driven decision-making

-

Sustainability and Governance Focus: Legal departments are playing a vital role in helping firms satisfy ESG criteria by ensuring responsibility and handling reporting responsibilities.

-

Sector-certain Customization: There is a growing need for legal instruments suited to certain industries such as healthcare, energy, and manufacturing, which handle sector-specific risks and laws.

-

Insight-Driven Legal Strategy: Analytics are becoming increasingly important in monitoring case results, forecasting regulatory trends, and guiding strategic strategy.

Growth Drivers:

-

Digital Transformation in Legal Functions: Businesses are digitizing legal procedures to improve responsiveness, decrease human labor, and speed up decision-making.

-

Process Automation Needs: Automation is becoming increasingly important for managing repetitive legal processes such as contract review, compliance inspections, and due diligence.

-

Scalability of Legal Infrastructure: As organizations expand, there is a greater requirement for legal tools and procedures that can scale with operations while maintaining compliance.

-

Regulatory Pressure: As legal and regulatory requirements evolve, there is a growing demand for systems and methods that assure constant, auditable compliance.

-

Globalization of Legal Risk: Legal functions must increasingly deal with multi-jurisdictional challenges, including numerous legal systems, languages, and international standards.

Overview of Market Intelligence Services for the Legal Market:

Recent evaluations have revealed important problems in the legal business, such as increased implementation costs and an increasing need for customized legal systems and instruments. As a result, firms are turning to market intelligence to unearth actionable insights that increase procurement efficiency, identify cost-cutting possibilities, and boost supplier management. These insights not only improve the effectiveness of legal technology installation but also help to comply with changing requirements and maintain high standards throughout legal operations—all while successfully reducing costs.

Procurement Intelligence for Legal: Category Management and Strategic Sourcing

To remain competitive in today's legal market, firms are improving procurement strategies using data-driven expenditure analysis and vendor performance evaluations. Robust category management and strategic sourcing are critical for lowering legal procurement costs and providing constant access to dependable, high-quality solutions. Businesses may use legal market information to improve procurement strategy, reduce risk, and negotiate better rates for legal technology, consulting services, and compliance tools. This strategic strategy enables legal teams to coordinate procurement with long-term organizational goals while maintaining operational agility and compliance integrity.

Pricing Outlook for Legal: Spend Analysis

The pricing environment for legal technology is projected to remain highly flexible, impacted by a variety of changing circumstances. Rapid developments in legal technology capabilities, rising demand for cloud-based systems, greater customisation requirements, and regional price discrepancies are all major factors.

Graph shows general upward trend pricing for Legal and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To handle these dynamics, legal departments and procurement teams are focusing more on simplifying procurement procedures and strengthening vendor relationships. Partnering with reputable legal technology suppliers, negotiating multi-year contracts, and investigating subscription-based pricing structures are all good long-term expenditure management techniques.

Despite pricing challenges, enterprises may remain cost-effective by focusing on scalable solutions, guaranteeing successful deployment, and embracing cloud-based platforms to boost flexibility and decrease infrastructure costs.

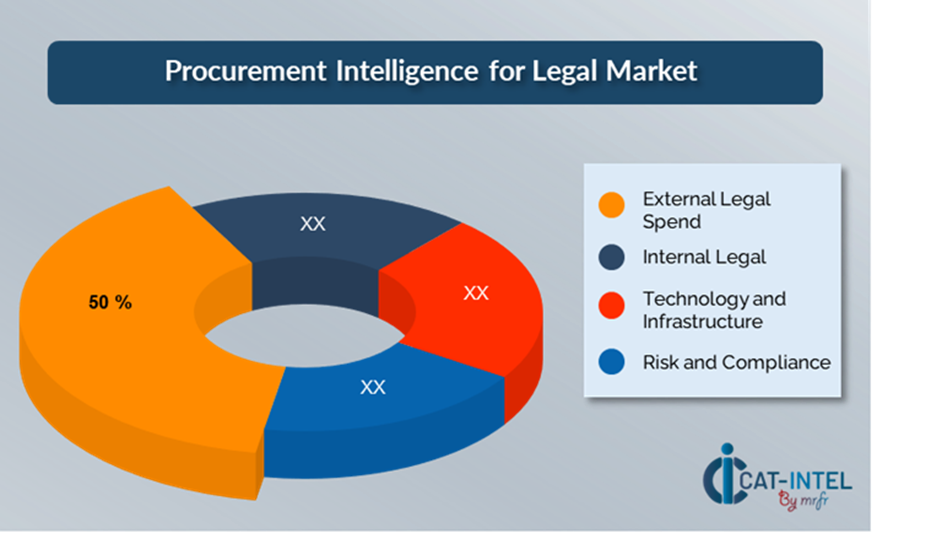

Cost Breakdown for Legal: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- External Legal Spend: (50%)

-

Description: Includes the expenses paid to outside counsel, law firms, consultants, and other third-party legal service providers.

-

Trend: Increased usage of Alternative Legal Service Providers (ALSPs) for lower-risk business. AND legal spend analytics tools to detect inefficiencies.

- Internal Legal: (XX%)

- Technology and Infrastructure: (XX%)

- Risk and Compliance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the changing legal technology world, streamlining procurement procedures and implementing strategic negotiating strategies can result in significant cost savings and enhanced operational performance. Long-term relationships with legal technology providers, particularly those that offer scalable, cloud-based platforms, can result in more attractive pricing arrangements, such as volume-based discounts and bundled service packages.

Partnering with forward-thinking legal technology providers—those that prioritize innovation, modular design, and AI-powered features—can result in increased value through improved analytics, automation capabilities, and lower long-term operational costs. These collaborations enable more flexible legal services by providing tools that may develop and adapt in tandem with business demands. Diversifying technology providers and implementing a multi-vendor approach may reduce dependency on a single source, lower the risk of service disruptions, and boost negotiating power.

Supply and Demand Overview for Legal: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The legal technology market is expanding steadily, driven by the rapid speed of digital change in industries such as corporate law, regulatory compliance, and legal operations. Rapid innovation, industry-specific solutions, and global economic trends all have an impact on both supply and demand.

Demand Factors:

-

Digital Transformation in Legal Operations: The need for centralized document management, regular process automation, and increased compliance monitoring is driving demand for advanced legal technology platforms.

-

Cloud-Based Adoption: There is a definite move toward cloud-native legal products, which is increasing demand for scalable, subscription-based platforms that enable remote work and real-time communication.

-

Sector-Specific Compliance Needs: Healthcare, banking, and industrial industries all require legal solutions that consider their specific regulatory frameworks and risks.

-

Integration with Technology: Legal departments are increasingly looking for platforms that interact smoothly with business systems, eDiscovery tools, and compliance software, allowing for a more connected and data-driven legal environment.

Supply Factors:

-

Technological Innovation: Advances in AI, machine learning, and cloud infrastructure are transforming legal technology services by improving automation, analytics, and decision assistance.

-

Expanding Vendor Landscape: The legal IT industry is becoming more diversified, with specialist providers and enterprise-scale vendors giving customers a wide choice of solutions.

-

Global Economic Influences: Currency changes, labour market upheavals, and regional investment in digital infrastructure continue to have an influence on legal technology cost and availability internationally.

-

Modular and Scalable Platforms: Vendors are increasingly providing modular legal systems that can expand with corporate expansion, allowing for customized deployment tactics.

Regional Demand-Supply Outlook: Legal

The Image shows growing demand for Legal in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Legal Market

North America, particularly the United States, is a dominant force in the global Legal market due to several key factors:

-

Size and Complexity of the US Economy: The United States has the world's largest economy, with a diverse range of sectors and extensive international commerce. This naturally generates considerable demand for the legal market.

-

Litigious Legal Culture: The United States has a more litigious legal system than many other countries, with numerous civil lawsuits, class actions, and regulatory enforcement activities.

-

Global Reach of US Law Firms: Many of the world's largest and most powerful law firms are in North America, primarily the United States.

-

Advanced Legal Infrastructure: North America has a highly developed legal education system, a strong court, and a well-established corpus of case law. -

Tech Innovation and IP Law Leadership: North America, particularly the United States, is a global leader in technology and innovation, resulting in high demand for legal services in intellectual property.

North America Remains a key hub Legal Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the legal technology industry is diversified and more competitive, with a mix of global players and specialised regional suppliers. These vendors play an important role in determining price strategies and customisation possibilities. Integration possibilities and overall service quality. The industry is headed by well-known legal technology companies who provide end-to-end solutions for document management, contract lifecycle automation, compliance tracking, and analytics.

Along with them, an increasing number of specialist companies emerge, each focusing on a specific legal function, such as AI-powered legal research, eDiscovery, regulatory change management, or risk analysis.

The legal tech ecosystem spans key legal and technology hubs, encompassing both internationally known platforms and creative local suppliers catering to sector-specific or jurisdictional requirements.

The changing supplier landscape gives legal teams a wide range of options, allowing them to choose solutions that correspond with their specific compliance needs, practice areas, and growth objectives.

Key Suppliers in the Legal Market Include:

- Kirkland & Ellis

- Latham and Watkins

- Baker McKenzie

- Skadden Arps Slate

- Meagher & Flom

- Sidley Austin

- Gibson Dunn & Crutcher

- Ropes and Gray

- White and Case

- Morgan, Lewis, and Bockius

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The legal technology industry is expanding rapidly as businesses engage in digital solutions to expedite legal processes, increase compliance, and enhance risk management.

|

|

Cloud Adoption |

The shift to cloud-based legal platforms is gaining traction, driven by the demand for scalable, cost-effective solutions that enable safe, remote collaboration in hybrid and distributed work settings. |

|

Product Innovation |

Legal technology vendors are increasing their solutions to include AI-enabled contract analysis, real-time legal analytics, and tools targeted to industry-specific regulatory requirements in industries such as banking, healthcare, and energy. |

|

Technological Advancements |

Breakthroughs in AI, machine learning, and robotic process automation (RPA) are boosting legal operations by allowing predicting insights, automating mundane procedures, and improving research accuracy. |

|

Global Trade Dynamics |

Evolving international rules, cross-border compliance needs, and evolving economic policies all have an impact on legal technology adoption, particularly for multinational corporations negotiating complicated legal environments. |

|

Customization Trends |

Demand is increasing for modular, adaptable legal technology platforms that interact with business systems and provide tailored functionality to satisfy the specific demands of legal departments and practice areas. |

|

Legal Attribute/Metric |

Details |

|

Market Sizing |

The global Legal market is projected to reach USD 23.53 billion by 2035, growing at a CAGR of approximately 7.45% from 2025 to 2035.

|

|

Legal Technology Adoption Rate |

Approximately 60% of legal departments worldwide have implemented legal technology solutions, with a noticeable move toward cloud-based systems to increase flexibility and minimize operating expenses.

|

|

Top Legal Industry Strategies for 2025 |

AI-driven contract review and analysis, compliance and reporting automation, improved cybersecurity standards, and the use of mobile legal tech solutions to boost accessibility are all important tactics for legal departments.

|

|

Legal Process Automation |

To boost productivity, over 50% of legal technology installations automate regular operations such as contract drafting, document inspection, compliance checks, and time monitoring.

|

|

Legal Process Challenges |

Legal teams confront significant problems such as high initial implementation costs, employee opposition to new technology, and data migration concerns and software upgrades and system maintenance are required on a continuous basis.

|

|

Key Suppliers |

Kirkland & Ellis, Latham and Watkins and Baker McKenzie are among the leading legal technology companies, with systems focused on legal research, document management, case management, and eDiscovery.

|

|

Key Regions Covered |

North America, Europe, and Asia-Pacific are major markets for legal technology adoption, with high demand in corporate law, regulatory compliance, and litigation assistance.

|

|

Market Drivers and Trends |

The increasing requirement for automated document management, the growing acceptance of cloud-based legal solutions, the desire for real-time analytics in case management, and the incorporation of new technologies.

|