Summary Overview

Large Molecule Drug Substance CDMO Market Overview:

The global Large Molecule Drug Substance CDMO market is expanding steadily, owing to increased demand in therapeutic areas such as cancer, immunology, and rare illnesses. This market offers a wide variety of services, including process development, scale-up, cGMP manufacturing, and analytical assistance, with a rising focus on biologics, cell and gene treatments, and mRNA technologies. Our paper provides a detailed examination of procurement trends, emphasizing cost-cutting tactics and the growing use of modern digital and analytical technologies to improve supply chain and manufacturing workflows.

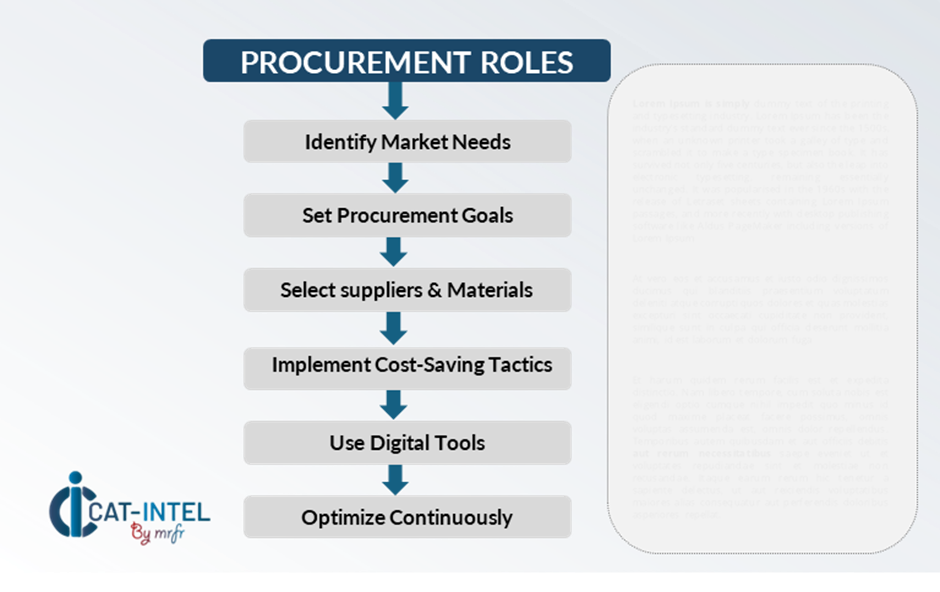

Key issues for procurement teams include managing large upfront investments in specialized infrastructure, guaranteeing scalability to meet changing client pipelines, adhering to strict quality and compliance requirements, and integrating new technology into complicated worldwide operations. Strategic sourcing, risk management, and innovation collaborations are critical for increasing CDMO involvement and delivering long-term value.

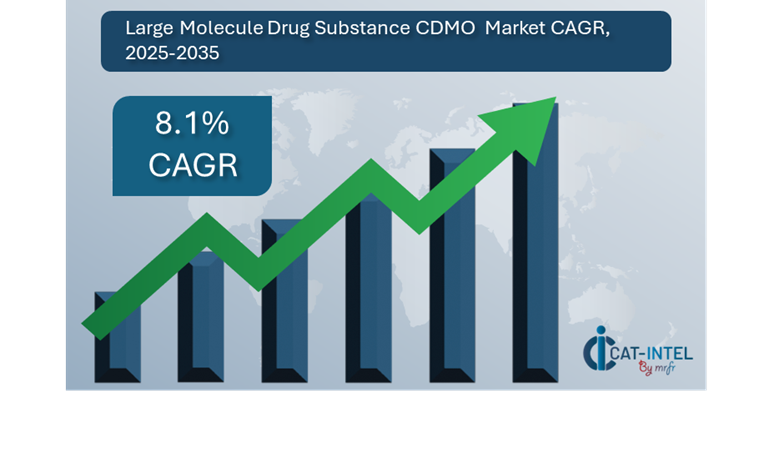

Market Size: The global Large Molecule Drug Substance CDMO market is projected to reach USD 20.82 billion by 2035, growing at a CAGR of approximately 8.1% from 2025 to 2035.

Growth Rate: 8.1%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: Biopharma sponsors are increasingly demanding real-time visibility operations across the CDMO value chain, boosting demand for simplified digitally connected production. -

Pipeline Growth and Biotech Expansion: The spike in biologics, such as monoclonal antibodies and mRNA-based medicines, is hastening outsourcing across the clinical and commercial stages. -

Technological Transformation: Advanced technologies like AI, machine learning and process analytics are altering how CDMOs approach development and manufacture. -

Innovations: Modular facility designs, and single-use technology enable CDMOs to rapidly grow and pivot in response to sponsor demands. -

Investment Initiatives: Global CDMOs are making significant investments in cutting-edge biomanufacturing campuses, digital infrastructure, and automation to fulfill increasing customer demand -

Regional Insights: North America and Asia Pacific have the most large-molecule CDMO capacity, with North America leading in innovation and compliance norms.

Key Trends and Sustainability Outlook:

-

Capacity Expansion with Cloud-Enabled Systems: CDMOs are using cloud-based technologies for real-time monitoring, batch traceability, and remote audits, which improves scalability and operational reliability. -

Smart Manufacturing Features: The use of AI, digital twins, and IoT for predictive maintenance, process optimization, and improved quality assurance. -

Sustainability Integration: CDMOs should prioritize green chemistry, energy-efficient processes, and waste reduction as they connect with sponsor sustainability goals and worldwide ESG standards. -

Tailored Solutions: There is a growing demand for process development and regulatory support for specialized therapeutic areas, particularly in cancer, rare illnesses, and biosimilars. -

Data-Driven Operations: Advanced analytics solutions enable CDMOs to optimize batch yields, track critical quality attributes (CQAs), and improve tech transfer results.

Growth Drivers:

-

Biotech Innovation Boom: Expanding pipelines, orphan drug designations, and tailored medicines are driving up demand for nimble, specialized CDMO partners.

-

Process Automation and Digitization: The implementation of PAT, MES, and QMS solutions improves production productivity, compliance, and data integrity. -

Scalability and Flexibility Requirements: Sponsors need CDMOs with the infrastructure and competence to go from bench to commercial while managing global regulatory complexities. -

Compliance and Regulatory Excellence: CDMOs' strong compliance systems help clients fulfill FDA, EMA, PMDA, and worldwide requirements. -

Global Supply Chain Integration: As pharmaceutical supply chains become more globalized, CDMOs that provide multi-region capabilities, multilingual assistance, and secure IT infrastructure gain a competitive edge.

Overview of Market Intelligence Services for the Large Molecule Drug Substance CDMO Market:

Recent evaluations have highlighted major hurdles in engaging CDMOs for big molecular medicinal substances, notably the hefty upfront outlay complex technology transfer processes and the necessity for customized production solutions. In this changing world, procurement knowledge is critical for making informed decisions and creating value. Market intelligence studies give meaningful insights into sourcing prospects, assisting biopharma firms in identifying cost-saving levers, improving supplier performance, and reducing the risk of manufacturing collaborations.

Procurement Intelligence for Large Molecule Drug Substance CDMO: Category Management and Strategic Sourcing.

To be competitive and resilient, firms are modernizing their procurement activities by identifying and managing critical CDMO categories based on molecular type, scale, and technological platform, which will streamline sourcing and create economies of scale. Gaining detailed access into CDMO spending to identify consolidation possibilities, minimize redundancies, and enhance forecasting accuracy. By integrating procurement strategies with market dynamics and pharmaceutical pipeline goals, organizations may negotiate more advantageous prices, ensure supply continuity, and establish flexible CDMO networks equipped to meet today’s complex biologics manufacturing needs.

Pricing Outlook for Large Molecule Drug Substance CDMO: Spend Analysis

Pricing Outlook for Large Molecule Drug Substance CDMO: Spend Analysis

The pricing environment for big molecule CDMO services is projected to remain somewhat volatile, affected by several major market and operational factors. Rising demand for complicated biologics, capacity constraints, increased technical complexity, and geographical cost disparities are the primary drivers.

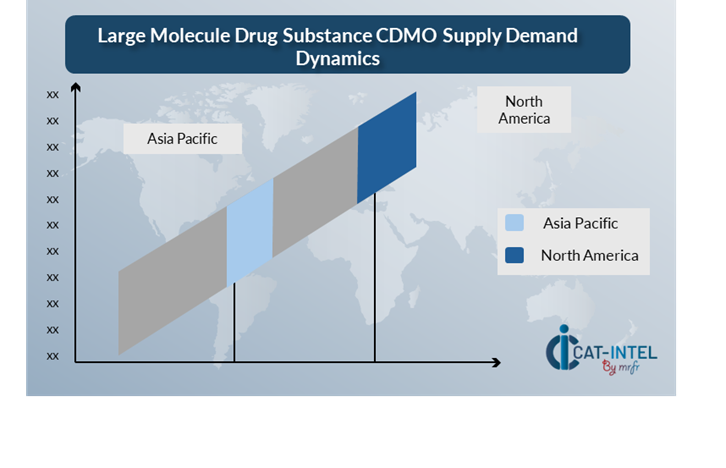

Graph shows general upward trend pricing for Large Molecule Drug Substance CDMO and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Graph shows general upward trend pricing for Large Molecule Drug Substance CDMO and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Pharmaceutical firms are using a variety of procurement and operational tactics to manage and optimize expenditure across CDMO partnerships, including developing long-term relationships with qualified CDMOs, which are backed by performance-based metrics and a clear communication channel.

Negotiating multi-year frameworks, volume-based pricing, and shared risk models to keep prices stable and incentives aligned. Exploring new engagement models that provide predictable pricing and scalable access to development and manufacturing infrastructure.

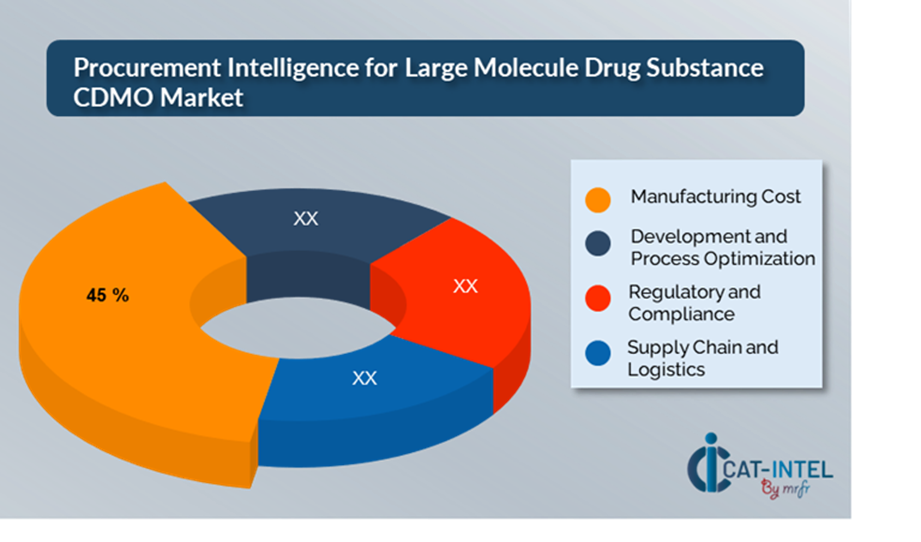

Cost Breakdown for Large Molecule Drug Substance CDMO: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Manufacturing Cost: (45%)

-

Description: This comprises raw supplies, consumables, labour, equipment utilization, facility overhead, and utilities needed for the manufacturing process. This comprises the costs of producing cell lines, fermenting, purifying, and filling biologics. -

Trend: There is a growing preference for modular and continuous biomanufacturing technologies, which seek to lower manufacturing costs by boosting yield and maximizing facility usage.

- Development and Process Optimization: (XX%)

- Regulatory and Compliance: (XX%)

- Supply Chain and Logistics: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the fast-changing big molecular medicinal substance CDMO market, improving procurement techniques and utilizing structured negotiating tactics can offer significant cost savings and drive greater operational efficiency. Long-term relationships with reputable CDMO partners, particularly those with scalable capabilities and a strong global infrastructure, offer more competitive pricing models. Volume-based discounts, milestone-based incentives, and bundled service packages are frequently used throughout the development, analytical, and production phases. Multi-year agreements not only provide economic certainty, but also facilitate easier technology transfer, knowledge retention, and alignment from the clinical to commercial phases.

Partnering with CDMOs that promote innovation, digital transformation, and manufacturing flexibility unlocks additional value by providing access to AI-enabled process monitoring and predictive quality control, lowering batch failures and rework costs. A multi-vendor procurement approach is becoming increasingly important in managing operational risk, ensuring company continuity, and maintaining bargaining power. Strategic sourcing, when combined with data-driven procurement procedures and innovation-centric CDMO selection, is proving crucial to guaranteeing cost-effectiveness, compliance, and resilience biomanufacturing operations in today’s biologics-driven market.

Supply and Demand Overview for Large Molecule Drug Substance CDMO: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

Supply and Demand Overview for Large Molecule Drug Substance CDMO: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Large Molecule Drug Substance CDMO market is expanding steadily, driven by increased outsourcing in the biopharmaceutical sector and the growing complexity of biologic drug pipelines. Biomanufacturing technology advancement, therapeutic area specialization, and global regulatory and economic developments all influence supply and demand dynamics.

Demand Factors:

-

Biotech and Pharma Pipeline Expansion: The increase of monoclonal antibodies, gene treatments, and mRNA-based biologics is driving need for specialist CDMO partners that can help development. -

Outsourcing Strategies: Pharmaceutical firms are progressively outsourcing the clinical and commercial manufacture of large molecular therapeutic substances to control risk, cut CapEx, and focus on core R&D. -

Therapeutic Area Complexity: Diseases such as cancer, autoimmune disorders, and uncommon diseases necessitate highly personalized biologics, boosting demand for CDMOs with specialized technical competence and regulatory experience. -

Integrated Capabilities and End-to-End Services: Demand is increasing for CDMOs that provide integrated services such as cell line generation, process scale-up, analytical assistance, and fill-finishing in a smooth, compliant framework.

Supply Factors:

-

Technological Advancements: Innovations in single-use bioreactors, continuous production, and digital twins, which increase CDMO capacity, productivity, and flexibility, making suppliers more competitive. -

Global CDMO Ecosystem Growth: A growing number of global CDMOs, ranging from specialized boutique players to large-scale international platforms, are providing a broader variety of technological capabilities. -

Economic and Regulatory Influences: Currency fluctuations, inflation, labour availability, and regional regulatory regulations (FDA, EMA, and PMDA), which all have an impact on cost structures, site selection, and capacity planning. -

Scalability and Modular Infrastructure: Top CDMOs are investing in modular, scalable biomanufacturing systems that can adapt to sponsor requirements.

Regional Demand-Supply Outlook: Large Molecule Drug Substance CDMO

The Image shows growing demand for Large Molecule Drug Substance CDMO in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Large Molecule Drug Substance CDMO Market

North America: Dominance in the Large Molecule Drug Substance CDMO Market

North America, particularly the United States, is a dominant force in the global Large Molecule Drug Substance CDMO market due to several key factors:

-

Strong Compliance Standards: The area is recognized for its stringent regulatory environment, and CDMOs in North America are well-versed in these standards, delivering dependable, high-quality services that meet worldwide compliance needs.

-

Established Biopharmaceutical Ecosystem: North America has a well-developed biopharma ecosystem, allowing CDMOs to effectively obtain raw materials, retain strong supplier relationships, and seamlessly integrate into clients' supply chains.

-

Strong Demand for Biotech Outsourcing: North American CDMOs are in high demand due to their ability to scale up production for clinical trials and commercial-scale manufacturing of these extremely complicated treatments.

-

Advanced Pharmaceutical Industry: The region's strong R&D infrastructure supports innovation in biologics and large-molecule drug development, resulting in a significant demand for contract research and manufacturing firms.

-

Access to Cutting-Edge Technology: The region's leadership in integrating innovations including single-use systems, continuous biomanufacturing, and digital manufacturing technologies enables CDMOs in North America to provide highly efficient and scalable solutions.

North America Remains a key hub Large Molecule Drug Substance CDMO Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the Large Molecule Drug Substance CDMO market is diversified and highly competitive, with a mix of global powerhouses and specialized regional companies. These CDMOs have an impact on crucial variables like as price structures, service quality, scalability, and time to market making supplier selection a strategic requirement for biopharma businesses.

The market is dominated by established worldwide CDMOs that provide full-service, end-to-end biologics capabilities, ranging from cell line creation and process characterization to commercial-scale GMP manufacture. These companies are frequently favoured due to their regulatory history, operational scalability, and capacity to handle late-stage and high-volume products. Simultaneously, niche and emerging CDMOs are gaining popularity by providing specific knowledge in areas such as mRNA, viral vectors, ADCs, and other next-generation technologies. These providers frequently distinguish themselves through agility, innovation, and personalized client service.

Key Suppliers in the Large Molecule Drug Substance CDMO Market Include:

- Catalent

- Lonza Group

- Samsung Biologics

- Wuxi Biologics

- Fujifilm DioSynth Biotechnologies

- Boehringer Ingelheim

- NovaSep

- Sandoz

- MabPlex

- KBi Biopharma

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The CDMO market for large molecule medicinal substances is expanding rapidly, driven by growing outsourcing of biologics development and production, particularly in burgeoning biotech centres and among mid-sized pharmaceutical companies. |

|

Cloud Adoption |

Growing demand for biologics and sophisticated medicines is driving CDMOs to invest in flexible, modular facilities and single-use technologies that enable scalability and shorter turnaround times for trial and commercial manufacturing. |

|

Product Innovation |

CDMOs are growing their capabilities by providing high-throughput process development, continuous biomanufacturing, and end-to-end integrated service models adapted to complex biologic modalities. |

|

Technological Advancements |

Cutting-edge technologies including process analytical technology (PAT), AI-enabled industrial analytics, and digital twins are increasing process control, product quality, and time to market. |

|

Global Trade Dynamics |

Evolving regulatory requirements, localization policies, and global trade concerns all have an impact on CDMO site selection, compliance methods, and supply chain design—particularly for multi-region medication launches. |

|

Customization Trends |

Sponsors are increasingly looking for CDMO partners that can provide bespoke solutions, such as platform procedures for specific molecule types, unique tech transfer protocols, and integration with sponsor quality systems and digital infrastructure. |

|

Large Molecule Drug Substance CDMO Attribute/Metric |

Details |

|

Market Sizing |

The global Large Molecule Drug Substance CDMO market is projected to reach USD 20.82 billion by 2035, growing at a CAGR of approximately 8.1% from 2025 to 2035.

|

|

Large Molecule Drug Substance CDMO Technology Adoption Rate |

Over 70% of biopharma companies currently outsource at least some of their big molecule production, with an increasing desire for end-to-end CDMO collaborations to shorten time-to-market and decrease Capex.

|

|

Top Large Molecule Drug Substance CDMO Industry Strategies for 2025 |

Key efforts include investing in single-use and modular buildings, digital manufacturing systems, increasing cell and gene therapy capacity, and developing regionally diverse supply chains.

|

|

Large Molecule Drug Substance CDMO Process Automation |

Approximately 60% of premier CDMOs use automation, real-time analytics, and AI-driven process control to increase yield, decrease deviations, and enable continuous improvement. |

|

Large Molecule Drug Substance CDMO Process Challenges |

Capacity limits, delayed technology transfers, regional regulatory complexity, and the high cost of facility and people investments are all significant issues. |

|

Key Suppliers |

Leading CDMOs include Catalent, Lonza, WuXi Biologics, and Fujifilm Diosynth, which provide worldwide access and specific expertise.

|