Summary Overview

Laminates (Bags and Pouches) Market Overview:

The global Laminates (Bags and Pouches) market is growing steadily, driven by increased demand in major industries such as food and beverage, personal care, pharmaceuticals, and consumer goods. This market encompasses a wide range of package styles, materials, and barrier technologies designed to meet changing consumer preferences and industry-specific functional needs. Our paper provides an in-depth examination of procurement trends, with a particular emphasis on cost-cutting tactics, supply chain agility, and the use of new packaging technologies to expedite manufacturing and extend product shelf life.

Key procurement difficulties for the future include controlling variable raw material costs, guaranteeing packaging scalability, maintaining sustainability compliance, and enabling seamless integration across production lines. As the market grows me competitive, businesses are turning to digital procurement platforms and strategic sourcing models to drive efficiency, minimize risk, and strengthen supplier relationships.

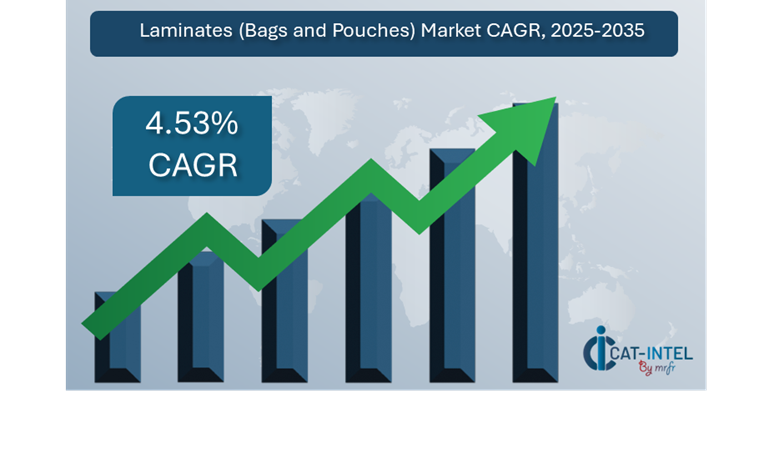

Market Size: The global Laminates (Bags and Pouches) market is projected to reach USD 18.16 billion by 2035, growing at a CAGR of approximately 4.53%% from 2025 to 2035.

Growth Rate: 4.53%

Growth Rate: 4.53%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: Leading companies are investing in smart packaging technology to acquire a better handle on production metrics and logistics coordination.

Retail and E-Commerce Growth: Innovative pouch and bag designs are gaining popularity in retail and e-commerce due to improved shelf presence and adaptability to product modifications.

Technological Transformation: Using AI for demand prediction and automation in packaging processes allows for speedier turnarounds and scalable customisation.

Product Innovations: Modular laminate constructions and mono-material solutions help companies achieve performance and environmental goals.

Investment Initiatives: Companies invest in high-speed laminating and pouch-converting technology, automation, and digital quality control systems.

Regional Insights: North America and Asia Pacific are leading market expansion, driven by strong consumer demand, manufacturing infrastructure, and focus on sustainability-driven packaging reforms.

Key Trends and Sustainability Outlook:

Sustainable Materials Adoption: Increased demand for recyclable, biodegradable, and bio-based laminates to achieve ESG standards and shifting consumer attitudes.

Smart Packaging Features: QR codes, RFID, and NFC tags are used for traceability, customer interaction, and product identification.

Circular Packaging Models: Take-back programs and closed-loop recycling initiatives are on the rise as firms seek to shut the loop on flexible packaging waste.

Customization and Brand Differentiation: There is a strong need for digitally printed, short-run package formats to support seasonal, promotional, and niche product launches.

Data-Driven Quality Control: The application of analytics and IoT-enabled monitoring to eliminate faults, increase consistency, and assure compliance with worldwide safety standards.

Growth Drivers:

Digital Transformation in Packaging: The integration of automation and real-time monitoring technologies throughout production plants to increase efficiency.

Rising Demand for Convenience Packaging: Consumers desire lightweight, portable solutions, thus laminated pouches and resealable bags continue to replace rigid packaging.

Scalability and Flexibility Requirements: Brands want packaging partners who can expand swiftly while providing a varied portfolio of bespoke laminate constructions.

Regulatory Compliance and Safety: As laws surrounding food safety and material usage tighten, providers are increasingly turning to certified, compliant solutions.

Globalized Supply Chains: International brands require globally uniform packaging quality with specialized personalization for each region.

Overview of Market Intelligence Services for the Laminates (Bags and Pouches) Market:

Recent market evaluations have identified major issues in the flexible packaging business, including increased raw material costs, customisation expectations, and supply chain unpredictability. These variables drive up implementation and manufacturing costs, particularly for specialist laminate architectures and high-performance pouch forms. To overcome these difficulties, procurement intelligence is becoming increasingly important.

Procurement Intelligence for Laminates (Bags and Pouches): Category Management and Strategic Sourcing

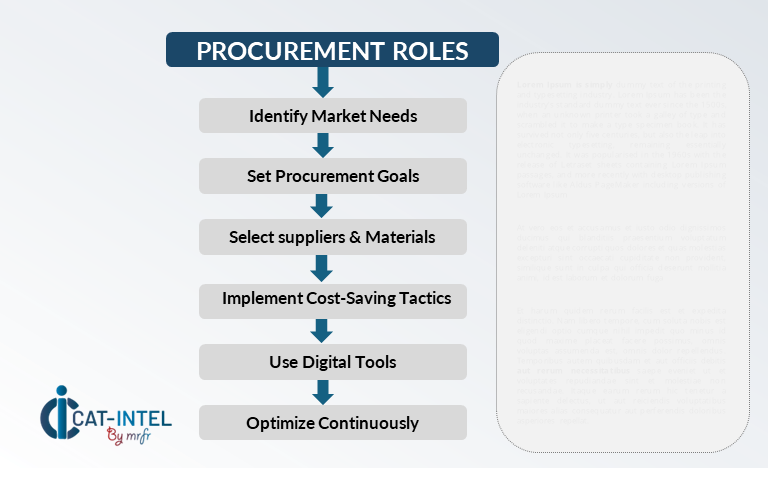

Businesses are using real-time market analytics to identify cost-cutting possibilities, better supplier performance management, and boost the overall success of sourcing and manufacturing operations.Regular evaluations of vendor performance—based on delivery timeframes, quality indicators, innovation, and responsiveness—ensure supply continuity and high operating standards, especially in fast-moving consumer markets. Market intelligence facilitates compliance with food safety, pharmaceutical, and environmental laws by ensuring that vendors meet growing global standards. It also helps in sourcing sustainable materials that meet ESG criteria without sacrificing functionality.

Pricing Outlook for Laminates (Bags and Pouches): Spend Analysis

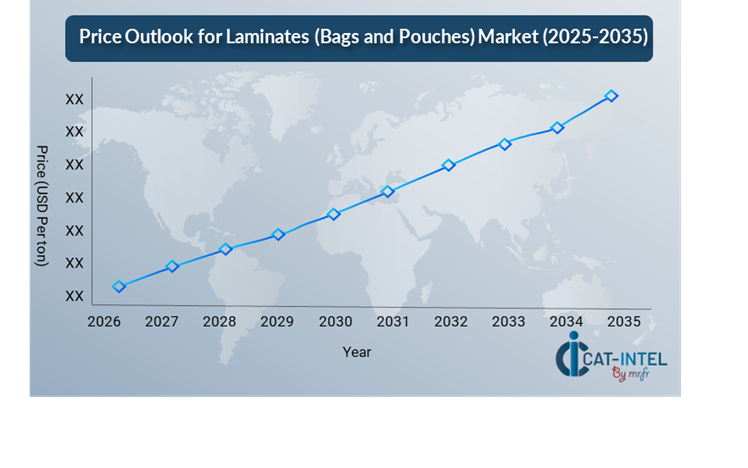

The price landscape for laminated flexible packaging is projected to remain somewhat dynamic, with swings caused by a mix of market forces and changing end-user expectations. Raw material instability, developments in packaging technology, customized needs, and regional cost variances in production and shipping all have an impact on price.

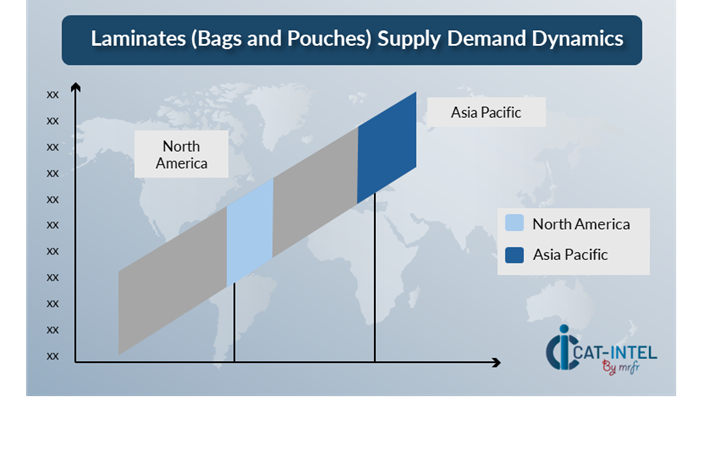

Graph shows general upward trend pricing for Laminates (Bags and Pouches) and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Building solid, long-term connections with dependable suppliers promotes cost stability, consistent material quality, and improved innovative cooperation. Using digital tools and analytics to watch markets in real time and estimate pricing trends allows for more proactive sourcing decisions and budget planning.

Negotiating multi-year supply agreements, implementing volume-based pricing, and investigating subscription or service-based business models are all emerging as successful cost-cutting strategies. Despite pricing constraints, businesses may retain cost-effectiveness and operational efficiency by emphasizing scalability in package design to manage volume swings without extensive retooling.

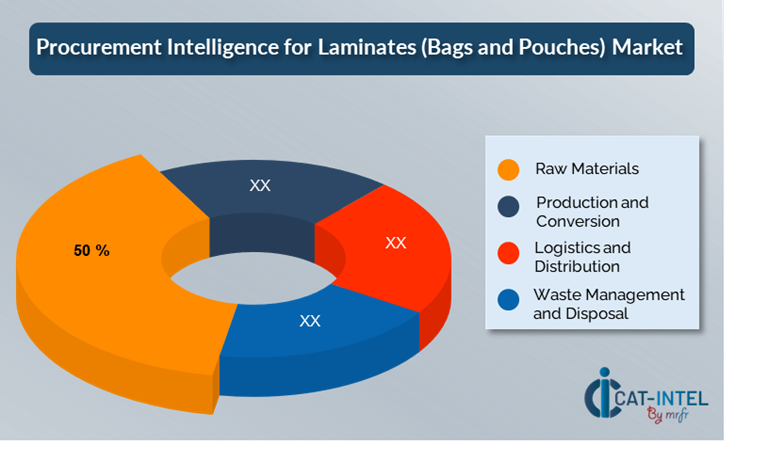

Cost Breakdown for Laminates (Bags and Pouches): Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Raw Materials: (50%)

Raw Materials: (50%)

Description: Raw materials utilized in the lamination process, including as films, resins, and adhesives, account for most of the laminate packaging's TCO.

Trend: With a growing emphasis on sustainable packaging, many businesses are turning to bioplastics and recyclable mono-materials.

Production and Conversion: (XX%)

Logistics and Distribution: (XX%)

Waste Management and Disposal: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the dynamic laminates market, improving procurement methods and employing savvy negotiating techniques are critical to attaining cost efficiency and long-term success. Strategic sourcing not only results in immediate cost savings, but it also improves long-term supply stability and packaging performance. Working with laminate and pouch manufacturers on multi-year contracts can lead to volume-based pricing, bundled value-added services, and preferential payment terms. These agreements improve forecasting accuracy while minimizing the impact of raw material price volatility.

Working with suppliers who promote material innovation, sustainability, and customizability gives a competitive edge. Access to high-barrier films, recyclable structures, or mono-material laminates lowers the long-term expenses associated with regulatory compliance and product returns. Diversifying supplier portfolios reduces reliance on a single source while mitigating risks including material shortages, supply interruptions, and capacity limits.

Cost Saving opportunities for Laminates (Bags and Pouches)Supply and Demand Overview for Laminates (Bags and Pouches): Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Laminates (Bags and Pouches) market is expanding steadily, fuelled by increased demand for flexible, sustainable, and high-performance packaging solutions in sectors like as food and beverage, personal care, pharmaceuticals, and e-commerce. Technological developments, shifting consumer tastes, and global economic situations all have an impact on the supply-demand balance.

Demand Factors:

Sustainability and Circular Economy Goals: Growing regulatory and consumer pressure is driving up demand for eco-friendly laminate constructions, such as mono-material structures.

E-Commerce and Convenience Packaging: As online shopping grows in popularity, there is a greater demand for long-lasting, lightweight, and tamper-evident pouches and bags.

Product Differentiation and Customization: Brands are looking for custom-printed, short-run laminate packaging to support product personalization, seasonal marketing, and limited-edition releases.

Functionality and Barrier Requirements: Industries such as food and pharmaceuticals demand high-barrier laminates to maintain product integrity, freshness, and safety compliance.

Supply Factors:

Converting Technology Advancements: Innovations in film extrusion, digital printing, and laminating processes are increasing supplier capabilities, improving material performance, and allowing for shorter turnaround times.

Diverse Supplier Ecosystem: With a mix of worldwide converters, regional manufacturers, and specialty experts, customers have a wide range of procurement possibilities.

Global Economic Conditions: Fluctuations in resin prices, transportation costs, and currency exchange rates continue to have an influence on material supply and pricing, especially in import-intensive economies.

Scalability and Production Flexibility: Suppliers are increasingly providing modular production setups and bespoke service levels, allowing organizations to increase package volume without committing to inflexible forms.

Regional Demand-Supply Outlook: Laminates (Bags and Pouches)

The Image shows growing demand for Laminates (Bags and Pouches) in both Asia Pacific and North America, with potential price increases and increased Competition.

The Image shows growing demand for Laminates (Bags and Pouches) in both Asia Pacific and North America, with potential price increases and increased Competition.

North America: Dominance in the Laminates (Bags and Pouches) Market

North America, particularly the United States, is a dominant force in the global Laminates (Bags and Pouches) market due to several key factors:

Sustainability Initiatives and Restrictions: Several APAC nations are enacting stronger restrictions regarding packaging sustainability. This is driving up the need for recyclable, biodegradable, and environmentally friendly laminates.

Expanding E-Commerce and Retail Industry: As online shopping grows, lightweight, durable, and transportation-friendly packaging becomes increasingly important, making laminates the favoured choice for this industry.

Large Manufacturing Hub: The region's extensive network of manufacturing facilities fuels strong demand for laminate goods, particularly in China, India, and Japan.

Cost-Effective Production and Raw Materials: The APAC area has cost-effective production capabilities, thanks to reduced labour rates, economies of scale, and easy access to raw materials.

Rising Consumer Demand: With a fast-expanding middle class, more urbanization, and rising disposable incomes in countries, there is a growing demand for convenient, durable, and visually appealing packaging.

Asia Pacific Remains a key hub Laminates (Bags and Pouches) Price Drivers Innovation and Growth.

Asia Pacific Remains a key hub Laminates (Bags and Pouches) Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The Laminates (Bags and Pouches) industry's supplier environment is diversified and competitive, with global packaging giants, regional converters, and specialist producers all playing a role. These suppliers have a significant impact on issues such as material cost, customisation capabilities, lead times, and sustainable performance. The market is dominated by well-established competitors who provide comprehensive packaging solutions ranging from multi-layer laminates to value-added services such as digital printing, pouch conversion, and packaging design support.

At the same time, smaller niche providers continue to gain market share by focusing on certain end-use industries, novel materials, or sophisticated barrier capabilities. Organizations that deal with both established global partners and nimble regional innovators, while employing strategic sourcing frameworks and supplier performance analytics, will be better positioned to negotiate market complexity and achieve long-term value.

Key Suppliers in the Laminates (Bags and Pouches) Market Include:

Uflex Limited

Amcor Plc

Mondi Group

Sealed Air Corporation

Berry Global,

ProAmpac

Constantia Flexibles

Huhtamaki Group

Clipper Packaging

Flex Pack

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The laminates market is expanding rapidly, driven by rising demand for flexible, lightweight, and sustainable packaging in industries such as food and beverage, personal care, and pharmaceuticals.

|

Cloud Adoption |

To satisfy sustainability goals, decrease environmental impact, and comply with growing packaging laws, brands are transitioning to recyclable, compostable, and mono-material laminates.

|

Product Innovation |

Suppliers are providing innovative laminate structures with improved barrier qualities, resealable features, and smart packaging elements to increase shelf life, user convenience, and product traceability.

|

Technological Advancements |

Digital printing, solvent-free laminating, and high-speed pouch conversion advancements provide for greater design freedom, shorter lead times, and increased manufacturing efficiency.

|

Global Trade Dynamics |

Fluctuations in resin price, transportation costs, and changes in import/export restrictions all have an influence on sourcing strategies, especially for multinational companies with complicated packaging supply chains.

|

Customization Trends |

Tailor-made packaging options, such as short-run digital printing, bespoke pouch sizes, and region-specific laminate specifications, are becoming increasingly popular for meeting distinct product and marketing demands. |

Laminates (Bags and Pouches) Attribute/Metric |

Details |

Market Sizing |

The global Laminates (Bags and Pouches) market is projected to reach USD 18.16 billion by 2035, growing at a CAGR of approximately 4.53%% from 2025 to 2035.

|

Laminates (Bags and Pouches) Technology Adoption Rate |

Around 70% of package businesses are using sophisticated lamination technologies, such as solvent-free procedures, digital printing, and smart packaging integration.

|

Top Laminates (Bags and Pouches) Industry Strategies for 2025 |

Key efforts include switching to mono-material architectures for recyclability, short-run and digital printing for customisation, diversifying sourcing, and investing in automated pouch conversion facilities to satisfy quick market demand.

|

Laminates (Bags and Pouches) Process Automation |

Approximately 60% of manufacturers use automated core operations such as film lamination, slitting, and pouch making to decrease manpower reliance, minimize mistakes, and boost production speed.

|

Laminates (Bags and Pouches) Process Challenges |

Raw material pricing volatility, supply chain interruptions, long customisation lead times, and the complexity of satisfying performance and sustainability requirements are all ongoing difficulties.

|

Key Suppliers |

Leading worldwide suppliers include Amcor Plc, Mondi Group, and Constantia Flexibles (Austria), as well as significant regional businesses that provide specialized or sustainable laminate solutions.

|

Key Regions Covered |

Asia-Pacific, North America, and Europe are the major markets, with food and beverage, personal care, pharmaceuticals, and e-commerce-ready flexible packaging seeing the most growth.

|

Market Drivers and Trends |

Consumer desire for lightweight, resealable packaging drives growth, as do legislative movements toward plastic reduction and recyclability, premiumization of product display, and breakthroughs in barrier films and sustainable substrates. |