Summary Overview

Laminate Films: North America and Europe Market Overview

The laminate films market in North America and Europe is steadily expanding, driven by increased demand in key areas such as food and beverage packaging, pharmaceuticals, personal care, and industrial applications. This diversified market encompasses a variety of film types such as polyester, polypropylene, nylon, and biodegradable laminates, with changing requirements for barrier performance, sustainability, and product protection. Our paper provides a detailed examination of procurement trends, with a particular emphasis on cost-cutting methods and the rising importance of digital technologies in optimizing sourcing and operating operations.

Looking ahead, the sector confronts important issues such as controlling growing raw material costs, ensuring supply chain resilience, adhering to severe environmental requirements, and responding to constantly changing customer expectations. Strategic sourcing and improved procurement information are increasingly important for remaining competitive, enabling companies to make informed decisions, reduce risk, and drive long-term value.

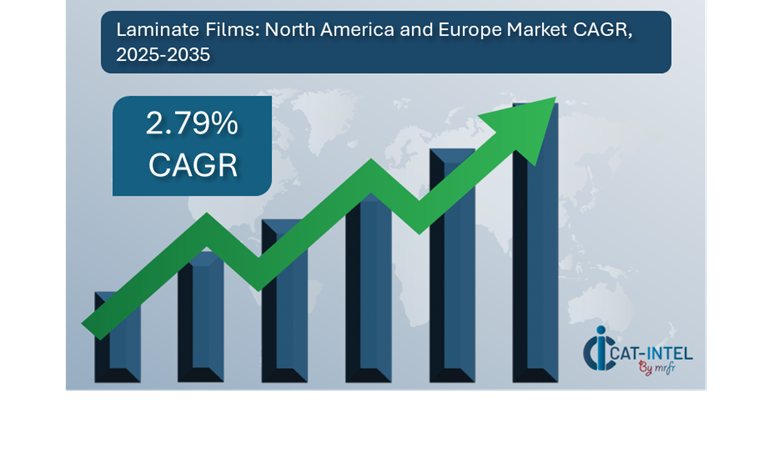

Market Size: The global Laminate Films: North America and Europe market is projected to reach USD 1.42 billion by 2035, growing at a CAGR of approximately 2.79% from 2025 to 2035.

Growth Rate: 2.79%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: Real-time data and integrated procedures across the laminate films value chain are becoming increasingly important in order to improve operational efficiency and optimize manufacturing workflows.

Retail and E-Commerce Growth: Laminated films are rapidly being customized for customer convenience, durability, and branding, particularly in the food, beverage, and personal care industries.

Technological Transformation: Automation, AI-enabled quality control, and smart manufacturing are transforming how laminate films are created, tested, and tailored.

Product Innovations: With modular product lines and customizable laminate solutions, manufacturers may better fulfil the different demands of their customers.

Investment in Sustainable Infrastructure: Companies are investing in smart factories and eco-friendly manufacturing techniques to cut energy usage, reduce carbon footprint, and maintain compliance.

Regional Insights: North America and Europe continue to dominate market growth due to improved manufacturing capabilities, strict packaging rules, and a strong demand for environmentally friendly packaging solutions.

Key Trends and Sustainability Outlook

Sustainable Material Integration: There is a rising trend for biodegradable, recyclable, and compostable laminate films to support company sustainability goals and meet customer demand for greener packaging.

Next-Generation Features: Antimicrobial coatings, high-barrier films, and temperature-resistant laminates are being used to increase shelf life, cleanliness, and product performance.

Data-Driven Production: Real-time analytics and digital twin technologies are being utilized to optimise production lines, save downtime, and improve quality assurance.

Customization Trends: Demand for industry-specific laminate films is increasing, particularly in pharmaceuticals, food packaging, and industrial applications, pushing innovation in material science and performance engineering.

Growth Drivers:

Digital Transformation in Manufacturing: The increased use of smart manufacturing technologies and process automation improves productivity, quality control, and operational transparency.

Growing Demand for Process Efficiency: Filmmakers are investing in modern technology and simplified workflows to cut costs, increase throughput, and adapt swiftly to market changes.

Scalability and Flexibility: Modular production methods and adaptable supply chains allow firms to grow operations and adjust to regional demand quickly.

Regulatory Compliance and Traceability: Tighter packaging and safety regulations in North America and Europe are pushing innovation in traceable, compliant laminate film solutions.

Globalization and Export Opportunities: Increased cross-border commerce and demand for premium packaged goods have opened new market prospects for high-performance laminate films that meet international requirements.

Overview of Market Intelligence Services for the Laminate Films: North America and Europe Market

Recent evaluations of the laminate film market have revealed important procurement problems, such as increased implementation costs, material price volatility, and the need for product customisation to fulfil various industrial requirements. In this environment, market intelligence reports are crucial for procurement teams to identify cost-saving possibilities, improve supplier selection, and simplify operational efficiency. Market intelligence helps businesses make better decisions and reduces procurement risks by offering data-driven insights into raw material trends, supplier performance, and competitive pricing structures.

Procurement Intelligence for Laminate Films: North America and Europe: Category Management and Strategic Sourcing

To be competitive in the laminate film market, firms are increasingly relying on category management and strategic sourcing strategies. Companies are improving their sourcing strategies by doing extensive spend analysis and regular vendor performance tracking to decrease total cost of ownership, enhance supplier relationships, and assure supply continuity. Effective category management allows firms to split their procurement operations by film type, application, or area, improving focus, control, and response.

Pricing Outlook for Laminate Films: North America and Europe: Spend Analysis

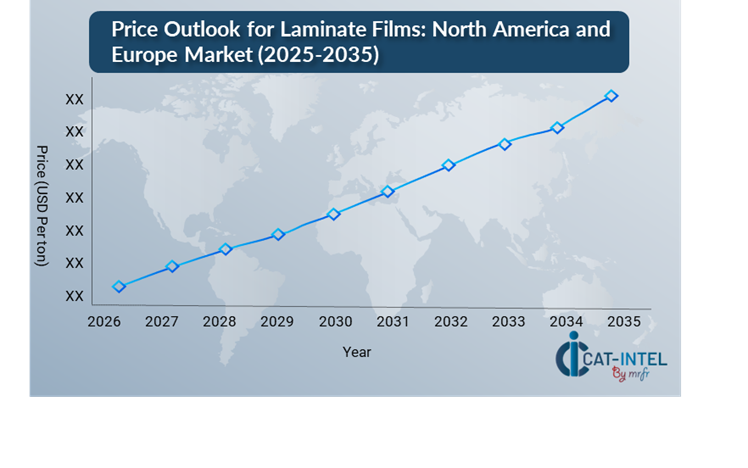

The pricing landscape for laminate films in North America and Europe is likely to remain somewhat volatile, owing to a range of market variables. Price trends are influenced by technical developments in film production, rising demand for sustainable materials, customized needs, and geographical disparities in raw material availability and labour prices.

Graph shows general upward trend pricing for Laminate Films: North America and Europe and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To save costs, businesses are using smarter procurement methods, with a focus on Building long-term connections with dependable suppliers offers constant quality, higher service levels, and better price arrangements. Using digital technologies for real-time market monitoring and predictive pricing forecasting promotes proactive decision-making and increases budget accuracy.

Multi-year agreements, volume-based pricing methods, and supply chain coordination may all help to keep costs stable and prices predictable. While premium films with enhanced features frequently attract higher pricing, firms are balancing innovation with long-term cost-effectiveness by focusing on sustainable packaging solutions that fulfil regulatory criteria and appeal to environmentally concerned consumers.

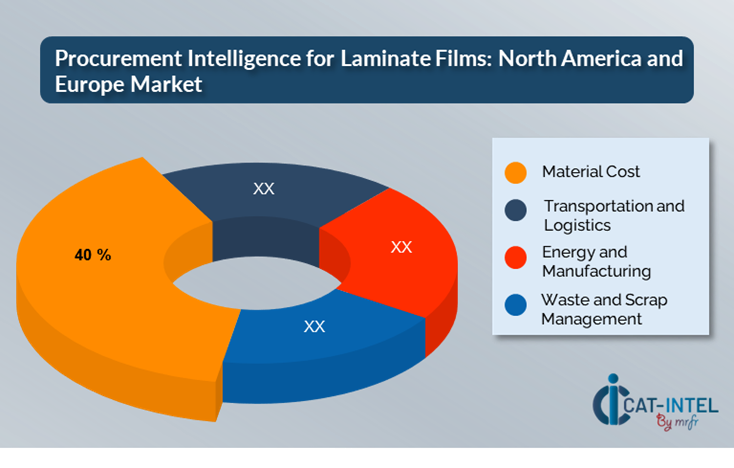

Cost Breakdown for Laminate Films: North America and Europe: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Material Cost: (40%)

Description: This comprises the cost of raw ingredients such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and other polymers required in the manufacturing process, as well as additives for coatings and treatments.

Trend Point: The transition to sustainable materials (e.g., biodegradable films, recycled content) is raising costs while increasing demand for environmentally friendly packaging.

Transportation and Logistics: (XX%)

Energy and Manufacturing: (XX%)

Waste and Scrap Management: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the laminate films industry, optimizing procurement procedures and using strategic sourcing and negotiating strategies can result in significant cost reductions while improving overall operational efficiency. Companies that handle supplier management and sourcing strategically are better positioned to navigate market turbulence and achieve long-term value. Establishing long-term partnerships with reputable film makers can lead to more competitive prices. Agreements that involve bulk savings, packaged services, or joint R&D activities provide financial and innovative benefits.

Companies may adapt to changing market needs without incurring excessive customisation costs by cooperating with suppliers who provide modular product lines and scalable manufacturing capability. These collaborations frequently give access to value-added features like bespoke coatings, recyclable materials, and application-specific film technologies, which decrease long-term operating complexity A multi-vendor sourcing approach allows businesses to lessen their reliance on a single supplier, avoid risks such as supply disruptions or price changes, and increase negotiating power during negotiations. Diversifying the supplier base allows for greater flexibility in regional sourcing and sustainability compliance.

Supply and Demand Overview for Laminate Films: North America and Europe: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The laminate films market continues to expand, driven by increased demand in industries such as food and beverage, pharmaceuticals, personal care, and industrial packaging. The supply and demand patterns are being influenced by innovation, regulatory challenges, and increasing consumer tastes, particularly in terms of sustainability and effectiveness.

Demand Factors:

Sustainability and Regulatory Compliance: In North America and Europe, consumer awareness, company ESG goals, and stringent packaging requirements are driving up demand for environmentally friendly and recyclable laminate films.

Growth of Packaged Goods with E-Commerce: The ongoing growth of online shopping, along with the necessity for long-lasting and appealing packaging, is driving the demand for high-performance films with excellent barrier qualities and printing capabilities.

Customization for Industry-Specific Needs: Key industries such as pharmaceuticals and food require films that are designed to suit cleanliness, safety, and shelf-life criteria, which drives demand for bespoke laminates.

Innovation in Product Features: Buyers are looking for films with advanced properties like moisture resistance and antimicrobial coatings, which increases the demand for technical collaboration and customized solutions.

Supply Factors:

Technological Advancements in Film Production: Ongoing innovation in coextrusion, solvent-free laminating, and biodegradable materials, allowing providers to produce more functional, sustainable, and cost-effective products.

Robust Vendor Ecosystem: The availability of a diversified supplier base, ranging from large-scale multinational producers to specialized specialty film makers, offers a variety of sourcing alternatives and competitive pricing.

Global Economic Conditions: Input costs such as resins and adhesives, labour rates, and energy prices, as well as currency variations, continue to influence the cost and availability of laminate films.

Flexible and Modular Manufacturing Capabilities: Suppliers are increasingly investing in flexible production systems that can handle changing order quantities and quick turnaround times, meeting the demands of both high-volume customers and specialized applications.

Regional Demand-Supply Outlook: Laminate Films: North America and Europe

The Image shows growing demand for Laminate Films in both North America and Europe, with potential price increases and increased Competition.

North America: Dominance in the Laminate Films: North America and Europe Market

North America, particularly the United States, is a dominant force in the global Laminate Films: North America and Europe market due to several key factors:

Strong Demand from End-Use Industries: North America, particularly the United States, has a vast packaging sector, with laminating films being used for food packaging, personal care items, and consumer goods.

Technological Advancements and Innovation: North America is home to cutting-edge research and development (R&D) and innovation, notably in the United States and Canada, where high investment in technology-driven solutions.

Favourable Economic Environment: North America has a well-established industrial infrastructure, supply chain networks, and logistics systems that enable efficient production and delivery of laminating films throughout the area.

Rising Consumer Demand: As consumers and businesses become more environmentally concerned, there is a growing desire for biodegradable films, recycled laminating materials, and films with less plastic content.

Proximity to Major Raw Material Suppliers: North America offers direct access to major suppliers of raw materials used in laminating films, including polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), which are manufactured in the United States and Mexico.

North America Remains a key hub for Laminate Films: North America and Europe Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The laminate films industry's supplier environment is diversified and extremely competitive, with global manufacturers and regional specialist suppliers influencing critical areas such as price structures, material innovation, customisation, and service quality. Established industry heavyweights provide a diverse array of high-performance films, while smaller, nimble suppliers focus on industry-specific applications or emerging demands such as sustainable materials, antimicrobial coatings, and functional packaging solutions.

Multinational film companies with vertically integrated operations provide large-scale production, technological assistance, and continuous supply capacity. Innovative regional players focused on bespoke laminates, biodegradable films, and short-run production, serving to niche markets such as organic food packaging, medical supplies, and premium retail packaging. These vendors are spending considerably in research and development for sustainable material innovation and enhanced conversion technologies are required to fulfill the changing needs of package converters, brand owners, and regulatory organizations.

Key Suppliers in the Laminate Films: North America and Europe Market Include

Berry Global Inc

Amcor Plc

Sealed Air Corporation

The Mondi Group

UPM-Kymmene Corporation

DuPont

Mitsubishi Chemical Corporation

Toray Plastics (America) Inc.

Politifilm

Kloeckner Pentaplast

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The laminate films market is expanding rapidly, backed by increased demand in packaging-intensive industries such as food and beverage and healthcare, and visual attractiveness is driving acceptance in both established and emerging regions.

|

Cloud Adoption |

A significant trend toward recyclable, biodegradable, and bio-based films is changing procurement and product development methods, while corporate ESG objectives are encouraging investment in green alternatives.

|

Product Innovation |

Suppliers are offering films with custom coatings, high barrier qualities, and smart features like as reseal ability and antimicrobial layers suited to fulfil the demands of various sectors.

|

Technological Advancements |

Innovations in lamination processes, digital printing compatibility, and automated quality control systems are increasing manufacturing efficiency and allowing for speedier responsiveness to market changes.

|

Global Trade Dynamics |

Fluctuations in resin pricing, changes in import/export restrictions, and increasing packaging regulations—particularly in the EU—all have an impact on sourcing strategy and supplier relationships.

|

Customization Trends |

The growing demand for application-specific laminate films is forcing producers to provide modular product lines and flexible manufacturing runs. Custom laminates that exceed industry standards for barrier protection, printing, and recycling are becoming increasingly popular.

|

Laminate Films: North America and Europe Attribute/Metric |

Details |

Market Sizing |

The global Laminate Films: North America and Europe market is projected to reach USD 1.42 billion by 2035, growing at a CAGR of approximately 2.79% from 2025 to 2035.

|

Laminate Films: North America and Europe Technology Adoption Rate |

Over 70% of package converters in these regions now use high-barrier, multi-layer, or sustainable laminate solutions, with substantial investment in biodegradable materials and recyclable film structures.

|

Top Laminate Films: North America and Europe Industry Strategies for 2025 |

Leading efforts include creating sustainable and recyclable laminate goods, investing in digital printing compatibility, improving film performance (such as reseal ability and antibacterial properties), and strengthening regional supply chains.

|

Laminate Films: North America and Europe Process Automation |

To increase throughput, around 60% of manufacturers use automated procedures including coating, slitting, and quality checking, minimize waste, and maintain consistent film performance.

|

Laminate Films: North America and Europe Process Challenges |

Key issues include fluctuating raw material prices, adhering to sustainability requirements, managing customisation at scale, and aligning production capacity with altering demand from fast-moving consumer goods (FMCG) sectors.

|

Key Suppliers |

Leading providers include Berry Global Inc. (USA), Mondi Group (UK), and Constantia Flexibles (Austria), as well as regional innovators that provide specialty and biodegradable film solutions.

|

Key Regions Covered |

North America (the United States and Canada) and Western Europe (Germany, France, and the United Kingdom) are the primary markets, with increasing demand for flexible packaging, pharmaceutical blister films, and environmentally friendly product lines.

|

Market Drivers and Trends |

Rising sustainability standards, increased consumer demand for safe and functional packaging, the rise of e-commerce and ready-to-eat goods, and the integration of smart coatings and sophisticated barrier technologies are all driving growth.

|