Summary Overview

Laminate Collapsible Tubes Market Overview:

The global Laminate Collapsible Tubes market is growing steadily, driven by increased demand in key areas such as personal care, pharmaceuticals, food, and industrial applications. This market encompasses a wide range of tube types, materials, and barrier technologies designed to meet changing customer expectations for sustainability, convenience, and product purity. Our paper provides an in-depth examination of procurement trends, highlighting cost-cutting initiatives and the use of sophisticated manufacturing processes to simplify supply chains and improve product quality.

Looking ahead, procurement teams will face important issues such as managing raw material prices, guaranteeing production scalability, maintaining rigorous quality and safety requirements, and aligning tube forms with changing packaging rules. Adoption of web design tools and procurement strategies is crucial for generating innovation and ensuring long-term competitiveness in this dynamic market.

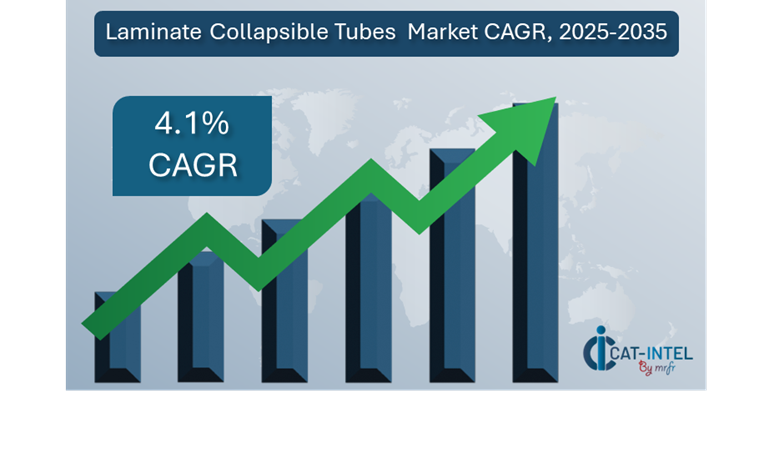

Market Size: The global Laminate Collapsible Tubes market is projected to reach USD 5.16 billion by 2035, growing at a CAGR of approximately 4.1% from 2025 to 2035.

Growth Rate: 4.1%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: To minimize lead times and increase efficiency, manufacturers are concentrating on lean manufacturing and automated filling and sealing processes. -

Retail and E-Commerce Growth: Brands are focusing on lightweight, flexible packaging solutions that improve shelf appeal and last-mile delivery efficiency. -

Technological Transformation: New package elements, such as QR codes and NFC-enabled caps, are emerging to improve customer involvement and traceability. -

Product Innovation: Customizable tube forms, such as dual-chamber, airless, and single-material tubes, are gaining popularity. -

Investment Initiatives: Companies are investing in environmentally friendly laminates, high-speed manufacturing lines, and digital printing technologies to improve production agility. -

Regional Insights: North America and Asia Pacific are the worldwide market leaders, driven by strong manufacturing, increased disposable incomes, and a desire for sustainable packaging solutions.

Key Trends and Sustainability Outlook:

-

Eco-Conscious Packaging: As environmental concerns grow, laminate tube producers are developing recyclable materials, bio-based laminates, and reduced plastic shapes. -

Smart Manufacturing: The use of AI-powered quality control, robots, and IoT-enabled monitoring is streamlining factory processes and increasing consistency. -

Customization and Branding: Advanced digital printing allows for small batch runs with colorful, photorealistic finishes, making it perfect for limited editions and focused marketing campaigns. -

Data-Driven Decisions: Real-time production analytics and supply chain visibility help businesses optimize material utilization, decrease waste, and assure consistent product performance. -

Demand for Convenience and Hygiene: Laminate tubes provide safe, portable, and sanitary dispensing, making them perfect for creams, gels, and oral care.

Growth Drivers:

-

Focus on Process Automation: Automated manufacturing and filling lines reduce human error while increasing output, particularly in high-growth markets such as pharmaceuticals and cosmetics. -

Global Brand Expansion: The need for adaptable, cost-effective, and regulatory-compliant tube packaging continues to rise. -

Regulatory Compliance: Manufacturers are complying with global packaging laws such as recyclability, labelling, and material safety. -

Sustainability Needs: The need for eco-friendly and recyclable packaging is increasing, with businesses focused on utilizing sustainable materials. -

Scalability Requirements: As organizations expand, they want scalable manufacturing capabilities to satisfy rising demand without sacrificing quality or efficiency.

Overview of Market Intelligence Services for the Laminate Collapsible Tubes Market:

Recent market evaluations have highlighted important procurement problems in the laminate collapsible tube business, including growing raw material costs, specific tooling needs, and the necessity for flexible manufacturing capabilities. Tailored solutions are frequently required, especially for companies wanting distinctive container shapes or specialised barrier qualities, which can increase both cost and complexity. Procurement intelligence reports are becoming increasingly important in assisting businesses in navigating these problems.

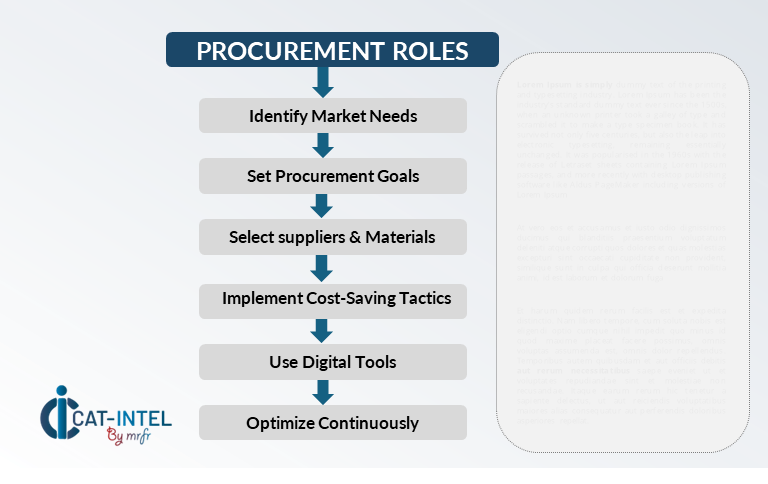

Procurement Intelligence for Laminate Collapsible Tubes: Category Management and Strategic Sourcing

In an increasingly competitive and environmentally conscious packaging world, efficient category management and smart sourcing are critical. Businesses are optimizing their spending by doing extensive cost breakdown studies, evaluating vendor performance, and benchmarking regional suppliers. These methods are critical for assuring constant access to high-quality laminate tubes while reducing risk and complying with industry requirements like as ISO certifications, FDA packaging rules, and sustainability benchmarks. Companies that use real-time market knowledge can improve their procurement strategy, obtain better contract terms, and shorten their time-to-market.

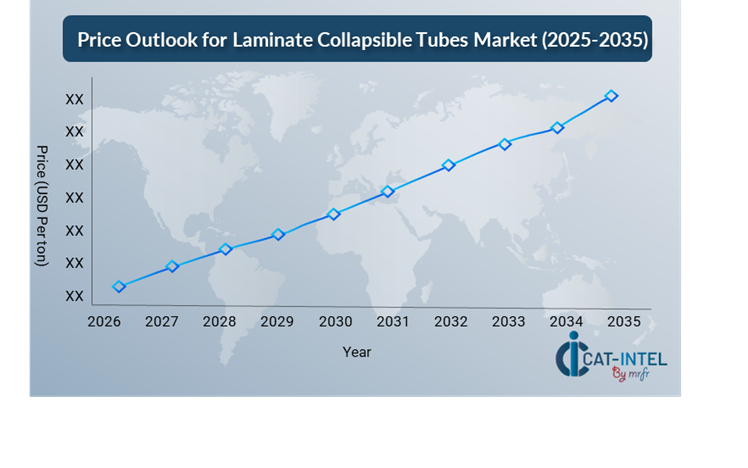

Pricing Outlook for Laminate Collapsible Tubes: Spend Analysis

The pricing environment for laminate collapsible tubes is projected to be somewhat dynamic, influenced by a range of variables. These include material advancements, global supply chain upheavals, customized requests, and regional cost discrepancies. Growing demand for eco-friendly laminates, combined with developments in barrier technology and smart packaging, is putting upward pressure on prices in a variety of product categories.

Graph shows general upward trend pricing for Laminate Collapsible Tubes and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To retain competitiveness and minimize expenditures, firms are increasing efforts around procurement optimization, including strategic vendor selection and performance monitoring, and harnessing market knowledge for real-time price benchmarking and forecasting.

Building long-term partnerships with dependable, quality-certified tube manufacturers, negotiating multi-year agreements to lock in attractive pricing and production capacity, and investing in scalable, automated filling and packaging processes to improve downstream efficiency

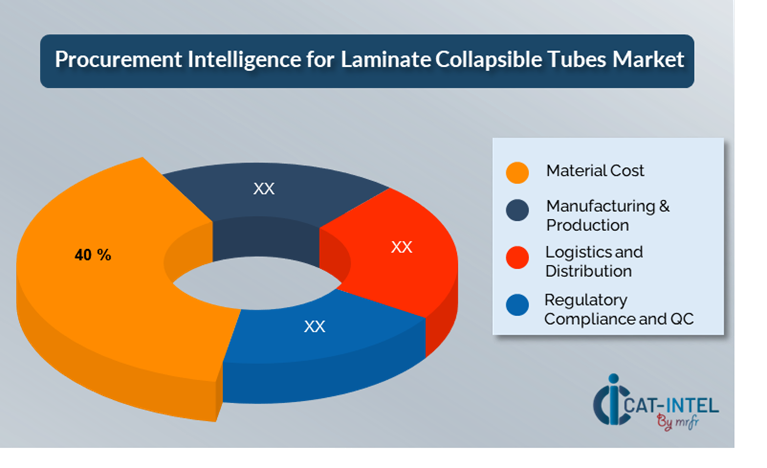

Cost Breakdown for Laminate Collapsible Tubes: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Material Cost: (40%)

-

Description: Material costs include charges for purchasing laminate film, adhesives, inks, and coatings required in tube manufacture. -

Trend: Material costs are changing towards eco-friendly and sustainable resources, including recyclable and biodegradable possibilities.

-

Manufacturing & Production: (XX%)

- Logistics and Distribution (XX%)

- Regulatory Compliance and Quality Control (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

Streamlining procurement procedures and using strategic negotiating methods in the laminate collapsible tube business can result in significant cost savings and improved supply chain resilience. Long-term agreements with reputable tube manufacturers, particularly those with sustainable and scalable production capabilities, enable businesses to secure more favourable pricing models, such as volume-based discounts and bundled service offerings like filling, labelling, and just-in-time delivery. Multi-year contracts not only keep prices stable in the face of material cost volatility, but they also provide steady supply and production capacity—important benefits in a demand-sensitive industry.

Partnering with suppliers who promote material innovation, automation, and flexible manufacturing lines adds long-term value by decreasing operational inefficiencies. Access to cutting-edge technologies, like recyclable laminates, smart packaging features, and digital printing, may reduce package waste, minimize lead times, and improve brand differentiation. Strategic diversification increases flexibility, regional supply access, and resistance to unexpected obstacles.

Supply and Demand Overview for Laminate Collapsible Tubes: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The laminate collapsible tubes market is growing steadily, driven by increased demand for sustainable, practical, and visually appealing packaging in industries such as personal care, pharmaceuticals, food, and industrial applications. Market dynamics are influenced by changing customer choices, technological innovation, and global economic situations.

Demand Factors:

-

Sustainability Expectations: The growing consumer and regulatory emphasis on eco-friendly packaging is driving up demand for recyclable, bio-based, and mono-material laminate tubes.

-

Brand Differentiation and Customization: To differentiate themselves in competitive marketplaces, brands want packaging that enables high-quality print finishes, bespoke design, and user-friendly dispensing forms. -

E-Commerce and Retail Growth: As direct-to-consumer and online retail formats gain traction, demand for sturdy, lightweight, and tamper-resistant packaging is increasing. -

Industry-Specific Compliance Needs: Pharmaceuticals and cosmetics require laminate tubes that fulfil rigorous hygiene, safety, and barrier criteria in order to maintain product efficacy and integrity.

Supply Factors:

-

Material and Technological Innovation:Advances in multilayer laminates, barrier coatings, and digital printing are allowing for high-performance, visually appealing tubes on a large scale.

-

Diverse Supplier Base: The market has a diverse vendor environment, ranging from major manufacturers with high-capacity lines to specialist makers providing niche, premium tube forms. -

Economic Influences: Fluctuations in raw material prices, energy costs, and regional labor markets, which have a direct impact on production costs and pricing tactics. -

Scalability & Production Flexibility: Suppliers are increasingly providing modular production capabilities, allowing them to satisfy both high-volume FMCG clients and smaller boutique brands with agility.

Regional Demand-Supply Outlook: Laminate Collapsible Tubes

The Image shows growing demand for Laminate Collapsible Tubes in both North America and Asia Pacific, with potential price increases and increased Competition.

The Image shows growing demand for Laminate Collapsible Tubes in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Laminate Collapsible Tubes Market

North America, particularly the United States, is a dominant force in the global Laminate Collapsible Tubes market due to several key factors:

-

Strong need from Key Industries: The region's huge and diversified customer base, together with a strong desire for high-quality, convenient, and environmentally friendly packaging solutions, ensures sustained need for laminate tubes. -

Innovative Technological Adoption: Companies in the region embrace innovative manufacturing processes such as digital printing, airless dispensing systems, and sustainable materials at a quicker rate than other regions. -

Strict Regulatory Standards: The North American market is subject to stringent packaging and environmental requirements. This has resulted in an emphasis on high-quality, sustainable packaging solutions that satisfy regulatory requirements. -

Strong Market Players and Suppliers: North America has a strong network of top suppliers and manufacturers of laminate collapsible tubes, including Montebello Packaging and Aluminium Packaging Company. -

High Consumer Awareness: In North America, there is a growing need for environmentally friendly and sustainable packaging. This has pushed businesses to choose laminate tubes because of their recyclability and lightweight nature.

North America Remains a key hub Laminate Collapsible Tubes Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The laminate collapsible tubes market has a broad and highly competitive supplier ecosystem, with a mix of multinational manufacturers and specialized regional players influencing the industry's trajectory. These vendors play an important role in setting price structures, customization possibilities, production scalability, and service quality. Established packaging companies dominate the market, providing full tube manufacturing solutions—while specialist providers frequently specialize to specific categories such as medicines, cosmetics, or natural goods, offering bespoke forms, decorative finishes, and smaller production runs.

With a rising emphasis on sustainability, speed to market, and supply chain resilience, package buyers are increasingly collaborating with suppliers who provide sophisticated material science knowledge and collaborative innovation capabilities. The future of laminates collapsible tube market will be formed by providers that can strike a balance between technological quality, environmental responsibility, and operational flexibility. Companies that strategically connect with the appropriate global and regional partners will be best positioned to generate growth, assure compliance, and provide exceptional product experiences.

Key Suppliers in the Laminate Collapsible Tubes Market Include:

- Berry Global

- Huhtamaki

- Essel Propack

- Montebello Packaging

- Alltub Group

- Amcor

- Neopac

- Intrapac International

- Unilever

- Kolbus

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The laminate collapsible tube market is expanding rapidly, driven by increased demand in the personal care, pharmaceutical, and food industries as consumer awareness, product affordability, and urbanization increase. |

Cloud Adoption |

There is a significant trend toward recyclable and mono-material laminate tubes as firms respond to customer demand for ecologically friendly packaging and prepare for tighter global packaging rules. |

Product Innovation |

Manufacturers are offering new tube forms, such as dual-chamber designs, airless dispensing systems, and digitally printed tubes with high-impact graphics and tactile finishes targeted to specific industry uses.

|

Technological Advancements |

Barrier technologies, automation, and digital printing are improving product performance and manufacturing efficiency. QR codes and serialized tracking are two examples of smart packaging technologies that are increasingly popular. |

Global Trade Dynamics |

Evolving trade restrictions, import/export taxes, and regional material sourcing limits all have an impact on supply chain strategy and supplier selection, especially for multinational businesses operating in many locations. |

Customization Trends |

The growing need for customized package formats—such as size variants, cap types, and laminate structures—is driving manufacturers to provide modular solutions and flexible manufacturing capabilities to meet the different brand demands.

|

|

Laminate Collapsible Tubes Attribute/Metric |

Details |

Market Sizing |

The global Laminate Collapsible Tubes market is projected to reach USD 5.16 billion by 2035, growing at a CAGR of approximately 4.1% from 2025 to 2035.

|

Laminate Collapsible Tubes Technology Adoption Rate |

Over 70% of major personal care and pharmaceutical companies have included modern laminate tube formats into their packaging processes, with rapid adoption of digitally printed and recyclable tube technology.

|

Top Laminate Collapsible Tubes Industry Strategies for 2025 |

Key methods include investing in sustainable materials, implementing high-speed and flexible manufacturing lines, using digital printing for brand differentiation, and improving regional supply capabilities to reduce risk.

|

Laminate Collapsible Tubes Process Automation |

Approximately 60% of laminate tube manufacturing facilities automate essential operations like as extrusion, sealing, labeling, and inspection to enhance speed, precision, and uniformity.

|

Laminate Collapsible Tubes Process Challenges |

In emerging markets, key problems include changing raw material prices, design customization complexity, sustainability compliance, and supply chain interruptions.

|

Key Suppliers |

Berry Global, Huhtamaki and Essel Propack are two major global providers, each of which offers a variety of laminated tubes adapted to different sectors.

|

Key Regions Covered |

North America, and Asia-Pacific are the leading regions, with considerable demand from the cosmetics, oral care, pharmaceutical, and food industries.

|

Market Drivers and Trends |

The drive for sustainable packaging, growing demand for easy and sanitary product forms, increased usage of digital printing, and customizing tendencies among developing consumer brands all contribute to market growth. |