Summary Overview

Labels Market Overview:

The global labels market is expanding steadily, fuelled by increased demand in key industries such as manufacturing, retail, healthcare, and logistics. This developing environment comprises a diverse range of labelling solutions, from digital and smart labels to sustainable and hybrid formats. Our paper provides a thorough examination of procurement trends in the label industry, with a particular emphasis on cost-cutting tactics and the use of digital tools to streamline sourcing and production processes.

Looking ahead, procurement leaders will confront various issues, including managing installation and transition costs, assuring solution scalability, maintaining data integrity, and enabling seamless interaction with old systems. Strategic sourcing and the use of intelligent procurement tools will be critical to optimizing value, boosting operational agility, and preserving a competitive advantage. As global demand rises, firms are looking to real-time market knowledge to make better decisions, increase efficiency, and manage risk throughout the supply chain.

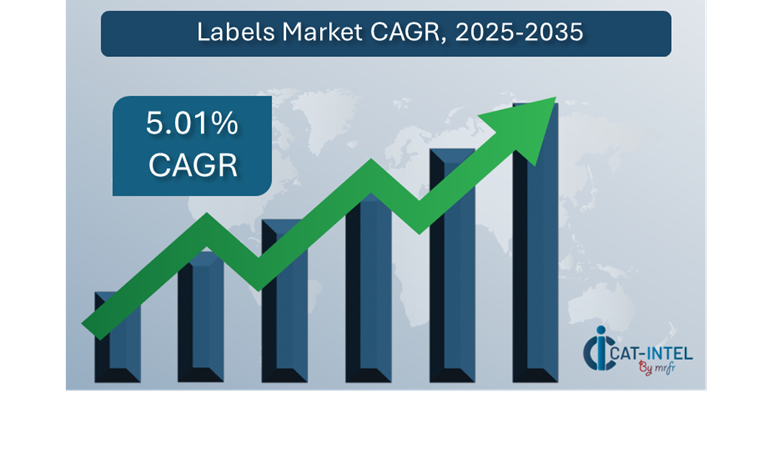

Market Size: The global Labels market is projected to reach USD 153.61 billion by 2035, growing at a CAGR of approximately 5.01% from 2025 to 2035.

Manufacturing and Supply Chain Optimization: Real-time data availability and seamless process integration are becoming increasingly important in improving efficiency across manufacturing and distribution networks.

Retail and E-Commerce Acceleration: The rapid growth of online and omnichannel retail has increased the demand for smarter inventory tracking, precise demand forecasting, and tailored consumer engagement

Technological Transformation: Advancements in AI, machine learning, and data automation are altering labeling operations, allowing for predictive maintenance and automated quality control throughout the supply chain

Modular Innovation: The advent of configurable, modular solutions has enabled firms to deploy only the tools they require, decreasing operational complexity while enhancing agility and cost-effectiveness.

Investment Priorities: Companies are increasing their investments in cloud-native technologies and smart labeling platforms to minimize infrastructure costs and offer real-time, remote access across multinational teams.

Regional Momentum: North America and Asia Pacific are driving digital change with strong infrastructure, a focus on sustainability, and rapid adoption.

Key Trends and Sustainability Outlook:

Cloud Integration: A widespread transition to cloud-enabled technologies enabling scalable, cost-effective labeling operations with improved data visibility and collaboration

Smart Technologies: AI, IoT, and blockchain-powered labels are enabling greater transparency, automation, and intelligent supply chain choices.

Sustainability Focus: The growing emphasis on resource-efficient production, waste reduction, and environmental compliance is driving up demand for recyclable, biodegradable, and smart labels.

Tailored Solutions: There has been a surge in demand for industry-specific labeling solutions, notably in healthcare, food and beverage, and manufacturing.

Data-Driven Insights: Advanced analytics enable organizations to estimate demand, adjust production schedules, and measure key performance indicators in real time.

Growth Drivers:

Digital Transformation: Accelerated integration of digital technologies is altering labeling procedures, increasing speed and precision.

Automation Needs: The growing need for end-to-end process automation, from order to delivery, encourages innovation in labeling technology.

Scalability and Flexibility: Businesses need solutions that can expand with expansion while keeping operational consistency across locations.

Compliance and Traceability: Increased regulatory obligations are driving investment in systems that assure correct reporting and traceability.

Global Expansion: As organizations expand globally, there is a high need for labeling systems that can handle different languages, currencies, and region-specific regulatory norms.

Overview of Market Intelligence Services for the Labels Market:

Recent market evaluations highlight important issues for label purchasers, including high implementation costs and an increased need for personalized solutions. To solve these difficulties, firms are using procurement analytics to identify cost-cutting possibilities, expedite supplier selection, and increase rollout success. Market intelligence reports provide actionable information that enable procurement teams to improve vendor management, increase sourcing efficiency, and comply with demanding industry requirements.

Procurement Intelligence for Labels: Category Management and Strategic Sourcing

In a highly competitive and developing label market, businesses are rethinking procurement by using category management and strategic sourcing initiatives. By conducting detailed spend analysis and tracking supplier performance, procurement teams can reduce total cost of ownership (TCO) through smarter negotiation and bulk purchasing, ensure consistent supply of high-quality labelling materials and technologies, and strengthen supplier relationships with performance-driven insights. Real-time market knowledge allows businesses to enhance sourcing strategy, gain negotiating power, and future-proof their label procurement processes against market instability.

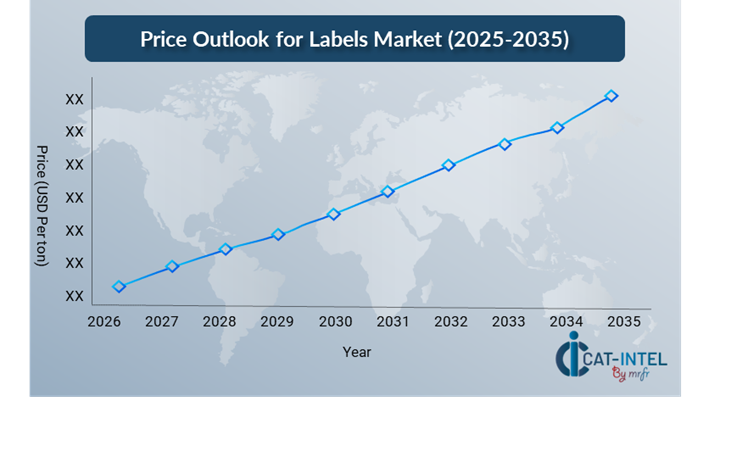

Pricing Outlook for Labels: Spend Analysis

The pricing environment for labeling solutions is projected to remain somewhat dynamic, with swings caused by a variety of reasons. Technological developments, increased need for smart and sustainable labels, customisation requirements, and regional pricing variances are all major causes of price variation.

Graph shows general upward trend pricing for Labels and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To successfully reduce costs, firms must optimize procurement procedures and improve vendor management. Key techniques include using customisable labeling solutions that allow businesses to pick and pay for just the capabilities they want, lowering total costs, and effective contract management systems that assist achieve better pricing and conditions, lowering expenses in the long run.

Building long-term partnerships with dependable suppliers can result in volume discounts and a continuous supply of high-quality supplies. Regardless of price problems, concentrating on scalability, implementing environmentally friendly and efficient labeling solutions, and using cloud-based technologies will be crucial to achieving operational excellence while being cost-effective.

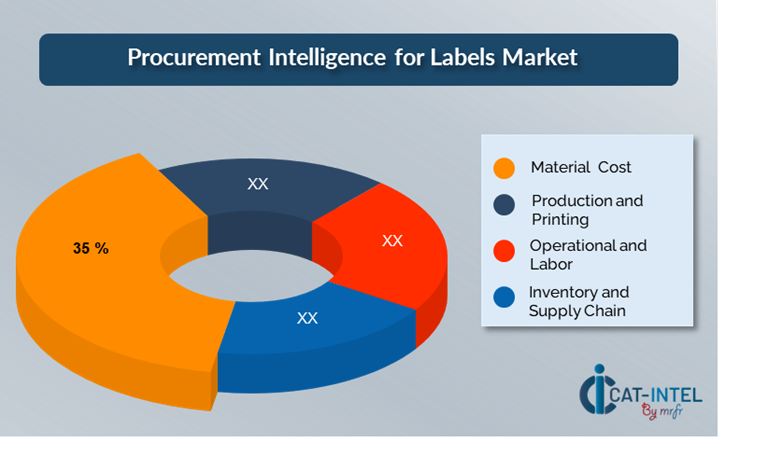

Cost Breakdown for Labels: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Material Cost: (35%)

Description: Material expenses are the fundamental cost of labeling. This comprises the cost of label stocks, adhesives, ink, and other label-production consumables.

Trend Point: There is an increasing preference for environmentally friendly materials (e.g., recycled paper, biodegradable films), which can have a substantial influence on label cost structure.

Production and Printing: (XX%)

Operational and Labour: (XX%)

Inventory and Supply Chain: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the label business, streamlining procurement procedures and using smart negotiating strategies may lead to considerable cost savings and increased operational efficiency. Long-term collaborations with reputable labeling material suppliers, particularly those who provide sustainable or creative labeling solutions, might assist obtain more advantageous pricing arrangements. Volume-based discounts, bundled service packages, and personalized pricing strategies are some examples. Subscription-based models and multi-year contracts provide unique opportunity for businesses to lock in reduced rates and protect themselves against future price volatility.

Collaboration with labeling suppliers who value innovation, scalability, and sustainability provides additional benefits, such as access to cutting-edge technology, smart labels, and eco-friendly solutions that reduce total operational expenses. Businesses that use advanced analytics and flexible solutions may modify their labeling systems to meet unique demands, saving waste and long-term costs. Businesses with a larger supplier base may stimulate competition and drive down prices, resulting in improved service levels and flexibility. Businesses in the labels sector may save money, improve operational efficiency, and position themselves to react to changing market needs by concentrating on long-term partnerships, strategic sourcing, and digital procurement technologies.

Supply and Demand Overview for Labels: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The labels market is enjoying consistent expansion, driven by the increased adoption of digital transformation efforts across industries such as manufacturing, Retail and healthcare. Technological improvements, specialized industry demands, and overall economic conditions all have an impact on supply and demand dynamics.

Demand Factors:

Digital Transformation Initiatives: The increased requirement for centralized data management and real-time tracking is driving up demand for smart labels and linked packaging solutions across numerous industries.

Sustainability and Eco-Friendly Trends: As businesses attempt to comply with environmental standards and appeal to environmentally concerned customers, there is an increase in demand for biodegradable, recyclable, and minimalist labeling solutions.

Industry-Specific Requirements: Different industries, such as healthcare, food and beverage, and manufacturing, require labeling solutions that are adapted to regulatory standards, compliance requirements, and operational processes.

Integration Capabilities: As more firms employ smart devices, the demand for labels that connect with IoT technologies and supply chain software grows.

Supply Factors:

Technological Advancements: Smart labels, RFID technology, and digital printing, which are increasing supplier competition and boosting labeling solution possibilities.

Vendor Ecosystem: The label industry is getting increasingly competitive, with an increasing number of suppliers providing a variety of solutions, ranging from huge multinational corporations to niche, specialized providers.

Global Economic Factors: Exchange rates, labor costs, and regional technology adoption rates all have an impact on the price and availability of labeling materials.

Scalability and Flexibility: Whether organizations need basic retail labels or comprehensive supply chain tracking labels, the flexibility to scale solutions based on their needs is a major selling factor.

Regional Demand-Supply Outlook: Labels

The Image shows growing demand for Labels in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Labels Market

Asia Pacific, particularly East Asia, is a dominant force in the global Labels market due to several key factors:

Leading Manufacturing Hub: With manufacturers producing large amounts of consumer products, automobile components, electronics, and medicines, there is an increasing demand for labeling solutions.

Growing Consumer Market: Countries such as China and India have millions of new consumers who seek packaged goods and retail products, highlighting the importance of appropriate labeling.

Evolving Regulatory Landscape: Labeling regulations in APAC nations are becoming stricter, particularly in the food and beverage, pharmaceutical, and chemical industries.

Technological Advancements in Labeling: The Asia-Pacific area has seen considerable advances in labeling technology, such as the use of digital printing, smart labels, and RFID technology.

Production Capabilities: APAC's strong supply chain networks allow the effective distribution of labeling products, bolstering its position in the global label industry.

Asia Pacific Remains a key hub Labels Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The labels market is diversified and competitive, with global leaders and regional experts influencing market dynamics. These vendors have a significant impact on crucial criteria such as cost, product customisation, and service quality. Large, established corporations dominate the market, offering full labeling solutions, while smaller, specialist players specialize in certain industry verticals or features, such as sustainable labeling and smart packaging.

The label supplier ecosystem includes both huge worldwide suppliers and creative local firms, each responding to specific industry needs. These providers are constantly evolving to meet the demands of industries such as healthcare, food and beverage, and manufacturing, providing personalized solutions that are compliant with regulatory requirements and operational processes. As businesses increasingly prioritize digital transformation, the need for smart labels, linked packaging, and IoT-enabled labels grows. Suppliers are improving their cloud capabilities combining cutting-edge technology such as RFID, sophisticated analytics, and AI, and offering flexible subscription models to meet changing business demands.

Key Suppliers in the Labels Market Include:

Sato Holdings Corporation

Avery Dennison Corporation

UPM Raflatac

Zebra Technologies

Label Systems Inc

Smurfit Kappa

Brady Corporation

Krone AG

Mouvent (a Bobst Group Company)

Lee and Man Paper Manufacturing Limited

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The labels industry is expanding rapidly, driven by increased demand for labeling solutions in industries such as retail, healthcare, and manufacturing to improve operational efficiency and consumer engagement.

|

Cloud Adoption |

Labeling companies are increasing their services to include novel features like smart labels, QR codes, and RFID-enabled packaging, which improve customer involvement and supply chain transparency.

|

Product Innovation |

Companies are looking for modular and adaptable labeling solutions that can work with third-party products, IoT devices, and supply chain management platforms to improve efficiency and scalability.

|

Technological Advancements |

Advances in IoT integration, smart packaging, and AI-powered analytics are revolutionizing labeling capabilities, allowing real-time tracking, predictive analytics, and improved automation in packaging and labeling processes.

|

Global Trade Dynamics |

Changes in global trade legislation, import/export policies, and regional economic situations all have an impact on labeling requirements, especially for multinational corporations that manage broad and complex product lines globally. |

Customization Trends |

There is a rising trend for environmentally friendly and sustainable labeling options. Environmental restrictions and customer demand for sustainability are driving corporations to adopt more biodegradable, recyclable, and minimalist labeling.

|

|

Labels Attribute/Metric |

Details |

Market Sizing |

The global Labels market is projected to reach USD 153.61 billion by 2035, growing at a CAGR of approximately 5.01% from 2025 to 2035.

|

Labels Technology Adoption Rate |

Approximately 60% of firms worldwide have implemented sophisticated labeling technologies like as RFID, smart labels, and digital printing, with a rising emphasis on sustainable and eco-friendly labels to achieve environmental goals.

|

Top Labels Industry Strategies for 2025 |

Key label market tactics include implementing IoT-enabled smart labels for real-time tracking, increasing consumer involvement with QR codes, prioritizing sustainability in labeling materials, and investing in modular labeling systems for flexibility.

|

Labels Process Automation |

Approximately 50% of label production operations are automated, which includes jobs such inventory tracking, label printing, and compliance reporting, enhancing operational efficiency and reducing manual errors.

|

Labels Process Challenges |

High material prices, supply chain interruptions, customisation complexity, and guaranteeing regulatory compliance in areas like as healthcare and food are all significant concerns.

|

Key Suppliers |

Leading label solution suppliers include Sato Holdings Corporation, Avery Dennison and UPM Raflatac, who provide complete solutions for smart, sustainable, and personalized labeling across a variety of sectors.

|

Key Regions Covered |

Asia Pacific and North America, are key markets for label adoption, with significant demand from the retail, food and beverage, and healthcare industries.

|

Market Drivers and Trends |

Rising demand for sustainability, smart packaging, sophisticated labeling technologies such as RFID and QR codes, and the integration of data analytics for real-time tracking and inventory management are driving the label market's rise.

|