Summary Overview

Lab Supplies Market Overview

The global lab supplies market is steadily expanding, driven by increased demand in areas such as healthcare, pharmaceuticals, biotechnology, and academic research. This market includes a wide range of products, including as consumables, reagents, instruments, and safety equipment. Our paper provides a detailed examination of procurement trends, with a particular emphasis on cost-cutting techniques and the use of digital solutions to expedite purchase and operational workflows.

Key procurement problems for the future include minimizing acquisition and inventory costs, maintaining supply chain scalability, protecting product quality and compliance, and smoothly integrating new technologies into existing lab operations. To remain competitive, businesses are increasingly reliant on digital procurement platforms, data-driven sourcing, and supplier performance analytics.

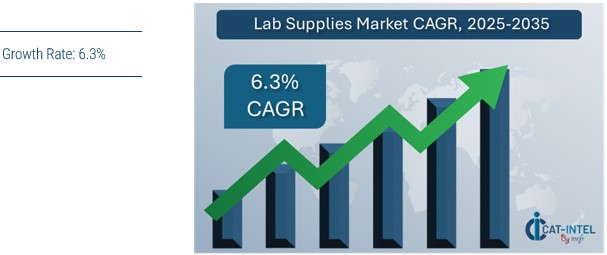

Market Size: The global Lab Supplies market is projected to reach USD 48 billion by 2035, growing at a CAGR of approximately 6.3% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Efficiency: Organizations are prioritizing solutions that streamline production, inventory management, and delivery to ensure that lab operations run smoothly.

-

Retail and E-Commerce Expansion: As the popularity of online lab supply procurement grows, suppliers are investing in better demand forecasting, inventory tracking, and customer engagement capabilities.

-

Technological Advancements: The integration of artificial intelligence (AI) and machine learning is changing the way lab supply chains are managed, allowing for predictive ordering and automatic replenishment systems.

-

Product and Service Innovation: Suppliers are providing modular and configurable solutions, allowing labs to purchase only what they need, when they need it, lowering costs, waste, and logistics complexity.

-

Strategic Investment: Organizations are turning to digital procurement platforms and cloud-based inventory systems to cut infrastructure costs and enable remote operations and monitoring.

-

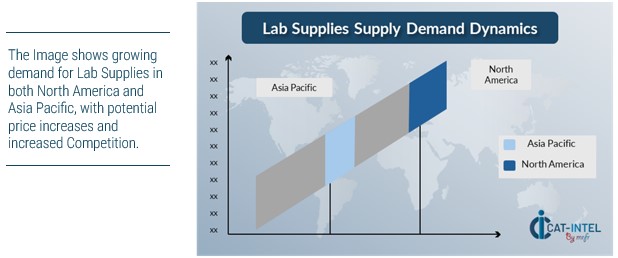

Regional Insights: North America and Asia Pacific continue to dominate in digital lab supply procurement, owing to strong digital infrastructure and growing research and healthcare sectors.

Key Trends and Sustainability Outlook:

-

Sustainability Focus: There is a rising emphasis on sustainable procurement techniques, such as purchasing environmentally friendly goods and reducing packaging waste.

-

Cloud Integration and Digital Tools: The popularity of cloud-based procurement and supply management solutions is increasing, driven by the requirement for scalability and low downtime.

-

Smart Technologies: Tools that use AI, IoT, and blockchain are being developed to improve supply chain transparency, automate procedures, and improve decision-making.

-

Customized Procurement: The increasing demand for industry-specific procurement solutions customized to industries such as clinical diagnostics, pharmaceutical R&D, and university research is driving supplier innovation.

-

Data-Driven Insights: Advanced analytics technologies assist firms in forecasting demand, tracking usage trends, optimizing stock levels, and managing supplier performance more efficiently.

Growth Drivers:

-

Digital Transformation: Businesses are investing in technology to modernize procurement, increase operational efficiency, and eliminate manual intervention.

-

Automation and Efficiency: Automated purchasing, inventory management, and compliance reporting are becoming commonplace in lab supply chains to minimize bottlenecks and improve accuracy.

-

Scalability: As research activities expand globally, there is an urgent need for supply systems that can adapt and develop alongside organizational needs.

-

Regulatory Compliance: Laboratories must adhere to strict compliance norms. To meet these regulatory obligations, digital procurement solutions can help ensure proper documentation and reporting.

-

Global Expansion: As research institutes and biotech enterprises grow globally, the requirement for reliable, compliant, and adaptable procurement systems that support multi-region operations continues to rise.

Overview of Market Intelligence Services for the Lab Supplies Market:

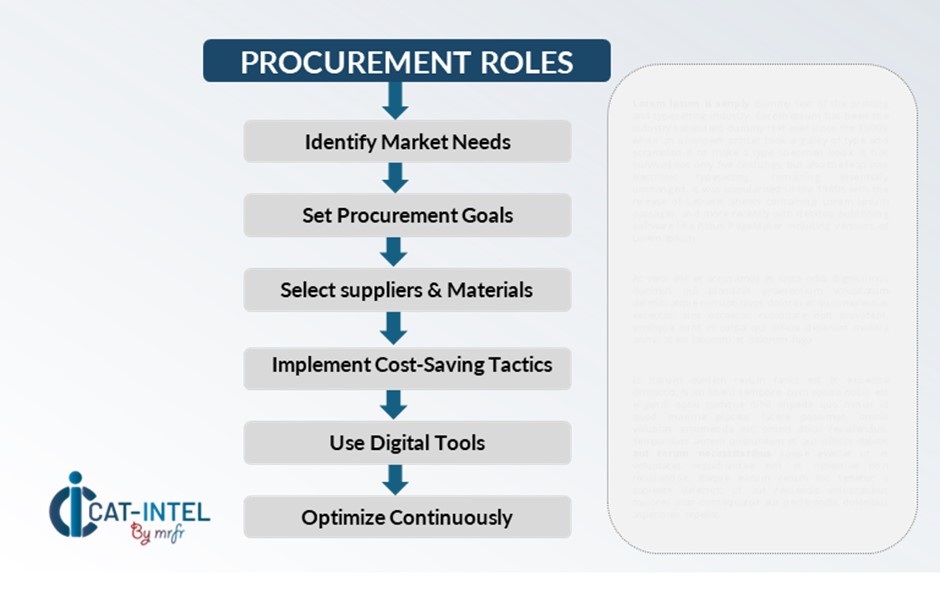

Recent market evaluations have revealed important procurement problems in the lab supplies industry, such as rising acquisition costs and a growing desire for product customization to fulfill unique research and operational requirements. Procurement intelligence reports are now crucial because they provide actionable insights into cost-saving potential, allowing firms to optimize supplier selection, improve contract negotiation, and create operational efficiency.

Procurement Intelligence for Lab Supplies: Category Management and Strategic Sourcing

To remain competitive, businesses are improving their procurement processes by focusing on expenditure analysis to uncover inefficiencies and decrease waste. Supplier performance tracking to ensure consistent quality and on-time delivery. These data-driven initiatives not only meet industry requirements such as safety, traceability, and sustainability, but also help to maintain high-quality operational processes while successfully managing procurement costs. Using real-time market intelligence, lab operations can improve procurement agility, assure supply continuity, and create scalable supplier alliances to meet changing research and clinical demands.

Pricing Outlook for Lab Supplies: Spend Analysis

The pricing prognosis for lab supplies is projected to be moderately dynamic, influenced by a variety of factors. Technological innovation, increased demand for specialized and sustainable products, customization requirements, and regional supply chain variations are all significant drivers.

Improving vendor management to provide consistent quality, competitive pricing, and supply chain resilience. Using modular procurement procedures, lab supplies are purchased based on precise operating requirements to avoid overstocking or wasteful inventory. Partnering with reliable suppliers who provide transparent pricing, predictable lead times, and flexible fulfillment strategies.

Negotiating long-term or volume-based contracts to ensure better pricing and reduce volatility. Despite escalating prices and supply chain concerns, prioritizing scalability, process standardization and the use of digital procurement platforms remain critical to attaining operational excellence and long-term cost control.

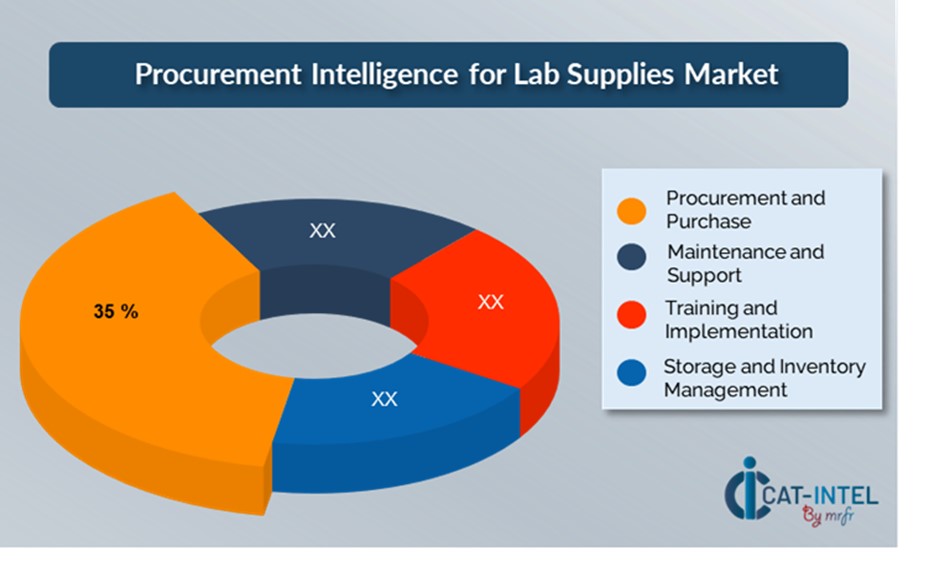

Cost Breakdown for Lab Supplies: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Procurement and Purchase: (35%)

-

Description: The initial purchase cost is the most direct expense, which includes the cost of lab supplies, equipment, or reagents.

-

Trend: Price pressure on lab supplies is increasing as procurement departments work to negotiate lower costs, particularly for consumables and reagents, through bulk purchasing and long-term supplier contracts.

- Maintenance and Support: (XX%)

- Training and Implementation: (XX%)

- Storage and Inventory Management: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the laboratory supplies industry, refining procurement techniques and employing efficient negotiation tactics can result in significant cost reductions while increasing operational efficiency. Long-term partnerships with dependable lab supply vendors, particularly those that provide scalable and flexible delivery models, can result in more favourable pricing structures, such as volume-based discounts, bundled product packages, and priority service agreements. Subscription-based delivery models and multi-year contracts for regularly used consumables are an excellent way to lock in reduced rates, increase budget predictability, and reduce exposure to price volatility over time.

Working with suppliers who prioritize innovation and supply chain agility creates long-term benefit. These vendors frequently offer access to digital inventory management tools, personalized product bundles based on lab usage patterns. Adopting a multi-vendor procurement approach enables businesses to lessen their reliance on a single supplier, reducing risks such as supply outages, service gaps, and pricing imbalances. A diverse supplier base not only increases negotiation power, but it also promotes competitive pricing and procurement resilience.

Supply and Demand Overview for Lab Supplies: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global lab supplies market is growing steadily, driven by increased research and diagnostic activities in industries such as healthcare, pharmaceuticals, biotechnology, and academia. This expansion is being driven by developing technology capabilities, more specialization in lab contexts, and larger economic and regulatory influences.

Demand Factors:

-

Digital Transformation in Laboratory Operations: Labs are increasing their use of digital tools for inventory tracking, automatic reordering, and data-driven procurement.

-

Rise in Remote Lab Functions: As decentralized and remote lab models gain popularity, there is a greater need for scalable, cloud-enabled procurement systems and subscription-based supply solutions.

-

Sector-Specific Requirements: Clinical labs, pharmaceutical R&D, and academic institutions require bespoke supply packages that meet tight industry standards (e.g., GLP, GMP) and are suited to highly specialized processes.

-

Integrated Supply Solutions: Labs look for vendors who can combine consumable delivery with equipment maintenance, digital procurement platforms, and data reporting.

Supply Factors:

-

Advances in Manufacturing and Smart Labelling: The application of AI, automation, and IoT-enabled monitoring in the manufacturing and distribution of lab supplies improves product traceability, consistency, and shelf life.

-

Expanding Vendor Ecosystem: The market has a growing mix of global suppliers, specialty vendors, and direct-to-lab distributors, providing purchasers with greater flexibility and specialized service options.

-

Global Economic Conditions: Raw material availability, shipping difficulties, labor rates, and currency fluctuations all have an impact on supply chain costs, contributing to regional price differences.

-

Modular and Scalable Supply Models: Suppliers are providing more flexible procurement options such as on-demand replenishment, modular supply kits, and scalable subscription programs.

Regional Demand-Supply Outlook: Lab Supplies

North America: Dominance in the Lab Supplies Market

North America, particularly the United States, is a dominant force in the global Lab Supplies market due to several key factors:

-

Advanced Healthcare and Research Infrastructure: The region is home to several of the top pharmaceutical corporations, biotech firms, and colleges conducting cutting-edge research and development.

-

Significant R&D Investment: North American countries invest heavily in research and development (R&D), particularly in the pharmaceutical, biotechnology, and medical device sectors.

-

Technological Advances and Innovation: Companies are increasingly adopting cloud-based solutions for inventory management and supply chain optimization, which is driving market growth.

-

Regulatory and Compliance Standards: North America has severe regulatory standards that labs must adhere to, such as FDA rules in the United States and Health Canada standards, which drives demand for high-quality, compliance lab supplies and equipment.

-

Strong Supplier and Distribution Networks: The region has an established network of suppliers, distributors, and service providers, making it easier for businesses and research institutes to obtain a diverse selection of lab products.

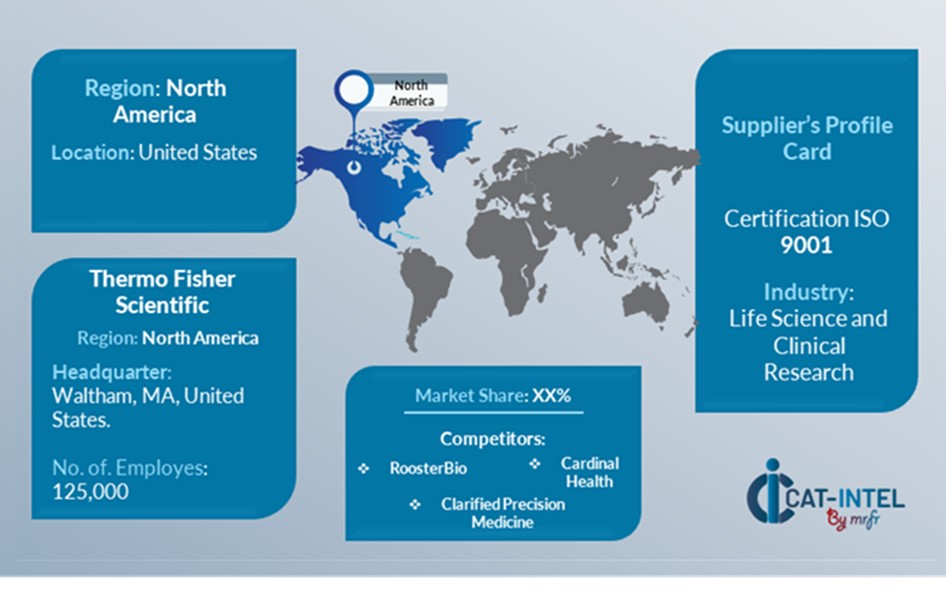

Supplier Landscape: Supplier Negotiations and Strategies

The lab supplies market has a diverse and highly competitive supplier landscape, dominated by a combination of multinational distributors, specialized manufacturers, and regional vendors. These vendors have a significant impact on key aspects of procurement, including pricing structures, product availability, customization capabilities, and service quality. Large, established vendors dominate the industry by providing complete product portfolios that range from basic consumables to high-end instrumentation, which are frequently combined with inventory management and support services.

At the same time, specialist providers cater to industry-specific requirements, such as ecologically friendly products, sterile manufacturing standards, or precise calibration equipment for research-intensive labs. As labs prioritize digital transformation and supply chain efficiency, suppliers are adjusting in crucial ways, such as improving e-commerce platforms and digital procurement integration, and delivering flexible, subscription-based supply models adapted to usage patterns. Suppliers who provide dependability, openness, and innovation are gaining a competitive advantage as buyers seek partners who can support scalable operations and long-term cost control.

Key Suppliers in the Lab Supplies Market Include:

- Thermo Fisher Scientific

- VWR International (Advantor)

- Sigma Aldrich (Merck Group)

- Agilent Technologies

- PerkinElmer

- Danaher Corporation

- Fisher Scientific

- BioRad Laboratories

- Labcorp Drug Development

- Sartorius AG

Key Developments Procurement Category Significant Development:

| Significant Development | Description |

| Market Growth | The lab supplies market is expanding rapidly due to increased demand from the healthcare, biotech, pharmaceutical research, and academic sectors, fueled by the rise of clinical diagnostics and R&D efforts. |

| Cloud Adoption | An increasing trend towards cloud-based procurement and supply chain management systems is taking hold, allowing labs to reduce inventories, optimize procurement processes, and obtain remote access. |

| Product Innovation | Suppliers are developing goods such as smart lab equipment, automated consumables, and AI-powered data tracking systems that are suited to the unique needs of industries such as genomics, pharmaceutical R&D, and clinical diagnosis. |

| Technological Advancements | Machine learning, IoT, and robotic process automation (RPA) are helping to automate supply chains and lab procedures, enabling predictive inventory management, and increasing real-time data analytics. |

| Global Trade Dynamics | Changes in global trade restrictions, supply chains, and regional economic conditions are influencing the availability, pricing, and compliance standards of lab supplies. |

| Customization Trends | There is a growing demand for bespoke lab supply solutions, such as modular procurement models and integrated software tools, that are tailored to individual research demands and workflows. |

|

Lab SuppliesAttribute/Metric |

Details |

| Market Sizing | The global Lab Supplies market is projected to reach USD 48 billion by 2035, growing at a CAGR of approximately 6.3% from 2025 to 2035. |

| Lab Supplies Technology Adoption Rate | Approximately 60% of labs worldwide have integrated digital tools and automated procurement systems, with a rising preference for cloud-based supply chain solutions for real-time inventory tracking and remote access. |

| Top Lab Supplies Industry Strategies for 2025 | Key methods include using AI for predictive analytics in inventory management, streamlining procurement using modular supply packages, focusing on sustainable sourcing, and increasing the use of automated supply chains for efficiency. |

| Lab Supplies Process Automation | Routine processes like as inventory management, consumable reordering, and compliance reporting are automated in around half of lab operations, resulting in less manual labour. |

| Lab Supplies Process Challenges | Major issues include inventory overstocking, supply chain disruptions, and inconsistent suppliers’ performance, and the need for compliance with industry regulations (e.g., FDA, GLP, GMP). |

| Key Suppliers | Thermo Fisher Scientific, VWR International, and Sigma-Aldrich (Merck) are among the leading lab supply providers, offering comprehensive solutions for laboratories, research institutions, and the healthcare industry. |

| Key Regions Covered | North America, Europe, and Asia-Pacific are the most popular markets for lab supplies, with particularly strong demand in pharmaceutical R&D, clinical diagnostics, and biotech research. |

| Market Drivers and Trends | Increased investments in healthcare R&D, rising demand for advanced lab equipment, the expanding use of AI for data processing, and a shift toward sustainable and environmentally friendly lab supplies all contribute to growth. |