Summary Overview

LAB Market Overview

The global LAB (Laboratory) market is expanding steadily, driven by demand from a wide range of industries, including pharmaceuticals, biotechnology, healthcare, and environmental testing. This market includes several types of laboratory solutions, such as automated systems, cloud-based platforms, and hybrid models. Our paper delves deeply into procurement trends, concentrating on cost-cutting methods and the use of digital tools to improve laboratory operations.

Key future problems in the laboratory sector include controlling high startup costs, maintaining scalability, protecting data security, and integrating sophisticated laboratory technology with current infrastructures. Digital tools and strategic sourcing are crucial for reducing laboratory procedures, increasing productivity, and remaining competitive. As global demand rises, firms are relying more on market intelligence to improve operational efficiency and reduce risks.

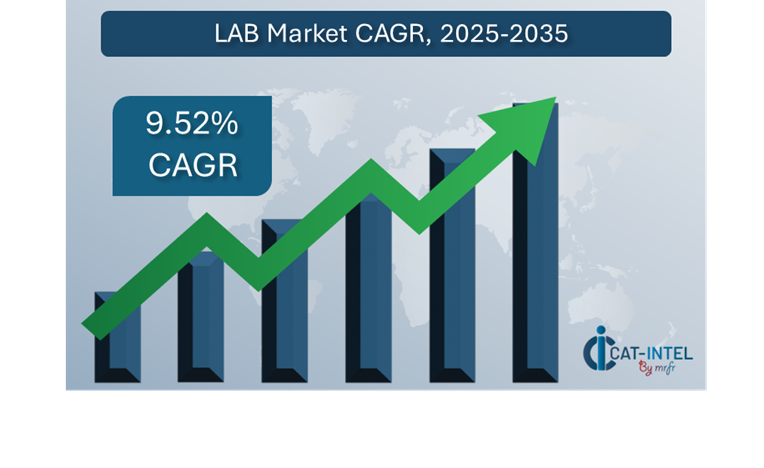

Market Size: The global LAB market is projected to reach USD 348.14 billion by 2035, growing at a CAGR of approximately 9.52% from 2025 to 2035.

Growth Rate: 9.52%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Testing Optimization: The growing demand for real-time data and process integration is prompting laboratories to adopt technologies that streamline workflows, resulting in faster and more accurate results.

Healthcare and Biotechnology Growth: These sectors' laboratories are increasingly relying on advanced technologies to optimize resource allocation, demand forecasting, and patient/research data management.

Technological Advancements: By integrating AI, machine learning, and automation, laboratory systems improve predictive analytics capabilities, increase efficiency, and enable more accurate, real-time decision-making.

Innovative Solutions: Modular lab systems are gaining popularity, allowing enterprises to choose and integrate only the capabilities they require, reducing complexity and improving resource utilization.

Investment in Infrastructure: Laboratories invest substantially in cloud-based technologies to cut infrastructure costs and enable remote testing, monitoring, and reporting, improving both flexibility and collaboration.

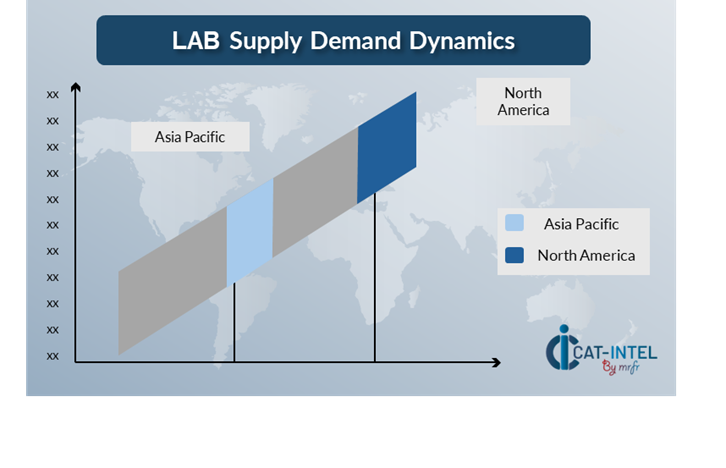

Regional Insights: North America and Asia Pacific continue to dominate the lab market, owing to strong digital infrastructure and increasing expenditures in cloud-based technologies and laboratory management solutions.

Key Trends and Sustainability Outlook

Cloud Integration: The increased use of cloud-based lab management systems enables scalability, improved data accessibility, and real-time communication across teams, hence boosting operational efficiency and accuracy.

Advanced Features: The integration of AI, IoT, and blockchain technology is modernizing laboratories by boosting decision-making, speeding automation, and increasing transparency in testing and reporting procedures.

Focus on Sustainability: Lab systems are becoming important in assisting firms in managing resources more efficiently, analyzing environmental impact, and ensuring compliance with sustainability standards through improved data tracking.

Customization Trends: There is an increasing need for lab management systems suited to certain industries like healthcare, life sciences, and environmental testing.

Data-Driven Insights: Advanced analytics in lab software solutions enable businesses to foresee trends, optimize resources, and monitor performance metrics in real time, resulting in more informed decision-making.

Growth Drivers:

Digital Transformation: The adoption of digital technologies in laboratories is accelerating, improving productivity, data analysis, and the speed of testing or research results.

Demand for Process Automation: With laboratories under increasing pressure to produce faster and more accurate findings, automating repetitive operations and workflows is becoming increasingly important in decreasing operational bottlenecks.

Scalability Requirements: Labs are looking for solutions that can scale with their operations, providing seamless integration and sustaining performance even as demand for testing services increases.

Regulatory Compliance: Laboratories are implementing complex systems to assure adherence to industry requirements, automate compliance reporting, and maintain high data accuracy standards.

Globalization: Laboratories that are expanding worldwide require systems that handle multi-language, multi-currency, and local regulatory requirements to facilitate smooth operations in global markets.

Overview of Market Intelligence Services for the LAB Market

Recent investigations have identified substantial problems in the laboratory industry, including as high setup and implementation costs, as well as the necessity for system customisation to match specific operational requirements. Market intelligence reports give actionable information to assist businesses overcome these challenges by discovering cost-cutting options, streamlining supplier management, and guaranteeing a smooth system deployment.

Procurement Intelligence for LAB: Category Management and Strategic Sourcing

In the competitive lab market, organizations are fine-tuning procurement processes through extensive expenditure monitoring and vendor performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs and providing access to high-quality lab systems. By utilizing actionable market knowledge, laboratories can fine-tune their buying strategies. Negotiate favorable terms for their technology requirements and find dependable and efficient solutions to satisfy their changing needs. This method allows firms to stay ahead of the curve while reducing operational expenses and improving system interoperability.

Pricing Outlook for LAB: Spend Analysis

The pricing prognosis for laboratory management solutions is likely to be moderately dynamic, impacted by a variety of factors. Technological developments, increased demand for cloud-based platforms, the need for system customization, and regional price variances are all key drivers.

Graph shows general upward trend pricing for LAB and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To effectively manage laboratory expenditures, optimize procurement procedures, improve vendor relationships, and implement modular lab solutions. Market monitoring technologies, analytics-based pricing predictions, and efficient contract management systems will all help to reduce costs.

Despite pricing and procurement constraints, labs should focus on scalability and robust implementation. By ensuring that their lab solutions are scalable and well-integrated, laboratories can retain operational efficiency while lowering long-term costs and staying competitive in a continually changing sector.

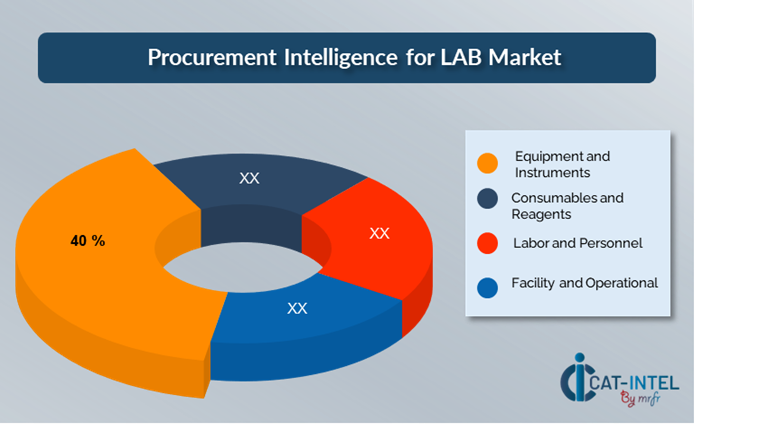

Cost Breakdown for LAB: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Equipment and Instruments: (40%)

Description: This covers the initial cost of purchasing lab equipment, such as microscopes, analysers, centrifuges, chromatographs, spectrometers, and other specialist tools.

Trend: Laboratories are rapidly turning to more efficient, multi-functional instruments that can conduct a variety of tests, eliminating the need for many single-purpose devices.

Consumables and Reagents: (XX%)

Labor and Personnel: (XX%)

Facility and Operational: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the laboratory industry, streamlining procurement processes and using strategic negotiation strategies can result in significant cost savings and increased operational efficiency. Long-term relationships with lab solution providers, particularly those who provide cloud-based or modular solutions, can result in more attractive pricing structures, such as volume discounts, bundled services, and extensive support packages. Negotiating multi-year contracts with lab solution providers can help you get better prices and defend against price increases. This technique is especially advantageous for cloud-based platforms since it provides continual access to upgrades, security features, and scalability for a fixed fee.

Partnering with vendors who prioritize innovation and scalability provides access to cutting-edge technologies such as AI-powered analytics, IoT integrations, and modular lab management systems. These features can optimize lab procedures and improve data accuracy. and lower long-term operating expenses. Adopting a multi-vendor strategy can reduce the risk of service outages, support challenges, and technology restrictions. It also increases negotiating power, allowing labs to get more competitive pricing and service agreements.

Supply and Demand Overview for LAB: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lab management systems market is expanding steadily, driven by increased digital transformation efforts in industries such as healthcare, pharmaceuticals, and environmental testing. Technological innovation, industry-specific needs, and global economic considerations all have an impact on supply and demand dynamics.

Demand Factors:

Digital Transformation in Labs: The need for centralized data management, automation, and faster processes is driving demand for more modern lab management systems.

Cloud Adoption: Labs are rapidly turning to cloud technology to facilitate multi-location collaboration, lower IT maintenance costs, and increase flexibility

Regulatory and Industry-specific requirements: Labs in highly regulated businesses like as healthcare and pharmaceuticals require LMS that is tailored to specific compliance criteria (e.g., HIPAA, FDA regulations).

Integration with IoT and Other Systems: As the use of smart equipment and devices in laboratories grows, flawless integration capabilities are becoming an important consideration in software selection.

Supply Factors:

Technological Advancements: The emergence of AI, machine learning, and cloud computing is changing LAB offerings. Increasing pressure on manufacturers to improve their LMS systems to remain competitive in the market.

Expanding Vendor Ecosystem: As the ecosystem grows, labs have more options and flexibility when it comes to selecting solutions that meet their individual requirements and budget.

Global Economic Conditions: In some locations, economic restrictions may limit the affordability of modern systems, whereas higher adoption rates may result in faster developments in LMS offerings.

Scalability and Flexibility: Modern LABs are becoming more modular, allowing suppliers to provide scalable systems that can accommodate labs of different sizes, from small independent labs to major research institutions.

Regional Demand-Supply Outlook: LAB

The Image shows growing demand for LAB in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the LAB Market

North America, particularly the United States, is a dominant force in the global LAB market due to several key factors:

Research and Development (R&D) Infrastructure: The region makes significant investments in R&D across a variety of sectors, including healthcare, pharmaceuticals, biotechnology, and environmental sciences, all of which rely on lab services.

Established Healthcare and Pharmaceutical Industry: North America is home to several of the world's leading healthcare and pharmaceutical companies. The broad healthcare network also generates a large volume of clinical testing, which drives demand for lab services.

Regulatory and Quality Standards: North America is known for its demanding regulatory frameworks, including FDA clearance processes, CLIA certification, and ISO standards, which drive demand for dependable, compliant lab service providers.

Access to Cutting-Edge Technology: North America is at the forefront of adopting and integrating cutting-edge lab technologies such as automation, artificial intelligence, and big data analytics.

Health and Environmental Initiatives: North America continues to engage in epidemiology studies, climate change research, and environmental monitoring, all of which require specialist lab services for testing and data collection.

North America Remains a key hub LAB Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the lab market is similarly diversified and fiercely competitive, with a mix of global leaders and specialised regional players defining the sector. These vendors have an impact on key elements such as pricing models, system customisation, and service quality. Established software vendors dominate the market, offering comprehensive lab management solutions. Smaller specialty players target on certain industries needs or advanced features like real-time analytics, AI integration, and IoT capabilities

Many smaller, more innovative local providers are carving out a niche by focusing on industry-specific demands or area compliance mandates. Their adaptability enables them to service specialized markets with more customized solutions. As the lab industry embraces digital transformation, Lab providers improve their cloud capabilities to provide more scalable, accessible, and cost-effective solutions. This includes providing customizable subscription options that lower upfront expenses and provide labs more predictable pricing.

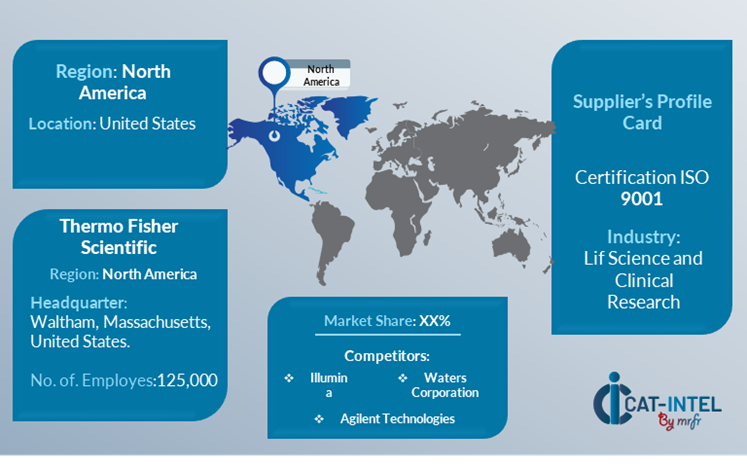

Key Suppliers in the LAB Market Include:

Thermo Fisher Scientific

Agilent Technologies

Perkin-Elmer

Merck Group

Shimadzu Corporation

Sartorius AG

Water Corporation

Fisher Scientific

Horiba Limited

BioRad Laboratories

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The increased use of digital technology in laboratory administration is driving market growth, particularly in emerging economies where modernization is underway. |

Cloud Adoption |

Cloud solutions provide the benefits of remote data access, improved collaboration across many sites, and the capacity to interact with other business technologies, making them an indispensable part of modern laboratory operations. |

Product Innovation |

Lab providers are enhancing their solutions with AI-powered analytics, real-time data processing, and industry-specific modules customized to different industries. These advancements enable labs to automate mundane processes, improve decision-making, and increase data security. |

Technological Advancements |

Technological advancements like as machine learning, IoT integration, and robotic process automation (RPA) are dramatically improving LMS capabilities, minimizing human labor and lab management errors. |

Global Trade Dynamics |

Laboratories dealing with complicated supply chains or multi-regional compliance standards are increasingly resorting to LMS platforms that can interact with global standards and allow for seamless cross-border operations. |

Customization Trends |

Labs want flexibility in how their systems are structured, so they may fulfill specific operating requirements and regulatory standards without being limited by rigid, one-size-fits-all solutions. |

|

LAB Attribute/Metric |

Details |

Market Sizing |

The global LAB market is projected to reach USD 348.14 billion by 2035, growing at a CAGR of approximately 9.52% from 2025 to 2035. |

LAB Technology Adoption Rate |

Approximately 60% of labs worldwide have implemented LMS solutions. Cloud-based LMS platforms are becoming increasingly popular due to its scalability, cost-efficiency, and accessibility. |

Top LAB Industry Strategies for 2025 |

AI-powered analytics for real-time data insights and predictive decision-making are critical lab market strategy. Prioritizing cybersecurity to protect sensitive data and guarantee compliance with regulations such as HIPAA, ISO, and FDA. |

LAB Process Automation |

Routine lab duties like as inventory management, data gathering, and compliance reporting are automated in around half of all LMS systems. This automation increases operational efficiency by eliminating human error, minimizing manual work, and improving result accuracy. |

LAB Process Challenges |

Key challenges include High implementation costs, particularly for small labs with limited budgets. Resistance to change from lab professionals who are used to established practices. Data migration challenges, especially when transferring significant amounts of legacy data to new systems. |

Key Suppliers |

Leading Lab suppliers include Thermo Fisher Scientific (USA), and Abbott Informatics (USA), which provide integrated solutions aimed at enhancing efficiency and compliance in healthcare and research labs. |

Key Regions Covered |

Major regions include North America, Europe, and Asia-Pacific, particularly in emerging markets with expanding healthcare, life sciences, and manufacturing sectors. |

Market Drivers and Trends |

The growing demand for centralized data management and regulatory compliance in laboratories. Cloud-based LMS systems are being used for improved accessibility, cost control, and scalability, as well as predictive capabilities and real-time data insights. |