Summary Overview

Lab Chemicals Market Overview

The global lab chemicals market is steadily growing, driven by rising demand in industries such as pharmaceuticals, biotechnology, healthcare, and research. This market covers a diverse range of chemical solutions, such as reagents, solvents, and specialty chemicals, which are required for laboratory activities. Our paper provides a thorough examination of procurement trends, emphasizing cost-cutting measures and the use of innovative digital tools to optimize procurement and operational processes.

Key procurement problems in the lab chemicals market include managing variable material costs, ensuring supply chain resilience, adhering to strict safety and regulatory compliance, and incorporating innovative technologies into established workflows. Digital procurement platforms and strategic sourcing are critical for improving purchase efficiency and guaranteeing long-term viability. As global demand rises, corporations are exploiting the market intelligence to improve operational efficiency, mitigate risks, and stay competitive in a rapidly evolving market.

Market Size: The global Lab Chemicals market is projected to reach USD 62.76 billion by 2035, growing at a CAGR of approximately 3.45% from 2025 to 2035.

Growth Rate: 3.45%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: There is an increasing need for real-time data and process integration to streamline lab operations and improve supply chain efficiency.

Retail and E-Commerce Growth: Laboratory chemicals are increasingly being used in industries like as pharmaceuticals and biotechnology to improve inventory management and customer relationship management (CRM).

Technological Transformation: Advancements in AI, machine learning, and automation boost lab productivity by improving predictive capacities and decision-making.

Innovations: The development of modular chemical solutions enables firms to pick and integrate only the goods required, lowering prices and complexity.

Investment Initiatives: Increased investment in cloud-based solutions for better access, scalability, and lower infrastructure costs in the lab chemicals sector.

Regional Insights: North America and Asia Pacific continue to lead the industry, fuelled by robust digital infrastructure and increased adoption of cloud-based systems across industries.

Key Trends and Sustainability Outlook:

Cloud Integration: The lab chemicals business is increasingly adopting cloud-based solutions to improve scalability, cost effectiveness, and data accessibility.

Advanced Features: The use of technologies such as AI, IoT, and blockchain to streamline lab procedures, increase transparency, and improve decision-making.

Focus on Sustainability: There is a demand for lab chemical solutions that promote sustainable practices, such as improved resource management and environmental compliance.

Customization Trends: There is an increasing demand for industry-specific chemical solutions targeted to areas such as healthcare, research, and manufacturing.

Data-Driven Insights: Use advanced analytics to improve demand forecasts, inventory optimization, and key performance indicators (KPIs) throughout lab operations.

Growth Drivers:

Digital Transformation: Increasing the use of digital technologies in the laboratory chemicals sector to boost production and operational efficiency.

Process Automation: There is an increased reliance on automated solutions to reduce repetitive procedures and eliminate operational bottlenecks in laboratory and manufacturing processes.

Scalability Needs: Businesses want versatile chemical solutions that can scale with their operations, providing smooth integration and performance as they expand.

Regulatory Compliance: Suppliers and consumers of lab chemicals are concerned with adhering to industry laws, and digital solutions help with reporting and data accuracy.

Globalization: There is an increase in demand for lab chemicals that cater to international markets and support multiple currencies and languages, as well as compliance with a variety of global laws.

Overview of Market Intelligence Services for the Lab Chemicals Market:

Recent investigations have identified numerous significant obstacles, including increased material costs, supply chain interruptions, and the requirement for product personalization. Market intelligence studies provide practical insights into procurement prospects, assisting businesses in identifying cost-saving initiatives, optimizing supplier relationships, and increasing procurement success. These insights also help to ensure compliance with industry standards, high-quality operations, and smart expense management.

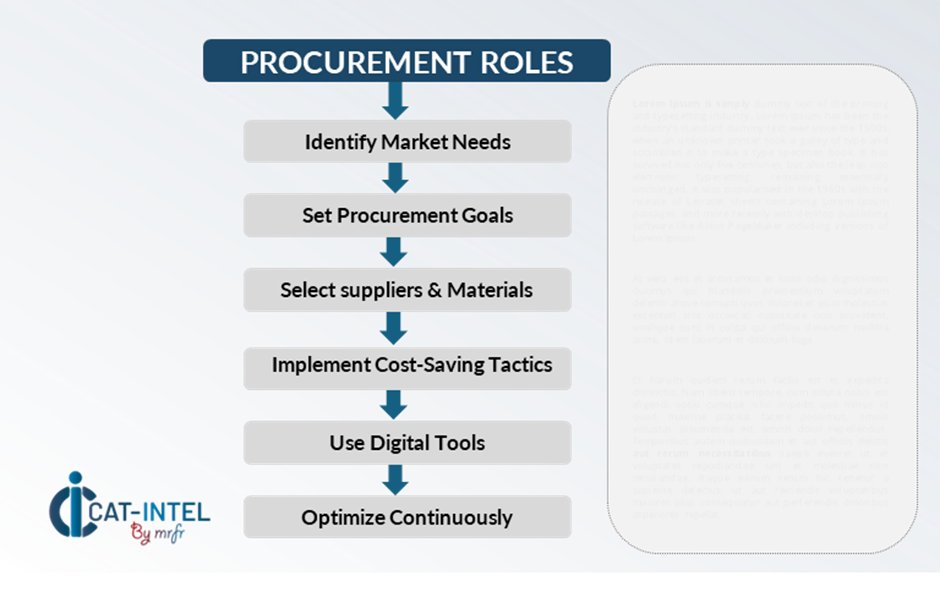

Procurement Intelligence for Lab Chemicals: Category Management and Strategic Sourcing

To remain competitive in the lab chemicals industry, businesses are improving procurement procedures with precise spend monitoring and supplier performance tracking. Effective category management and strategic sourcing are critical to lowering procurement costs while maintaining a consistent supply of high-quality chemical products. Businesses may improve their procurement strategy, negotiate better supplier terms, and connect their chemical sourcing with operational and sustainability objectives by accessing actionable market intelligence.

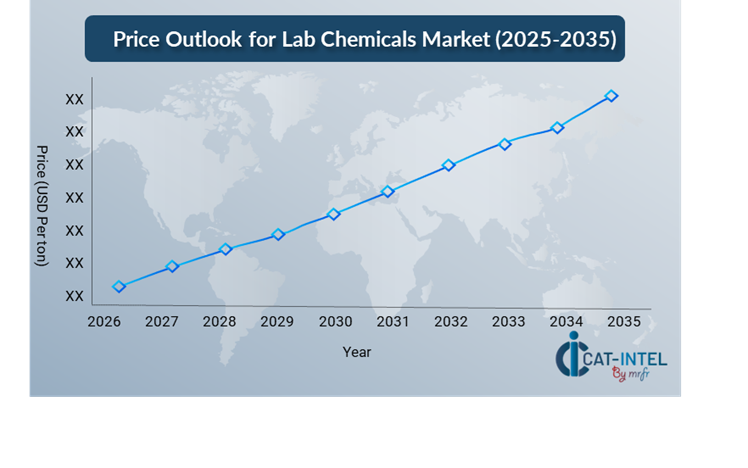

Pricing Outlook for Lab Chemicals: Spend Analysis

The pricing prognosis for lab chemicals is projected to be moderately dynamic, with changes affected by several significant factors. These include technological developments, need for environmentally friendly and specific chemical solutions, customized requirements, and regional pricing variances. The rising emphasis on safety standards, regulatory compliance, and product traceability is also driving up lab chemical prices.

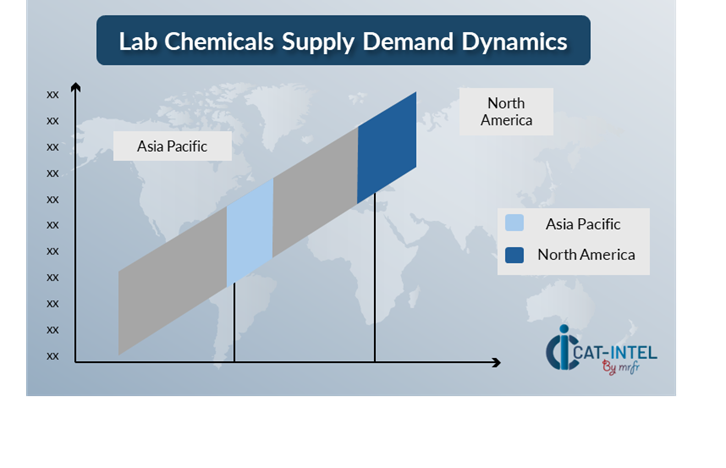

Graph shows general upward trend pricing for Lab Chemicals and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement procedures, strengthen supplier relationships, and implement flexible chemical sourcing solutions are critical for cost management in the lab chemicals industry. Leveraging digital technologies for market monitoring, analytics-based price forecasting, and smart contract management can help to increase cost efficiency.

Negotiating multi-year agreements to secure prices and reduce price swings. Despite the hurdles, concentrating on scalability, establishing strong supply chain management, and investing in sustainable sourcing will be important to retaining cost-effectiveness and operational efficiency in the lab chemicals sector.

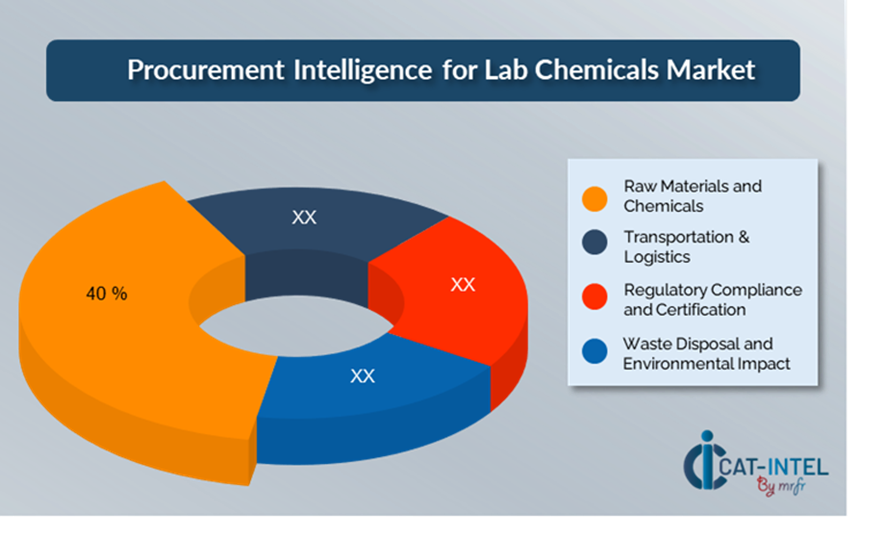

Cost Breakdown for Lab Chemicals: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Raw Materials and Chemicals: (40%)

Description: This is the most expensive component of the cost structure, and it covers the cost of obtaining the actual chemicals or raw materials required for laboratory activities.

Trend: Sustainability trends promote the use of more cost-effective and ecologically friendly chemicals, which may have an impact on pricing.

Transportation & Logistics: (XX%)

Regulatory Compliance and Certification: (XX%)

Waste Disposal and Environmental Impact: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the lab chemicals business, streamlining procurement processes and employing strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Establishing long-term partnerships with dependable suppliers, particularly those who provide sustainable and specialized chemical solutions, can result in more favourable pricing structures, volume-based discounts, and bundled services. Subscription-based arrangements and multi-year contracts allow you to lock in reduced pricing while minimizing the impact of price rises over time.

Partnering with suppliers who promote innovation and scalability provides access to cutting-edge technology like sustainable chemical alternatives and automated delivery systems, which can help lower long-term operational expenses. Reducing reliance on a single supplier by using a multi-vendor method can reduce risk exposure, alleviate disruptions such as supply chain breakdowns, and increase negotiating power, resulting in competitive price and reliability. By adopting these methods into procurement procedures, firms may reduce costs, maintain supply chain resilience, and assure consistent quality, all while delivering long-term value in the lab chemicals industry.

Supply and Demand Overview for Lab Chemicals: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lab chemicals market is steadily expanding, fuelled by rising demand in industries such as pharmaceuticals, biotechnology, healthcare, and research. Technological improvements, industry-specific needs, and global economic considerations all have an impact on supply-demand dynamics.

Demand Factors:

Digital Transformation Initiatives: There is a growing demand for lab chemicals to support these advances, such as reagents, solvents, and specialty chemicals for research and manufacturing operations.

Sustainability Trends: As environmental consciousness grows, there is a greater demand for environmentally friendly chemical solutions in laboratories, research institutions, and manufacturing operations.

Industry-Specific Requirements: Industries such as healthcare, pharmaceuticals, and biotechnology have stringent regulatory requirements that necessitate high-quality, compliance lab chemicals.

Integration Capabilities: There is a growing demand for lab chemicals that interact smoothly with automated systems, smart devices, and IoT-enabled lab equipment to streamline research and production operations.

Supply Factors:

Technological Advancements: Chemical production process innovations, such as AI-powered research and automation, are improving the quality, efficiency, and availability of lab chemicals.

Vendor Ecosystem: The industry is seeing an increase in the number of lab chemical suppliers, both large-scale and specialist vendors.

Global Economic Factors: Currency variations, labour costs, and regional economic situations all have an impact on lab chemical pricing and availability, with suppliers responding to shifts in worldwide demand.

Scalability and Flexibility: Modern lab chemical solutions are becoming more versatile, enabling vendors to suit the needs of organizations.

Regional Demand-Supply Outlook: Lab Chemicals

The Image shows growing demand for Lab Chemicals in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Lab Chemicals Market

North America: Dominance in the Lab Chemicals Market

North America, particularly the United States, is a dominant force in the global Lab Chemicals market due to several key factors:

Strong Pharmaceutical and Biotechnology Industries: North America, notably the United States, is home to several of the world's largest pharmaceutical and biotechnology corporations.

Research and Development Infrastructure: The region has a well-established R&D ecosystem, including top-tier universities, research institutions, and laboratories that require a diverse range of high-quality chemicals for experimentation.

Regulatory Compliance and Safety Standards: North America maintains strict rules and safety standards to ensure that lab chemicals fulfil high purity and safety requirements.

Technological Innovation: North America is a leader in technological innovation, including the use of AI, robots, and automation into laboratory settings.

Developed Healthcare and Diagnostics Sector: The presence of a robust healthcare infrastructure, including diagnostic laboratories, hospitals, and testing facilities, adds to the need for lab chemicals.

North America Remains a key hub Lab Chemicals Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the lab chemicals market is equally diverse and competitive, with a mix of global players and specialized regional providers. These vendors influence critical elements such as product cost, quality, customisation, and delivery services. Well-established chemical producers dominate the market, offering broad product portfolios, while smaller, specialist suppliers focus on specific industries or unique offers such as eco-friendly chemicals, specialized reagents, or advanced analytical solutions.

Suppliers are increasingly using sustainable, biodegradable, or low-toxic chemicals to suit the growing demand for ecologically responsible products in industries such as pharmaceuticals, healthcare, and research. With a focus on bespoke solutions, suppliers are providing more flexible chemical packages, such as customizable formulations and scalable supply choices that can accommodate both small research labs and large industrial users.

Key Suppliers in the Lab Chemicals Market Include:

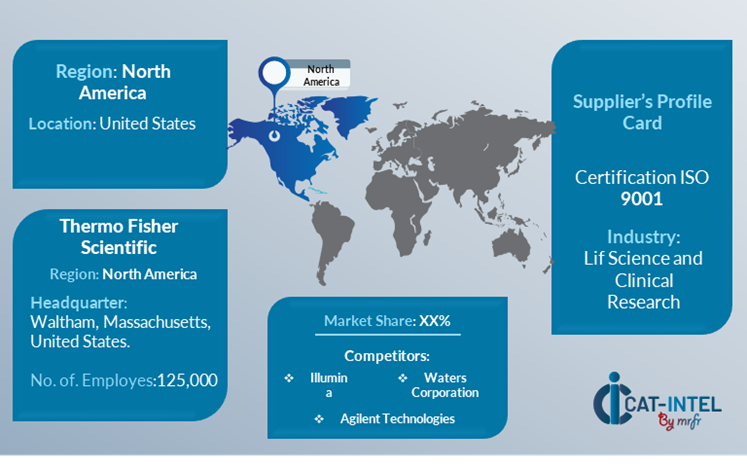

Thermo Fisher Scientific

Merck Group

BASF

Sigma-Aldrich

Lonza Group

Agilent Technologies

Fisher Scientific

Honeywell International

VWR International

Eastman Chemical Company.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The lab chemicals market is expanding rapidly as high-quality, specialized chemical solutions are in great demand in industries such as pharmaceuticals, healthcare, and biotechnology. This expansion is especially evident in emerging markets. |

Cloud Adoption |

Increased environmental awareness and regulatory pressure are driving a growth in demand for eco-friendly and sustainable chemical solutions, particularly in the pharmaceutical and research industries. |

Product Innovation |

Chemical providers are innovating by developing cutting-edge products including biodegradable chemicals, high-purity reagents, and smart chemicals developed for use in automated and IoT-enabled laboratories. |

Technological Advancements |

AI-powered research, automated chemical analysis, and smart lab equipment integration are increasing lab efficiency, boosting decision-making, and lowering human error.

|

Global Trade Dynamics |

Changes in global trade legislation, compliance standards, and regional economic policies are influencing lab chemical pricing and availability, and multinational corporations are adjusting their procurement plans accordingly. |

Customization Trends |

The demand for personalized chemical solutions is increasing, as businesses seek product flexibility, such as customized chemical formulations or modular supply chain choices, to fulfil unique industrial or operational requirements. |

|

Lab Chemicals Attribute/Metric |

Details |

Market Sizing |

The global Lab Chemicals market is projected to reach USD 62.76 billion by 2035, growing at a CAGR of approximately 3.45% from 2025 to 2035. |

Lab Chemicals Technology Adoption Rate |

Around 70% of firms in industries such as pharmaceuticals, healthcare, and biotechnology have implemented advanced lab chemical solutions, with a rising reliance on sustainable and specialized chemical products. |

Top Lab Chemicals Industry Strategies for 2025 |

Key objectives include promoting sustainability through eco-friendly chemicals, investing in smart chemicals for IoT-enabled labs, automating supply chains, and improving compliance with industry laws. |

Lab Chemicals Process Automation |

To improve efficiency and accuracy, approximately 50% of lab chemistry procedures are automated, including inventory management, compliance reporting, and production monitoring.

|

Lab Chemicals Process Challenges |

Fluctuating raw material costs, supply chain interruptions, regulatory compliance issues, and the requirement for chemical formulation innovation all provide significant obstacles.

|

Key Suppliers |

Leading lab chemical suppliers include Thermo Fisher Scientific, Merck Group, BASF, who provide a diverse range of products in industries such as healthcare, pharmaceuticals, and research.

|

Key Regions Covered |

North America, Europe, and Asia-Pacific are major markets for lab chemical demand, with significant demand in the pharmaceutical, biotechnology, and research industries.

|

Market Drivers and Trends |

The increased demand for specialized, sustainable chemicals, laboratory automation technology, developments in chemical formulations, and compliance with demanding regulatory norms are all driving growth.

|