Summary Overview

Lab Centrifuges Market Overview

The global lab centrifuges market is steadily expanding, driven by rising demand in industries such as healthcare, pharmaceuticals, biotechnology, and academic research. This market includes many types of centrifuge systems, such as tabletop, floor-standing, and ultracentrifuges. Our paper delves deeply into procurement trends, highlighting cost-cutting techniques and the use of sophisticated technologies to optimize laboratory operations.

Future procurement problems include managing equipment acquisition costs, guaranteeing scalability for different research demands, maintaining safety and compliance standards, and incorporating centrifuge systems with existing lab infrastructure. The use of smart lab innovations and strategic sourcing are critical for optimizing centrifuge procurement and assuring long-term research and operational efficiency. As global demand rises, firms are increasingly using market intelligence to increase productivity, reduce operational risks, and stay competitive in the evolving research landscape.

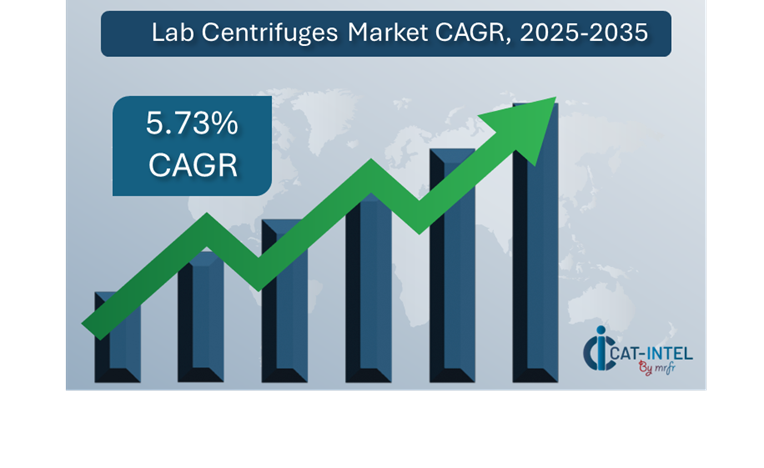

Market Size: The global Lab Centrifuges market is projected to reach USD 9.36 billion by 2035, growing at a CAGR of approximately 5.73% from 2025 to 2035.

Growth Rate: 5.73%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: Real-time data and process integration in laboratories is becoming increasingly important for optimizing workflows and improving operational efficiency.

Healthcare and Research Growth: The rising demand for advanced lab equipment, including as centrifuges, in healthcare, pharmaceuticals, and research institutes is driving the adoption of automated systems to expedite operations and improve data accuracy.

Technological Advancements:AI and machine learning are improving centrifuge capabilities, allowing for more precise and efficient sample processing via predictive analytics and automation.

Innovative Designs: The invention of modular lab centrifuges enables enterprises and research labs to tailor their equipment to specific requirements, lowering prices and operational complexity.

Technology Investment: Significant investments are made in sophisticated lab centrifuges, particularly those with automated features, to improve operational efficiency and ensure high-quality results.

Regional Insights: North America and Asia Pacific continue to dominate the lab centrifuge market, owing to advances in digital infrastructure and the increased usage of automation in laboratories.

Key Trends and Sustainability Outlook:

Cloud Integration: The growing popularity of cloud-based laboratory data management solutions, which provide for simpler access, more scalability, and enhanced data sharing capabilities.

Advanced Features: Adding cutting-edge technologies like AI, IoT, and blockchain to lab centrifuges improves operational transparency, data tracking, and decision-making processes.

Focus on Sustainability: Centrifuges that reduce energy consumption, waste, and resource efficiency are gaining popularity as sustainability becomes a top issue in research and healthcare.

Customization Trends: As organizations seek equipment that matches their unique operational requirements, there is an increase in demand for centrifuges adapted to certain industries.

Data-Driven Insights: Modern centrifuge systems use advanced analytics to improve performance, enhance throughput, and assure sample integrity.

Growth Drivers:

Digital Transformation: As more research institutions and healthcare facilities implement digital technology, the demand for high-performance centrifuges that facilitate automation and productivity grows.

Demand for Process Automation: The use of modern centrifuge systems in laboratories is driven by the requirement for automation to reduce manual labor and ensure sample processing accuracy.

Scalability Requirements: Laboratories require centrifuge systems that can increase research volumes or clinical demands while retaining good performance and reliability.

Regulatory Compliance: Centrifuge manufacturers are working to ensure that their products meet stringent regulatory requirements in industries such as healthcare and pharmaceuticals.

Globalization: Centrifuges that meet different international needs, such as multilingual interfaces and compliance with worldwide standards, are in high demand.

Overview of Market Intelligence Services for the Lab Centrifuges Market:

Recent evaluations have revealed significant constraints in the lab centrifuges industry, such as high capital investment costs and the necessity for system modification to fulfill unique research or clinical requirements. Market intelligence studies provide valuable information on procurement prospects, allowing businesses to find cost-cutting initiatives, optimize supplier management, and assure successful implementation. These insights also assist firms in complying with industry rules, maintaining high operational standards, and successfully managing expenses while incorporating cutting-edge centrifuge technologies into their operations.

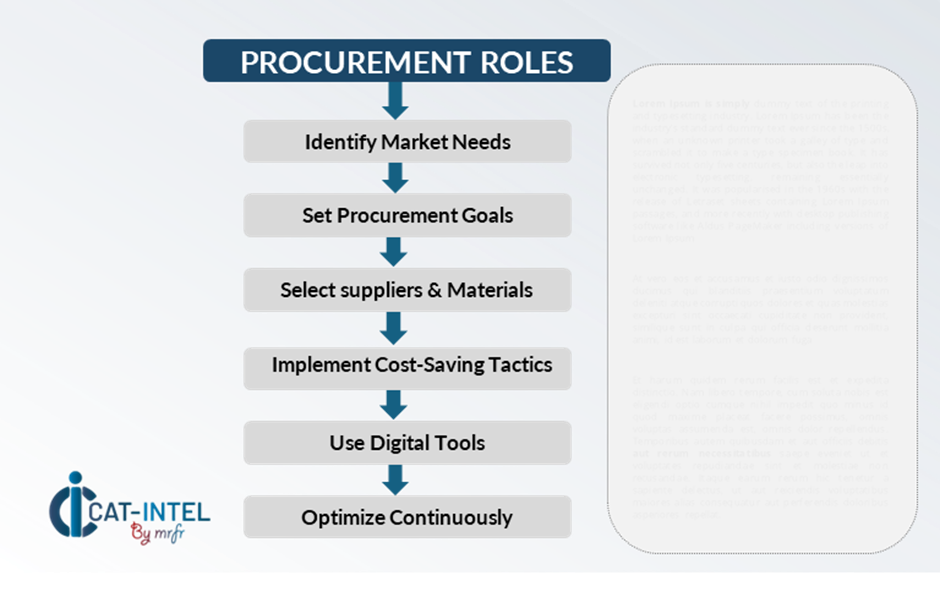

Procurement Intelligence for Lab Centrifuges: Category Management and Strategic Sourcing

To remain competitive in the lab centrifuge industry, firms are optimizing procurement procedures by analyzing spend and tracking supplier performance. Effective category management and strategic sourcing are critical for lowering procurement costs while maintaining a steady supply of high-quality centrifuge equipment. By employing actionable market intelligence, research institutes and healthcare facilities can improve their procurement strategies, negotiate better terms with vendors, and obtain the best centrifuge systems for their specific needs.

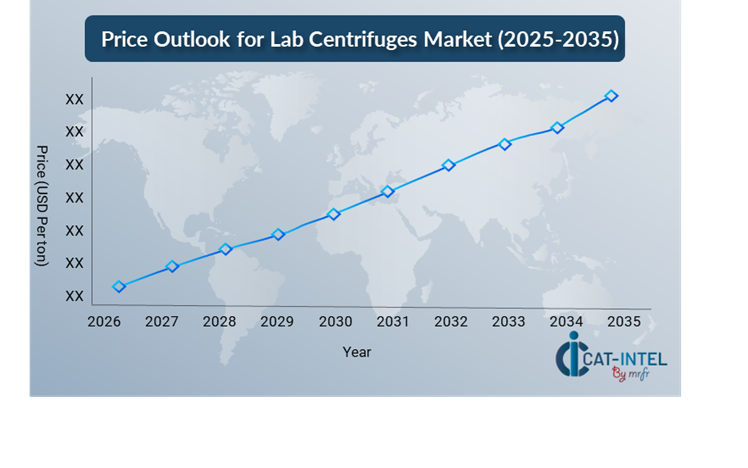

Pricing Outlook for Lab Centrifuges: Spend Analysis

The pricing prognosis for lab centrifuges is likely to be moderately dynamic, impacted by several major factors. Technology advancements, increased demand for automated and cloud-integrated solutions, customization requirements, and regional pricing disparities all contribute to potential price swings.

Graph shows general upward trend pricing for Lab Centrifuges and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to simplify procurement procedures, improve supplier management, and implement modular centrifuge systems are crucial for cost reduction. Using digital technologies for market monitoring, price forecasting using analytics, and effective contract management can enhance cost efficiency.

Partnering with reputable centrifuge manufacturers, negotiating long-term contracts, and investigating flexible pricing methods are all useful cost-management techniques. Despite these obstacles, focusing on scalability, guaranteeing seamless equipment implementation, and adopting automation and cloud-based technologies will be critical for preserving cost-effectiveness while achieving operational excellence in research and clinical labs.

Cost Breakdown for Lab Centrifuges: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Initial Purchase: (40%)

Description: This is the initial cost of purchasing the laboratory centrifuge. It covers the cost of the unit, installation, and any additional hardware or accessories needed for functioning.

Trend Point: A downward trend due to more competition and modular possibilities. While the initial prices are significant, developments in technology and modular designs enable labs to choose the capabilities they require, lowering unnecessary expenses.

Maintenance and Operating: (XX%)

Consumables and Replacement: (XX%)

Labor Cost: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the lab centrifuge business, streamlining procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Long-term partnerships with centrifuge suppliers, particularly those who provide advanced and automated systems, can result in more favourable price arrangements, such as volume-based discounts and bundled service packages. Flexible pricing methods, such as subscription-based contracts or multi-year agreements, allow you to lock in reduced rates while also protecting against future price hikes.

Collaborating with centrifuge manufacturers who prioritize innovation and scalability provides additional benefits, such as access to cutting-edge technology like AI integration, increased automation capabilities, and modular systems, all of which help minimize long-term maintenance and operational expenses. Implementing digital procurement technologies, such as contract management platforms and equipment utilization analytics, promotes transparency and minimizes over-provisioning, and optimizes the performance and longevity of centrifuge systems.

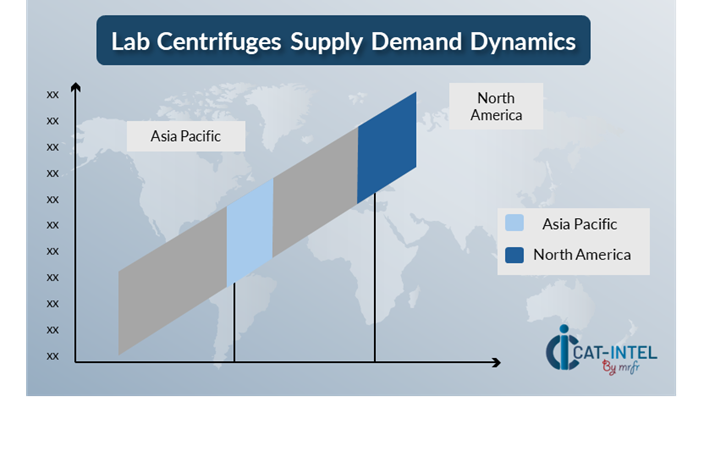

Supply and Demand Overview for Lab Centrifuges: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lab centrifuge market is steadily expanding, fueled by technical developments and rising demand in industries such as healthcare, pharmaceuticals, and research. Automation advancements, industry-specific requirements, and macroeconomic conditions all have an impact on supply and demand dynamics.

Demand Factors:

Automation Technological Advances: As the requirement for precision, efficiency, and automation in research and clinical laboratories grows, so does the demand for sophisticated centrifuge systems that can process samples more quickly and correctly.

Integration of Advanced Features: As labs rely more on cloud-based platforms and IoT-enabled devices, they are looking for centrifuge systems with improved connectivity, remote monitoring, and data integration capabilities.

Industry-Specific Needs: Centrifuge systems that fulfill high regulatory standards and operational procedures are required by laboratories in industries such as healthcare and biotechnology to ensure safety, compliance, and reliable results.

Customization and Scalability: Laboratories are looking for centrifuge solutions that can be adapted to their individual requirements, whether for small-scale research or large-scale clinical applications, while also allowing for future expansion.

Supply Factors:

Technological Advancements: AI, automation, and energy efficiency are improving centrifuge capabilities, enabling real-time data tracking, predictive maintenance, and faster sample processing.

Vendor Ecosystem: The centrifuge industry is becoming more varied, with both large-scale providers and boutique manufacturers offering a wide range of products tailored to the unique requirements of various laboratory conditions.

Global Economic Conditions: Exchange rates, labor costs, and regional adoption rates of new technologies all have an impact on the price and availability of lab centrifuges, especially in emerging economies.

Scalability and Flexibility: Modern centrifuges are becoming more modular and adaptable, allowing vendors to accommodate a wide range of laboratory sizes and applications.

Regional Demand-Supply Outlook: Lab Centrifuges

The Image shows growing demand for Lab Centrifuges in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Lab Centrifuges Market

North America, particularly the United States, is a dominant force in the global Lab Centrifuges market due to several key factors:

Strong Pharmaceutical Industries: The pharmaceutical and biotechnology sectors in North America are among the largest in the world, necessitating precise and high-performance lab equipment such as centrifuges for drug research and laboratory testing.

Demand for Diagnostic and Clinical Testing: Due to the prevalence of numerous diseases and the growing need for diagnostic testing, particularly in clinical and hospital settings, centrifuges are in high demand in North America.

Robust Healthcare Regulations: The region's emphasis on meeting medical device and laboratory standards, such as FDA regulations in the United States, ensures that only high-quality centrifuge items are utilized in laboratories.

Healthcare and Research Infrastructure: The region places a high value on biomedical research, diagnostics, and healthcare services, which generates demand for advanced laboratory equipment.

Innovation and R&D Investment: Companies in the region heavily invest in R&D, resulting in the development of cutting-edge centrifuge technologies, such as high-speed, automated, and energy-efficient systems.

North America Remains a key hub Lab Centrifuges Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the lab centrifuge market is similarly diversified and competitive, with global leaders and regional manufacturers all affecting crucial elements such as pricing, equipment customisation, and service quality. Large, well-established businesses dominate the market by providing complete centrifuge systems, whereas smaller, niche vendors concentrate on specific laboratory requirements or specialized characteristics such as automation, energy efficiency, and enhanced data integration.

The lab centrifuge supplier ecosystem encompasses important technology regions, with global vendors leading in innovation and large-scale production, and local companies providing tailored solutions to fulfill industry-specific requirements such as healthcare or pharmaceutical compliance. Centrifuge providers are improving their technology by incorporating features like as IoT connectivity, remote monitoring, and predictive maintenance capabilities, as laboratories and research institutes prioritize efficiency, accuracy, and automation.

Key Suppliers in the Lab Centrifuges Market Include:

Thermo Fisher Scientific

Beckman Coulter

Eppendorf AG

Sigma-Aldrich (Merck Group)

Kubota Corporation

Hettich Instruments

Thermo Electron Corporation

Andreas Hettich GmbH and Co

Becton Dickinson

VWR International.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The lab centrifuge market is expanding steadily, owing to rising demand in the healthcare, research, and pharmaceutical industries for better sample processing and automation. |

Cloud Adoption |

There is a growing trend towards cloud-connected centrifuge systems, which enable remote monitoring, data integration, and increased scalability in lab operations. |

Product Innovation |

Centrifuge manufacturers are using cutting-edge technologies like real-time data tracking, AI-powered analytics, and automated maintenance to boost sample processing efficiency and accuracy. |

Technological Advancements |

Innovations like as IoT integration, energy-efficient designs, and automated features improve centrifuge performance, reduce manual intervention, and enable predictive maintenance. |

Global Trade Dynamics |

Changes in international trade legislation, compliance standards, and regional economic situations have an impact on lab centrifuge supply and pricing, especially in emerging markets.

|

Customization Trends |

The demand for modular and customizable centrifuge systems adapted to specific research requirements is growing, allowing laboratories to select features such as rotor capacity, speed, and automation. |

Lab Centrifuges Attribute/Metric |

Details |

Market Sizing |

The global Lab Centrifuges market is projected to reach USD 9.36 billion by 2035, growing at a CAGR of approximately 5.73% from 2025 to 2035. |

Lab Centrifuges Technology Adoption Rate |

Approximately 60% of laboratories worldwide have implemented modern centrifuge systems, with a clear shift toward automated and cloud-connected solutions for increased efficiency and scalability.

|

Top Lab Centrifuges Industry Strategies for 2025 |

Key methods include integrating IoT for real-time monitoring, using energy-efficient designs, providing modular systems adapted to industrial demands, and boosting automation for faster, more accurate sample processing.

|

Lab Centrifuges Process Automation |

Approximately 50% of centrifuge systems are now automated, particularly for routine operations such as sample sorting, temperature management, and maintenance, resulting in increased operating efficiency.

|

Lab Centrifuges Process Challenges |

Major challenges include high initial expenditures, complexity in connecting with other lab equipment, assuring regulatory compliance, and managing centrifuge system maintenance and durability.

|

Key Suppliers |

Leading centrifuge manufacturers include Thermo Fisher Scientific, Eppendorf AG, and Beckman Coulter, who provide a diverse range of equipment for a variety of laboratory applications.

|

Key Regions Covered |

North America, Europe, and Asia-Pacific are key regions for lab centrifuge use, with substantial demand from the healthcare, research, and biotechnology sectors.

|

Market Drivers and Trends |

Growth is being driven by rising need for precision in clinical and research applications, technical improvements such as IoT integration and automation, and the requirement for energy-efficient, high-performance centrifuges.

|