Summary Overview

Jet Fuel Market Overview

The global jet fuel market is steadily expanding, driven by growing demand in sectors such as aviation, defence, and transportation. This market covers a wide range of jet fuels, including traditional kerosene-based fuel, sustainable aviation fuel (SAF), and biofuels. Our paper provides a thorough examination of procurement trends, emphasizing cost-cutting measures and the use of sophisticated technology to improve supply chain efficiency and operational operations.

The key challenges facing the jet fuel sector are controlling variable fuel prices, providing a stable and sustainable supply, navigating regulatory compliance, and resolving environmental concerns. The use of digital procurement technologies and innovative sourcing tactics is critical for delivering cost reductions, enhancing fuel supply, and remaining competitive in a dynamic market. As worldwide demand for air travel grows, airlines and fuel suppliers are turning to market information to streamline operations, decrease risk exposure, and improve long-term sustainability.

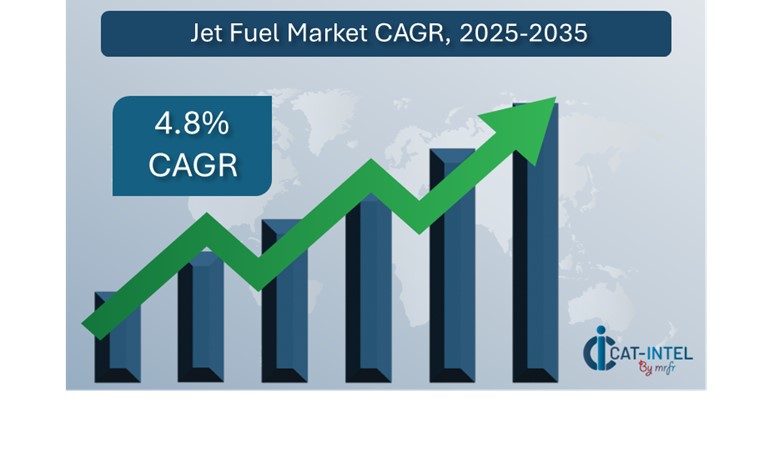

Market Size: The global Jet Fuel market is projected to reach USD 508.55 billion by 2035, growing at a CAGR of approximately 4.8% from 2025 to 2035.

Growth Rate: 4.8%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: As stakeholders work to streamline jet fuel production, transportation, and distribution, there is an increasing demand for real-time data and enhanced process integration.

Retail and E-Commerce Growth: The expansion of the global retail and e-commerce sectors is causing the aviation and logistics industries to improve fuel supply chain management.

Technological Advancements: AI and machine learning are transforming fuel management by allowing for predictive analytics, automation, and increased fuel efficiency.

Innovative Fuel Solutions: The rise of sustainable aviation fuel (SAF) and biofuels opens new potential for businesses to minimize carbon footprints while ensuring energy security.

Investment in Cloud Infrastructure: More organizations are turning to cloud-based systems to handle fuel procurement, distribution, and inventory, which improves remote access and data security.

Regional Growth: North America and Asia Pacific are critical to the growth of the jet fuel industry, because to their well-established infrastructure and growing demand for more sustainable, efficient fuel alternatives.

Key Trends and Sustainability Outlook:

Sustainability Needs: As part of a larger push for sustainability, the jet fuel industry is rapidly incorporating technologies like IoT, AI, and blockchain.

Industry-Specific Solutions: Customized fuel solutions are becoming increasingly popular, with businesses choosing for fuel management systems tailored to the needs of the aviation, defence, and transportation industries.

Data-Driven Decision Making: Advanced data analytics enable fuel providers and aircraft operators to make more informed judgments regarding inventory management, fuel optimization, and pricing strategies.

Cloud Integration: The growing use of cloud-based aviation fuel management systems improves scalability, lowers infrastructure costs, and provides real-time data access across worldwide supply chains.

Advanced Features: Integrating AI, IoT, and blockchain technology into aviation fuel systems improves decision-making, streamlines automation, and increases transparency.

Growth Drivers:

Digital Transformation: More players are using advanced digital tools to increase efficiency, streamline fuel procurement, and improve customer experience.

Demand for Process Automation: The growing requirement for automated processes in fuel procurement and logistics is a driving factor, reducing bottlenecks and speeding up decision-making.

Scalability Requirements: Businesses seek systems that can scale with their operations, enabling for smooth integration of fuel supply chains across worldwide markets.

Regulatory Compliance: Jet fuel firms use digital solutions to ensure compliance and automate reporting, lowering the risk of penalties and assuring accurate environmental tracking.

Globalization: As international aviation and petroleum distribution grow, organizations are looking for solutions that handle many currencies, languages, and international compliance.

Overview of Market Intelligence Services for the Jet Fuel Market:

Recent evaluations of the jet fuel business have identified numerous significant difficulties, including high implementation costs for advanced fuel management systems and the necessity for system customisation to match unique operational requirements. Market intelligence studies offer useful data that help businesses find cost-cutting opportunities, optimize supplier relationships, and improve the success of fuel procurement and distribution operations. These insights also help to maintain compliance with industry rules and high operational standards, all while successfully controlling costs.

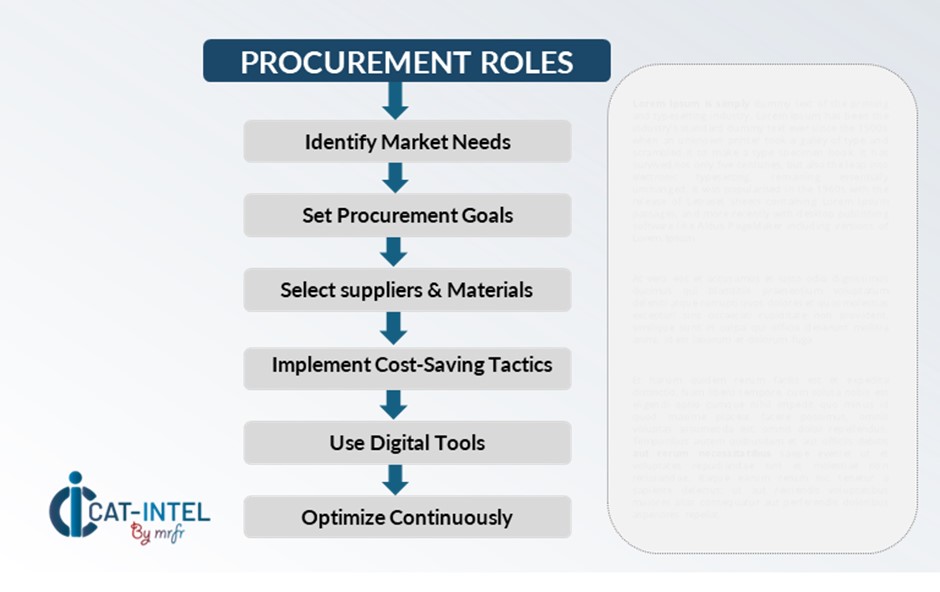

Procurement Intelligence for Jet Fuel: Category Management and Strategic Sourcing

To stay competitive in the jet fuel industry, businesses are streamlining procurement procedures through spend analysis and vendor performance tracking. Effective category management and strategic sourcing are critical for lowering fuel procurement costs while maintaining a consistent supply of high-quality jet fuel. Businesses may use actionable market intelligence to modify their procurement strategies and negotiate better terms with gasoline suppliers, assuring continuous fuel availability while reducing operational expenses.

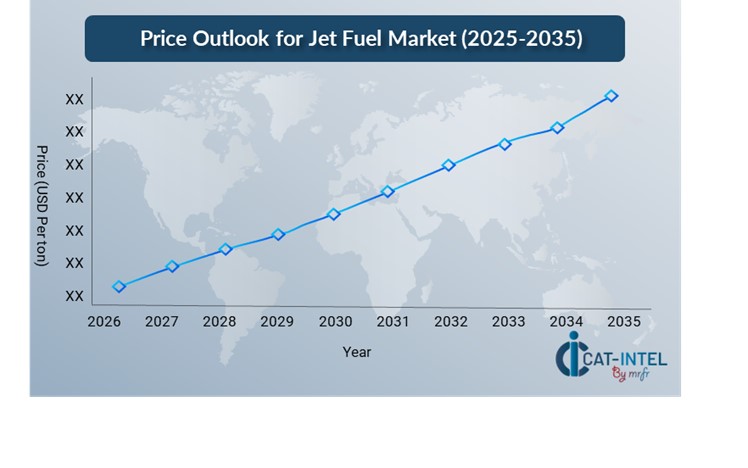

Pricing Outlook for Jet Fuel: Spend Analysis

The pricing prognosis for jet fuel is likely to remain moderately volatile, with changes affected by a variety of variables including technology developments, rising demand for sustainable fuel alternatives, regional pricing disparities, and swings in worldwide supply and demand. Furthermore, an increased emphasis on environmental compliance, safety standards, and sustainability goals is likely to exert upward pressure on fuel pricing.

Graph shows general upward trend pricing for Jet Fuel and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve vendor management, and implement modular fuel solutions adapted to specific demands are critical for cost control. Leveraging digital technologies for market monitoring, advanced analytics-based pricing predictions, and effective contract administration can help firms reduce costs.

Developing long-term connections with reputable gasoline suppliers to maintain price stability and competitiveness. Regardless of the obstacles given by shifting prices, concentrating on sustainable fuel solutions, guaranteeing operational scalability, and leveraging cloud-based procurement systems will be crucial for sustaining cost effectiveness and operational excellence.

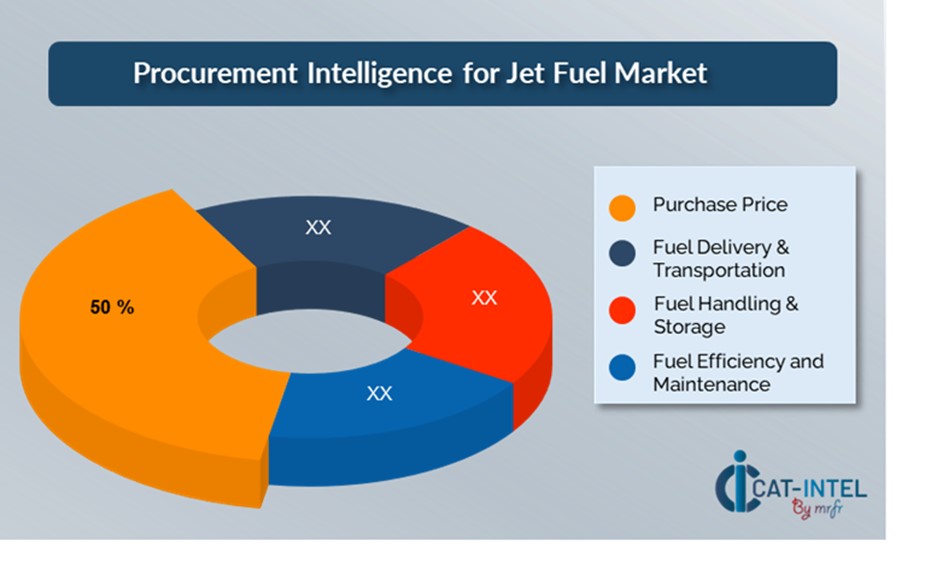

Cost Breakdown for Jet Fuel: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Purchase Price: (50%)

Description: This cost is determined by crude oil prices, regional price changes, and supplier-airline contract terms. Jet fuel prices can fluctuate due to market forces, political reasons, and seasonal variations in demand.

Trend: Airlines are increasingly considering hedging measures to lock in fuel prices and reduce price volatility.

Fuel Delivery & Transportation: (XX%)

Fuel Handling & Storage: (XX%)

Fuel Efficiency and Maintenance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the jet fuel sector, streamlining procurement processes and using strategic negotiation strategies can result in significant cost savings and improved supply chain efficiency. Long-term partnerships with fuel suppliers, particularly those that provide sustainable aviation fuel (SAF) or other environmentally friendly options, can result in more attractive price structures and terms, such as volume-based discounts and bundled fuel supply packages. Subscription-based models and multi-year contracts provide opportunity to lock in favourable rates, reducing price volatility over time and ensuring more stable fuel expenses.

Collaborating with innovative fuel providers who value sustainability and scalability provides the added benefit of incorporating advanced fuel management systems with features such as real-time tracking, AI-driven demand forecasting, and automated refuelling processes, which can help reduce long-term operational costs and improve overall supply chain efficiency. Diversifying vendor alternatives and implementing a multi-vendor strategy helps reduce reliance on a single provider, hence minimizing the risks related with service disruptions, price hikes, or supply chain bottlenecks.

Supply and Demand Overview for Jet Fuel: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The jet fuel market is steadily growing, owing to numerous demand and supply dynamics impacted by technical improvements, sustainability initiatives, and global economic situations. The market's trajectory is shaped by both demand and supply variables, including changing customer needs and fuel production capacity.

Demand Factors:

Sustainability and Environmental Regulations: Rising environmental concerns and regulatory pressures are driving demand for sustainable aviation fuel (SAF) and other environmentally friendly alternatives.

Increasing Air Travel Need: As worldwide travel recovers, the need for jet fuel rises dramatically. Airlines are concentrating on optimizing fuel procurement to fulfil rising demand while effectively managing expenses.

Technological Innovations: Airlines are implementing modern technology such as AI-powered route optimization and fuel-efficient aircraft to reduce fuel consumption, resulting in more efficient fuel demand planning.

Industry-Specific Needs: The aviation industry has specific fuel needs, such as multi-fuel compliance (e.g., SAF vs. standard jet fuel), which influences procurement tactics.

Supply Factors:

Integration Capabilities: As digitization accelerates, airlines and fuel providers are increasingly adopting IoT-connected fuel management systems, which provide real-time tracking, automated refuelling, and improved forecasting.

Technological Advancements: The incorporation of AI, machine learning, and data analytics in the jet fuel sector, which improves fuel management systems and demand predictions, making providers more competitive.

Vendor Ecosystem: The jet fuel business is diversifying, with an increasing number of vendors selling traditional and sustainable aviation fuels, giving airlines more options.

Scalability and Flexibility: As fuel supply systems become more modular, suppliers may provide flexible solutions for both large-scale commercial airplanes and regional carriers with diverse fuel requirements and budgets.

Regional Demand-Supply Outlook: Jet Fuel

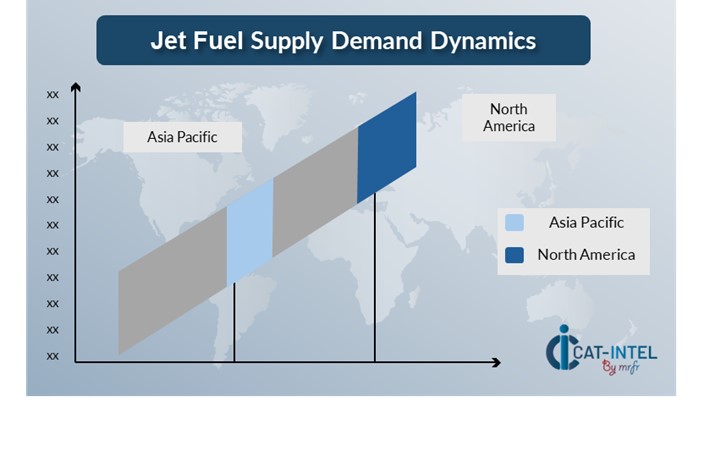

The Image shows growing demand for Jet Fuel in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Jet Fuel Market

North America, particularly the United States, is a dominant force in the global Jet Fuel market due to several key factors:

High Air Traffic Volume: North America has some of the world's largest and busiest airports, and the high amount of domestic and international flights pushes up demand for jet fuel in the region.

Strong Refining Capacity: The region has extensive refining facilities for jet fuel production; this capacity assures a consistent and stable supply of jet fuel both locally and for export markets.

Investment in Sustainable Aviation Fuel: North America's strong emphasis on innovation, policy support, and sustainability programs places it as a key role in the future of jet fuel.

Aviation and Aerospace Industry: North America plays an important role in the aviation and aerospace industries, including major aircraft manufacturers like Boeing (USA) and Bombardier (Canada) are based in the region.

Strategic Geographic Location: North America's strategic location between Europe and Asia-Pacific makes it an important transit hub for international aviation fuel trade. The region is a logistical hub for jet fuel storage and distribution throughout the Western Hemisphere.

North America Remains a key hub Jet Fuel Price Drivers Innovation and Growth.

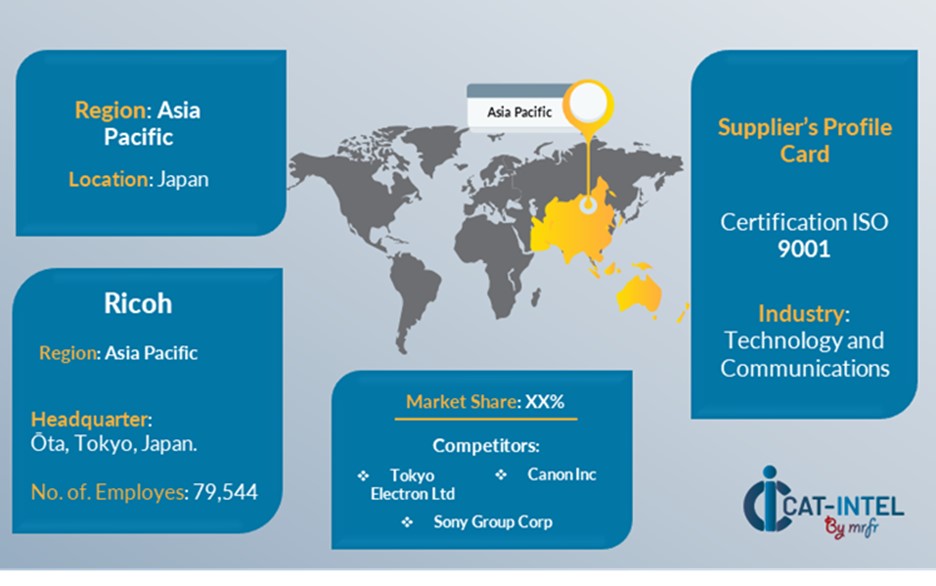

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment for jet fuel is similarly diversified and competitive, with global fuel giants and regional suppliers influencing major market aspects including as pricing, supply reliability, sustainability requirements, and service quality. The industry is dominated by well-known fuel firms, such as big oil corporations and aviation fuel suppliers, but there is also an increasing presence of smaller, specialist players focusing on sustainable aviation fuels (SAF) and novel fuel management solutions.

Smaller, innovative suppliers are progressively carving out their portion of the industry, especially those focused on sustainable aviation, fuel (SAF), biofuels, and fuel management systems. As digital transformation drives change across industries, cloud-based solutions and sophisticated fuel technologies will play a critical role in shaping the future of the jet fuel industry. Airlines and suppliers alike are investing in smart fuel management systems, which will allow for more effective tracking, forecasting, and optimization of fuel consumption. Blockchain integration for supply chain transparency, as well as AI-powered analytics, can help to decrease costs, improve sustainability, and increase operational efficiency.

Key Suppliers in the Jet Fuel Market Include:

ExxonMobil

Royal Dutch Shell

British Petroleum (BP)

Chevron

TotalEnergies

Sinopec

Rosneft

Reliance Industries

Marathon Petroleum

Valero Energy

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The jet fuel market is expanding rapidly, driven by a recovery in global air travel, increased demand from commercial airlines, and the development of cargo transport. |

Cloud Adoption |

A growing emphasis on sustainable aviation fuel (SAF) and biofuels is altering the jet fuel market, owing to regulatory demands and the aviation industry's commitment to lowering carbon emissions. |

Product Innovation |

Fuel providers are progressively incorporating cutting-edge technology such as AI-powered demand forecasting, IoT-enabled fuel management, and real-time fuel tracking, allowing airlines to optimize consumption and cut costs. |

Technological Advancements |

AI, machine learning, and blockchain technologies are improving fuel management systems by providing predictive insights into fuel use and automating refuelling operations. Fuel optimization algorithms help improve fuel usage and eliminate inefficiencies. |

Global Trade Dynamics |

Changes in trade legislation, geopolitics, and economic policies have an impact on gasoline supply chains and pricing. For example, the price volatility of crude oil, combined with regulatory changes in emission standards across areas, effects jet fuel pricing and supply. |

Customization Trends |

Airlines are looking for more personalized fuel solutions that meet their individual requirements, such as bulk fuel delivery contracts, fuel hedging programs, and solutions that comply with regional sustainability regulations. |

|

Jet Fuel Attribute/Metric |

Details |

Market Sizing |

The global Jet Fuel market is projected to reach USD 508.55 billion by 2035, growing at a CAGR of approximately 4.8% from 2025 to 2035. |

Jet Fuel Technology Adoption Rate |

To cut carbon emissions and increase fuel efficiency, over 80% of commercial airlines worldwide are increasingly implementing sustainable aviation fuel (SAF) and novel fuel management technology, including as AI-powered fuel optimization systems.

|

Top Jet Fuel Industry Strategies for 2025 |

Prioritizing sustainable fuel development, automating fuel procurement with sophisticated analytics, integrating AI and machine learning for predictive fuel demand forecasting, and focusing on digital fuel management platforms for increased efficiency and transparency are among the key tactics.

|

Jet Fuel Process Automation |

Approximately 60% of jet fuel procurement activities are now automated, including real-time inventory management, fuel logistics optimization, and supply chain tracking, which use IoT and AI to cut costs and increase operational efficiency.

|

Jet Fuel Process Challenges |

Price instability, supply chain interruptions caused by geopolitical events, a reliance on crude oil, and regulatory barriers to satisfying emission regulations are all significant challenges.

|

Key Suppliers |

ExxonMobil, Shell, BP, and TotalEnergies are among the leading jet fuel suppliers, as are LanzaTech and Velocys, which specialize on sustainable aviation fuel (SAF).

|

Key Regions Covered |

North America, Europe, and Asia-Pacific are among the most prominent locations for jet fuel usage, with major demand generated by commercial airlines, cargo transport businesses, and military sectors in the Middle East and Asia.

|

Market Drivers and Trends |

The recovery of global aviation traffic, a shift toward sustainability, technology improvements in fuel management, and demand for low-carbon fuel alternatives such as SAF all contribute to growth.

|