Summary Overview

Japan Courier, Express, and Parcel Logistics Market Overview

The Japan Courier, Express, and Parcel Logistics (CEPL) market is expanding rapidly, driven by increased demand in industries such as e-commerce, manufacturing, retail, and healthcare. This industry offers a variety of logistical solutions, such as same-day delivery, next-day services, and customized shipping alternatives. Our paper provides a detailed examination of procurement trends, with an emphasis on cost-cutting techniques and the use of innovative digital tools to expedite logistics operations and improve service quality.

The key future difficulties in logistics procurement are minimizing operational costs, assuring scalability, maintaining data security, and maximizing integration with existing supply chain systems. Adopting digital solutions for route optimization, automated tracking, and strategic sourcing is critical for increasing efficiency and maintaining industry competitiveness in the long run. As demand rises, businesses are increasingly turning to market data to increase operational efficiency, cut costs, and manage risks in an ever-changing logistical scenario.

Market Size: The global Japan Courier, Express, and Parcel Logistics market is projected to reach USD 112.3 billion by 2035, growing at a CAGR of approximately 11.82% from 2025 to 2035.

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: There is an increasing demand for real-time data integration and smooth process alignment to streamline logistics operations, resulting in increased efficiency and shorter delivery times.

Retail and E-Commerce Growth: The desire for more effective logistics solutions is pushing the use of advanced systems for inventory tracking, demand forecasting, and customer relationship management.

Technological Advancements: AI, machine learning, and automation are improving logistics operations by providing predictive capabilities and real-time tracking systems.

Innovation: The trend to modular solutions enables logistics organizations to select and integrate exactly the services they require, cutting costs while maintaining operational flexibility.

Investment in Digital Tools: Businesses are rapidly investing in cloud-based logistics solutions to reduce infrastructure costs, enhance scalability, and enable remote monitoring and management of operations.

Regional Insights: Asia Pacific and North America continue to be significant contributors to market growth, owing to strong digital infrastructure and widespread usage of cloud solutions in the logistics sector.

Key Trends and Sustainability Outlook:

Cloud Integration: The expanding use of cloud-based solutions improves scalability, cost efficiency, and access to real-time data, all of which are critical for modern logistics operations.

Advanced Features: The integration of cutting-edge technologies such as AI, IoT, and blockchain enables smarter decision-making, increased automation, and improved transparency throughout the entire value chain.

Sustainability Focus: Logistics companies use digital solutions to optimize resource utilization, track carbon emissions, and comply with environmental regulations, aligning with global sustainability goals.

Customization: The growing need for industry-specific logistics solutions—tailored to industries such as healthcare, retail, and manufacturing—enables businesses to address unique operating difficulties.

Data-Driven Insights: Advanced analytics are enabling logistics organizations to make better decisions by forecasting demand, optimizing delivery routes, and tracking performance metrics for continuous improvement.

Growth Drivers:

Digital Transformation: The fast use of digital technologies is transforming logistics operations, allowing businesses to increase efficiency, cut lead times, and provide better customer service.

Demand for Process Automation: Companies are increasingly looking for technology that can streamline operations, decrease human error, and accelerate deliveries.

Scalability Requirements: As logistics organizations develop globally, they need scalable solutions to handle higher volumes, various transit modes, and increased client demand

Regulatory Compliance: As rules become stricter in many regions, logistics organizations are turning to modern technologies to automate compliance reporting and ensure data management integrity.

Globalization: The growth of global supply chains necessitates logistics systems that enable multi-currency, multi-language, and international compliance, ensuring smooth operations across borders.

Overview of Market Intelligence Services for the Japan Courier, Express, and Parcel Logistics Market:

Recent market evaluations have identified numerous major issues in the logistics business, including high operational costs, the need for system modification, and sustaining efficiency in the face of increasing demand. As logistics firms extend their services, they must discover cost-cutting solutions, streamline supplier management, and improve implementation success to keep their competitive advantage

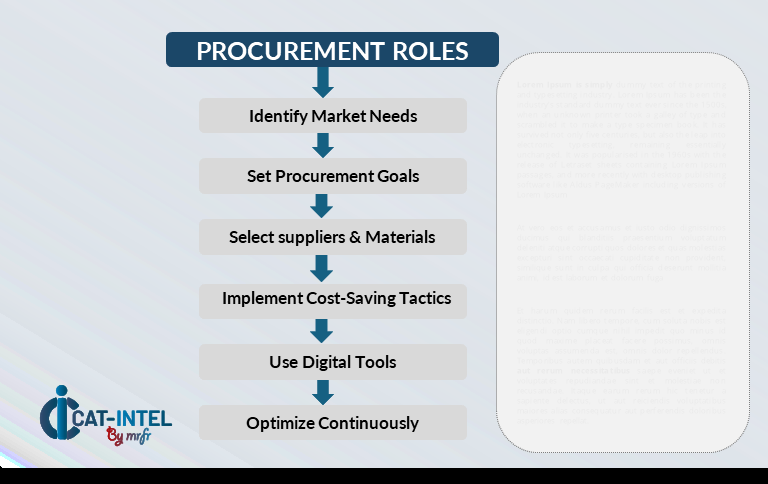

Procurement Intelligence for Japan Courier, Express, and Parcel Logistics: Category Management and Strategic Sourcing

Market intelligence reports offer actionable insights to assist logistics companies optimize procurement strategy, increase supplier relationships, and cut operating expenses. These insights are critical for identifying procurement possibilities, assuring industry compliance, and delivering high-quality service levels. Logistics firms can use procurement information to effectively manage expenses, optimize delivery performance, and exceed customer expectations while keeping costs under control.

Pricing Outlook for Japan Courier, Express, and Parcel Logistics: Spend Analysis

The price landscape for logistics services is expected to remain moderately dynamic, with differences impacted by a variety of factors. Technological developments, increased demand for cloud-based solutions, customized requirements, and geographical disparities in service pricing are all key drivers

Graph shows general upward trend pricing for Japan Courier, Express, and Parcel Logistics and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, manage vendor relationships effectively, and exploit modular logistics solutions are critical for cost reduction in the logistics industry. As logistics firms grow and update their operations, they must meet rising demand for faster, more efficient, and secure delivery services. Building solid, long-term connections with dependable logistics suppliers can assist assure consistent service delivery while also providing opportunity for better contract conditions, particularly when negotiating price for high-volume or long-term agreements. The emphasis on cloud integration and modular solutions opens substantial opportunity to maintain cost-effectiveness while increasing operations efficiently.

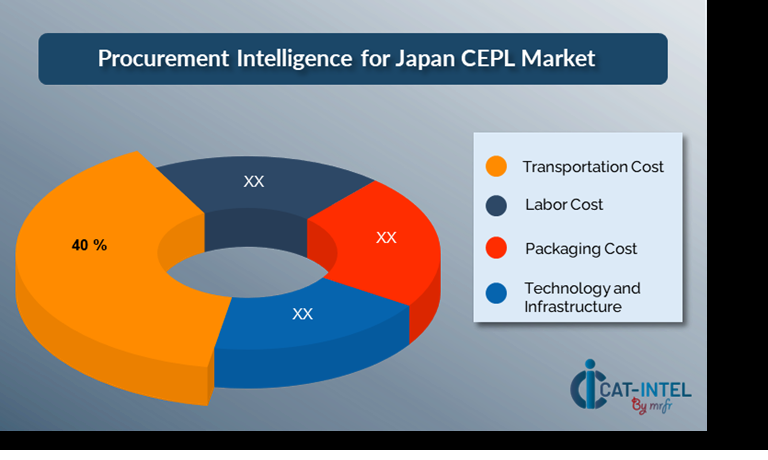

Cost Breakdown for Japan Courier, Express, and Parcel Logistics: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Transportation Cost: (40%)

Description: This comprises the cost of fuel, vehicle maintenance, driver compensation, and third-party carrier services. It also includes the expenditures of moving commodities from one area to another, whether by road, air, or train.

Trend: Growing adoption of environmentally friendly vehicles and sustainability programs is lowering transportation expenses, particularly in cities like Tokyo where congestion and air pollution are concerns.

Labor Cost: (XX%)

Packaging Cost: (XX%)

Technology and Infrastructure: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the fast-paced logistics business, streamlining procurement processes and implementing effective negotiation strategies are critical drivers of cost savings and operational efficiency. As providers attempt to streamline operations, logistics organizations can take a variety of tactics to improve their procurement strategy and negotiate better terms with service providers. Long-term contracts with logistics service providers, particularly those that offer cloud-based platforms or modular solutions, can yield significant cost savings. Subscription-based models and multi-year contracts with logistics companies can help you save even more money.

Collaboration with logistics providers who value innovation and scalability provides additional benefits, such as the use of AI-powered solutions for route optimization, predictive analytics, and demand forecasting. These technologies improve overall operating efficiency by reducing delays, conserving fuel, and streamlining inventory management. Incorporating digital procurement technologies, such as contract management platforms and usage analytics, enables logistics organizations to track service utilization, measure performance, and avoid overprovisioning of services. This increases openness and accountability while ensuring that corporations only pay for what they really use.

Supply and Demand Overview for Japan Courier, Express, and Parcel Logistics: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Japanese courier, express, and parcel logistics market is expanding rapidly, driven by rising demand for fast, dependable, and efficient delivery services across a wide range of industries. Evolving consumer expectations, technology innovation, and the general logistics landscape define the factors driving supply and demand in this market.

Demand Factors:

E-Commerce Surge: The rapid growth of online shopping in Japan has increased demand for dependable courier and parcel delivery services. Customers are increasingly expecting rapid, cost-effective, and secure shipping alternatives.

Same-Day Delivery Expectations: As consumer speed expectations rise, so does demand for fast delivery services, particularly for urgent and time-sensitive products.

Industry-Specific Needs: Certain industries, such as healthcare, electronics, and food services, require customized logistics solutions that cater to temperature-sensitive items, regulatory compliance, and high-value goods

Last-Mile Delivery Innovations: The increased emphasis on optimizing last-mile delivery, fueled by urbanization and traffic congestion in large cities, is driving demand for innovative, sustainable delivery solutions.

Supply Factors:

Technological Advancements: Automation, artificial intelligence, and real-time tracking systems, which improve operational efficiency and service delivery.

Vendor Diversification: A diverse set of logistics providers, including both conventional companies and newer, tech-driven entrants, provides businesses with a selection of delivery alternatives tailored to their individual requirements.

Global Economic Factors: Changes in fuel prices, labor costs, and regional economic situations can all have an impact on logistics pricing and service availability in Japan.

Scalability and Flexibility: Logistics providers are increasingly providing modular, adaptable solutions that enable businesses of all sizes to scale their delivery services based on volume and complexity requirements.

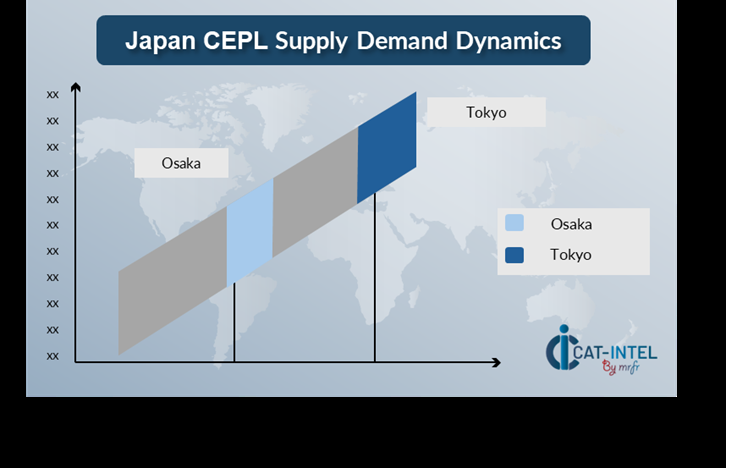

Regional Demand-Supply Outlook: Japan Courier, Express, and Parcel Logistics

The Image shows growing demand for Japan Courier, Express, and Parcel Logistics in both Tokyo and Osaka, with potential price increases and increased Competition.

Tokyo: Dominance in the Japan Courier, Express, and Parcel Logistics Market

Tokyo is a dominant force in the global Japan Courier, Express, and Parcel Logistics market due to several key factors:

Strategic Geographical Location: Tokyo serves as Japan's economic and logistical powerhouse. It has world-class infrastructure, including ports, airports, and railways.

Largest Consumer Market: Tokyo is Japan's largest city by population and the country's economic hub, with a dense concentration of enterprises, consumers, and e-commerce activity.

Innovation and Technology Adoption: The city's emphasis on digital transformation improves operational efficiency, lowers costs, and provides better customer service in the highly competitive logistics sector.

Supportive Business Environment: The city has strong government regulations that support green logistics solutions, including subsidies for electric vehicles and fuel-efficient fleets, as well as considerable infrastructure assistance.

Dense Urban Population: Tokyo's dense urban population necessitates effective last-mile delivery systems. This is a significant motivator for logistics companies to create novel and scalable delivery systems.

Tokyo Remains a key hub Japan Courier, Express, and Parcel Logistics Price Drivers Innovation and Growth.

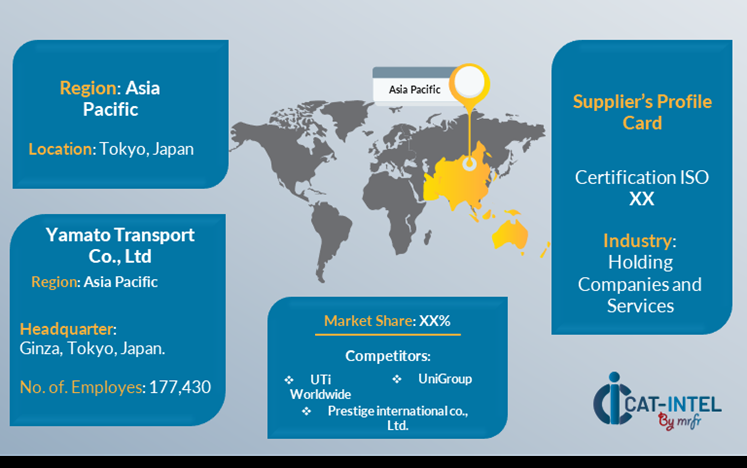

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in Japan's Courier, Express, and Parcel Logistics market is both diversified and extremely competitive, with a mix of global logistics behemoths and regional service providers defining the industry dynamics. The market is dominated by well-known multinational logistics businesses that provide complete delivery networks, while smaller, regional competitors and startups specialize in specific niches such as last-mile delivery, tech-enabled services, and environmentally friendly shipping methods.

The logistics supplier ecosystem is spread throughout important geographical regions, with both huge global logistics corporations and creative local companies specializing in satisfying the unique needs of Japanese industries. Logistics companies are expanding their capabilities with sophisticated technology, optimizing delivery routes, integrating AI for real-time tracking, and providing flexible delivery models to meet the market's changing demands.

Key Suppliers in the Japan Courier, Express, and Parcel Logistics Market Include:

Yamato Transport Co., Ltd.

Sagawa Express Co., Ltd

Japan Post Group

DHL Japan (DHL Express)

FedEx Express

United Parcel Service (UPS) Japan

Amazon Logistics Japan

TNT Japan

Seino Transportation Co., Ltd.

Rakuten Super Logistics

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The Japan Courier, Express, and Parcel Logistics market is expanding rapidly, owing to increased demand for faster, more dependable, and cost-effective delivery services, which has been fuelled in part by e-commerce boom and the need for worldwide trade.

|

Cloud Adoption |

As organizations seek more scalable, adaptable, and cost-effective logistics solutions, there is a rising preference for cloud-based logistics platforms that enable them to manage deliveries, track shipments in real time, and integrate smoothly across several digital systems.

|

Product Innovation |

Logistics providers are improving their solutions by adding AI-powered route planning, real-time tracking, and smart analytics to improve operational efficiency, save costs, and increase customer satisfaction.

|

Technological Advancements |

Automation, machine intelligence, robotics, and the Internet of Things are all making major improvements to logistics capabilities. These technologies allow for more effective warehouse management, predictive analytics for demand forecasting, and automated sorting systems.

|

Global Trade Dynamics |

Changes in international trade legislation, cross-border customs procedures, and regional economic policies are altering logistics operations for multinational corporations that manage complicated supply chains, customs compliance, and international shipping.

|

Customization Trends |

There is an increasing demand for logistics solutions tailored to specific industrial needs. Customizable delivery services, such as same-day and next-day alternatives, modular delivery solutions, and connectivity with other corporate systems, are helping logistics organizations gain a competitive advantage.

|

Japan Courier, Express, and Parcel Logistics Attribute/Metric |

Details |

Market Sizing |

The global Japan Courier, Express, and Parcel Logistics market is projected to reach USD 112.3 billion by 2035, growing at a CAGR of approximately 11.82% from 2025 to 2035.

|

Japan Courier, Express, and Parcel Logistic Technology Adoption Rate |

Around 60% of Japanese logistics organizations have used modern technologies like as artificial intelligence for route optimization, real-time tracking systems, and warehouse automation, with a significant shift toward cloud-based logistics platforms for more scalability and flexibility.

|

Top Japan Courier, Express, and Parcel Logistics Industry Strategies for 2025 |

Key strategies involve incorporating AI and machine learning for route optimization and forecasting and investing in automation for warehouse management, improving last-mile delivery efficiency and implementing environmentally friendly delivery options.

|

Japan Courier, Express, and Parcel Logistics Process Automation |

Approximately 50% of logistics organizations use automation to expedite routine processes such as package sorting, inventory management, and delivery scheduling, with the goal of lowering operational costs and improving service speed.

|

Japan Courier, Express, and Parcel Logistics Process Challenges |

Major issues include rising fuel and labor costs, handling last-mile delivery complexities in cities, keeping up with variable e-commerce demand, and achieving sustainability requirements while maintaining service efficiency.

|

Key Suppliers |

Yamato Holdings, Sagawa Express, Japan Post, and worldwide giants such as DHL, FedEx, and UPS are among the leading logistics providers, offering comprehensive delivery services for both domestic and international shipments.

|

Key Regions Covered |

Japan, North America, and Europe are among the top locations for logistics adoption, with e-commerce, manufacturing, retail, and food industries demanding time-sensitive, dependable shipping solutions.

|

Market Drivers and Trends |

Growth is being driven by the rise of e-commerce, the demand for rapid and dependable last-mile delivery, the integration of smart technologies such as AI and IoT for route optimization and tracking, and the growing demand for environmentally sustainable logistics solutions.

|