Summary Overview

Learning and Development Market Overview:

The global Learning and Development (L&D) market is expanding steadily, driven by rising demand in industries such as technology, healthcare, finance, and manufacturing. Organizations are investing in a wide range of learning and development options, including as digital learning platforms, in-person training, and blended learning models, to future-proof their staff and promote scaled performance. Our paper provides a detailed overview of new trends in corporate learning, with a particular emphasis on cost-effective development techniques and the use of digital tools to improve employee engagement and performance results.

Key difficulties for the future of L&D include managing escalating program implementation costs, guaranteeing scalability across global teams, preserving data privacy in learning platforms, and seamlessly integrating learning technologies with current HR and business infrastructure. To remain competitive, firms are focusing on digital upskilling, tailored learning paths, and data-driven talent initiatives.

Market Size: The global Learning and Development market is projected to reach USD 596.34 billion by 2035, growing at a CAGR of approximately 9.21% from 2025 to 2035.

Growth Rate: 9.21%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: There is a growing demand for real-time skill data and workforce capability mapping to optimize operations and guarantee frontline staff are future ready.

-

Retail and E-Commerce Growth: Invest in agile learning systems to increase staff onboarding, customer engagement training, and demand forecasting using data-literate workforces

-

Technological Transformation: Advances in AI and machine learning are transforming L&D by providing individualized learning experiences, predictive skill gap assessments, and automated content distribution.

-

Innovations: Modular learning ecosystems enable firms to design development programs based on role, function, or business unit, increasing relevance while lowering cost and complexity.

-

Investment Initiatives: Companies are progressively investing in cloud-based learning and development systems to promote remote learning, save infrastructure costs, and improve global team accessibility.

-

Regional Insights: North America and Asia-Pacific are popular locations for L&D adoption, with high demand in industries such as healthcare, technology, finance, and manufacturing.

Key Trends and Sustainability Outlook:

-

Cloud Integration: The widespread use of cloud-based learning systems for increased scalability, data integration, and real-time performance monitoring.

-

Advanced Features: The integration of AI, IoT, and blockchain technologies is changing L&D by providing adaptive learning, immersive experiences (such as AR/VR), and transparent certification tracking.

-

Focus on Sustainability: Learning efforts are increasingly integrated with ESG objectives, with programs focusing on environmental awareness, ethical leadership, and sustainable business practices.

-

Customization Trends: There is a growing need for industry-specific learning courses adapted to the changing demands of industries such as healthcare, manufacturing, and financial services

-

Data-Driven Insights: Advanced analytics enable L&D teams to evaluate learner progress, estimate workforce capabilities, and link learning investments with business outcomes.

Growth Drivers:

-

Digital Transformation: The rapid adoption of learning technologies to improve worker agility, collaboration, and creativity.

-

Demand for Process Automation: Automated learning workflows and intelligent suggestions enable HR and L&D teams to focus on strategic projects.

-

Scalability Needs: Organizations desire learning solutions that grow with business demands, allowing for constant upskilling across locations and functions.

-

Regulatory Compliance: Learning systems help organizations achieve compliance standards by providing defined training routes and verified data.

-

Globalization: There is a growing demand for multilingual, culturally adapted training solutions to support varied, global workforces.

Overview of Market Intelligence Services for the Learning and Development Market:

Recent investigations have found important issues in corporate learning, such as high implementation costs and rising demand for tailored, role-specific training programs. In response, businesses are turning to market intelligence to identify strategic possibilities for optimizing learning investments, streamlining vendor selection, and improving implementation outcomes. These insights enable firms to better control learning program expenditures, enhance provider relationships, and ensure alignment with industry-specific compliance requirements

Procurement Intelligence for Learning and Development: Category Management and Strategic Sourcing

To remain competitive and flexible in today's fast changing business environment, firms are using procurement best practices when selecting L&D platforms, tools, and content providers. This involves extensive cost analysis, performance benchmarking of learning suppliers, and aligning learning outputs with company goals. Strategic sourcing and efficient category management are critical to optimizing procurement in the L&D arena, as they drive cost savings, provide scalability, and support the ongoing growth of a high-performing workforce.

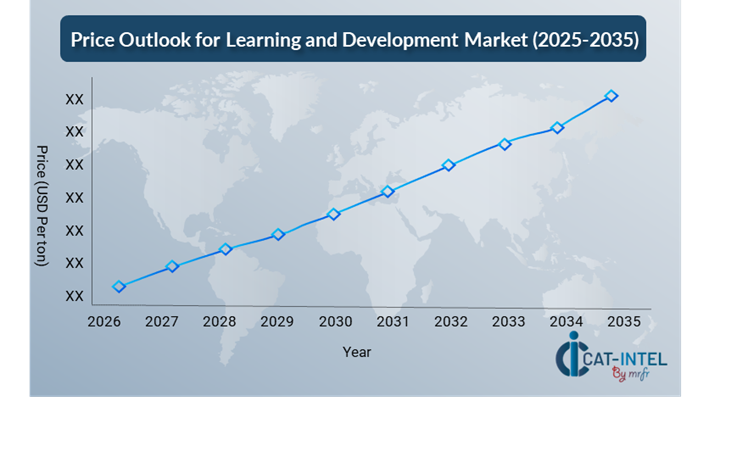

Pricing Outlook for Learning and Development: Spend Analysis

The pricing environment for Learning & Development (L&D) solutions is projected to remain somewhat dynamic, affected by several critical variables. Pricing changes are being driven by rapid technical improvements, increased demand for scalable digital learning platforms, varied levels of content customisation, and geographical disparities in provider models and delivery costs incorporating volume-based discounts and packaged service offers that fit with changing organizational demands.

Graph shows general upward trend pricing for Learning and Development and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic

Partnering with innovative L&D vendors who prioritize scalability and continuous improvement provides added value, such as personalized learning experiences, advanced analytics, AI-driven insights, and modular content delivery, resulting in increased workforce readiness and lower long-term development costs.

Digital procurement technologies, like as contract management systems and platform use statistics, are critical for encouraging transparency, minimizing over-licensing, and assuring the best use of learning resources.

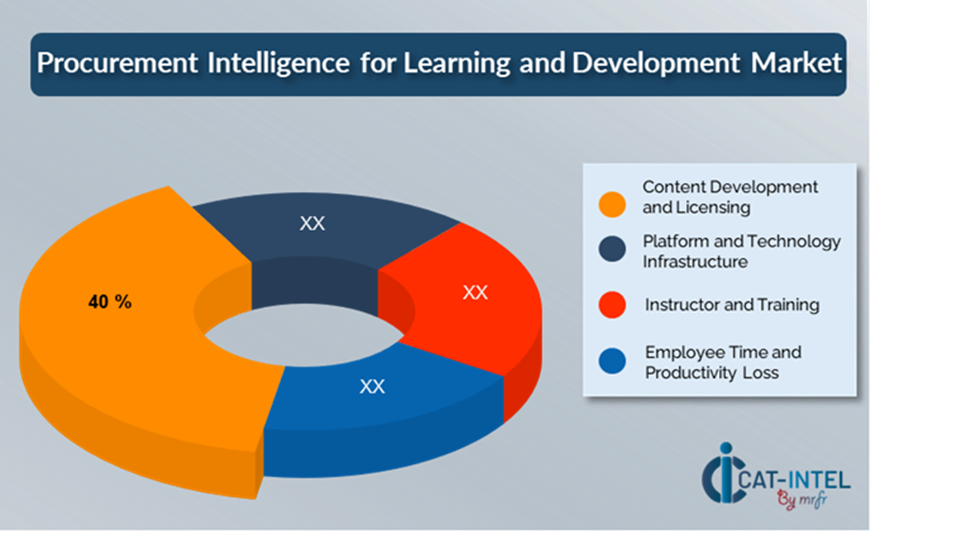

Cost Breakdown for Learning and Development: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Content Development and Licensing: (40%)

-

Description: Content development and licensing involve the creation or purchase of training products such as courses, certifications, software, and content subscriptions.

-

Trend Point: As learning and development programs become more tailored and on-demand, the demand for high-quality, scalable content increases.

- Platform and Technology Infrastructure: (XX%)

- Instructor and Training: (XX%)

- Employee Time and Productivity Loss: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Learning and Development (L&D) area, streamlining program delivery and using strategic partnership techniques can result in considerable cost savings and increased organizational impact. Long-term agreements with L&D solution providers, particularly those that provide cloud-based or subscription-based platforms, can lead to more advantageous pricing structures, such as volume discounts and complete service packages. Multi-year partnerships can provide superior value while protecting enterprises from potential price increases.

Partnering with suppliers who value innovation and scalability provides additional benefits, including access to cutting-edge learning analytics, AI-driven customization, and adaptable content ecosystems. These features not only improve student engagement but also streamline administration and lower long-term ownership costs. Integrating digital technologies such as learning experience platforms (LXPs), contract management systems, and use monitoring software increases visibility and assures optimal resource allocation and prevents underutilization of training assets.

Supply and Demand Overview for Learning and Development: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Learning & Development (L&D) market is growing steadily, driven by increased need for digital transformation in industries such as manufacturing, retail, and healthcare. Rapid technology innovation, growing desire for tailored learning experiences, and shifting global business conditions all have an impact on supply and demand dynamics.

Demand Factors:

-

Digital Transformation Initiative: Organizations are investing in learning and development platforms to provide centralized information sharing, workforce agility, and training process automation.

-

Cloud-based Learning Solutions: The transition to cloud-native learning platforms is driving up demand for scalable, mobile-friendly, subscription-based L&D technologies that enable hybrid and remote workforces.

-

Industry-specific Learning: Healthcare, manufacturing, and financial sectors all demand compliance-driven training and specialized material that adheres to regulatory requirements, operational regulations, and industry best practices.

-

System Integration Demands: There is an increasing demand for learning and development platforms that work seamlessly with HR systems, performance management tools, and business information platforms.

Supply Factors:

-

Technological Advancements: AI, machine learning, and immersive technologies (e.g., AR/VR) are boosting learning and development services by providing adaptive learning, intelligent content distribution, and real-time performance feedback.

-

Expanding Provider Ecosystem: A wide and expanding list of L&D vendors—from nimble startups to enterprise-level providers—provides consumers with additional alternatives, ranging from off-the-shelf solutions to completely customized learning ecosystems.

-

Global Economic Conditions: Currency changes, labour costs, and regional infrastructure have an influence on pricing strategies, localization possibilities, and platform accessibility in various countries.

-

Scalability and Modular Design: Modern learning platforms are becoming more modular and adaptable, allowing providers to cater to enterprises of all sizes while offering tailored solutions for specific learning objectives.

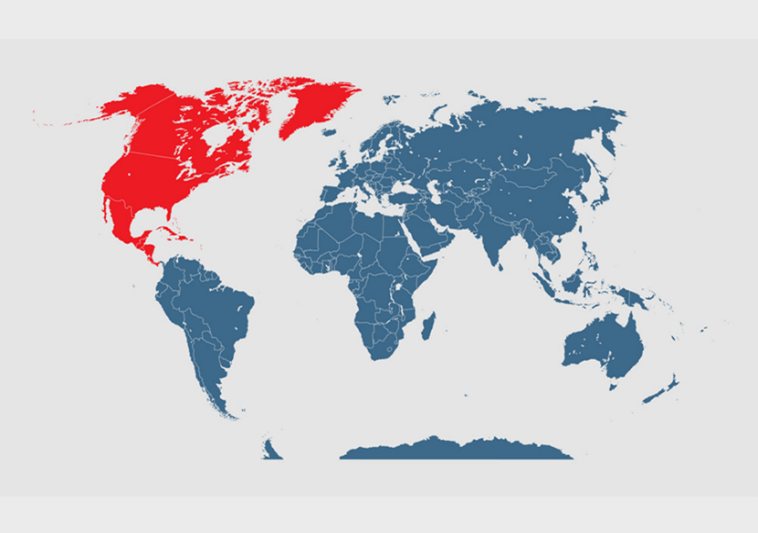

Regional Demand-Supply Outlook: Learning and Development

The Image shows growing demand for Learning and Development in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Learning and Development Market

North America, particularly the United States, is a dominant force in the global Learning and Development market due to several key factors:

-

Technological Advancement and Adoption: North America leads in the use of modern technologies such as AI, machine learning, AR/VR, and cloud-based solutions, which are transforming the learning and development industry.

-

Strong Corporate Investment: Businesses are investing in new learning and development solutions to upskill their workforce, retain talent, and meet the demands of rapidly changing industries such as technology, finance, and healthcare.

-

Strong Educational Infrastructure: North America has a well-developed educational and professional training infrastructure, with a strong demand for both formal and informal learning options.

-

Diversified and Talented Workforce: The region's workforce is very diversified and talented, necessitating different and specialized learning solutions.

-

High Demand for Compliance: North American firms have a high demand for training and development solutions that may assist satisfy these standards. that offer regulatory compliance modules and certifications.

North America Remains a key hub Learning and Development Price Drivers Innovation and Growth.

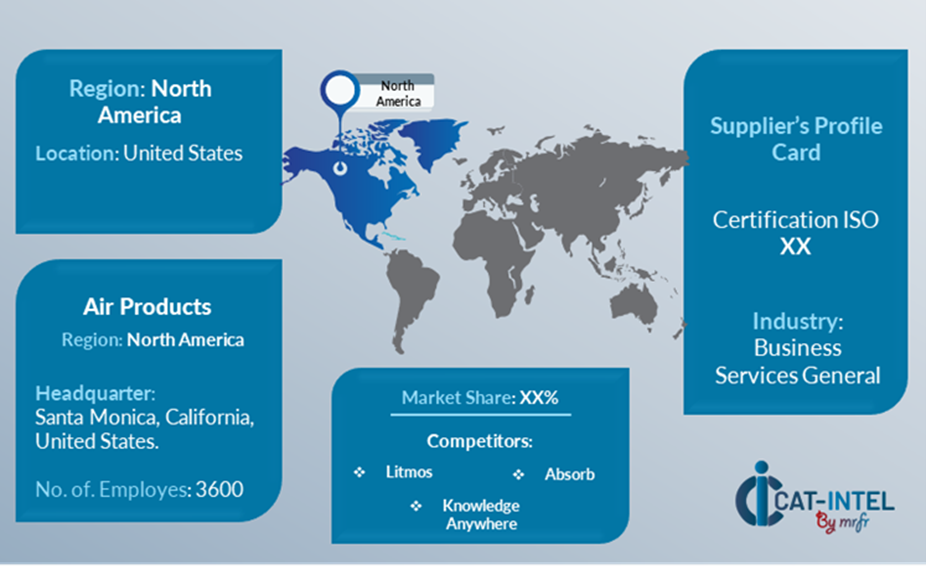

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the Learning & Development (L&D) industry is diverse and more competitive, with a dynamic mix of global giants and regional innovators. These suppliers have a significant impact on pricing strategies, platform customisation, content quality, and learner experience. Established L&D vendors provide end-to-end learning management systems (LMS) and talent development platforms, while smaller, specialized companies provide specific solutions.

The L&D supplier ecosystem spans important technological regions and includes both internationally known platforms and nimble, local players who adjust their products to specific business requirements and cultural settings. As enterprises focus more on digital transformation and workforce upskilling, L&D providers respond with improved cloud capabilities, tailored learning paths, and modular, subscription-based pricing structures.

Key Suppliers in the Learning and Development Market Include:

- Cornerstone On-Demand

- LinkedIn Learning

- Cornerstone On-Demand

- Skillsoft

- SAP Litmos

- Udemy for Business

- Moodle

- Degreed

- PluralSight

- Edcast

- Khan Academy.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The Learning & Development market is expanding rapidly as enterprises emphasize worker upskilling, digital learning adoption, and capability development particularly in emerging regions with growing digital infrastructure. |

Cloud Adoption |

The demand for scalable, cost-effective, and accessible solutions that enable hybrid and remote learning models is driving the increasing use of cloud-based learning platforms.

|

Product Innovation |

L&D solution providers are expanding their solutions with AI-powered learning pathways, real-time performance tracking, and industry-specific training modules geared to industries such as healthcare, manufacturing, and finance. |

Technological Advancements |

Machine learning, immersive learning (AR/VR), and learning automation tools are revolutionizing the learning and development environment, allowing for predicted skill evaluations and individualized learning experiences. |

Global Trade Dynamics |

Evolving compliance needs, regional training standards, and labor market movements all have an impact on global L&D plans, particularly for multinational firms that manage varied, scattered teams. |

Customization Trends |

Organizations are increasingly seeking tailored learning solutions, including modular content, flexible delivery formats, and seamless integration with HR systems and performance management platforms. |

Learning and Development Attribute/Metric |

Details |

Market Sizing |

The global Learning and Development market is projected to reach USD 596.34 billion by 2035, growing at a CAGR of approximately 9.21% from 2025 to 2035.

|

Learning and Development Technology Adoption Rate |

Around 70% of organizations worldwide have adopted digital learning platforms, with a strong emphasis on cloud-based, scalable solutions for remote and hybrid learning environments.

|

Top Learning and Development Industry Strategies for 2025 |

Key tactics include applying AI to tailor learning routes, using mobile learning solutions, integrating immersive technologies (AR/VR) to increase engagement, and focusing on data-driven skill development. |

Learning and Development Process Automation |

To improve operational efficiency, almost 60% of L&D projects automate administrative duties such as learning management, certification monitoring, and compliance reporting.

|

Learning and Development Process Challenges |

Major issues include high program costs, opposition to new learning technology, content relevancy, and the necessity for ongoing content upgrades and platform maintenance.

|

Key Suppliers |

Leading L&D solution providers include Cornerstone OnDemand, LinkedIn Learning, and Moodle, which provide complete training platforms and content solutions across several sectors.

|

Key Regions Covered |

North America and Asia-Pacific are popular locations for L&D adoption, with high demand in industries such as healthcare, technology, finance, and manufacturing.

|

Market Drivers and Trends |

The growing need for remote learning, individualized upskilling, the integration of AI and data analytics in learning, and the use of immersive and experiential learning technologies all contribute to growth.

|