Summary Overview

Lead Market Overview:

The global lead (Pb) market is steadily expanding, driven by demand from industries such as construction, automotive, electronics, and energy. This market includes a variety of lead-based items, such as lead-acid batteries, shielding materials, and lead alloys. Our paper provides a thorough examination of procurement trends, emphasizing cost-cutting measures and the use of sophisticated technology to improve procurement and operational procedures.

Looking ahead, important procurement difficulties will include controlling raw material costs, guaranteeing product scalability, assuring supply chain security, and integrating lead-based goods into changing industry standards. Digital procurement and strategic sourcing technologies are becoming increasingly important for improving efficiency, lowering risk, and maintaining long-term competitiveness. As worldwide demand for lead continues to climb, businesses are increasingly depending on market information to improve operational performance and mitigate risks.

Market Size: The global Lead market is projected to reach USD 39.45 billion by 2035, growing at a CAGR of approximately 17.4% from 2025 to 2035.

Growth Rate: 17.4%

-

Sector Contributions: Growth in the market is driven by:-

Manufacturing and Supply Chain Optimization: Improving operational efficiency requires more real-time data and seamless process integration. -

Automotive and Electronics Growth: The need for lead-acid batteries, which are used in automobiles and electronic gadgets, is driving the need for improved inventory management, demand forecasting, and supply chain planning.

-

-

Technological Transformation: Advancements in AI, machine learning, and automation are boosting operational control in sectors that rely on lead, resulting in smarter decisions. -

Innovations: The creation of modular goods, such as lead alloys and batteries, enables producers to choose and incorporate just the materials and components required. -

Investment Initiatives: There is a strong drive to invest in improved, sustainable solutions for lowering the carbon footprint of lead-based goods. -

Regional Insights: Asia Pacific and North America are leading the push, thanks to robust digital infrastructure and increased use of innovative technology.

Key Trends and Sustainability Outlook:

-

Sustainability Focus: The increased emphasis on sustainability encourages businesses to improve resource management and compliance with environmental goals. -

Customization Trends: As different industries seek particular lead uses, there is an increasing demand for customized lead-based solutions adapted to the unique needs of sectors such as automotive and energy storage. -

Data-Driven Insights: Advanced analytics assist firms in more effectively forecasting demand, optimizing inventory levels, and tracking key performance indicators connected to lead sourcing and manufacturing. -

Digital Transformation: Companies are rapidly using smart technologies to boost manufacturing efficiency, such as automating lead production operations and improving battery life and capacity. -

Demand for Process Automation: Businesses are turning to more efficient solutions to simplify the manufacture and procurement of lead-based goods, minimizing operational bottlenecks and waste.

Growth Drivers:

-

Scalability Requirements: Businesses are concentrating on scalable solutions for lead procurement and production that can rapidly adjust to changing market needs, guaranteeing seamless integration across global supply chains. -

Regulatory Compliance: Compliance with global environmental and safety laws is driving innovation in lead-based goods, as firms strive to satisfy changing industry requirements. -

Globalization: As businesses grow, there is a greater demand for lead solutions that can fulfill varied geographical standards, including as multi-currency and international compliance. -

Advanced Features: Modern lead providers are increasingly providing value-added services such as tailored lead alloys for specific industrial purposes (e.g., batteries, cables, construction). -

Sustainability Focus: Closed-loop recycling technologies that recover lead from spent batteries while reducing reliance on mining.The use of low-emission smelting methods is growing.

Overview of Market Intelligence Services for the Lead Market:

Recent market evaluations have highlighted important issues such as high implementation costs and the need for system customisation in the Lead (Pb) industry. Market intelligence studies are critical in giving meaningful insights into procurement prospects, allowing businesses to find cost-saving strategies, optimize supplier management, and improve the overall performance of their procurement operations. These insights also assist firms in meeting industry standards, maintaining high-quality operational procedures, and managing costs effectively across the supply chain.

Procurement Intelligence for Lead: Category Management and Strategic Sourcing

To be competitive in the Lead (Pb) industry, businesses are improving procurement strategies through expenditure monitoring and supplier performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs while assuring a steady supply of high-quality lead-based items like lead-acid batteries and alloys. Businesses may use actionable market knowledge to fine-tune their procurement strategy and negotiate advantageous terms for procuring lead materials, ensuring that their supply chains are both cost-effective and robust.

Pricing Outlook for Lead: Spend Analysis

The pricing prognosis for lead (Pb) goods is projected to remain volatile, with potential changes caused by several major variables. Manufacturing technology developments, industry demand fluctuations, regional pricing differences, and supply chain dynamics are a few examples.

Graph shows general upward trend pricing for Lead and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To minimize procurement expenses and assure cost-effective lead-based material sourcing, businesses should prioritize streamlining procurement procedures, improving vendor management, and exploring tailored lead solutions based on unique industry requirements. Leveraging digital technologies for market monitoring, price forecasting using sophisticated analytics, and efficient contract administration will be critical to enhancing cost efficiency.

Partnering with dependable lead suppliers, negotiating long-term contracts, and investigating bulk purchasing arrangements can all assist to offset the effects of price fluctuation. Flexible pricing arrangements, such as tiered pricing based on volume or longer-term contracts, can help to keep procurement prices stable in the face of market swings

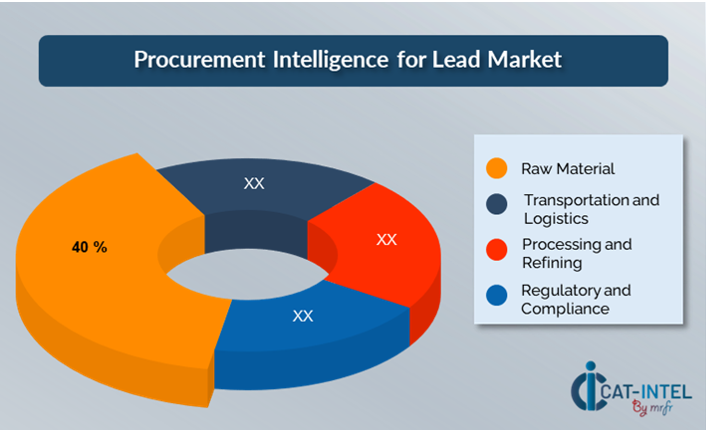

Cost Breakdown for Lead: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Material: (40%)

Description: The spot market price of lead is driven by supply-demand dynamics, mining production, geopolitical concerns, and inventory levels on global exchanges such as LME. Trend: Global lead prices are fluctuating due to increased demand for battery storage (EVs, solar). Recycled lead is gaining popularity as a cost-effective and environmentally friendly alternative.

-

Transportation and Logistics: (XX%)

- Processing and Refining: (XX%)

-

Regulatory and Compliance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Lead (Pb) industry, streamlining procurement procedures and using strategic negotiating strategies can result in significant cost savings and improved operational efficiency. Long-term partnerships with reputable suppliers, particularly those who provide ecologically responsible and sustainable lead-based products, can result in more attractive pricing structures and conditions. Subscription-based models and long-term contracts with lead suppliers allow you to achieve cheaper rates and mitigate the impact of pricing variations over time. Businesses, for example, can enter into long-term sourcing agreements for lead alloys or lead-acid batteries, assuring a consistent supply at predictable pricing, which is especially helpful in a market with volatile raw material prices.

Collaboration with suppliers who value innovation and sustainability provides additional benefits, such as access to innovative lead-processing technology and more efficient recycling solutions. This lowers long-term running expenses and accords with environmental objectives. Furthermore, adopting digital procurement solutions, such as supplier management systems and use analytics, may assist firms in increasing transparency, reducing waste, and optimizing lead material procurement.

Supply and Demand Overview for Lead: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lead (Pb) market is steadily expanding, driven by rising demand in industries such as automotive, energy, electronics, and construction. Technological improvements, regulatory challenges, and global economic considerations all have an impact on market supply and demand dynamics.

Demand Factors:

-

Technological Advances in Energy and Electronics: The increased need for efficient energy storage technologies, such as lead-acid batteries, is pushing up demand for lead. -

Environmental Regulations and Compliance: Growing environmental concerns and regulatory norms governing lead use are increasing demand for more sustainable and compatible lead-based solutions. -

Industry-Specific Requirements: Certain sectors, such as automotive and renewable energy, require bespoke lead-based solutions that are designed to suit operational and regulatory requirements. -

Integration with Renewable Energy Projects: Lead-based storage systems are in high demand, notably for solar and wind power projects.

Supply Factors:

-

Technological Advancements in Lead Production: Innovations in lead processing and recycling are increasing lead production efficiency while decreasing prices. -

Global Supplier Ecosystem: Businesses benefit from a diversified pool of lead sources, ranging from large-scale mining enterprises to specialist recyclers. -

Global Economic Factors: Economic developments in key lead-producing areas like China, Australia, and the United States have an influence on worldwide pricing and supply stability. -

Scalability and Flexibility: As demand for lead-based solutions expands across sectors, current lead products become more modular and flexible.

Regional Demand-Supply Outlook: Lead

The Image shows growing demand for Lead in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Lead Market

Asia Pacific, particularly East Asia is a dominant force in the global Lead market due to several key factors:

-

High demand in the Automotive Sectors: The increasing use of lead-acid batteries in conventional and electric vehicles (EVs), as well as backup power systems and renewable energy storage, creates a significant demand for lead. -

Leading in Lead Production: China and India are among the world's major lead producers and refiners, using both primary (mine) and secondary (recycling) sources. -

Strong Industrial and Infrastructure Growth: Rapid urbanization and infrastructural development in Asia Pacific's growing nations have raised demand for lead in construction materials, cables, pipelines, and radiation shielding. -

Expanding Electronics and Consumer Goods: Asia-Pacific, particularly China and Southeast Asia, is a major manufacturing hub for electronics and consumer goods. Lead is commonly used in soldering, batteries, and shielding components. -

Strong Recycling Ecosystem with Government Support: Many APAC nations, notably China, have established effective lead recycling ecosystems to minimize reliance on mining and support environmental restrictions.

Asia Pacific Remains a key hub Lead Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the Lead (Pb) market is similarly diversified and fiercely competitive, with a mix of global industry heavyweights and regional suppliers influencing market dynamics. These suppliers have a substantial impact on critical issues such as cost, product quality, sustainability standards, and supply chain resilience. The industry is dominated by well-known lead mining and processing businesses, with smaller, specialized players focusing on specialty applications such as lead recycling, lead-based alloys, and green lead solutions.

As sustainability becomes a top issue in the lead business, several providers are focused on novel solutions including lead recycling, eco-friendly lead-acid batteries, and sophisticated lead alloy compositions. To address the increased demand for lead-based products, suppliers are providing flexible pricing structures such as long-term contracts, volume-based discounts, and unique payment arrangements.

Key Suppliers in the Lead Market Include:

- Gravita India Ltd

- Glencore

- Hindustan Zinc Limited

- Teck Resources Limited

- KOREAZINC

- Doe Run Resources

- BHP Group

- China Northern Rare Earth Group High Technology

- Vedanta Resources

- Shaanxi Dongling Lead and Zinc Co., Ltd.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The lead (Pb) market is expanding due to rising demand in industries such as automotive, electronics, and energy storage. The increase in infrastructure projects and renewable energy adoption fuels the need for lead-based goods. |

Cloud Adoption |

Companies are focused on lead recycling technology and eco-friendly manufacturing practices to lessen the environmental effect of lead extraction and consumption.

|

Product Innovation |

Lead suppliers are driving innovation by creating lead-based solutions such as enhanced lead-acid batteries for electric cars and energy storage systems, as well as lead alloys customized to specific uses. |

Technological Advancements |

Innovations in lead processing, recycling technologies, and energy-efficient applications improve lead-based product performance and efficiency, boosting demand in industries such as renewable energy, automotive, and electronics. |

Global Trade Dynamics |

Changes in global trade rules, such as tariffs and export limits, as well as differences in environmental regulations between areas, have an influence on lead pricing and the availability of lead-based goods in international markets. |

Customization Trends |

The need for bespoke lead goods is growing, as sectors such as automotive and electronics require unique lead alloys and components. Leading vendors are tailoring their services to meet sector-specific requirements, delivering bespoke solutions to boost performance and efficiency. |

Lead Attribute/Metric |

Details |

Market Sizing |

The global Lead market is projected to reach USD 39.45 billion by 2035, growing at a CAGR of approximately 17.4% from 2025 to 2035. |

Lead Technology Adoption Rate |

Around 70% of lead-dependent industries (such as automotive, energy storage, and construction) have embraced advanced lead-based goods, notably battery technology and energy storage solutions.

|

Top Lead Industry Strategies for 2025 |

Investing in sustainable lead recycling processes, employing energy-efficient lead-acid batteries, focusing on lead alloy improvements, and diversifying sourcing to improve supply chain resilience are all important measures.

|

Lead Process Automation |

Approximately 45% of lead processing plants have automated processes such as material handling, battery manufacture, and lead alloy production to increase efficiency and save costs.

|

Lead Process Challenges |

Major hurdles include lead-use regulations, raw material price changes, environmental concerns, and supply chain interruptions. |

Key Suppliers |

Gravita India Ltd, Glencore (Switzerland) and Lead Battery Recycling Company (USA) are leading providers in the lead sector, with goods ranging from lead-acid batteries to lead alloys and recycled materials.

|

Key Regions Covered |

Asia-Pacific and North America are key markets for lead uptake, with major demand in the automotive, electronics, and renewable energy industries.

|

Market Drivers and Trends |

Growth is being driven by rising demand for lead in energy storage (for example, lead-acid batteries for electric cars), advances in lead recycling, and breakthroughs in lead alloys and energy storage applications.

|