Summary Overview

Laundry Services Market Overview:

The global laundry services market is steadily expanding, driven by rising demand in industries such as hospitality, healthcare, residential, and commercial institutions. This developing industry encompasses a wide range of service types, including on-demand, subscription-based, and industrial-scale options. Our paper provides a thorough examination of procurement trends, emphasizing cost-cutting techniques and the use of digital technology to improve service delivery and operational performance.

Looking ahead, important difficulties in the laundry services sector include controlling growing operating expenses, expanding service capabilities, maintaining cleanliness and compliance requirements, and integrating current technologies into existing workflows. The use of digital technologies and data-driven sourcing methods is becoming increasingly important for improving service quality, promoting customer happiness, and ensuring long-term success. As global demand grows, businesses are increasingly utilizing markets insights to improve efficiency, enhance service delivery, and minimize operational risks.

Market Size: The global Laundry Services market is projected to reach USD 123.9 billion by 2035, growing at a CAGR of approximately 12.7% from 2025 to 2035.

Growth Rate: 12.7%

-

Sector Contributions: Growth in the market is driven by:-

Manufacturing and Supply Chain Optimization: The laundry services industry is seeing an increase in demand for real-time data and integrated logistics to help simplify operations. -

Retail and E-Commerce Growth: The rise of online shopping and home delivery services has spurred laundry suppliers to improve inventory monitoring, pickup, and delivery scheduling.

-

-

Technological Transformation: Cutting-edge advances in automation, artificial intelligence, and smart logistics are revolutionizing laundry processes. -

Service Innovation: Modular service offerings enable suppliers to tailor solutions for industries such as hospitality, healthcare, and fitness, minimizing operational complexity. -

Strategic Investments: Businesses are investing in cloud-based operations platforms and mobile solutions to reduce infrastructure costs and enable real-time operational monitoring. -

Regional Insights: North America and Asia Pacific continue to dominate the market, owing to rising disposable income and increased use of technology-driven laundry services.

Key Trends and Sustainability Outlook:

-

Digital Integration: Cloud-based and app-enabled washing services are increasingly popular due to their scalability, cost-effectiveness, and accessibility for both B2B and B2C customers. -

Smart Technologies: The integration of AI, IoT, and automated sorting systems is improving decision-making, energy efficiency, and transparency. -

Sustainability Needs: Laundry suppliers face increasing pressure to minimize water and energy use. Advanced technologies now provide better resource tracking, environmentally friendly detergents, and compliance with green requirements. -

Tailored Solutions: Industry-specific service models are in high demand, like specialist linen care for hospitals and delicate clothing handling for luxury fashion outlets. -

Data-Driven Optimization: Analytics may help estimate service demand, manage load capacity, optimize delivery routes, and monitor equipment performance for continual improvement.

Growth Drivers:

-

Digital Transformation: Laundry providers are modernizing their operations and improving customer delivery due to the increased usage of digital technologies. -

Process Automation: Automated washing, folding, and delivery technologies save labor costs, increase throughput, and assure consistent quality. -

Scalability Focus: Businesses need partners that can scale laundry operations across several sites while keeping consistent standards. -

Compliance and Standards: Strict hygiene and safety laws, particularly in healthcare and food service, need traceability and compliance readiness. -

Globalization of Service Expectations: Laundry suppliers with multilingual customer assistance, cross-border logistics, and consistent service delivery are in high demand as brands and hospitality chains expand globally.

Overview of Market Intelligence Services for the Laundry Services Market:

Recent market evaluations have highlighted important operational problems in the laundry services industry, such as high installation and setup costs and the need for service customisation to match client-specific requirements. Procurement intelligence reports are critical in providing actionable information, allowing firms to identify cost-saving possibilities, optimize supplier management, and improve the success rate of service rollouts.

Procurement Intelligence for Laundry Services: Category Management and Strategic Sourcing

To stay competitive, laundry service providers are streamlining their procurement processes using data-driven tactics including cost analysis and supplier performance monitoring. Effective category management, whether for linens, detergents, or equipment, and strategic sourcing are essential for lowering procurement costs and guaranteeing constant access to high-quality materials and service components. Businesses that use comprehensive market research may improve their procurement strategies, get advantageous vendor terms, and adjust swiftly to market developments.

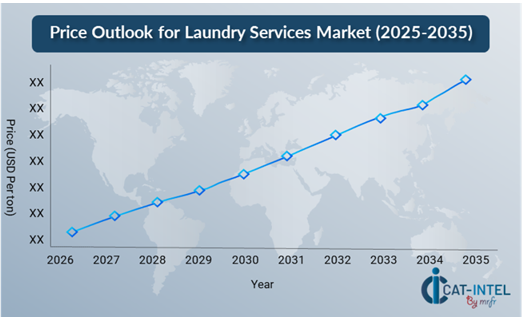

Pricing Outlook for Laundry Services: Spend Analysis

The pricing outlook for commercial and industrial laundry services is likely to be somewhat volatile, influenced by a variety of variables. Automation and eco-friendly technology are key drivers, as is the growing need for on-demand and subscription-based service models, industry-specific customisation requirements, and regional pricing variances.

Graph shows general upward trend pricing for Laundry Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To preserve profitability and control growing costs, firms are focused on improving procurement operations, building supplier relationships, and adopting modular service models adapted to unique industry needs. The utilization of digital technologies for real-time market monitoring, cost forecasting using data analytics, and automated contract administration is critical in improving cost efficiency.

Partnerships with dependable service providers, long-term agreements, and the exploration of flexible pricing structures such as usage-based or subscription models are all important techniques for successful cost control. Despite pricing problems, emphasizing scalability, investing in modern infrastructure, and implementing environmentally friendly solutions will be important to sustaining long-term operations and service quality.

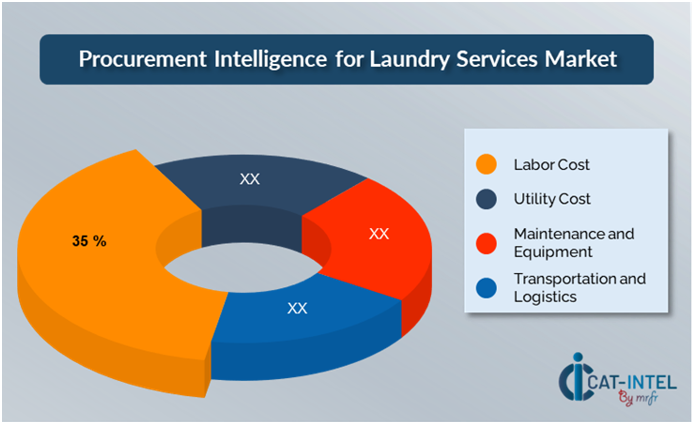

Cost Breakdown for Laundry Services: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Labor Cost: (35%)

-

Description: This comprises compensation for employees involved in washing, drying, sorting, and folding, as well as administrative professionals who oversee operations. -

Trend: Automated washing, folding, and sorting systems are increasingly being utilized to cut labor costs, increase operational efficiency, and reduce turnover.

-

- Utility Cost: (XX%)

- Maintenance and Equipment: (XX%)

- Transportation and Logistics: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the commercial laundry services market, streamlining procurement procedures and implementing strategic negotiating strategies may result in significant cost savings and increased operational efficiency. Long-term agreements with service providers, particularly those providing scalable, technology-enabled solutions, can result in advantageous pricing structures such as volume-based discounts, bundled service packages, and locked-in prices through multi-year contracts. Adopting subscription-based or pay-as-you-go models increases flexibility, improves cash flow management, and protects against unexpected price increases.

Partnering with forward-thinking providers who value innovation and operational scalability provides long-term benefits such as access to smart automation, real-time use tracking, and configurable service modules adapted to industry-specific requirements. Leveraging digital procurement tools, such as contract lifecycle management systems, vendor performance dashboards, and use analytics improves transparency, reduces service overages, and ensures resources are in line with real demand. Furthermore, diversifying supplier portfolios and investigating multi-vendor methods can minimize dependency on a single source, alleviate risks such as service disruptions, and increase negotiating leverage during contract negotiations.

Supply and Demand Overview for Laundry Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global laundry services market is growing steadily, driven by rising demand for outsourced solutions in industries such as hospitality, healthcare, manufacturing, and residential. Technological developments, rising demands for hygiene and sustainability, and larger economic movements all influence supply and demand dynamics.

Demand Factors:

-

Outsourcing and Operational Efficiency: Demand for outsourced laundry services is increasing, particularly in industries with stringent hygiene regulations, such as healthcare and food services. -

Sustainability and Eco-Conscious Practices: Clients are increasingly looking for suppliers who use water- and energy-efficient technology and ecologically friendly detergents, fueling demand for greener service models. -

Customized Industry Solutions: Sectors such as hospitality, healthcare, and fitness require specific laundry services that adhere to regulatory compliance, fabric care requirements, and quick turnaround times. -

Technology-Driven Expectations: There is an increasing need for laundry services that enable real-time order tracking, digital booking, and integrated logistics, hence improving convenience and transparency.

Supply Factors:

-

Technological Advancement: Automation in laundry, folding, and logistics, as well as IoT-enabled equipment and smart inventory systems, which improve service quality and operating efficiency. -

Expanding Provider Ecosystem: A diverse range of providers—from tiny, specialized laundromats to large-scale commercial operators—are improving market competitiveness and providing buyers more options. -

Global Economic Conditions: Labor costs, energy prices, and regional economic trends all have an impact on service pricing and provider scalability, particularly in international hospitality and healthcare networks. -

Scalability and Flexibility: Laundry operators are investing in modular, scalable systems to offer personalized service packages and dynamic pricing models to small and large businesses alike.

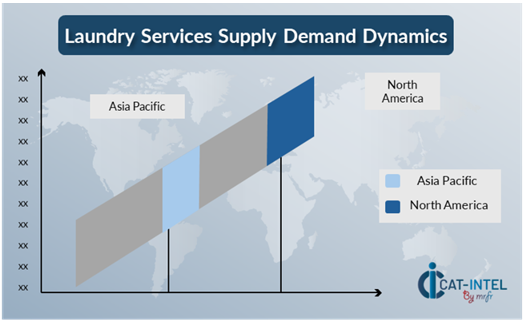

Regional Demand-Supply Outlook: Laundry Services

The Image shows growing demand for Laundry Services in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Laundry Services Market

North America, particularly the United States, is a dominant force in the global Laundry Services market due to several key factors:

-

Strong Demand in Key Sectors: North America has a well-developed healthcare system and a large hospitality business, both of which are major users of laundry services. -

Advanced Technology Adoption: North American laundry service providers are quick to implement automation, IoT technology, and data-driven solutions, which helps them stay competitive in a changing market. -

High Disposable Income: North America, particularly the United States, has high disposable incomes and consumer expenditure. This opens a large market for premium laundry services. -

Regulatory Compliance and Hygiene Standards: Laundry must meet high standards because to strict cleanliness and safety laws in North America, particularly in the healthcare and food-related industries. -

Established Infrastructure: Efficient distribution networks and innovative logistics solutions allow for rapid and dependable washing services, reinforcing the region's industry leadership.

North America Remains a key hub Laundry Services Price Drivers Innovation and Growth.

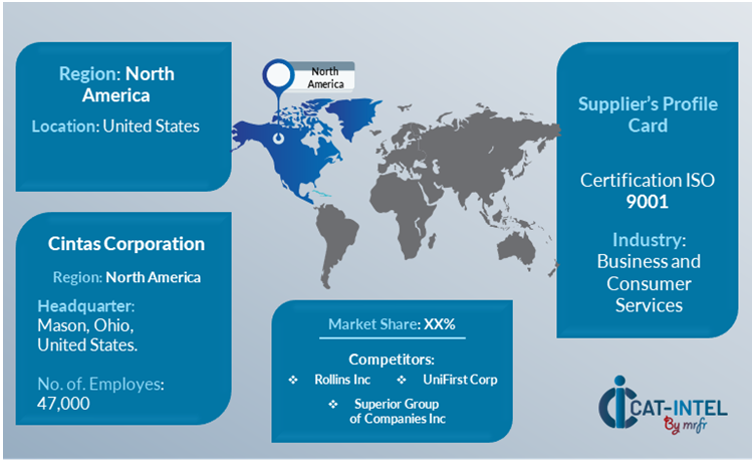

Supplier Landscape: Supplier Negotiations and Strategies

The laundry services industry's supplier environment is diversified and increasingly competitive, dominated by large-scale commercial suppliers and specialized regional operators. These vendors have a significant impact on pricing patterns, service personalization, quality standards, and turnaround times. Established national and international service providers lead the industry, providing full laundry and linen management solutions to industries like healthcare, hospitality, and manufacturing.

Along with these big businesses, smaller specialist providers are carving out space by offering industry-specific knowledge, customized service, and advances in eco-friendly techniques or digital service integration. Organizations continue to focus on cost efficiency, hygienic compliance, and sustainability, laundry companies are reacting by increasing capacity, investing in automation, and using adaptable service models such as pay-per-use, subscription-based packages, and real-time service tracking.

Key Suppliers in the Laundry Services Market Include:

- Cintas Corporation

- Alsco

- Elis SA

- STALWART Linen Service

- Linen King

- Bunzl

- Mission Linen Supplies

- Jersey Linen Service

- Sodexo

- Clean Uniforms and More.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The laundry services industry is witnessing robust expansion, driven by increased outsourcing of non-core tasks by firms looking to simplify operations and decrease internal overhead. |

Cloud Adoption |

Demand for convenience, transparency, and operational flexibility has fueled a rapid trend toward digital platforms and app-based service models that provide real-time order monitoring, automated billing, and remote scheduling.

|

Product Innovation |

On-demand models, subscription services, and eco-friendly laundry solutions are helping providers extend their offerings, which are typically tailored to address industry-specific demands such as infection control in hospitals or delicate fabric care in luxury accommodation. |

Technological Advancements |

Smart washing systems, IoT-enabled equipment, route optimization software, and automated sorting improve service speed, energy efficiency, and traceability while decreasing human error and labor reliance. |

Global Trade Dynamics |

Changes in energy prices, global supply chain disruptions, and environmental restrictions all have an influence on logistics, material procurement (such as linens and detergents), and pricing strategies, particularly for international laundry suppliers. |

Customization Trends |

Flexible, client-specific service models are becoming increasingly popular. Businesses want personalized service packages, tiered pricing, and specialized handling that fits their operational workflows and regulatory needs. |

Laundry Services Attribute/Metric |

Details |

Market Sizing |

The global Laundry Services market is projected to reach USD 123.9 billion by 2035, growing at a CAGR of approximately 12.7% from 2025 to 2035.

|

Laundry Services Technology Adoption Rate |

Approximately 60% of commercial laundry suppliers have used digital platforms or automation technologies, with a growing interest in IoT-enabled systems and mobile client interaction tools. |

Top Laundry Services Industry Strategies for 2025 |

Key measures include investing in energy-efficient equipment, developing smart logistics for pickup and delivery, and creating industry-specific service packages, and digitizing customer experiences through apps and portals.

|

Laundry Services Process Automation |

Around 50% of large-scale laundry businesses employ automation for sorting, washing, folding, and invoicing, which increases throughput, reduces worker reliance, and improves uniformity.

|

Laundry Services Process Challenges |

Common obstacles include high electricity prices, labor shortages, equipment maintenance requirements, and adherence to hygiene and environmental standards.

|

Key Suppliers |

Cintas Corporation (USA), Elis SA (France), and Alsco (USA) are among the largest suppliers, with regional companies offering specialized or customized services.

|

Key Regions Covered |

North America, Europe, and Asia-Pacific dominate the market, owing to urbanization, hospitality expansion, and outsourcing tendencies in industries like as healthcare and manufacturing. |

Market Drivers and Trends |

The growing emphasis on cleanliness, outsourcing of non-core activities, adoption of green and sustainable laundry techniques, and the incorporation of smart technology into operational workflows all contribute to growth. |