Summary Overview

Lactic Acid Market Overview:

The worldwide lactic acid market is steadily expanding, driven by increased demand in major industries such as food and beverage, pharmaceuticals, personal care, and biodegradable plastics. This market covers both synthetic and naturally generated lactic acids, which are employed in a variety of applications ranging from food preservation and pH regulation to biopolymer manufacturing. Our paper provides a detailed examination of procurement trends in the lactic acid sector, emphasizing cost-cutting techniques as well as the rising importance of sustainable sourcing and digital technologies in streamlining procurement and manufacturing processes.

Looking ahead, the lactic acid market confronts several strategic difficulties, including controlling production costs, guaranteeing supply chain scalability, maintaining quality standards, and negotiating complicated global regulatory landscapes. Adoption of new procurement technology and enhanced market knowledge is increasingly crucial for strengthening supply resilience, increasing operational efficiency, and sustaining a competitive advantage in a continually changing market.

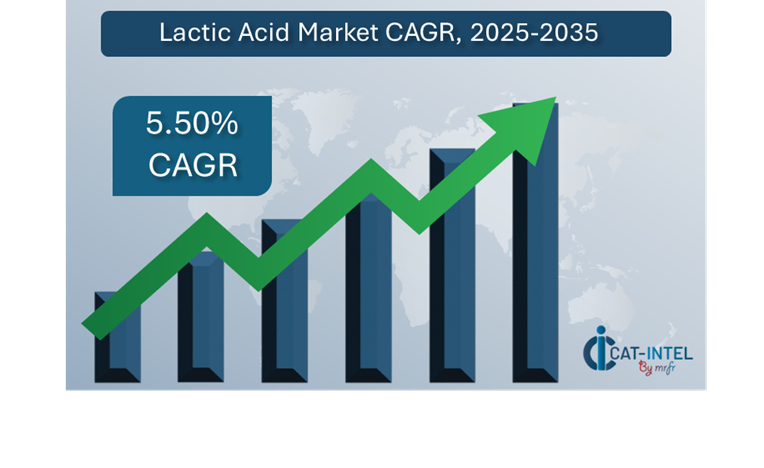

Market Size: The global Lactic Acid market is projected to reach USD 9.06 billion by 2035, growing at a CAGR of approximately 8.55% from 2025 to 2035.

Growth Rate: 8.55%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: In the lactic acid sector, real-time data visibility and flawless process integration are becoming increasingly important. -

Retail and Consumer Product Growth: Manufacturers are working on improving inventory control, demand forecasting, and customer responsiveness to support retail and e-commerce growth. -

Technological Transformation: Advances in biotechnology and process automation are transforming the lactic acid industry, increasing production accuracy and lowering waste. -

Innovations: The development of modular manufacturing techniques and adaptable formulations enables companies to tailor lactic acid products to individual industrial requirements, therefore lowering costs and operating complexity. -

Investment Initiatives: Companies are increasing their investment in sophisticated fermentation technologies, renewable raw material procurement, and sustainable processing infrastructure. -

Regional Insights: North America and Asia Pacific remain significant growth markets, because to robust industrial infrastructure and supportive legislative frameworks that encourage green chemistry.

Key Trends and Sustainability Outlook:

-

Green Manufacturing: A strong push for bio-based lactic acid and ecologically responsible production processes is influencing procurement and product development strategies. -

Advanced Technologies: Integrating AI, IoT, and automation into manufacturing facilities increases traceability, minimizes downtime, and optimizes resource use. -

Sustainability Focus: Lactic acid manufacturers are meeting worldwide ESG criteria by tracking emissions, increasing water efficiency, and using circular economy models. -

Tailored Solutions: The growing need for application-specific lactic acid variants—for use in bioplastics, medicinal, or food-grade products—is driving customization and innovation. -

Data-Driven Optimization: The use of analytics allows for improved forecasting, more effective raw material planning, and real-time performance monitoring throughout production and supply chains.

Growth Drivers:

-

Sustainable Transition: The growing desire for bio-based and biodegradable alternatives is boosting demand for lactic acid across sectors.

-

Process Automation: Implementing automated production and packaging processes improves throughput while reducing human error. -

Growing Worldwide Demand: Necessitates scalable manufacturing systems capable of satisfying different regional and sector-specific requirements. -

Regulatory Alignment: Lactic acid makers benefit from systems that assure product safety, traceability, and adherence to food, pharmaceutical, and environmental regulations. -

Global Market Expansion: As the usage of lactic acid varies by application and area, organizations are expanding their presence to facilitate cross-border logistics, compliance, and localization.

Overview of Market Intelligence Services for the Lactic Acid Market:

Recent market evaluations have highlighted important issues in the lactic acid sector, such as high manufacturing and sourcing costs, as well as the necessity for customized product formulations to fulfill the different industrial requirements. In this changing context, procurement information is crucial for discovering cost-saving possibilities, improving supplier engagement, and assuring effective product adoption.

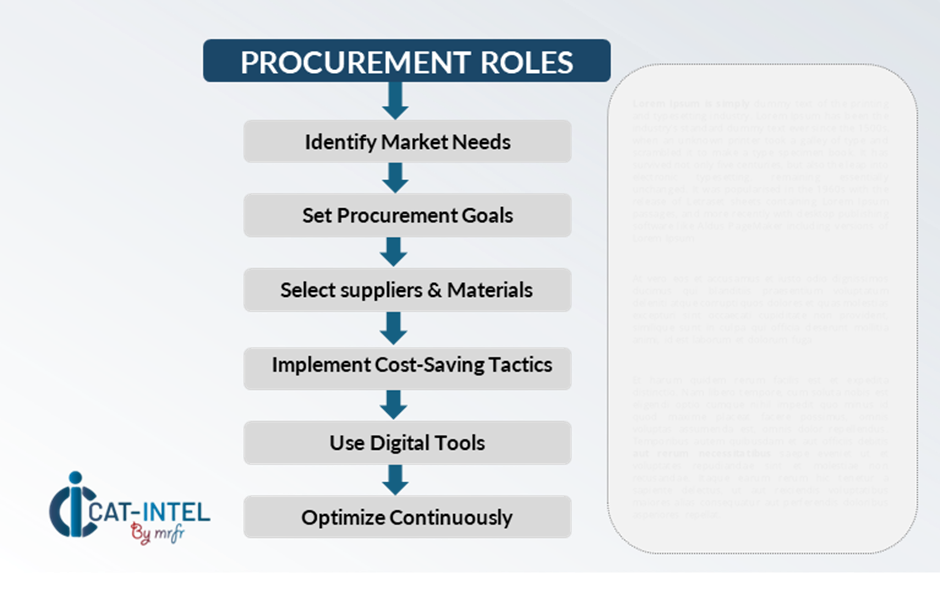

Procurement Intelligence for Lactic Acid: Category Management and Strategic Sourcing

Strategic sourcing and excellent category management are critical for increasing efficiency and ensuring a strong supply chain. Companies are using advanced procurement technologies, such as expenditure analysis and supplier performance monitoring, to improve purchasing decisions, obtain competitive pricing, and maintain a steady supply of high-quality lactic acid. Market intelligence studies give actionable information that help firms meet regulatory and sustainability objectives while maintaining operational excellence. Businesses may enhance supplier negotiations, reduce risk, and increase overall profitability in the highly competitive global lactic acid market by fine-tuning procurement methods based on data.

Pricing Outlook for Lactic Acid: Spend Analysis

The pricing prognosis for lactic acid is expected to remain somewhat dynamic, impacted by a variety of variables such as technical developments in manufacturing, fluctuations in raw material availability, regional cost variances, and rising demand for bio-based and high-purity formulations

The pricing prognosis for lactic acid is expected to remain somewhat dynamic, impacted by a variety of variables such as technical developments in manufacturing, fluctuations in raw material availability, regional cost variances, and rising demand for bio-based and high-purity formulations

Graph shows general upward trend pricing for Lactic Acid and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To address these difficulties while maintaining cost effectiveness, businesses are actively seeking to simplify procurement procedures, improve supplier management, and implement flexible sourcing models. Utilizing digital technologies for market monitoring, predictive pricing analytics, and contract lifecycle management can result in considerable cost savings.

Strategic techniques including collaborating with dependable producers, establishing long-term supply agreements, and investigating volume-based or index-linked pricing structures are becoming more relevant. Despite continued price swings and an emphasis on scalable production, efficient application of sustainable technologies, as well as regional supply chain optimization, will be crucial in guaranteeing long-term cost management and operational resilience in the worldwide lactic acid market.

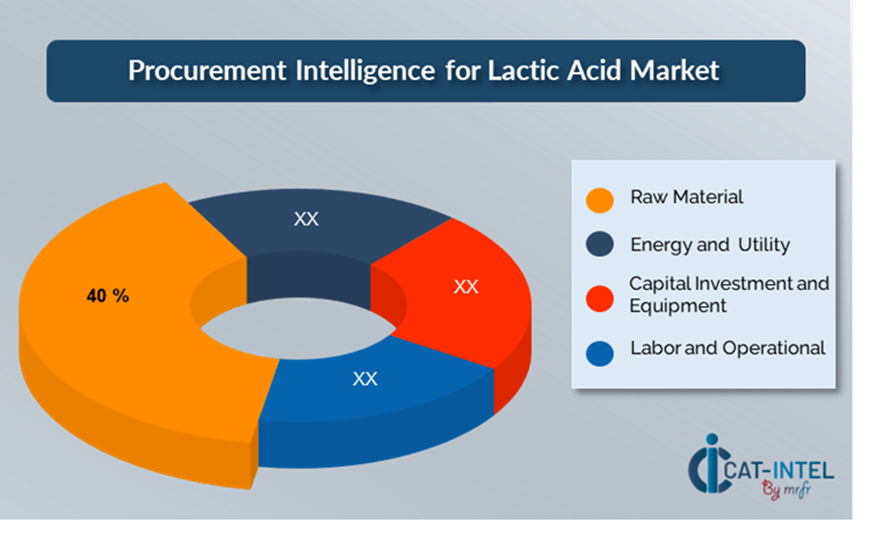

Cost Breakdown for Lactic Acid: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Material: (40%)

-

Description: Raw material expenses make up the majority of the total cost of production (TCO) for lactic acid, which is often produced from renewable feedstocks such as maize, sugar beets or cassava. -

Trend Point: There is an increasing trend towards adopting renewable, locally produced resources to decrease reliance on volatile pricing, hence lowering costs and carbon footprints.

- Energy and Utility: (XX%)

- Capital Investment and Equipment: (XX%)

- Labour and Operational: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the lactic acid sector, streamlining procurement procedures and employing effective negotiating strategies can result in significant cost savings and improved operational performance throughout the value chain. Establishing long-term supply agreements with reputable lactic acid suppliers, particularly those focusing on sustainable and scalable production, allows for more attractive price arrangements, such as volume-based discounts, bundled value-added services, and tailored delivery dates.

Collaborating with innovative suppliers who invest in sophisticated fermentation technologies, automation, and green chemical techniques helps to reduce long-term costs by increasing production efficiency and lowering waste. Furthermore, the utilization of digital procurement technologies, such as contract management systems and usage-based analytics, improves transparency, reduces surplus inventory, and assures more accurate demand planning. Implementing multi-vendor sourcing techniques improves procurement resilience by minimizing reliance on a single supplier, limiting risk to interruptions, and increasing bargaining leverage.

Supply and Demand Overview for Lactic Acid: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

Supply and Demand Overview for Lactic Acid: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The worldwide lactic acid market is growing steadily, driven by rising demand for bio-based and sustainable solutions in industries such as food & beverages, medicines, personal care, and bioplastics. Technological innovation, legislative reforms, and changing customer tastes all impact supply and demand.Demand Factors:

-

Sustainability & Green Chemistry Initiatives: Growing environmental concerns and a shift toward bio-based alternatives are driving up demand for lactic acid. -

Health & Wellness trends: The increasing demand for natural preservatives, functional food additives, and biocompatible medicinal excipients is driving up lactic acid use. -

Application-Specific Requirements: Industries including personal care and medical devices require high-purity, tailored lactic acid grades that adhere to demanding quality and regulatory criteria. -

Circular Economy and Bioplastics Growth: The need for biodegradable polymers, such as PLA (polylactic acid), is quickly increasing due to regulatory demands and customer preference for eco-friendly goods.

Supply Factors:

-

Fermentation Technology Advances: Innovations in microbial fermentation, feedstock optimization, and downstream processing are improving production efficiency and promoting supply-side competitiveness. -

Diverse Supplier Ecosystem: A combination of major global producers and developing regional manufacturers guarantees a large supplier base, giving customers additional options and competitive pricing. -

Global Economic Conditions: Raw material prices, energy costs, and logistical restrictions all have an impact on manufacturing capacity, as well as regional availability and pricing. -

Scalability and Product Flexibility: Suppliers are increasingly offering modular production methods and configurable product grades to meet a wide range of industry needs, improving their capacity to respond to changing market demands.

Regional Demand-Supply Outlook: Lactic Acid

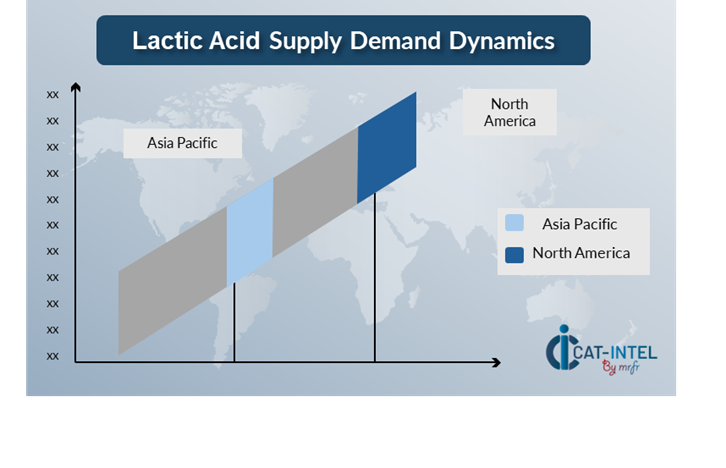

The Image shows growing demand for Lactic Acid in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Lactic Acid Market

North America, particularly the United States, is a dominant force in the global Lactic Acid market due to several key factors:

-

Advanced Technological Capabilities: North America is home to numerous innovative firms who use cutting-edge fermentation technology and bio-based production processes. -

Sustainability and Regulatory Support: There is a rising emphasis on bio-based chemicals and green alternatives to petroleum-based goods, which is fostering the expansion of the lactic acid market. -

Established Supply Chain and Infrastructure: The region's availability to raw materials such as maize, along with efficient logistical networks, enables a steady and cost-effective supply of lactic acid to a variety sectors. -

Presence of Major Market Players: North America is home to some of the world's largest lactic acid manufacturers, which contribute considerably to the market's dominant position. -

Strong Demand from Key Industries: North America has a high need for lactic acid in important industries such as food and drinks, bioplastics, medicines, and cosmetics.

North America Remains a key hub Lactic Acid Price Drivers Innovation and Growth.

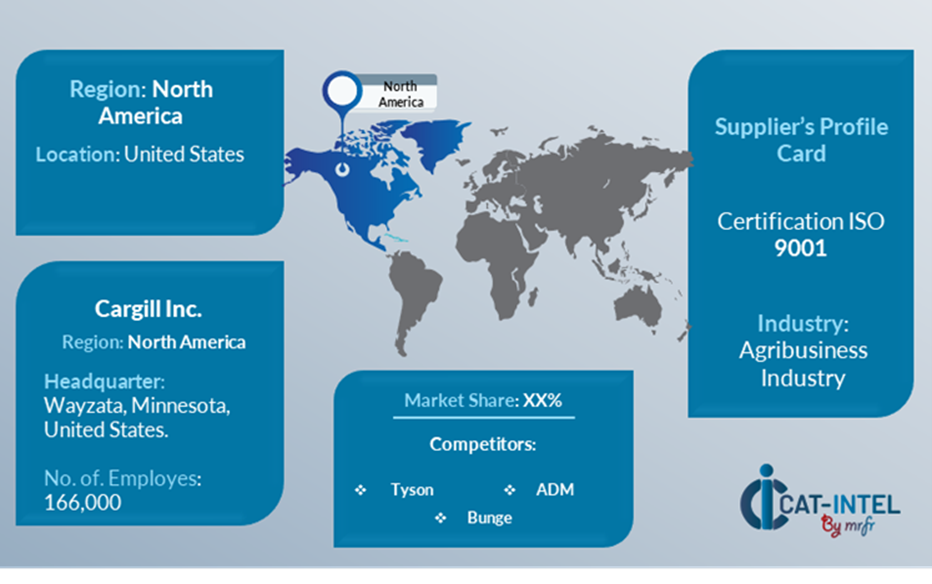

Supplier Landscape: Supplier Negotiations and Strategies

The lactic acid market's supplier environment is varied and competitive, with a mix of multinational chemical makers and specialist regional manufacturers. Established multinational companies with large-scale fermentation capabilities and diverse product portfolios dominate the market, while smaller, niche producers are gaining traction by focusing on industry-specific formulations, high-purity grades, and bio-based and sustainable production methods.

The lactic acid supplier ecosystem spans key manufacturing locations and includes both large global companies and creative local producers that serve to the specific needs of industries such as food and drinks, medicines, personal care, and bioplastics. As demand increases, providers are investing in innovative fermentation technologies, renewable feedstocks, and modular production capabilities to improve efficiency and scalability.

Key Suppliers in the Lactic Acid Market Include:

- Cargill Inc.

- Corbion N.V.

- NatureWorks LLC.

- Jungbunzlauer Suisse AG

- LG Chem Ltd

- Henan Jindan Lactic Acid Technology Co., Ltd

- PolyLactic Acid (PLA) Holdings

- DuPont Tate & Lyle Bioproducts

- Sumitomo Chemical Co., Limited

- Shandong Yiwei Chemical Company, Ltd

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The lactic acid market is expanding rapidly, fueled by increased demand in industries such as food and beverage, pharmaceuticals, personal care, and bioplastics.

|

Cloud Adoption |

Manufacturers are rapidly embracing bio-based and environmentally friendly production processes in response to worldwide demand for greener options and more responsible raw material sourcing. |

Product Innovation |

Lactic acid producers are diversifying their product offerings with high-purity grades, bespoke formulations, and functional blends tailored to the unique demands of industries such as healthcare, food preservation, and biodegradable polymers. |

Technological Advancements |

Fermentation technological advancements, feedstock optimization, and process automation are increasing production efficiency, yields, and aiding scale-up initiatives in global industrial centers.

|

Global Trade Dynamics |

Shifting international trade rules, developing food safety requirements, and rising demand for biodegradable goods are all impacting export patterns and compliance tactics, particularly for multinational businesses with worldwide supply networks. |

Customization Trends |

There is a growing need for industry-specific lactic acid grades, including unique concentrations and specifications, which allows producers to provide tailored solutions and meet changing client needs in regulated areas. |

|

Lactic Acid Attribute/Metric |

Details |

Market Sizing |

The global Lactic Acid market is projected to reach USD 9.06 billion by 2035, growing at a CAGR of approximately 8.55% from 2025 to 2035.

|

Lactic Acid Technology Adoption Rate |

Approximately 60% of lactic acid manufacturers are implementing sophisticated technologies such as automated fermentation systems, AI-assisted quality control, and sustainable processing solutions to boost production efficiency and decrease environmental impact.

|

Top Lactic Acid Industry Strategies for 2025 |

Key initiatives include increasing production capacity, investing in renewable feedstocks, producing high-purity and tailored formulations, and building strategic alliances to increase the worldwide market. |

Lactic Acid Process Automation |

Approximately half of large-scale lactic acid factories include technology in fermentation monitoring, pH control,filtration, and packaging processes to boost output and minimize human error.

|

Lactic Acid Process Challenges |

Significant hurdles include variable raw material prices, regulatory compliance complexity, costly capital investment for new technologies, and logistical restrictions in emerging countries.

|

Key Suppliers |

Cargill Inc., Jungbunzlauer Suisse AG, and Henan Jindan Lactic Acid Technology Co., Ltd.are among the world's largest manufacturers of lactic acid.

|

Key Regions Covered |

North America, Europe, and Asia-Pacific are major manufacturing and consumption regions, with China, India, and the United States driving demand for bioplastics, food processing, and medicines.

|

Market Drivers and Trends |

Rising demand for sustainable materials, greater usage in food preservation and health supplements, increased investment in PLA (polylactic acid) bioplastics, and a shift toward circular economy practices are all driving market expansion.

|