Summary Overview

Isopropanol Market Overview

The global isopropanol market is steadily expanding, driven by demand from industries such as healthcare, automotive, industrial, and pharmaceuticals. This market covers many types of isopropanol, such as industrial-grade, medical-grade, and customized versions. Our paper provides a detailed examination of procurement trends, with an emphasis on cost-cutting techniques and the use of innovative technology to improve procurement and operational procedures.

The key prospective challenges in the isopropanol industry are controlling procurement costs, guaranteeing continuous supply, addressing environmental concerns, and optimizing transportation logistics. Adoption of digital tools, as well as strategic sourcing, will be critical in increasing efficiencies and remaining competitive. As global demand rises, organizations are leveraging market intelligence to improve operational performance, efficiently manage risks, and satisfy the growing need for high-quality isopropanol across diverse sectors.Market Size: The global Isopropanol market is projected to reach USD 8.52 billion by 2035, growing at a CAGR of approximately 7.63% from 2025 to 2035.

Sector Contributions: Growth in the market is driven by

Manufacturing and Supply Chain Optimization: The growing demand for isopropanol in industrial processes and cleaning applications necessitates the need for more efficient operations.

Pharmaceutical and Healthcare Demand: The rising use of isopropanol for sanitization and disinfection in healthcare settings is driving growth in this industry.

Technological Transformation: Advances in automation and data analytics allow for more accurate tracking of isopropanol production, which improves supply chain and overall operational efficiency.

Production Innovations: By developing more efficient production processes and specialty-grade isopropanol products, firms may address the needs of certain industries.

Investment Initiatives: Companies are progressively investing in more energy-efficient, sustainable production processes, as well as advanced supply chain technologies, to deliver cost reductions.

Regional Insights: Asia Pacifica and North America remain major contributors to the global isopropanol market, driven by strong industrial production and growing adoption of sustainable production.

Key Trends and Sustainability Outlook:

Sustainability in Production: A greater emphasis on environmentally friendly production methods and sustainable raw material sourcing in order to reduce environmental effect and comply with regulations.

Advanced Manufacturing Technologies: The combination of artificial intelligence, automation, and blockchain technology improves traceability, transparency, and operational efficiency in isopropanol production and distribution.

Demand for Customization: There is a growing demand for isopropanol grades and formulations tailored to industries such as pharmaceuticals, cosmetics, and automobiles.

Environmental Compliance: Producers are using technology to track resource usage and assure compliance with environmental rules, contributing to the worldwide push for sustainability.

Data-Driven Decision Making: Using advanced analytics to optimize production processes, estimate demand, and improve inventory management is becoming increasingly important for businesses to remain competitive.

Growth Drivers:

Industrial and Healthcare Expansion: The growing use of isopropanol for a variety of applications, from industrial cleaning to sanitization, is driving consistent demand in major industries such as healthcare, automotive, and electronics.

Demand for Automation: There is an increasing reliance on automation technology to increase the speed, quality, and cost-effectiveness of isopropanol manufacturing operations.

Scalability in Supply Chains: The requirement for scalable manufacturing and distribution systems that can adapt to market demand and regional restrictions.

Regulatory Compliance: Stricter laws governing product purity and environmental effect are pushing innovation in isopropanol production, with a focus on compliance through improved transparency and tracking.

Globalization: As organizations develop globally, the demand for isopropanol solutions that adhere to international legislation, multi-currency markets, and varied regional standards grows.

Overview of Market Intelligence Services for the Isopropanol Market:

Recent investigations have revealed numerous significant problems in the isopropanol business, including high procurement costs and the need for supply chain efficiency. Market intelligence studies provide meaningful insights into procurement prospects, assisting businesses in identifying cost-saving initiatives, optimizing supplier relationships, and ensuring efficient operating procedures. These insights also help to achieve industry requirements while producing high-quality products and successfully controlling costs.

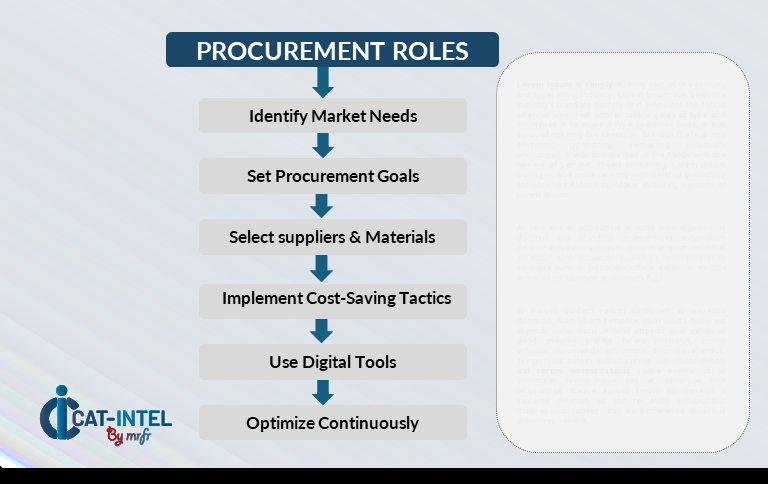

Procurement Intelligence for Isopropanol: Category Management and Strategic Sourcing

To remain competitive in the increasing isopropanol industry, businesses are fine-tuning their procurement strategies using advanced expenditure analysis and supplier performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs while maintaining a consistent supply of high-quality isopropanol. Businesses can use actionable market intelligence to refine procurement strategy, negotiate advantageous terms with suppliers, and optimize sourcing decisions to meet their specific requirements for production and distribution.

Pricing Outlook for Isopropanol: Spend Analysis

The price prognosis for isopropanol is projected to be moderately volatile, with changes caused by a variety of variables. Production technology developments, rising demand across numerous industries, regional pricing variances, and supply chain dynamics are all significant drivers. Furthermore, the growing emphasis on sustainability, regulatory compliance, and product quality is driving higher isopropanol prices.

Graph shows general upward trend pricing for Isopropanol and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement processes, improve supplier management, and implement efficient manufacturing methods are critical for cost control. Using digital technologies for market monitoring, advanced analytics-based pricing predictions, and efficient contract administration will help to reduce costs even further.

To efficiently control isopropanol procurement expenses, consider partnering with trusted suppliers, negotiating long-term contracts, and considering bulk purchasing or subscription-based pricing methods. Despite these limitations, by focusing on scalability and establishing solid supply chain operations and adopting sustainable practices will be essential for maintaining both cost-effectiveness and product quality.

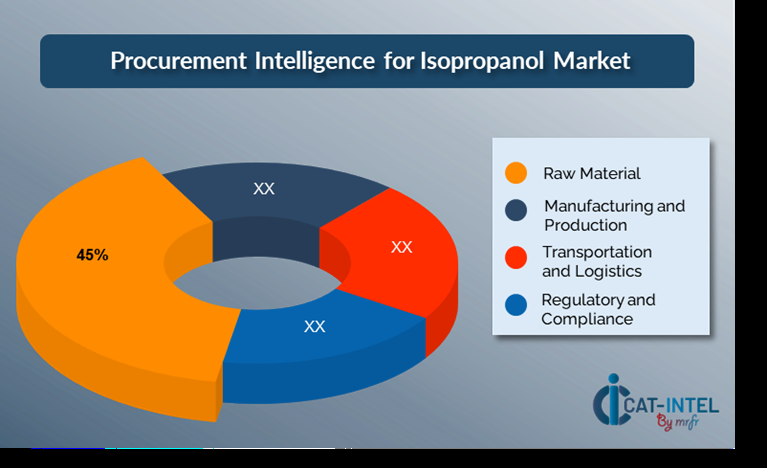

Cost Breakdown for Isopropanol: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Raw Material: (45%)

Description: It comprises the cost of propylene, a significant raw material in isopropanol manufacturing, as well as other petrochemical feedstocks.

Trend: The trend is towards the adoption of alternate feedstocks to lessen reliance on crude oil, which may result in long-term cost savings.

Manufacturing and Production: (XX%)

Transportation and Logistics: (XX%)

Regulatory and Compliance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the isopropanol business, streamlining procurement processes and using strategic negotiation strategies can lead to significant cost savings and increased supply chain efficiency. Long-term relationships with dependable suppliers, particularly those that provide bulk or sustainable sourcing choices, can result in improved price structures and more advantageous terms, such as volume discounts and long-term contract flexibility. Using flexible pricing structures such as bulk purchase and subscription-based contracts, or multi-year agreements provides opportunities to secure lower rates and shield against potential price fluctuations over time.

Partnering with suppliers who value innovation and sustainability provides additional benefits like as access to more efficient production methods, eco-friendly sourcing, and higher product quality—all of which can help decrease long-term operational expenses. Implementing digital procurement solutions, such as supplier performance management systems and inventory analytics, improves transparency, reduces stockouts, and optimizes material movement through the supply chain.

Supply and Demand Overview for Isopropanol: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The isopropanol market is also expanding steadily, propelled by a range of demand and supply variables in industries such as healthcare, pharmaceuticals, manufacturing, and automotive. Technological improvements, changing regulatory requirements, and global economic situations all have an impact on market supply and demand dynamics.

Demand Factors:

Healthcare and Hygiene Demands: The continual need for sanitization, disinfectants, and sterile conditions in healthcare, pharmaceuticals, and consumer products fuels significant demand for isopropanol.

Industrial and Manufacturing Use: The increased use of isopropanol in manufacturing operations, such as cleaning, degreasing, and as a solvent in production, drives continuous demand in a variety of industrial sectors.

Sustainability and Regulatory Pressures: Growing environmental concerns and harsher laws are driving industry to embrace sustainable manufacturing techniques and responsibly sourced chemicals.

Customization for Industry Needs: Certain industries, such as healthcare and electronics manufacturing, require unique isopropanol grades for sterilization, electronics cleaning, and cosmetic formulations.

Supply Factors:

Technological Advancements: New production technologies, such as more efficient distillation methods and green chemistry practices, are improving isopropanol supply capacities and increasing provider competitiveness.

Supplier Diversity: A growing number of suppliers, including global chemical giants and regional businesses, are offering customers with more options, enhancing market accessibility and competition.

Global Economic Conditions: Changes in raw material costs, labor costs, and currency rates have a substantial impact on the price and availability of isopropanol, resulting in variability throughout the worldwide supply chain.

Scalability and Flexibility: As the need for small-batch, high-purity isopropanol and large-scale industrial production grows, suppliers are encouraged to provide flexible production capabilities.

Regional Demand-Supply Outlook: Isopropanol

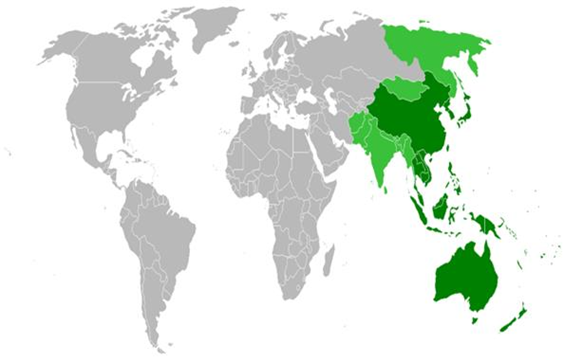

The Image shows growing demand for Isopropanol in both Asia Pacific and North America, with potential price increases and increased Competition

Asia Pacific: Dominance in the Isopropanol Market

Asia Pacific, particularly East Asia, is a dominant force in the global Isopropanol market due to several key factors:

Growing Demand for Consumer Goods: Asia-Pacific's growing urban population and rising disposable incomes are driving up demand for electronics, personal care products, and cleaning supplies.

Raw Material Availability: The region benefits from a cost-effective supply chain as well as the availability of raw materials for isopropanol production, such as propylene, assuring a consistent and inexpensive supply for both regional and global markets.

Expansion of End-Use Applications: Isopropanol is being used in more end-user applications, including automotive, cleaning, agriculture, and personal care, because to stronger hygiene and safety regulations, especially following the COVID-19 epidemic.

Strong Industrial Base: The region's strong industrial base, particularly in automotive, electronics, and textiles, creates high demand for isopropanol, which is utilized as a solvent and cleaning agent in these industries.

Rapid Industry Growth: The pharmaceutical and healthcare sectors in Asia-Pacific countries are quickly expanding. Isopropanol is critical for the manufacturing of disinfectants and sanitizers and as a key component in the pharmaceutical manufacturing process.

Asia Pacific Remains a key hub Isopropanol Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the isopropanol market is similarly diversified and competitive, with a mix of global chemical giants and regional producers impacting market dynamics. These suppliers have an impact on critical elements such as pricing, product quality, sourcing, and availability. Well-established chemical companies dominate the market, producing large volumes of isopropanol for a variety of industries, while smaller, specialized providers focus on niche applications or high-purity formulations for sectors such as healthcare, pharmaceuticals, and electronics.

The isopropanol supplier ecosystem extends across important manufacturing regions such as North America, Europe, and Asia, with global firms driving production and localized companies catering to unique industry needs. As organizations continue to prioritize operational efficiency, sustainability, and regulatory compliance, suppliers are innovating by embracing more sustainable manufacturing practices, improving product quality, and offering flexible pricing models to meet the dynamic needs of various industries.

Key Suppliers in the Isopropanol Market Include:

LG Chem

ExxonMobil

Dow Chemicals

Shell Chemicals

SABIC

Indian Oil Corporation

Ineos Group

Maruzen Petrochemical Co., Ltd

Reliance Industries

Shandong Honda Chemical Co., Ltd.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The isopropanol market is expanding rapidly, fueled by growing demand from industries such as healthcare, manufacturing, and consumer products, particularly in emerging regions where industrial expansion is quickening.

|

Cloud Adoption |

Environmental laws and customer demand for greener, safer chemical alternatives have led to an increased emphasis on eco-friendly production processes and sustainable sourcing.

|

Product Innovation |

Isopropanol suppliers are innovating by manufacturing high-purity, customized grades of isopropanol for specific industries such as medicines, cosmetics, and electronics, while bringing sustainability and efficiency improvements into production.

|

Technological Advancements |

Automated production processes, AI-powered supply chain forecasting, and IoT-enabled inventory management improve the efficiency and transparency of the isopropanol supply chain, resulting in cost reductions.

|

Global Trade Dynamics |

Changes in global trade legislation, tariffs, and compliance requirements affect isopropanol availability and costs, significantly for multinational corporations navigating complex logistics and regulatory landscapes.

|

Customization Trends |

There is a growing need for isopropanol formulations suited to specific sector requirements, such as high-purity variants for pharmaceutical applications and eco-friendly versions for consumer goods and cleaning products.

|

Isopropanol Attribute/Metric |

Details |

Market Sizing |

The global Isopropanol market is projected to reach USD 8.52 billion by 2035, growing at a CAGR of approximately 7.63% from 2025 to 2035.

|

Isopropanol Technology Adoption Rate |

Approximately 60% of enterprises in the healthcare, pharmaceutical, and manufacturing industries use isopropanol for a variety of applications, with an increasing need for high-purity and environmentally friendly alternatives.

|

Top Isopropanol Industry Strategies for 2025 |

Key initiatives include increasing the use of sustainable production processes, using sophisticated manufacturing technology for efficiency, focusing on regulatory compliance, and growing market offerings in certain areas (e.g., electronics and healthcare).

|

Isopropanol Process Automation |

To increase operational efficiency, over 50% of isopropanol production facilities use automated procedures, such as robotics and artificial intelligence for quality control and supply chain management.

|

Isopropanol Process Challenges |

Major challenges include volatility in raw material pricing, regional supply chain interruptions, and environmental regulatory compliance sustainability, and dependence on global trade dynamics.

|

Key Suppliers |

LG Chem, ExxonMobil and Dow Chemicals, and are among the leading suppliers of isopropanol, offering a diverse range of grades for a variety of applications.

|

Key Regions Covered |

Asia Pacific, North America and Europe are key markets for isopropanol adoption, with high demand from the healthcare, pharmaceutical, electronics manufacturing, and cleaning industries.

|

Market Drivers and Trends |

The increased need for disinfectants, sanitizers, and solvents in numerous industries, as well as the trend toward sustainable production and developments in manufacturing technology, are driving growth.

|