Summary Overview

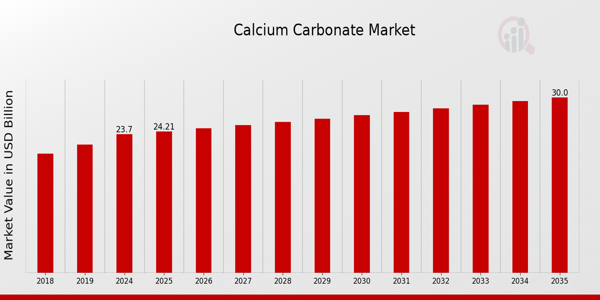

Calcium Carbonate Market Overview:

The global calcium carbonate market is experiencing steady growth, driven by increasing demand across various industries, including construction, pharmaceuticals, plastics, and food & beverages. Calcium carbonate is a versatile material used for applications such as fillers, coatings, and additives. This market is seeing significant advancements in production processes and innovations, contributing to improved product quality and reduced costs. Our report provides an in-depth analysis of emerging procurement trends, focusing on cost-effective strategies through strategic partnerships, and the growing importance of digital tools to streamline supply chain management and procurement processes.

Future procurement challenges in the calcium carbonate market include the need for accurate demand forecasting, supported by digital procurement solutions that improve responsiveness in this competitive landscape. Effective sourcing and procurement management strategies will be crucial to optimize the supply chain, minimize risks, and ensure product quality across diverse applications.

The outlook for the calcium carbonate market is positive, with robust growth expected through 2032, driven by several factors:

- Market Size: The global calcium carbonate market is anticipated to reach USD 41,382.5 billion by 2032, growing at a compound annual growth rate (CAGR) of around 5.4 % from 2024 to 2032.

Growth Rate: 5.4%

- Sector Contributions: Growth is largely driven by:

- Demand in Construction: Calcium carbonate is widely used in the construction industry as a key component in cement and building materials.

- Pharmaceutical and Food & Beverage Demand: The demand for high-quality, food-grade, and pharmaceutical-grade calcium carbonate is rising due to regulatory standards and consumer preferences for natural products.

- Technological Innovations: The market is benefiting from advancements in production techniques and the development of high-performance calcium carbonate products that cater to specific industrial applications.

- Investment Initiatives: Companies are investing in enhanced extraction technologies and supply chain improvements to meet the growing demand for calcium carbonate while ensuring sustainability and cost-effectiveness.

- Regional Insights: Asia-Pacific holds a major share in the global calcium carbonate market, driven by the industrial growth in countries like China and India. North America and Europe also remain key markets due to established industrial sectors.

Key Trends and Sustainability Outlook:

- Increased Digital Integration: Adoption of digital technologies in manufacturing and supply chain management is improving the efficiency of calcium carbonate production and distribution, reducing operational costs.

- Innovative Applications: The expanding use of calcium carbonate in newer applications such as nanotechnology and environmental remediation is creating new growth avenues for the market.

- Focus on Sustainability: As industries seek to minimize their environmental impact, there is an increasing emphasis on eco-friendly extraction methods and sustainable sourcing practices.

- Customized Solutions: Demand for specialized calcium carbonate products tailored to specific industrial applications is on the rise. Companies are developing customized solutions to meet the needs of various sectors, including pharmaceuticals and food processing.

- Data-Driven Approaches: The growing use of data analytics in production and supply chain management is optimizing the procurement process and enhancing decision-making capabilities.

Growth Drivers:

- Infrastructure Development: The ongoing demand for calcium carbonate in construction materials, including paints, coatings, and cement, is a key driver of market growth.

- Regulatory Compliance: Increasing regulatory requirements in the food and pharmaceutical industries are driving demand for high-quality, certified calcium carbonate products.

- Sustainability Practices: Rising pressure to adopt environmentally friendly practices is motivating manufacturers to explore more sustainable and efficient production methods for calcium carbonate.

- Customization of Products: Industries are increasingly seeking customized calcium carbonate solutions that meet specific product specifications and regulatory requirements.

Overview of Market Intelligence Services for the Calcium Carbonate Market:

Recent analyses highlight that the calcium carbonate market is facing challenges due to fluctuating raw material prices, rising production costs, and increasing demand for specialized products. Market intelligence reports provide valuable insights into cost-saving opportunities and procurement strategies that help stakeholders manage price volatility, ensure product quality, and optimize supply chain operations. By leveraging these insights, companies can enhance procurement processes and remain competitive in an evolving market.

Procurement Intelligence for Calcium Carbonate: Category Management and Strategic Sourcing:

To stay ahead in the competitive calcium carbonate market, businesses are refining their procurement strategies through advanced spend analysis tools, enabling better vendor management and expenditure tracking. Strategic sourcing is a key focus to ensure timely availability of high-quality calcium carbonate at competitive prices. By leveraging market intelligence and category management practices, companies can streamline supply chains, reduce procurement costs, and ensure consistency in product quality, ultimately supporting growth in diverse industry sectors.

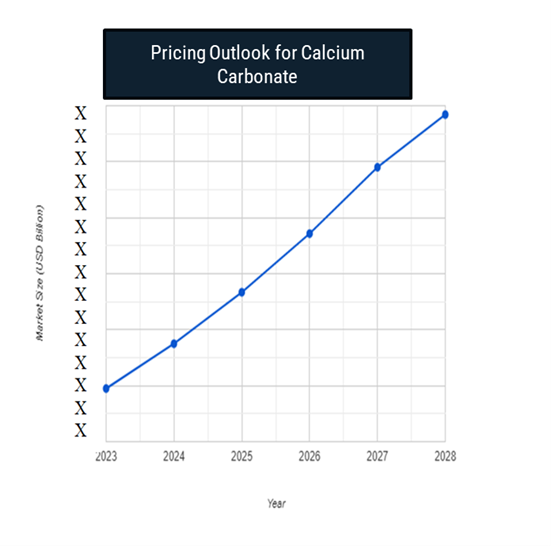

Pricing Outlook for Calcium Carbonate: Spend Analysis

The pricing outlook for calcium carbonate is expected to remain relatively stable, although potential price fluctuations may occur due to several key factors. Rising costs of raw materials, such as limestone and energy, are significant drivers of price changes. Additionally, the increasing demand for high-purity and specialized grades of calcium carbonate used in industries like pharmaceuticals, food and beverages, and plastics may also impact pricing trends.

Graph shows general upward trend pricing for calcium carbonate and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to improve manufacturing efficiency, reduce waste, and incorporate advanced technologies like automation and more efficient extraction methods are crucial in controlling production costs. Moreover, the development of alternative sourcing strategies and innovative production techniques can help mitigate price increases.

Working with environmentally conscious suppliers, prioritizing sustainable practices, and improving transportation and distribution efficiency are essential strategies for managing costs. Despite these challenges, a continued focus on research and development, maintaining high-quality standards, and adhering to industry regulations will be vital for managing price fluctuations effectively.

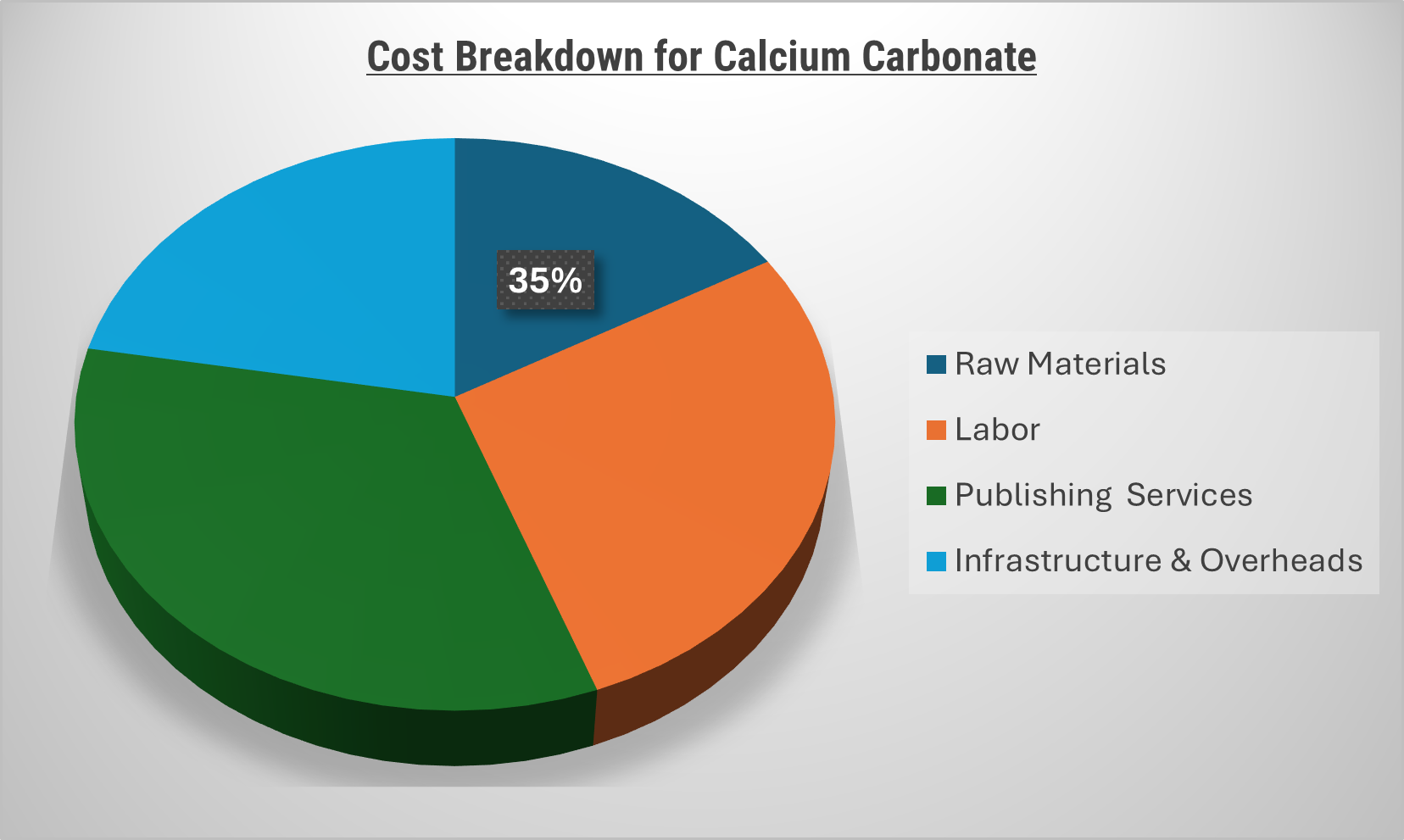

Cost Breakdown for Calcium Carbonate: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Materials (35%)

- Description: Raw materials in cables production include wires, connectors, terminals, and protective insulation materials, all of which must meet industry standards for quality, durability, and safety.

- Trends: Increasing global demand for high-performance materials and the push for eco-friendly and recyclable materials are shaping procurement trends. Suppliers are adopting innovative techniques to enhance material efficiency and sustainability.

- Labor (XX%)

- Publishing Services (XX%)

- Infrastructure & Overheads (XX%)

Cost-Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies

In the calcium carbonate industry, optimizing procurement strategies and refining production processes can result in significant cost savings and operational efficiencies. Establishing long-term partnerships with raw material suppliers, especially for limestone and energy sources, offers opportunities for bulk purchase discounts, thus lowering the overall cost per unit. Strategic collaborations with manufacturers can also lead to cost reductions through better payment terms and the realization of economies of scale. Investing in modern production technologies, such as automated grinding mills and energy-efficient kilns, can help reduce labor costs, enhance production accuracy, and minimize material waste. Moreover, focusing on energy-efficient practices and sourcing sustainable raw materials can further reduce operational expenses, while appealing to environmentally conscious consumers. Companies can also consider multi-sourcing strategies to reduce risks related to supply chain disruptions and enhance bargaining power with suppliers.

Supply and Demand Overview for Calcium Carbonate: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The calcium carbonate market continues to grow, driven by technological advancements and rising demand from industries such as construction, pharmaceuticals, food and beverages, and plastics. The supply-demand dynamics are shaped by innovations in material production, changing customer needs, and the expanding global market.

Demand Factors

- Construction and Infrastructure Growth: The demand for calcium carbonate in cement, paints, coatings, and other building materials is increasing due to the boom in infrastructure projects and construction activities globally.

- Pharmaceutical and Food Applications: The rising demand for high-purity calcium carbonate in pharmaceuticals, food additives, and dietary supplements is driving market growth.

- Plastics and Polymers: The plastics industry’s need for fillers and stabilizers in various products is another significant demand driver for calcium carbonate.

- Environmental Sustainability: The growing focus on sustainable construction materials and eco-friendly products is contributing to higher demand for calcium carbonate as a naturally occurring and environmentally friendly material.

Supply Factors

- Technological Advancements: Continuous innovations in production techniques, such as more efficient grinding processes and the development of specialty-grade calcium carbonate, enhance supply capabilities.

- Availability of Raw Materials: The availability of high-quality limestone and energy resources is a critical factor in the supply chain, influencing production costs and material quality.

- Global Supply Networks: Expansion of production facilities in regions with lower operational costs helps optimize the supply chain and reduce production costs for manufacturers.

- Supplier Competition: Intense competition among suppliers results in better pricing, improved product quality, and enhanced service offerings, benefiting buyers with more cost-effective solutions.

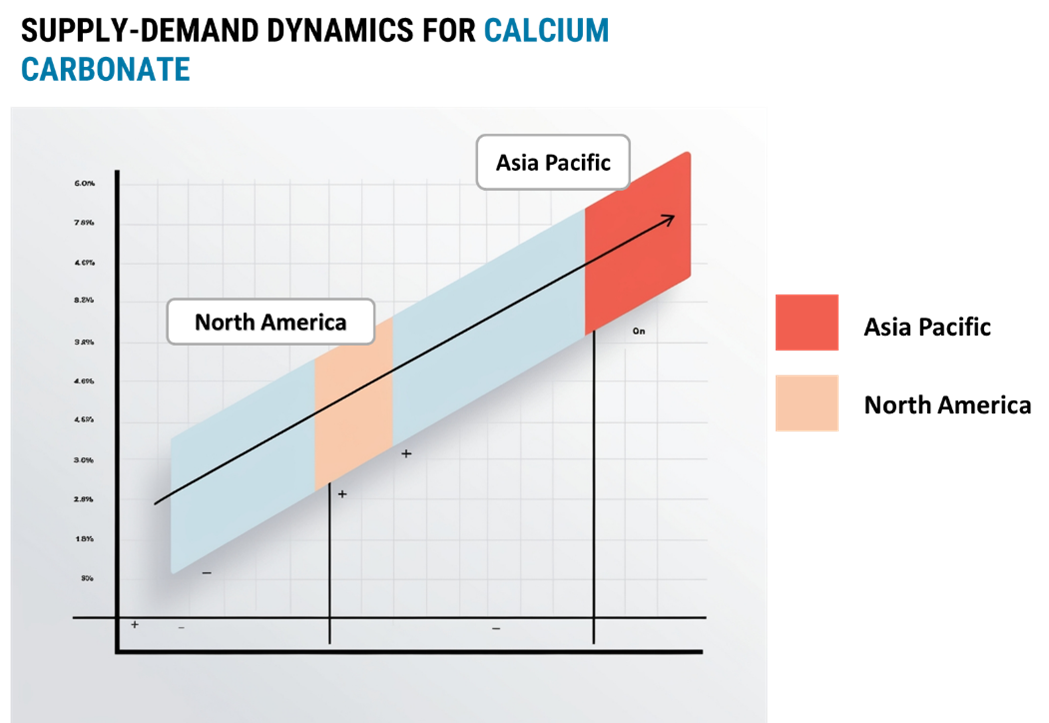

Regional Demand-Supply Outlook: Calcium Carbonate

The Image shows growing demand for calcium carbonate in both Asia and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in Calcium Carbonate

The Asia Pacific region, particularly countries like China, India, and Japan, plays a leading role in the global calcium carbonate market, driven by several key factors:

- Strong Industrial Growth: The rapid expansion of industries such as construction, automotive, and manufacturing in Asia Pacific has led to an increased demand for calcium carbonate.

- Cost-Effective Production Capabilities: The region benefits from large-scale, cost-efficient production facilities, with abundant limestone resources and lower labor costs, enabling manufacturers to produce high-quality calcium carbonate at competitive prices.

- Infrastructure Development: With significant investments in infrastructure projects across Asia Pacific, particularly in countries like China and India, there is a growing need for calcium carbonate in construction materials like cement, which drives the demand for both ground and precipitated calcium carbonate.

- Regulatory Compliance and Sustainability Initiatives: Asia Pacific manufacturers are increasingly adhering to international quality standards and environmental regulations, ensuring that their calcium carbonate products meet the necessary safety and purity levels.

Asia Pacific Remains a key hub calcium carbonate price drivers Innovation and Growth.

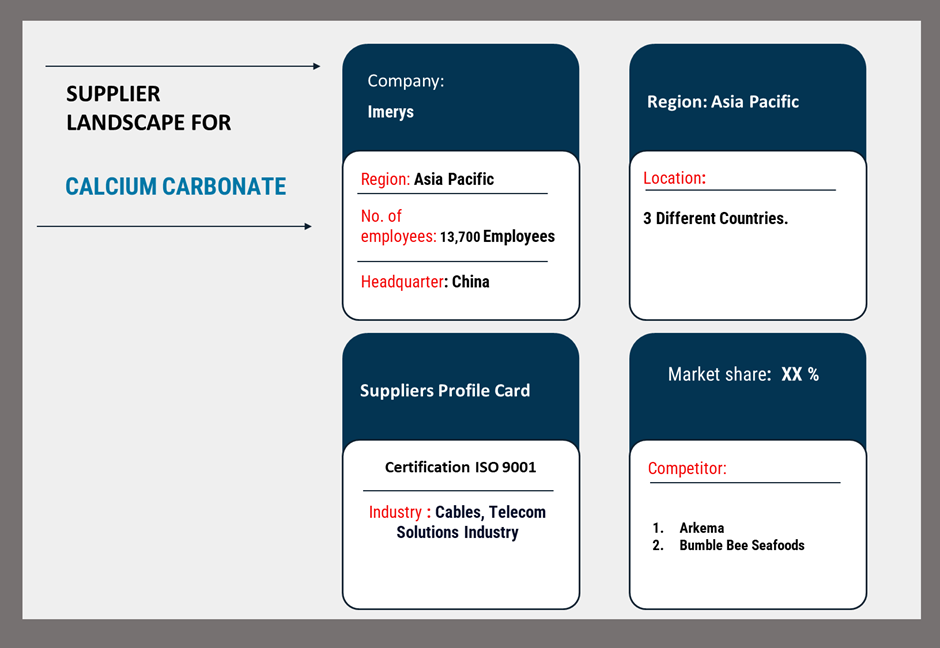

Supplier Landscape: Supplier Negotiations and Strategies for Calcium Carbonate

The supplier landscape in the calcium carbonate market is varied, with numerous global and regional suppliers playing a pivotal role in market growth. These suppliers significantly influence pricing, product innovation, and the availability of high-quality calcium carbonate products. The market is highly competitive, with both well-established players and emerging firms offering specialized products tailored to a wide range of industries.

Currently, the supplier landscape is witnessing notable innovation and strategic collaborations, as leading global suppliers maintain substantial market shares while smaller companies are expanding by focusing on niche markets such as pharmaceuticals, food and beverages, and specialized industrial applications.

Key suppliers in the calcium carbonate market include:

- Imerys

- Omya AG

- Schundelmeier

- Huber Engineered Materials

- Minerals Technologies Inc.

- Maruo Calcium Co., Ltd.

- Calcium Carbonate Plant

- Yuncheng Chemical Industry Group

- Lhoist Group

- Sibelco

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The global calcium carbonate market is expanding, driven by demand from industries such as construction, plastics, and pharmaceuticals. |

Sustainable Practices |

Focus on eco-friendly production methods and the use of renewable energy sources is enhancing sustainability in the market. |

Product Diversification |

Diversification in calcium carbonate products, including ground and precipitated grades, caters to various industrial and specialized applications. |

Technological Innovations |

Adoption of advanced processing technologies, such as nano-calcium carbonate production, improves product quality and reduces costs. |

E-commerce Expansion |

Growth in online sales channels facilitates global access to calcium carbonate products, meeting industrial and commercial needs. |

Focus on Miniaturization |

Rising demand for high-purity, fine particle calcium carbonate supports developments in electronics, pharmaceuticals, and food industries. |

Regional Manufacturing Hubs |

Development of cost-effective manufacturing hubs in Asia Pacific and North America strengthens supply chains and boosts production capacity. |

Calcium Carbonate Attribute/Metric |

Details |

Market Sizing |

Global calcium carbonate market is anticipated to reach USD 41,382.5 billion by 2032, growing at a compound annual growth rate (CAGR) of around 5.4 % from 2024 to 2032. |

Technology Adoption Rate |

Approximately 35% of manufacturers are adopting advanced processing technologies, including nano-calcium carbonate production and high-purity formulations. |

Top Strategies for 2024 |

Focus on enhancing product quality, expanding applications in pharmaceuticals and food, ensuring regulatory compliance, and integrating sustainable production methods. |

Process Automation |

25% of companies have automated production processes, such as grinding, precipitation, and quality testing, to improve efficiency and consistency. |

Process Challenges |

Major challenges include managing raw material availability, meeting strict quality standards, and addressing environmental concerns. |

Key Suppliers |

Leading suppliers include Imerys, Omya AG, Minerals Technologies Inc., Huber Engineered Materials, and Sibelco, offering a range of calcium carbonate products. |

Key Regions Covered |

Asia-Pacific, North America, and Europe, with significant demand in China, India, the U.S., and Germany driven by construction, plastics, and food industries. |

Market Drivers and Trends |

Growth driven by increased use in construction, demand for plastics and paints, eco-friendly production trends, and advancements in pharmaceutical applications. |