Summary Overview

Air Freight Australia Market Overview:

The air freight market is steadily expanding, fuelled by rising demand in industries such as manufacturing, retail, healthcare, and e-commerce. This sector offers a variety of air freight solutions, including expedited, standard, and temperature-controlled services. Our paper examines procurement trends in depth, with an emphasis on cost optimization tactics and the use of digital tools to improve logistics and operational efficiency.

Procurement's key future challenges include managing rising fuel costs, assuring scalability, preserving data security in tracking systems, and integrating air freight solutions with current supply chain networks. Digital technologies and strategic sourcing are critical for improving air freight operations, assuring timely delivery, and increasing long-term competitiveness. As worldwide demand for speedier shipping grows, businesses are using market data to increase operational efficiency, shorten lead times, and reduce the risks associated with supply chain interruptions. In the Australian air freight sector, the demand for dependable, cost-effective, and scalable air freight solutions is growing. Companies are concentrating on employing modern technologies like IoT for real-time tracking and AI for predictive analytics to make better decisions and estimate demand more accurately.

Market Size: The Air Freight Australia market is projected to reach AUD 2.59 billion by 2035, growing at a CAGR of approximately 3.84% from 2025 to 2035.

Growth Rate: 3.84%

Growth Rate: 3.84%

Manufacturing and Supply Chain Optimization: Companies are increasingly resorting to air freight solutions to address the demand for faster delivery and more efficient logistics management.

Retail and E-commerce Growth: With the increasing rise of the retail and e-commerce industries, firms are leveraging air freight to optimize inventory management and assure speedier order fulfilment and provide better customer service. As demand for speed and reliability increases, the air freight market is evolving to cater to these needs

Technological Transformation: Artificial intelligence (AI) and machine learning technologies are driving innovation in air freight solutions. Predictive analytics and automation are being used to improve route optimization, decrease delays, and increase fuel efficiency.

Innovations: Air freight companies are increasingly adopting modular logistics solutions, which enable businesses to select and integrate the exact services they require, such as temperature-controlled cargo and tracking capabilities, lowering costs and boosting flexibility.

Investment Initiatives: Air freight businesses are investing in modern technologies and infrastructure to streamline operations, cut costs, and improve service.

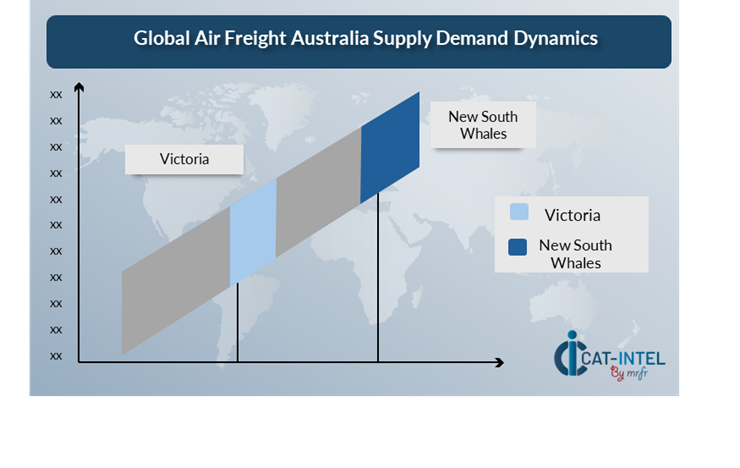

Regional Insights: New South Whales and Victoria identifies prominent regions for air freight due to their strong digital infrastructure, adoption of cloud-based logistics solutions, and desire for fast and reliable delivery.

Key Trends and Sustainability Outlook:

Cloud Integration: The growing use of cloud-based solutions is making air freight more scalable, cost-effective, and accessible to businesses that want real-time data and tracking.

Advanced Features: Technologies such as artificial intelligence, Internet of Things, and blockchain are being integrated with air freight services to improve decision-making, transparency, and shipment security.

Focus on Sustainability: Sustainability is a growing trend in air freight, with corporations striving on lowering carbon emissions through route optimization, fuel-efficient equipment, and the use of environmentally friendly packaging.

Customization Trends: There is an increasing need for industry-specific air freight services, notably in sectors such as pharmaceuticals, autos, and perishable commodities, which require specialist logistical solutions.

Data-Driven Insights: Advanced data analytics enables air freight carriers to optimize operations and estimate demand and track shipment performance, leading to more efficient supply chain management.

Digital Transformation: The introduction of digital tools and technologies is altering the air freight business by allowing for real-time tracking, automated route planning, and improved service.

Demand for Process Automation: The desire for faster, more efficient processes is driving the automation of many parts of air freight, including document processing, inventory management, and shipment tracking.

Scalability Needs: Businesses are looking for scalable air freight solutions that can grow with their demands and handle unpredictable demand, particularly as supply networks expand.

Regulatory Compliance: Because air freight frequently involves international shipments, businesses rely on air freight services to help them comply with worldwide rules, such as customs clearances and cargo safety standards.

ization: The rise of trade has boosted the need for air freight solutions that support multi-currency, multi-language, and compliance with international regulations.

Overview of Market Intelligence Services for the Air Freight Australia Market:

Recent evaluations have identified important problems in the air freight sector, including increased transportation costs and the need for service customization to satisfy industry expectations. Market intelligence reports provide useful insights into procurement prospects, allowing businesses to identify cost-cutting initiatives, optimize supplier relationships, and improve operational efficiency. These insights also help to comply with international shipping standards and assure high-quality service delivery while effectively controlling expenses.

Procurement Intelligence for Air Freight Australia: Category Management and Strategic Sourcing

To remain competitive in the air freight industry, businesses are optimizing procurement procedures using spend analysis and vendor performance tracking. Effective category management and strategic procurement are essential for lowering logistics costs and maintaining a steady supply of high-quality air freight services. Businesses can improve service quality while reducing costs by employing actionable market knowledge to enhance procurement strategy, negotiate advantageous terms with air freight carriers, and optimize delivery schedules.

Pricing Outlook for Air Freight Australia: Spend Analysis

The pricing outlook for air freight services in Australia is projected to be moderately dynamic, with potential fluctuations caused by a variety of variables. Fuel price variations, desire for speedier transportation, particular cargo customisation requirements, and regional pricing disparities are all important factors to consider. Furthermore, the increasing usage of technological integrations such as AI-powered route optimization, IoT tracking for real-time data,

Graph shows general upward trend pricing for Air Freight Australia and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Graph shows general upward trend pricing for Air Freight Australia and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to simplify procurement procedures, improve vendor management, and implement modular air freight solutions are critical for cost control. Leveraging digital tools for market monitoring, advanced analytics-based pricing forecasting, and efficient contract administration will help the Australian air freight sector become more cost-effective.

Partnering with reputable air freight suppliers, negotiating long-term contracts, and investigating flexible pricing methods such as volume-based discounts and subscription-based models are all critical tactics for effectively managing air freight expenses. Despite these hurdles, scalability, easy operational implementation, and the use of cloud-based logistics platforms will be important to sustaining cost-effectiveness and efficiency in the competitive Australian air freight market.

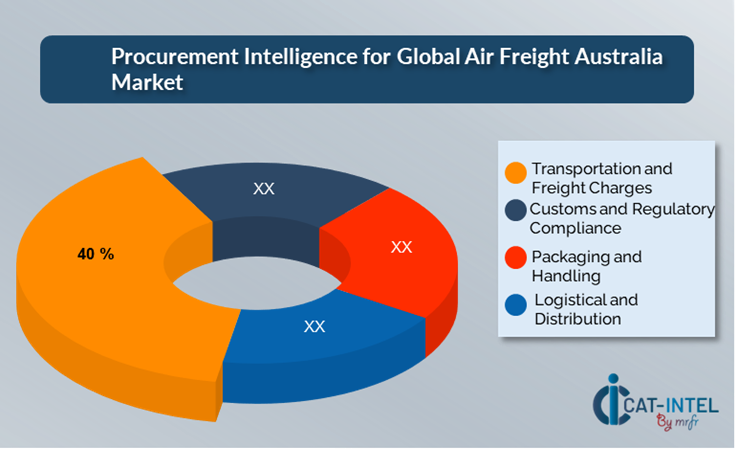

Cost Breakdown for Air Freight Australia: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Transportation and Freight Charges: (40%)

Description: The cost of air transport, comprising base rates, fuel surcharges, and weight-based charges, accounts for most air freight expenditures.

Trend: Transportation and freight management systems are increasingly being digitized and automated. This involves using real-time tracking, AI-powered route optimization, and cryptocurrency to improve transparency and efficiency.

Customs and Regulatory Compliance: (XX%)

Packaging and Handling: (XX%)

Storage and Warehousing: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Australian air freight industry, improving procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Long-term agreements with air freight service providers, particularly those providing cloud-based logistics platforms, can result in better pricing structures and more advantageous conditions, such as volume-based discounts and bundled service packages.

Collaborating with air freight providers who prioritize innovation and scalability provides additional benefits, such as access to advanced analytics, AI-powered route optimization, and modular logistics solutions, which reduce long-term operational costs. Implementing digital procurement technologies, such as contract management platforms and usage analytics, improves transparency, reduces overprovisioning, and maximizes service use. Diversifying vendor alternatives and implementing multi-vendor strategies can lessen reliance on a single source while mitigating risks such as service interruptions.

Supply and Demand Overview for Air Freight Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Australian air freight market is steadily expanding, driven by rising demand for fast, dependable, and cost-effective transportation solutions in industries such as manufacturing, retail, and healthcare. Technological improvements, industry-specific needs, and regional economic considerations all have an impact on supply and demand.

Demand Factors:

E-commerce Growth and Trade: The growth of e-commerce and international trade is increasing demand for air freight services to assure quick delivery times, particularly for perishable commodities and high-value items.

Adoption of Cloud-based Logistics Solutions: The trend to cloud-based freight management solutions is driving up demand for scalable, subscription-based air freight services that provide greater tracking and analytics.

Industry Specific Requirements: Pharmaceutical, electronics, and automotive industries all demand specialized logistics solutions that are adapted to regulatory standards and supply chain requirements.

Seamless Integration with Business Systems: There is a growing need for air freight services that integrate smoothly with other logistics management software and IoT devices to enable real-time tracking and process optimization.

Supply Factors:

Technological Advancements: AI, machine learning, and IoT are improving air freight services through route optimization, fuel cost reduction, and operational efficiency.

Vendor Ecosystem: An increasing number of air freight providers, including and regional operators, give different options for Australian firms wishing to optimise their logistics operations.

Regional Economic Factors: Exchange rates, fuel prices, and labour costs in Australia, as well as the country's economic situation, all have a substantial impact on the pricing and availability of air freight services.

Scalability and Flexibility: Modern air freight solutions have grown more modular, allowing service providers to serve to enterprises of different sizes and sectors by providing flexible choices to fulfil unique logistical requirements.

Regional Demand-Supply Outlook: Air Freight Australia

The Image shows growing demand for Air Freight Australia in both New South Whales and Victoria, with potential price increases and increased Competition

New South Whales: Dominance in the Air Freight in Australia

New South Australia, particularly Sydney, is a dominant force in the air freight market due to several key factors:

Strategic Location: Sydney is strategically positioned as Australia's primary gateway to significant foreign markets, including Asia-Pacific, North America, and Europe.

Sydney Kingsford Smith Airport (SYD) Infrastructure: Sydney's Kingsford Smith Airport is Australia's busiest and best-equipped airport for both passenger and cargo travel. Its upgraded facilities, advanced technology, and efficient customs processes enable high-volume, fast-tracked air freight operations while also ensuring connection.

Strong Business and Economic Hub: As Australia's financial and business hub, Sydney is home to a huge number of corporations, increasing demand for air freight services. The city's role as an economic hub necessitates effective logistics solutions to support businesses such as pharmaceuticals, retail, manufacturing, and agriculture.

Established Air Freight Network: Major airlines, like Qantas, Emirates SkyCargo, Singapore Airlines Cargo, and others, fly straight from Sydney, offering a diverse choice of services and strong international connections for prompt and dependable delivery.

Access to key Freight Markets: It is a transshipment point for air freight, providing fast access to key manufacturing hubs in China, Southeast Asia, and elsewhere, making it an appealing option for both Australian exporters and worldwide importers.

New South Whales Remains a key hub Air Freight Australia Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The Australian air freight supplier landscape is diversified and highly competitive, with both market leaders and regional players shaping the industry's dynamics. These vendors have a significant impact on pricing patterns, service quality, and operational efficiency. The market is dominated by well-known air freight service providers that provide complete logistics solutions, while smaller, specialized firms focus on business needs such as perishable goods, temperature-sensitive shipments, or tailored service offerings like advanced tracking and AI-driven route optimization.

The air freight supplier ecosystem in important transportation zones comprises well-known carriers such as DHL, FedEx, and UPS, as well as innovative local Australian operators who cater to unique regional needs. As Australian businesses prioritize speed, reliability, and cost-efficiency in logistics, air freight suppliers are developing cloud-based logistics platforms, incorporating cutting-edge technologies such as IoT tracking and AI-powered route optimization, and offering flexible pricing models such as subscription-based services to meet market demands. These innovations enable firms to manage supply chains and provide speedier, more efficient air freight services.

Key Suppliers in the Air Freight market in Australia include:

Qantas Freight

DHL Express

Federal Express

United Parcel Service (UPS)

Toll Group

Kuehne + Nagel

DB Schenker

China Airlines Cargo

Singapore Airlines Cargo

Emirates SkyCargo

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The Australian air freight business is growing significantly, driven by the desire for faster, more effective delivery alternatives, especially as e-commerce and international trade continue to rise, especially in the Asia-Pacific area. The growing demand for speedy and dependable transportation services has prompted firms to seek low-cost air freight solutions to support their worldwide supply chains.

|

Cloud Adoption |

The air freight business is increasingly turning to cloud-based logistics technologies because to the need for real-time tracking, remote access, and scalability. This shift improves the effectiveness of logistics operations, allowing organizations to streamline supply chains, cut operational costs, and improve customer service.

|

Product Innovation |

Air freight companies in Australia are diversifying their products by including AI-powered analytics, real-time data processing, and smart logistics solutions specialized to specific industries such as healthcare, automotive, and electronics. These advances assist firms to manage their supply networks by providing better route planning, predictive analysis.

|

Technological Advancements |

Technological advancements, including machine learning, IoT integration, and RPA, are transforming air freight logistics. These technologies improve predictive insights, automate tracking and inventory management, and optimize shipping routes, allowing air freight businesses to deliver more efficiently.

|

Trade Dynamics |

As Australian businesses become more involved in worldwide trade, air freight services are adjusting to suit the changing needs of international supply chains, providing solutions that comply with customs rules and assure timely deliveries.

|

Customization Trends |

Whether it's specialized handling for perishable goods, temperature-controlled shipments, or integration with third-party tools to improve tracking and reporting, Australian businesses are increasingly turning to flexible, personalized air freight solutions to meet their specific operational needs.

|

Air Freight Australia Attribute/Metric |

Details |

Market Sizing |

The Air Freight Australia market is projected to reach AUD 2.59 billion by 2035, growing at a CAGR of approximately 3.84% from 2025 to 2035.

|

Air Freight Australia Technology Adoption Rate |

Around 60-65% of logistics and supply chain organizations worldwide have implemented modern air freight solutions, with a clear trend toward digital platforms and real-time tracking systems that improve scalability and flexibility in operations.

|

Top Air Freight Australia Industry Strategies for 2025 |

Key air freight industry strategies for 2024 include integrating AI and machine learning to optimize route planning and predictive maintenance, streamlining operations with modular air freight systems, prioritizing cybersecurity to protect cargo data, and implementing mobile logistics systems to provide real-time tracking and customer visibility.

|

Air Freight Australia Process Automation |

Approximately 50-55% of air freight operations have automated processes such as cargo tracking, inventory management, and customs processing to increase productivity and lower the risk of human mistake, resulting in faster delivery times.

|

Air Freight Australia Process Challenges |

High operational expenses, complex regulatory requirements, capacity constraints in air transport, and reliance on volatile fuel prices are all significant issues in air freight. Furthermore, the ongoing desire for speedier deliveries frequently causes supply chain bottlenecks and delays.

|

Key Suppliers |

Leading air freight firms include Qantas Freight, DHL Express and Federal Express. These organizations provide comprehensive solutions for worldwide air transportation, logistics management, and supply chain optimization.

|

Key Regions Covered |

Prominent regions for air freight adoption include New South Whales, Victoria and Queensland, with high demand from businesses such as e-commerce, medicines, and automobiles.

|

Market Drivers and Trends |

The air freight industry is expanding due to increased demand for real-time tracking systems, faster delivery services, scalable logistics platforms, and the integration of modern technologies such as IoT, AI, and machine learning to optimize shipping routes and predict delays.

|