Rising Demand for Cost Efficiency

The Healthcare BPO Market is experiencing a notable surge in demand for cost efficiency among healthcare providers. As healthcare organizations strive to reduce operational costs while maintaining quality services, outsourcing non-core functions has become increasingly attractive. Reports indicate that healthcare providers can save up to 30% on operational costs by leveraging BPO services. This trend is particularly pronounced in administrative tasks such as billing, coding, and claims processing, where specialized BPO firms can offer expertise and technology that streamline processes. Consequently, the Healthcare BPO Market is likely to expand as more organizations recognize the financial benefits of outsourcing, thereby driving growth and innovation in the sector.

Focus on Enhanced Patient Experience

The emphasis on enhanced patient experience is becoming a critical driver in the Healthcare BPO Market. As patients increasingly demand personalized and efficient services, healthcare providers are turning to BPO solutions to improve service delivery. Outsourcing functions such as appointment scheduling, telehealth services, and patient follow-ups allows healthcare organizations to focus on core competencies while ensuring a seamless patient experience. The market for patient engagement solutions is projected to grow significantly, indicating a shift towards more patient-centric care models. This focus on patient experience is likely to propel the Healthcare BPO Market forward, as organizations seek to meet evolving patient expectations.

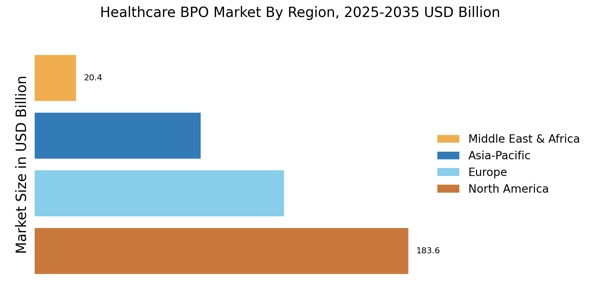

Growing Global Healthcare Expenditure

The growing The Healthcare BPO Industry. As countries allocate more resources to healthcare, the demand for efficient service delivery and operational support increases. According to recent estimates, global healthcare spending is expected to reach USD 10 trillion by 2025, creating a substantial market for BPO services. This increase in expenditure is prompting healthcare organizations to seek outsourcing solutions that can help manage costs while improving service quality. Consequently, the Healthcare BPO Market is poised for growth as organizations look to capitalize on the rising healthcare budgets and the need for efficient operational strategies.

Technological Advancements in Healthcare

Technological advancements are playing a pivotal role in shaping the Healthcare BPO Market. The integration of artificial intelligence, machine learning, and data analytics into BPO services is enhancing operational efficiency and improving patient outcomes. For instance, AI-driven tools can automate routine tasks, allowing healthcare providers to focus on patient care. Moreover, The Healthcare BPO Market is projected to reach USD 50 billion by 2026, indicating a growing reliance on data-driven decision-making. As technology continues to evolve, the Healthcare BPO Market is expected to adapt, offering more sophisticated solutions that cater to the needs of healthcare organizations, thus fostering further growth.

Increased Regulatory Compliance Requirements

The Healthcare BPO Market is significantly influenced by the increasing regulatory compliance requirements imposed on healthcare organizations. With the rise of stringent regulations aimed at protecting patient data and ensuring quality care, healthcare providers are compelled to seek external expertise to navigate these complexities. BPO firms specializing in compliance can help organizations adhere to regulations such as HIPAA and GDPR, thereby mitigating risks associated with non-compliance. This trend is likely to drive demand for BPO services, as healthcare organizations prioritize compliance and risk management, ultimately contributing to the growth of the Healthcare BPO Market.