Certified Global Research Member

Key Questions Answered

- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

Why Choose Market Research Future?

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

The Military Body Armor Market is a segment within the broader defense industry, driven by the imperative to enhance the protection and survivability of military personnel in various operational environments. The market dynamics are predominantly shaped by the evolving nature of modern warfare, increased focus on soldier survivability, technological advancements in materials, and the ongoing threat of asymmetric conflicts. One of the key drivers influencing the Military Body Armor Market is the changing nature of combat scenarios, characterized by unconventional warfare, insurgency, and counter-terrorism operations. Military forces worldwide recognize the need for advanced body armor solutions that can effectively safeguard soldiers against a range of threats, including ballistic, blast, and fragmentation hazards.

Technological innovation is a pivotal factor shaping the dynamics of the Military Body Armor Market. Manufacturers continually invest in research and development to enhance the protective capabilities of body armor systems. Advancements in materials, such as high-performance fibers, ceramics, and composite structures, contribute to the development of lighter, more durable, and flexible body armor solutions. The integration of smart materials and emerging technologies, such as sensors and communication systems, further adds to the complexity and capabilities of modern military body armor.

The threat landscape and regional security concerns significantly influence the market dynamics of military body armor. As military forces adapt to emerging threats, the demand for specialized body armor configurations evolves. The market responds with tailored solutions, including modular armor systems that can be customized based on mission requirements. The ability to provide protection against a spectrum of threats, from small arms fire to improvised explosive devices (IEDs), shapes the development and deployment of military body armor systems.

Government defense budgets and procurement strategies play a crucial role in the Military Body Armor Market dynamics. Defense agencies allocate funds for the acquisition of protective equipment, including body armor, based on strategic priorities and threat assessments. Economic conditions, geopolitical considerations, and evolving security challenges influence defense spending, impacting the pace and scale of military body armor procurements. Market players must navigate these budgetary considerations and align their offerings with the evolving needs of defense agencies to secure contracts and remain competitive.

The operational requirements and preferences of military end-users contribute to the market dynamics of body armor systems. Soldiers and tactical units may prioritize factors such as weight, mobility, and comfort, in addition to protection levels. The market responds with innovations in design, ergonomics, and materials to address these considerations, ensuring that body armor systems provide optimal protection without hindering the agility and effectiveness of military personnel.

Global conflicts and international collaborations also impact the Military Body Armor Market dynamics. Military alliances and partnerships influence the standardization of protective equipment, including body armor, to enhance interoperability among allied forces. Joint development programs and multinational procurements create a dynamic environment where manufacturers with the ability to meet international standards and specifications gain a strategic advantage in the market.

The evolving threat of unconventional warfare, including urban warfare and counterinsurgency operations, shapes the requirements for military body armor. As military forces engage in diverse operational environments, the need for body armor that offers not only ballistic protection but also effective mitigation against blast and fragmentation hazards becomes paramount. The market dynamics respond to these evolving threats with the development of multi-threat body armor systems designed to address the complex challenges faced by modern armed forces.

Military Body Armor Market Highlights:

Global Military Body Armor Market Overview

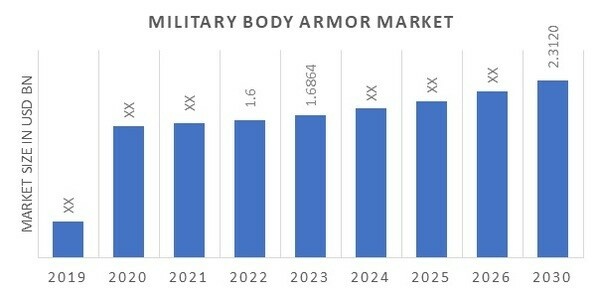

Military Body Armor Market Size was valued at USD 1.6 billion in 2022. The Military Body Armor market industry is projected to grow from USD1.6864 Billion in 2023 to USD 2.31208 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.40% during the forecast period (2023 - 2030) and increased Innovative techniques that can offer enhanced protection. The combination of technology has also resulted in lightweight armor, the key market driver enhancing market growth.

Source Secondary Research, Primary Research, MRFR Database, and Analyst Review

Military Body Armor Market Trends

- Rising terrorism and hostile activities worldwide are driving market growth

One of the major drivers in the military body armor market is the rising terrorism and hostile activities worldwide. Due to this, countries and governments are highly expanding their defense. There are many territorial conflicts as well that have increased military operations in the past. To provide additional safety to the soldiers, several countries are investing in bulletproofs, vests, and modern military body armor for their military. For instance, in 2019, KDH Defense Systems Inc. announced that the company got a contract worst $29.9 million from the US Army and the other two contracts worth $40 million. Furthermore, rising military warehouses worldwide have increased the need for military body armor, propelling the market CAGR.

Additionally, the growing awareness about commercial security in the U.S. drives the demand for body armor. Furthermore, as threats become more prevalent, worries about security in commercial areas such as retail security, healthcare security, and transportation security are growing rapidly. As a result, demand for this product is expected to rise over the forecast period.

Modern-day warfare practices include counterinsurgency, counterterrorism, and guerrilla warfare operations that may injure soldiers, causing fatal injuries. Similar scenarios exist in law enforcement wherein criminals, felons, and law offenders can fatally injure corresponding officers, thus necessitating investment in personal body armor and related equipment.

Outlook military is influenced by evolving geopolitical tensions, emerging technologies, and the imperative to adapt to new security threats, driving investments in modernization and cybersecurity measures.

Body armor is specifically developed to shield the wearer from the effect of firearm rounds on human organs. Body armor saves several lives. It also provides additional protection during car accidents and other assaults on police officers. Most law-enforcement body armor and helmets are designed to defeat attacks from handgun firing. They are driving the military body armor market revenue.

Military Body Armor Market Segment Insights

- Military Body Armor Level Insights

Based on Level, the Military Body Armor market segmentation includes Level I, Level IIA, Level II, Level IIIA, Level III, and Level IV. The level IV segment accounted for the highest military body armor market share of 25% in 2022. This is due to the high performance of Level-IV armor. Level IIIA is a soft armor category. The materials used to make the Level IIIA and Level III choices differ. The Level IIIA product can also be used with other protective panels by giving maximum protection. This type of body armor can be worn overtly as well as covertly. Some manufacturers also offer IIIA+ products to protect against shotgun shells, such as 9 mm civil defense rounds. The Level II segment is expected to grow at a CAGR of 7.0% over the forecast period. Level II protection armor protects a common handgun round and is lightweight, concealable, and comfortable. Compared to Level IIA, Level II provides greater protection against blunt force trauma. The level III product is suitable for council employees, officers, and even civilians and is the widely used protection armor.

- Military Body Armor Material Insights

Based on Material, the Military Body Armor market segmentation includes Law Enforcement Protection and Civilians. The law enforcement segment accounted for the highest military body armor market. Security personnel and first respondents will likely boost demand for this product over the projected period as they carry out their duties to ensure safety and security and detect, prevent, and prosecute offenses. Increasing government expenditure for internal safety and control in the country worldwide is also likely to propel the segment's growth. The enormous weight of the body armor makes it difficult for military men to wear and move freely on the battlefield.

- Military Body Armor Application Insights

Based on Material, the Military Body Armor market segmentation includes steel, UHMWPE, aramid, composite ceramic, and others. Composite ceramic accounted for 30% of 2022 due to the growing demand for body armor with high protective properties. Military surplus body armor with ceramic plates offers many advantages and is highly protective.

- Military Body Armor Product Type Insights

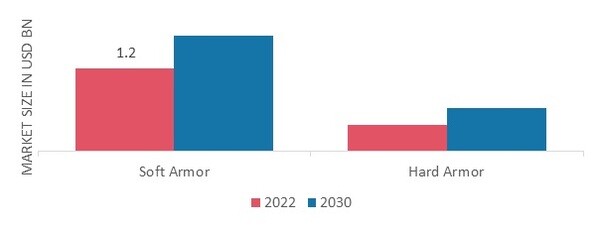

Based on product type, the Military Body Armor market segmentation includes soft and hard armor. Among these, the soft armor segment dominated the market with a share of 44.9% in 2022. This was because soft shields are ideal for flexibility and comfort. Soft product provides highly flexible and comfortable protection against pistol ammo and is used by law enforcement officers, first respondents, and for covert operations. At the same time, hard product uses durable materials, such as ceramics, ceramic composites, steel, polyethylene, and occasionally, materials like Kevlar.

Figure1: Military Body Armor Market, by Product Type, 2022 & 2030 (USD billion)

Source Secondary Research, Primary Research, MRFR Database, and Analyst Review

- Military Body Armor Product Style Insights

Based on the style, the Military Body Armor market segmentation includes covert and overt. The overt segment led the military body armor market by registering the highest share of over 85% in 2022. This can be attributed to higher protection from large spikes/blades and heavy gunfire. Overt body armor is worn on top of the clothing and is often bulkier and heavier as engineered using various Kevlar layers. The covert type is expected to witness a CAGR of 6.9% over the forecast period. Compared with the overt kind, covert armor can comfortably be worn beneath regular clothing or a standard uniform. This benefit makes it ideal for a very important person (VIP) and security staff who prefer something other than showcasing the armor.

For instance,In February 2022, India advertised fresh "Veer" helmets for the Indian Army's soldiers. Defense drafted these helmets and Homeland Security Company MKU, which are consonant with the modular accessory connector system employed for multi-accessory installation.

For instance,February 2021 DuPont de Nemours Inc. recently acquired Core Matrix Technology, a Tex Tech Industries Inc. subsidiary specializing in bullet fragmentation and ballistic performance solutions for the military. Additionally, they also help reduce back trauma disorders. This acquisition aligns with expanding the firm's presence towards an expanded portfolio.

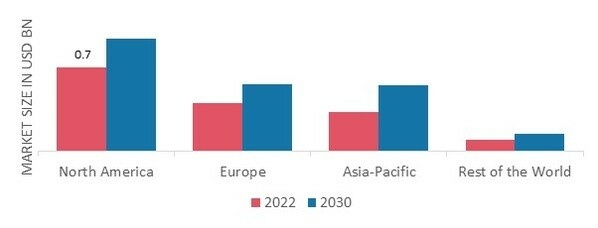

- Military Body Armor Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. North America, this rising adoption of ballistic protection suits in various industries will boost the market growth in this Region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure2: MILITARY BODY ARMOR MARKET SHARE BY REGION 2022 (%)

Source Secondary Research, Primary Research, MRFR Database, and Analyst Review

Europe's Military Body Armor market accounts for the second-largest market share dueto the increased spending attributed to military upgradation in terms of personal safety and weapons upgrades. Further, the German Military Body Armor market held the largest market share, and the UK Military Body Armor market was the fastest-growing market in the European Region.

The Asia-Pacific Military Body Armor Market is expected to grow at the fastest CAGR from 2023 to 2030. This is due to increased military spending in the Region. Moreover, China’s Military Body Armor market held the largest market share, and the Indian Military Body Armor market was the fastest-growing market in the Asia-Pacific region.

Military Body Armor Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Military Body Armor market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The military body armor industry must offer cost-effective items to expand and survive in a more competitive and rising market climate.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the Military Body Armor industry to benefit clients and increase the market sector. In recent years, the Military Body Armor industry has offered some of the most significant advantages to the military. Major players in the Military Body Armor market, including Elmon (Greece), Honeywell (US), BAE Systems (UK), Coorstek Inc. (US), Du Pont (US), Point Blank Enterprises Inc (US), and others, are attempting to increase market demand by investing in research and development operations.

DuPont de Nemours, Inc., commonly shortened to DuPont, is an American multinational chemical company first formed in 1802 by a French American chemist and industrialist. The company played a major role in the development of Delaware and first arose as a major supplier of gunpowder. DuPont’s expertise spans high-performance fibers and foams, aramid papers, non-woven structures, water purification technologies, and protective garments. DuPont de Nemours Inc. recently acquired Core Matrix Technology, a Tex Tech Industries Inc. subsidiary specializing in bullet fragmentation and ballistic performance solutions for the military. Additionally, they also help reduce back trauma disorders. This acquisition aligns with expanding the firm's presence towards an expanded portfolio.

MKU manufactures optronics devices like night vision binoculars and monocular as personal and platform armor solutions. MKU has centers of research & development in India and Germany that develop ballistic protection technologies for the company. Additionally, it has its own In house Ballistic testing laboratory in Germany, which can conduct ballistic testing up to STANG Level IV, including various other prevalent testing standards, ly. It recently launched a new technology called the 6th generation ballistic protection technology called "GEN-6," offering a substantial reduction in the weight and thickness of personal body armor by 40% and 30%, respectively. The Government of India has recently contracted the company to manufacture and supply 1.59 lakh ballistic helmets to the Indian Army. India advertised fresh "Veer" helmets for the Indian Army's soldiers. Defense drafted these helmets and Homeland Security Company MKU, which are consonant with the modular accessory connector system employed for multi-accessory installation.

Key Companies in the military body armor market include

- Elmon (Greece)

- Honeywell (US)

- BAE Systems (UK)

- Coorstek Inc. (US)

- Du Pont (US)

- Point Blank Enterprises Inc (US)

- MKU Limited (India)

- M (US Safariland

- LLC (US)

- Survitec Group Limited (UK)

Military Body Armor Industry Developments

For Instance, March 2022 the United Kingdom's armed forces proclaimed new body armor advancements for women in its armed forces. The upgraded protective apparatus the Virtus Scalable Tactical Vest, results from a partnership between several Ministry of Defence and industry organizations, including the Source Tactical Gear, Defence Science, and Technology Laboratory, and Defence Equipment and Support.

For Instance, March 2019 the U.S. Army announced a contract worth USD 29.9 million with KDH Defense Systems Inc. to increase their Modular Scalable Vest (MSV) Gen-II system munition.

Military Body Armor Market Segmentation

Military Body Armor Level Outlook

- Level I

- Level IIA

- Level II

- Level IIIA

- Level III

- Level IV

Military Body Armor Application Outlook

- Law Enforcement Protection

- Civilians

Military Body Armor Material Outlook

- Steel

- UHMWPE

- Aramid

- Composite Ceramic

- Others

Military Body Armor Product Type Outlook

- Soft Armor

- Hard Armor

Military Body Armor Product Style Outlook

- Covert

- Overt

Military Body Armor Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.