Global Inorganic Salts Market Overview

The inorganic salts market size was valued at USD 127.06 billion in 2023. The inorganic salts industry is projected to grow from USD 133.54 Billion in 2024 to USD 189.17 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.45% during the forecast period (2024 - 2032). Increasing adoption of inorganic metal salts and growing demand for pharmaceuticals are the key market drivers enhancing the market growth. Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Inorganic Salts Market Trends

-

Increasing demand for fertilizers is driving the market growth

The market CAGR for inorganic salts is being driven due to the growth of the fertilizer and pesticide industry. Nitrogen-containing salts, such as ammonium salts, are widely used in fertilizer production as they act as nitrogen suppliers. They also produce insecticides and agrochemicals for soil treatment and conditioning. Some inorganic salts are ammonium nitrate, ammonium sulfate, calcium nitrate, diammonium phosphate, mono ammonium phosphate, and others. Increased need for crop yields, owing to the world's growing population, is surging the demand for agrochemicals, which is further boosting demand. The total nutritional capacity of ammonia, phosphoric acid, and potash in fertilizers was 317.5 million tons in 2020, according to the Food and Agriculture Organization (FAO), and it is likely to expand further. This is expected to surge the demand for inorganic salts market revenue.

Many common inorganic salts are salt substitutes, including potassium chloride, potassium sulfate, magnesium sulfate, and calcium chloride. One of today's developing trends is using these salts instead of sodium chloride. For instance, potassium salts are the most frequently used alternative for sodium salts as their taste closely approaches that of sodium chloride. The significant danger associated with a high sodium salt diet and growing knowledge of its detrimental effects on the body is driving up demand. Ferrous sulfate is one of the iron deficiency-treated inorganic salts frequently recommended to patients suffering from anemia caused by iron deficiency. Inorganic salts are commonly used as antacids in medicinal applications, increasing their popularity.

Inorganic salts find use in a variety of industries, including pharmaceuticals. Increased use of inorganic compounds as precursors and catalysts in producing various medicinal products is expected to drive market expansion. Hydrochloride salts, for example, are the most prevalent salts used in pharmaceutical drug manufacture, according to an article published by drugs.com. With around 15.5% of the market share. They have an important role in the body's activities and metabolism. Bone minerals are inorganic components of bone tissues. The balance of sodium and potassium in cells is maintained by these inorganic salts in plasma. The increased demand for health drinks containing these inorganic salts will drive market expansion.

Furthermore, the agricultural industry is a significant consumer of inorganic salts, particularly fertilizers such as potassium chloride and ammonium nitrate, which are used to enhance crop yield. In the food and beverage industry, inorganic salts are used as additives and preservatives to improve food products' shelf life and texture. In the water treatment industry, inorganic salts such as aluminum sulfate and ferrous sulfate are used to purify water.

Inorganic Salts Market Segment Insights

Inorganic Salts Type Insights

The inorganic salts market segmentation, based on type, includes sodium salts, magnesium salts, calcium salts, potassium salts, ammonium salts, and others. The sodium salts segment dominated the market, accounting for major market revenue over the forecast period. This is majorly due to their broad spectrum of applications across various industries.

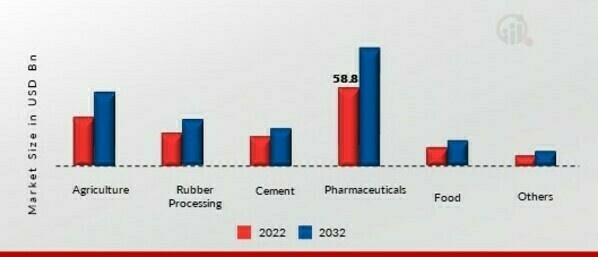

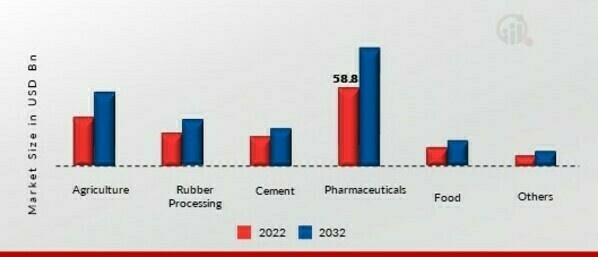

Inorganic Salts Application Insights

The inorganic salts market segmentation, based on application, includes agriculture, pharmaceuticals, cement, rubber processing, food, and others. The agriculture category generated the most income over the forecast period. This is due to the use of inorganic salts in augmenting soil nutrients, thereby improving yield. The growing demand for such inorganic salts in the production of various significant chemical compounds and materials in the soil rise the market growth.

Figure 1: Inorganic Salts Market, by Application, 2022 & 2032 (USD billion)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

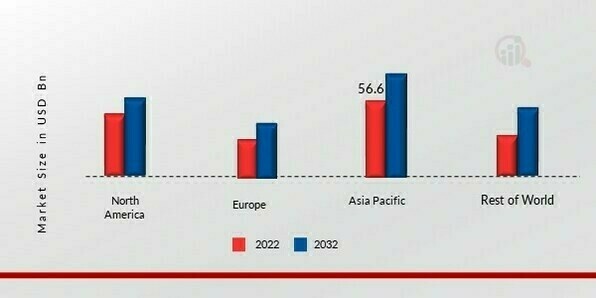

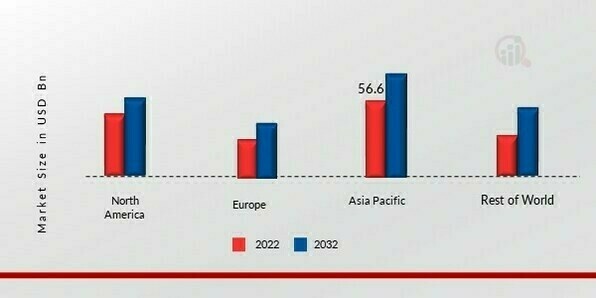

Inorganic Salts Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American inorganic salts market will dominate this market due to the increasing adoption of inorganic salts containing nitrates. These inorganic salts are used in manufacturing explosives and ammunition. Additionally, increasing the adoption of fertilizers to boost farm yield is predicted to influence market growth in this region. Moreover, the US inorganic salts market held the largest market share, and Canada inorganic salts market was the fastest-growing market in the North America region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: INORGANIC SALTS MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Europe inorganic salts market accounts for the second-largest market share due to the high demand for pharmaceutical drugs from the healthcare sector, and increasing agricultural developments and initiatives taken by the government to yield maximum crop production are expected to drive demand in this region. Further, the German inorganic salts market held the largest market share, and the UK inorganic salts market was the fastest-growing market in the Europe region.

The Asia Pacific inorganic salts market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to expanding awareness of a healthy lifestyle and nutrition and rising per capita disposable income. Moreover, China inorganic salts market held the largest market share, and the Indian inorganic salts market was the fastest-growing market in the Asia Pacific region.

Inorganic Salts Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the inorganic salts market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the inorganic salts industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the inorganic salts industry to benefit clients and increase the market sector. Major players in the inorganic salts market, including Eastman Chemical Company, Emerald Performance Materials, Thermo Fisher Scientific Inc., BEHN MEYER, GFS Chemicals, Inc., Lanxess, Lenntech, LobaChemie Pvt. Ltd., Merck KGaA, and others, are attempting to increase market demand by investing in research and development operations.

Solvay SA is a chemical manufacturing company. It manufactures and distributes specialty polymers, essential chemicals, and chemical materials, among others. It serves consumers operating in aeronautics & automotive, natural resources & environment, electrical & electronics, agrochemical, food, consumer goods, building & construction, healthcare, industrial applications, and other sectors. The firm uses special chemicals made with eco-friendly materials to expand product quality and performance. It innovates and partners with customers globally in many diverse end markets. The company has research & innovation centers and industrial sites in Europe, North America, Latin America, and Asia. In September 2019, Solvay confirmed that it expanded its manufacturing capacity for soda ash by 600-kilo tonnes to fulfill long-term market progress in various implementations and raise its capacity for sodium bicarbonate by 200 kilo tonnes, resolving demands for flue gas initiatives to improve air quality.

Arkema SA is a specialty chemical and advanced materials company. The company offers solutions for adhesives, biobased materials, coatings, composites, health care, and sports equipment. Its product portfolio includes technical polymers, filtration and adsorption, organic peroxides, biochemicals, fluoro gases, hydrogen peroxide, acrylics, coating resins, photocurable resins, rheology additives, and others. The company's products are used in various sectors such as agriculture, air conditioning, automotive, chemicals, construction, coating, consumer goods, electrical, oil, health, packaging, plastics, pulp, rubber, sports, and water treatment, among others. In September 2021, Arkema announced a price increase in its Hydrogen Peroxide and Sodium Chlorate. Effective October 1st, 2021, Arkema raised its price across its Hydrogen Peroxide and Sodium Chlorate ranges in Europe and for the export markets by 15%.

Key Companies in the Inorganic Salts market include

-

Redmond Clay & Salts Company (Utah, U.S.)

-

United Salts Corporation (Texas, U.S.)

-

Eastman Chemical Company (Tennessee, U.S.)

-

Arkema (Colombes, France)

-

Solvay (Brussels, Belgium)

-

Tata Chemicals (Mumbai, India)

-

GFS Chemicals (Ohio, U.S.)

-

Otsuka Chemical (Gurugram, India)

-

Behn Meyer (Hamburg, Germany)

Inorganic Salts Industry Developments

April 2021: K+S sold America's salts industry to Stone Canyon Industries Holdings, Mark Demetree, and Partners. K+S Group finalized the divestment of its America's salts business associated with the Operating Unit Americas to Stone Canyon Industries Holdings LLC and Mark Demetree and Partners at the price of USD 2.93 billion. With the deal of America's operating unit, the firm is taking major steps toward reducing its debt.

December 2020: Verkhnekamsk Potash Co., a part of Acron Group, completed the skip shaft sinking at the Talitsky Mine construction site. Acron Group is developing a Potash deposit as a part of its investment program.

Inorganic Salts Market Segmentation

Inorganic Salts Type Outlook

-

Sodium Salts

-

Magnesium Salts

-

Calcium Salts

-

Potassium Salts

-

Ammonium Salts

-

Others

Inorganic Salts Application Outlook

-

Agriculture

-

Pharmaceuticals

-

Cement

-

Rubber processing

-

Food

-

Others

Inorganic Salts Regional Outlook

-

North America

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Rest of Europe

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

Inorganic Salt Market Highlights:

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review