India Tyre Manufacturers Market Overview

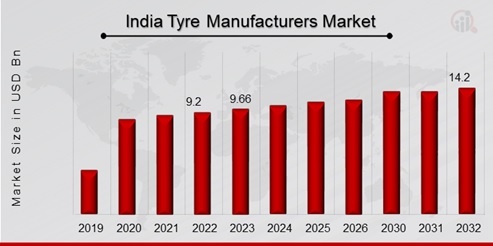

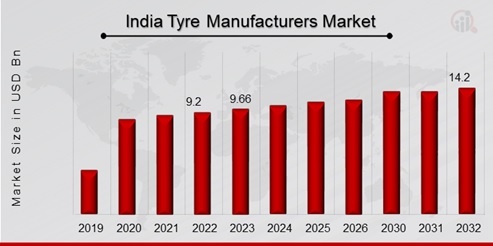

India Tyre Manufacturers Market Size was valued at USD 9.2 Billion in 2022. The tyre manufacturers industry is projected to grow from USD 9.66 Billion in 2023 to USD 14.2 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.00% during the forecast period (2024 - 2032). Growth in vehicle sales directly translates to higher demand for tires, as new vehicles require tyres upon purchase which is one of the key market drivers driving the India tyre manufacturers market.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

India Tyre Manufacturers Market Trends

-

Increasing production of automobiles is driving the market growth

The Indian tyre manufacturers market CAGR is expanding due to the increasing production of automobiles. India represents a promising marketplace because of its unexpectedly growing vehicle income, expanding car fleet size, and rising car production. With a developing populace and improving financial conditions, India has witnessed an enormous surge in car income in recent years. According to facts from the Society of Indian Automobile Manufacturers (SIAM), car sales in India have been on a constant upward thrust, with passenger car income increasing through 11.14% in the fiscal 12 months 2021-22 as compared to the previous year. This uptrend in automobile income translates to higher demand for tires, as each new vehicle offered calls for tires upon purchase.

Furthermore, India's car industry has witnessed a surge in vehicle manufacturing, fueled through each domestic call for export opportunities. With India emerging as a global manufacturing hub for cars, tire manufacturers enjoy the growing automobile production inside the United States of America. According to data from the Ministry of Commerce and Industry, India's automobile industry produced over 23 million automobiles within the economic year 2020-21, showcasing the USA's developing manufacturing competencies. This boom in automobile manufacturing without delay contributes to the call for tires, as every car produced calls for tires as a crucial aspect. As a result, tire manufacturers in India are properly placed to capitalize on the possibilities offered with the aid of the growing automobile manufacturing trend. Moreover, the rising car fleet length in India similarly drives calls for tires, particularly within the aftermarket section. As the prevailing car fleet expands due to factors which include populace boom, urbanization, and progressed living standards, the need for tire replacements will increase. According to Statista, India had over 300 million registered automobiles as of 2021, with this wide variety anticipated to continue developing within the coming years. This increasing automobile fleet offers an extensive growth opportunity for tire manufacturers, as automobiles require tire replacements due to put on and tear, punctures, or enhancements over time. Thus, driving the India tyre manufacturers market revenue.

India Tyre Manufacturers Market Segment Insights

-

Tyre Manufacturers Vehicle Type Insights

The India tyre manufacturers market segmentation, based on Vehicle Type, includes Two Wheelers, Three Wheelers, Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, and Off the Road. The Two Wheelers segment dominated the market in 2023. The growing global vehicle fleet, fueled by population growth, urbanization, and improved living standards, boosts demand for replacement two wheelers tires. As vehicles age, the need for tire replacements increases, driving growth for tire manufacturers.

-

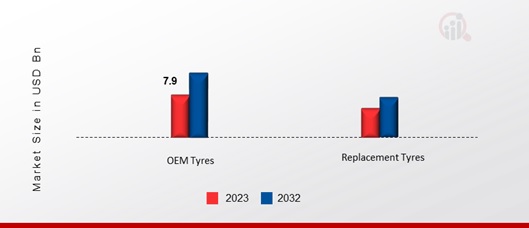

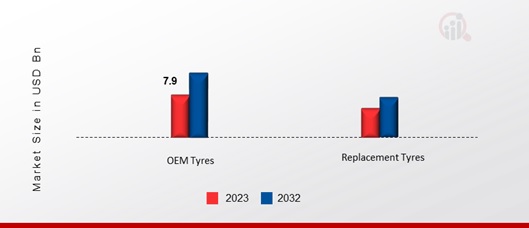

Tyre Manufacturers OEM and Replacement Insights

The India tyre manufacturers market segmentation, based on OEM and Replacement, includes OEM Tyres and Replacement Tyres. The OEM Tyres category generated the most income in 2023. The need for original equipment manufacturer tyres is greatly impacted by the expansion of the automobile sector, especially in developing nations like China, India, and Southeast Asia. There is a direct correlation between the number of cars manufactured and the need for tires—both replacement and original vehicle assembly.

Figure 1: India Tyre Manufacturers Market, by OEM and Replacement, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Tyre Manufacturers Domestic Production and Imports Insights

The India tyre manufacturers market segmentation, based on Domestic Production and Imports, includes Domestic Production and Imports. The domestic production category generated the most income in 2023. The effective manufacture and distribution of tyres depend on having enough infrastructure, including ports, highways, and transportation networks. Infrastructure improvements can boost local output by lowering transportation costs and enhancing supply chain effectiveness.

Tyre Manufacturers Radial and Bias Tyres Insights

The India tyre manufacturers market segmentation, based on Radial and Bias Tyres, includes Bias Tyres and Radial Tyres. The radial tyres category generated the most income in 2023. When opposed to bias-ply tyres, radial tyres offer better traction, handling, and overall performance. This is especially apparent when it comes to stopping distance and cornering stability. Additionally, radial tyres have less rolling resistance, which improves a car's fuel economy. This is becoming more and more significant as environmental concerns push the automobile sector to adopt greener alternatives.

Tyre Manufacturers Tube and Tubeless Tyres Insights

The India tyre manufacturers market segmentation, based on Tube and Tubeless Tyres, includes Tube Tyres and Tubeless Tyres. The tubeless tyres category generated the most income in 2023. Because tubeless tyres include a self-sealing characteristic, they are less likely to suddenly deflate than tube-type tyres. This characteristic lowers the chance of accidents by preventing quick air loss in the case of a puncture. In addition, tubeless tyres usually provide superior handling, cornering, and stability than their tube-type equivalents. This is because of the way they are made, which reduces rolling resistance and improves control by removing friction from the tyre and tube.

Tyre Manufacturers Tyre Size Insights

The India tyre manufacturers market segmentation, based on Tyre Size, includes Small, Medium, Large. The medium category generated the most income in 2023. Many different types of vehicles, such as sedans, SUVs, crossovers, and light trucks, frequently utilize medium-sized tyres. The demand for medium-sized tyres may rise in response to any growth in sales of these vehicle types. In addition, there can be a rise in the need for medium-sized tyres on vehicles like SUVs and light trucks used in transportation and construction as urbanization and infrastructure projects grow.

Tyre Manufacturers Price Insights

The India tyre manufacturers market segmentation, based on Price, includes Low, Medium High. The medium category generated the most income in 2023. Increasing environmental awareness and sustainability concerns drive demand for eco-friendly tire solutions. Medium priced tire manufacturers are investing in sustainable materials, manufacturing processes, and recycling initiatives to attract environmentally conscious consumers and align with corporate sustainability goals, driving growth in the medium segment.

India Tyre Manufacturers Country Insights

The northern vicinity of India, which includes states like Delhi, Uttar Pradesh, Punjab, and Haryana, is characterized by a dense population and sturdy industrial interest. This area has a great demand for tires, pushed with the aid of passenger automobiles and industrial automobiles. States like Punjab and Haryana have a thriving agricultural quarter, leading to a high demand for agricultural tires utilized in tractors and different farm gadgets. The presence of predominant towns like Delhi and Chandigarh contributes to the call for passenger car tires, which is pushed by urbanization and growing disposable earnings. The western area, comprising states like Maharashtra, Gujarat, and Rajasthan, is a key hub for automobile manufacturing and commercial hobbies. This location debts to a sizable portion of India's automobile production.

India Tyre Manufacturers Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the tyre manufacturers market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the tyre manufacturers industry must offer cost-effective items.

Major players in the tyre manufacturers market are attempting to increase market demand by investing in research and development operations, includes MRF Limited, CEAT Limited, JK Tyre & Industries Ltd., Apollo Tyres Ltd.

Key companies in the tyre manufacturers market include

- MRF Limited

- CEAT Limited

- JK Tyre & Industries Ltd.

- Apollo Tyres Ltd

India Tyre Manufacturers Industry Developments

June 2023: JK Tyre & Industries Ltd, a leading radial tyre manufacturer, announced the completion of the first phase of the manufacturing capacity expansion in Madhya Pradesh.

India Tyre Manufacturers Market Segmentation

Tyre Manufacturers Vehicle Type Outlook

Tyre Manufacturers OEM and Replacement Outlook

- OEM Tyres

- Replacement Tyres

Tyre Manufacturers Domestic Production and Imports Outlook

- Domestic Production

- Imports

Tyre Manufacturers Radial and Bias Tyres Outlook

Tyre Manufacturers Tube and Tubeless Tyres Outlook

- Tube Tyres

- Tubeless Tyres

Tyre Manufacturers Tyre Size Outlook

Tyre Manufacturers Price Outlook

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 9.2 Billion |

| Market Size 2023 |

USD 9.66 Billion |

| Market Size 2032 |

USD 14.2 Billion |

| Compound Annual Growth Rate (CAGR) |

5.00% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019-2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Vehicle Type, OEM and Replacement Segment, Domestic Production and Imports, Radial and Bias Tyres, Tube and Tubeless Tyres, Tyre Size, Price Segment, and Region |

| Countries Covered |

India |

| Key Companies Profiled |

MRF Limited, CEAT Limited, JK Tyre & Industries Ltd., Apollo Tyres Ltd |

| Key Market Opportunities |

Expanding presence in rapidly growing markets like Asia and Africa. |

| Key Market Dynamics |

Integration of sensors and connectivity features to monitor tyre pressure, temperature, and tread wear.Increasing use of recycled materials and bio-based compounds to reduce environmental impact. |

Frequently Asked Questions (FAQ) :

The India tyre manufacturers market size was valued at USD 9.66 Billion in 2023.

The market is projected to grow at a CAGR of 5.00% during the forecast period, 2024-2032.

The key players in the market are MRF Limited, CEAT Limited, JK Tyre & Industries Ltd., Apollo Tyres Ltd.

The Two Wheelers category dominated the market in 2023.

The OEM Tyres category had the largest share in the market.