Certified Global Research Member

Key Questions Answered

- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

Why Choose Market Research Future?

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Global In Vitro Diagnostics Market Overview

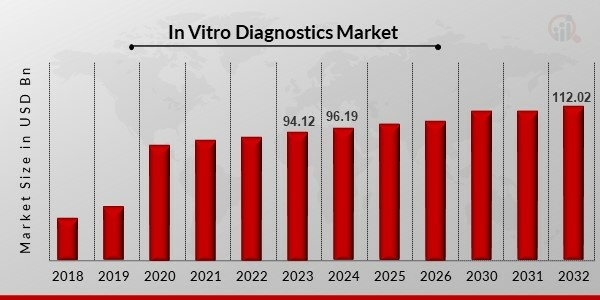

The In Vitro Diagnostics Market Size was valued at USD 94.12 Billion in 2023 and is projected to grow from USD 96.19 Billion in 2024 to USD 112.02 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 1.92% during the forecast period (2024 - 2032). Increased instances of chronic diseases and rising health concerns are the key market drivers enhancing the market growth.

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

In Vitro Diagnostics Market Trends

- Growing instances of chronic diseases are driving the market growth

Market CAGR for in vitro diagnostics is being driven by the rising chronic diseases and technological upgrades. The high prevalence of chronic and infectious diseases, the rising use of point-of-care (POC) diagnostics, cutting-edge technologies in in-vitro diagnostic products, and growing acceptance of companion diagnostics and personalised medicine are all factors contributing to the growth of the IVD market. The Centres for Disease Control and Prevention (CDC) estimate that 18.2 million persons in the United States aged 20 and older have coronary artery disease (CAD) in 2021. In the United States, heart disease is the main factor in fatalities. The market is driven by the rising prevalence of chronic diseases, which raises the demand for expensive diagnostic treatments.

The utilisation of cutting-edge technology in the IVD industry is another factor contributing to the expansion of the current market. Traditional diagnostics have given way to a new generation of gene-level diagnostics, representing a paradigm change. This was made feasible by integrating cutting-edge technologies into the IVD platform, including genetic testing, molecular diagnostics, polymerase chain reaction (PCR), and next-generation sequencing (NGS). Additionally, more product launches with cutting-edge features are anticipated to fuel the industry. For instance, Agilient Technologies introduced IVD-compliant tools, kits, and reagents in June 2022 for usage in accordance with the new IVDR legislation of the European Union.

Furthermore, since there is a rising need for IVD kits and reagents for the rapid and precise diagnosis of SARS-CoV2 virus infection across the population, the COVID-19 pandemic brought in vitro diagnostics to the fore. Due to the fact that include analysing diverse biological samples, the COVID-19 epidemic had a favourable effect on the market. This aided in the diagnosis of contagious illnesses like COVID-19. An important element in containing the COVID-19 outbreak was testing. The article, "The Impact of COVID-19 on the Invitro Diagnostic Industry," which appeared in April 2021, underlined the importance of IVD testing using human body samples to fight COVID-19. Due to the increased usage of pandemic-required advancements like remote collections and digital pathology, the sector experienced tremendous growth after COVID-19. Thus, driving the revenue.

In Vitro Diagnostics Market Segment Insights

In Vitro Diagnostics Product & Service Insights

The market segments of In Vitro Diagnostics, based on product & service includes Reagents & Kits, Instruments, and Data management Software. The reagents & kits segment dominated the market. Due to considerable R&D initiatives being performed by key market players for the development of novel reagents, the category is anticipated to maintain its leadership while increasing at the quickest CAGR over the forecast period. Companies can now concentrate on lucrative niche markets in the IVD industry thanks to the introduction of kits that enable speedier cancer detection. LiquidPlex Dx and FusionPlex Dx cancer diagnostic kits, for instance, were introduced by Invitae in February 2022 to enable effective management of cancer patients with medication and prompt delivery of the necessary information.

In Vitro Diagnostics Application Insights

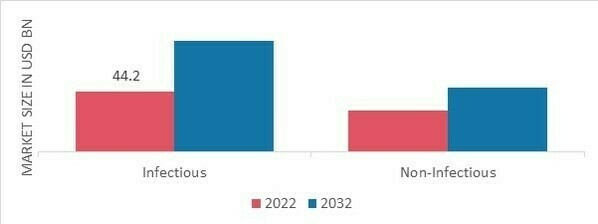

The market segmentation of based on application, includes Infectious Diseases, and Non-Infectious Diseases. The category for infectious diseases has the largest market share. The identification of infectious disease-causing bacteria is made possible by IVDs. HIV/AIDS, TB, hepatitis, and pneumonia are the most frequently occurring life-threatening illnesses. In addition, major market participants are collaborating to make it easier for patients and healthcare professionals to obtain high-quality, cutting-edge laboratory services. Figure 1 In Vitro Diagnostics Market, by Application, 2022 & 2032 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

In Vitro Diagnostics Regional Insights

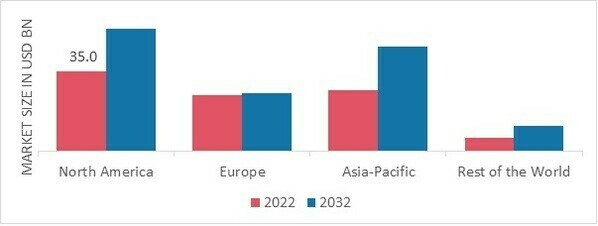

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American In Vitro Diagnostics market area will dominate this market, owing to an increase in the instances of chronic diseases and rising geriatric population.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2 IN VITRO DIAGNOSTICS MARKET SHARE BY REGION 2022 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe market accounts for the second-largest market share due to the technological advancements and rise in demands for point-of-care testing. Further, the German market held the largest market share, and the UK market was the fastest growing market in the European region

The Asia-Pacific In Vitro Diagnostics Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to rising incomes and governmental support within the region. Moreover, China’s market of In Vitro Diagnostics held the largest market share, and the market of In Vitro Diagnostics was the fastest growing market in the Asia-Pacific region.

In Vitro Diagnostics Key Market Players & Competitive Insights

Leading market players are involving themselves in various research and development related activities to strengthen their product lines, which will help the market grow more. Market players are also adopting a number of strategic activities to expand their footprint, with important market developments including new product launches, contract & agreements, mergers & acquisitions, increased investments, and partnerships with other organizations. To grow and sustain in a competitive and rising market climate, industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the industry to benefit clients and increase the market sector. In recent years, the industry has offered some of the most significant advantages to medicine. Major players in the market of including Abbott Laboratories, Bio-Rad Laboratories Inc., Hoffman-LA Roche AG, Grifols S.A., bioMerieux S.A., DiaSorin S.p.A., Ortho Clinical Diagnostics, Qiagen N.V., Siemens AG, Becton Dickinson & Company, and others, are attempting to increase market demand by investing in research and development operations.

A wide variety of healthcare goods are discovered, developed, produced, and sold by Abbott Laboratories (Abbott), including branded generic medications, diagnostic tools and procedures, and infant, child, and adult nutritional supplements. The business also sells a range of medical devices, such as those for neuromodulation, electrophysiology, rhythm control, vascular and structural cardiac devices, and heart failure. The business also sells dietary supplements, minerals, and nutrition goods. It runs manufacturing sites all around the world and has research and development centres in the US, China, Colombia, India, Singapore, Spain, and the UK. In October 2020, The healthcare business Abbott Laboratories (NYSE ABT), and Quanterix Corporation, a company that digitises biomarker analyses to improve the science of precision health, have agreed into a non-exclusive royalty-bearing licence agreement. Abbott now has non-exclusive access to Quanterix's patents pertaining to bead-based technology for use in in vitro diagnostic (IVD) applications.

Grifols SA is a pharmaceutical and chemical manufacturing firm called. The company is dedicated to improving the health and wellbeing of individuals all over the world. Research, development, production, and commercialization of plasma-derived medicines, hospital pharmacy products, and clinically applicable diagnostic technology are its main areas of concentration. The business creates plasma-derived protein treatments for people with rare, persistent, and fatal infections. For use in biotechnology research, producing pharmaceutical and diagnostic goods, and clinical trials, Grifols provides biological materials. For blood banks, clinical laboratories, and transfusion centres, Grifols offers solutions for hemostasis, immunoassay, and transfusion medicine. In December 2021, The TÜV SÜD Product Service and BSI, both of which are EU-designated notified bodies under the new regulation, have granted Grifols its first Technical Documentation Assessment and Quality Management System certificates under the Medical Devices Regulation (IVDR). Grifols is a leader in the development of plasma-derived therapies and cutting-edge diagnostic solutions.

Key Companies in the market of In Vitro Diagnostics include

- Abbott Laboratories

- Bio-Rad Laboratories Inc.

- Hoffman-LA Roche AG,

- Grifols S.A.

- bioMerieux S.A.

- DiaSorin S.p.A.

- Ortho Clinical Diagnostics

- Qiagen N.V.

- Siemens AG

- Becton Dickinson & Company

Industry Developments

January 2021 The quick handheld TBI blood test developed by Abbott was given FDA approval. The pioneering test is used to evaluate patients with minor traumatic brain injuries (TBIs) and concussions. In addition, Abbott introduced the RealTime SARS-CoV-2 assay, a PCR-based test, in March 2020 for the diagnosis of COVID-19, and BioMedomics introduced a point-of-care COVID-19 test in May 2020 that can identify antibodies in blood within 15 minutes.

January 2022 In order to enhance patient care, Roche Diagnostics (Switzerland) introduced the Cobas pulse system, a blood glucose management tool with mobile digital health capabilities.

In Vitro Diagnostics Market Segmentation

In Vitro Diagnostics Market Products & Service Outlook

- Reagents & Kits

- Instruments

- Data management software

In Vitro Diagnostics Market Applications Outlook

- Infectious Disease

- Non-Infectious Disease

In Vitro Diagnostics Market Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.