*Disclaimer: List of key companies in no particular order

Top listed companies in the Europe Heavy Construction Equipment industry are:

Volvo Equipment,

Liebherr Group

Volvo CE

CNH Industrial NV

JCB

Wirtgen Group

Key Player Strategies:

Dominant players like Liebherr, Volvo Construction Equipment, and CNH Industrial are leveraging their strong brand recognition, extensive distribution networks, and R&D capabilities to maintain market share. These companies invest heavily in product innovation, focusing on automation, efficiency, and emission reduction technologies. For example, Liebherr's latest excavator models boast enhanced fuel efficiency and advanced safety features.

Asian manufacturers like XCMG and Zoomlion are aggressively entering the market with cost-competitive offerings. They often target price-sensitive segments and are making inroads into rental fleets. XCMG's recent entry into the electric construction equipment space with its all-terrain crane and excavator highlights their ambition to disrupt the market.

Collaboration and partnerships are becoming increasingly common, with players teaming up for technology development, market access, and shared production facilities. For instance, Volvo CE and BOMAG collaborated on a joint venture for road construction equipment, while JCB partnered with Hitachi Construction Machinery for excavator production.

Market Share Analysis:

The market is relatively consolidated, with the top six players accounting for over 60% of market share. However, regional variations exist, with local brands holding significant shares in specific countries. Italy's Comer Industries, for example, enjoys a strong position in the excavator market.

Factors influencing market share include product range, brand reputation, pricing strategies, after-sales service, and geographical presence. OEMs with a diversified product portfolio catering to various equipment types and applications, like Volvo CE, tend to have an edge.

Rental penetration is increasing, impacting sales strategies. Players are offering flexible rental options and expanding their service networks to cater to this growing segment. CNH Industrial's acquisition of rental company Mateco underlines the importance of this trend.

New and Emerging Trends:

Sustainability is a major driver, with growing demand for electric and hybrid construction equipment. Companies are actively developing and deploying greener technologies, driven by stricter emission regulations and customer preferences. JCB's recent launch of its electric mini excavator exemplifies this trend.

Automation and digitalization are transforming the industry. Advanced telematics systems, remote monitoring capabilities, and semi-autonomous features are being integrated into equipment, improving efficiency and safety. Volvo CE's CoPilot suite of digital solutions is a leading example.

Focus on aftermarket services is intensifying. Players are recognizing the value of providing comprehensive maintenance, repair, and parts support to retain customers and generate recurring revenue. Wirtgen Group's extensive service network for its road construction equipment demonstrates this emphasis.

Overall Competitive Scenario:

The European heavy construction equipment market is on the cusp of significant change. While established players retain dominance, new entrants and disruptive technologies are shaping the future. Players who adapt to changing customer needs, invest in R&D, and embrace sustainability will be best positioned to succeed. The increasing focus on partnerships, rental penetration, and aftermarket services further adds complexity to the competitive landscape, making it a dynamic and exciting market to watch.

Latest Company Updates:

Volvo Equipment:

- October 2023: Acquired Mack Trucks from American Axle & Manufacturing, strengthening its position in the heavy-duty truck market. (Source: Volvo Group press release)

Liebherr Group:

- December 2023: Announced plans to invest €480 million in its French production facilities for excavators and wheel loaders. (Source: Liebherr Group press release)

Volvo CE:

- December 2023: Partnered with Trimble to develop integrated telematics and automation solutions for construction equipment. (Source: Volvo CE press release)

CNH Industrial NV:

- November 2023: Launched the New Holland T4F and T5F tractors, designed for sustainable farming practices. (Source: CNH Industrial website)

Heavy Construction Equipment Market Highlights:

Europe Heavy Construction Equipment Market Overview:

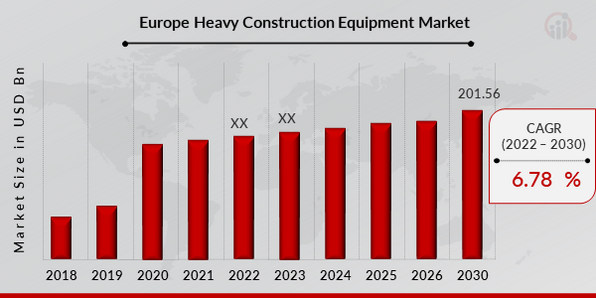

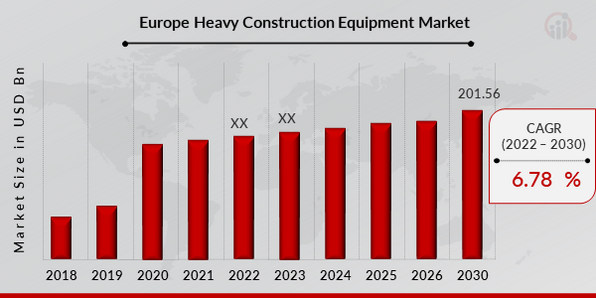

In addition, the global Europe heavy construction equipment market has been expected to rise at a CAGR of 6.78%, with a value of USD 201.56 billion over the estimated forecast year of 2024-2030.The construction equipment is designed for executing the construction works. It is used for dozing, grading, hauling, compacting and leveling, placing materials, transferring heavy loads and excavating and digging the ground. It comprises the ditchers, bulldozers, pumps, graders, tractors, excavators, cranes, derricks, loaders and backbones. It also includes the pavers, scrapers, generators, pile drivers, concrete mixers, off-highway hauliers, trucks, and compactors and rollers. Due to the rising environmental concerns and the increasing need to promote energy conservation, several players are focusing on developing the fuel consumption for the construction equipment.

The significant growth of the construction of the housing projects and other commercial infrastructure on account of the rapid urbanization and the increasing global population represents one of the key factors influencing the Europe heavy construction equipment market growth. However, the rising of automation in the construction processes due to the scarcity of skilled labor and the increasing emphasis on minimizing the overall cost and the time for the project completion contributes to the market's growth.

Industrial News

Large construction projects worldwide are expected to drive the crane and the construction machinery market shortly. Europe is planning on various construction projects; Germany, France, and Italy witnessed the highest growth rates due to the region's construction projects.

The projects include the port extension, an underwater tunnel connecting the major European regions, and the railway tunnels, including the use of the many types of cranes that drive the entire growth of the Europe heavy construction equipment market sectors.

December 5, 2023: JCB Unveiled new 55Z-1 electric mini excavator, expanding electric machine portfolio. (Source: JCB website)

In March 2021, Rothmund GmbH Kran und Montage purchased its second LTM 1230-5.1 from Liebherr after buying the first six months ago. In the same month, Schussmann Kranservice GmbH also received the new LTM 1230-5.1.

Europe Heavy Construction Equipment Market Regional Analysis

European market growth is mainly depending upon the countries such as Italy, Germany, U.K, Spain and France and others.

The European market is facing an economic slowdown in the recent years due to the unusual demand. Due to the Europe heavy construction equipment market uncertainty and sovereign debt crisis the Western European countries are facing the restraints in the growth activities but Scandinavian countries such as Denmark, Norway and Sweden are likely to be safe from this crises and uncertainty. The heavy construction equipment market is expecting ainadequate growth rate forecast in both commercial and residential spending by 2030. Also there are many planned constructions site are planning on postponing their plan due to the crises.

The spending on construction are likely to be stable and stagnant in in Western Europe with a very little growth expectations. Germany is considered to be a fasting growing region in Europe followed by Spain, Ireland, U.K, France and others. These regions will experience a decline growth rate till 2027.

In the coming years, the Eastern Europe countries such as Poland, Russia and others will be expecting positive waves of huge spending on constructions. Non- residential sector will be forecasted as the fastest growing sector.

Huge investment from Asia-Pacific and North America has created a ladder of opportunity for the European market to grown in the coming years.

Furthermore, the report offers broad analysis of industry overview of Heavy Construction Equipment which includes types, application analysis, end users, supply chain management and key regulations in various regions along with the heavy construction equipment distributor analysis.

Nextly, the report covers geographical analysis of Western Europe and Eastern Europe. Furthermore, the report has been bifurcated on the basis of by types (earthmoving equipment, material handling equipment, heavy construction vehicles, others (cranes, excavator, dozer)), by application (mining & excavation, earthmoving, transportation, lifting, material handling, others), by end users (oil & gas industry, construction industry, military, mining, agriculture & forestry and others).

The heavy construction equipment market analysis research report provides detail analysis of market in terms of value market. The report also provides the future outlook of the market till 2021. Moreover, the global as well as market share of various players based on methods is also analyzed in the report. Lastly, the report provides company profiles of major players in the market.Finally, the report provides trends, drivers and restraints along with the conclusion.

The top companies Studied in this report are:-

Europe Heavy Construction Equipment Market Scope

This market research report covers the Europe: heavy construction equipment analysis market by types, application, end users and region.

Europe Heavy Construction Equipment Market

Europe Heavy Construction Equipment Market, by Types

Europe Heavy Construction Equipment Market, by Applications

- Mining & Excavation

- Earthmoving

- Transportation

- LiftingMaterial

- Handling

- Others

Europe Heavy Construction Equipment Market, by End Users

- Oil & Gas Industry

- Construction Industry

- Military

- Mining

- Agriculture

- Forestry and Others

Europe Heavy Construction Equipment Market, by Regions

-

Western Europe

- U.K

- Spain

- Italy

- France

- Germany

- Rest of Western Europe

-

Eastern Europe

Research Methodology

To calculate Heavy Construction Equipment market size, we have considered revenue of top players in the market and to offer accuracy, our research is supported by industry experts who offer insight on industry structure and technology assessment, competitive landscape, penetration, emerging products and trends. Their analysis is based (80 to 85%)on primary &(15 to 20%) on secondary researchas well as years of professional expertise in their respective industries. In addition to analyze current and historical trends, ouranalysts predict where the market is headed over the next five to ten years. It varies by segment for these categories geographically presented in the list of Europe Heavy Construction Equipment market tables. Top-down and bottom-up are important strategies of processing the information and knowledge ordering, used in a variety of fields including humanistic, software and scientific theories and management and organization. Inpractice, they can be seen as a style of thinking, teaching, or leadership.

Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Heavy Construction Equipment Market Highlights: