- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Global Frozen Processed Food Market Overview

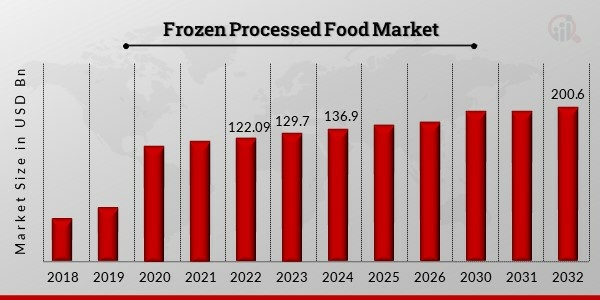

Frozen Processed Food Market Size was valued at USD 129.7 billion in 2023. The Frozen Processed Food industry is projected to grow from USD 136.9 Billion in 2024 to USD 200.6 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.89% during the forecast period (2024 - 2032). Increased demand for convenience food and the hectic lifestyle of consumers due to demanding work culture are the key market drivers enhancing the market growth.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Frozen Processed Food Market Trends

- Growing demand for convenience food driving the market growth

The market CAGR for frozen processed food is being driven by the rising demand for convenience food. The demand for convenience foods in consumers has risen considerably over the past few years. The inclination of consumers toward convenience food products like baked goods, confectioneries, beverages, and other ready meals, is because of their ease of preparation and consumption. The rapid increase in demand for ready-to-eat food products is because of the sudden shift in dietary habits among consumers.

In recent years, the invention of frozen food products has been driven by the advancement in food processors, which allowed them to include frozen food products such as fruits, vegetables, meat, and seafood as an ingredient, improving the product quality and providing products as per the consumers' demand. A large number of manufacturers are concentrating on producing frozen foods to get a better hold of market share because of the high demand. Consumers are searching for affordable, convenient, and flavorful food products throughout the day because of the fast-paced life, which provides enormous growth opportunities for frozen food products. Consumers look for convenience foods that will reduce their food preparation time. The major factors looked at by customers in convenience foods are the ease of packaging, use, nutritional value, variety, safety, and product appeal. Ready meals are the most popular frozen food products. The increasing popularity of seasonal foods is because of the hectic lifestyle of consumers and the availability of seasonal fruits and vegetables owing to the techniques providing a frozen form of processed food products. The easy transportation of frozen products across the globe has increased the demand for frozen processed food products in the market.

The change in the lifestyle of the population globally due to busy schedules is boosting the consumption of frozen processed food. The increase in the number of working women is raising the demand for frozen processed food products as they do not get time to cook and elaborate nutritious meal options. The development due to urbanization is also boosting the market; more than half of the population lives in urban areas, which as a result, increases the number of urban consumers in order to get wider choices and better food availability. It also contributes significantly towards improved living standards and raising incomes that boost the affordability of frozen processed food products to a greater extent. Thus, driving the Frozen Processed Food market revenue.

Frozen Processed Food Market Segment Insights

Frozen Processed Food Type Insights

The Frozen Processed Food market segmentation, based on type, includes Frozen ready meals, Frozen seafood & meat products, Frozen snacks & bakery products, and others. Frozen seafood and meat segment dominated the frozen processed food product market due to the extended shelf-life and nutrition content of frozen non-veg products and seafood products and the change in the lifestyle and busy schedule of people. The frozen snack & bakery products segment is the next fasted growing in the market.

Frozen Processed Food Distribution Channel Insights

The Frozen Processed Food market segmentation, based on distribution channels, includes Supermarkets/ Hypermarkets, Specialty stores, Convenience stores, and online. The supermarket/ hypermarket is dominating the frozen processed food market. This is because the infrastructure of the store and hypermarkets are available with freezing and temperature-controlling facilities, which boosts the growth of this segment as a distribution channel for frozen processed food products.

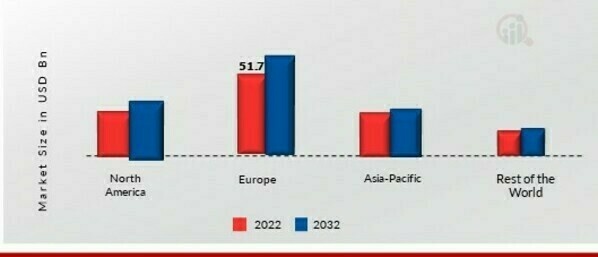

Figure 1: Frozen Processed Food Market, by Distribution channel, 2022 & 2032 (USD billion)

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Frozen Processed Food Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The European frozen processed food market area dominates this market, owing to an increase in the vegan population and hectic lifestyles demanding ready-to-eat breakfast products. It is the most attractive market in the world as it has high purchasing power and economic stability. Furthermore, the German frozen processed food market is the fastest growing in the European region.

Further, major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: FROZEN PROCESSED FOOD MARKET SHARE BY REGION 2022 (%)

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

North American Frozen Processed Food market, accounts for the second-largest market share due to the increasing attraction towards frozen food among the millennial who live alone and the variety of options available in the product. Further, the German Frozen Processed Food market and UK Frozen Processed Food market held the largest market share in the European region

The Asia-Pacific Frozen Processed Food Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to customers adopting digital retailing platforms and an increase in refrigeration facilities in retail shops. Moreover, China’s Frozen Processed Food market and India Frozen Processed Food market held the largest market share in the Asia-Pacific region.

Frozen Processed Food Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Frozen Processed Food market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Frozen Processed Food industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Frozen Processed Food industry to benefit clients and increase the market sector. In recent years, the Frozen Processed Food industry has offered some of the most significant advantages to the food industry. Major players in the Frozen Processed Food market, including General Mills, Inc. (U.S.), Conagra Brands, Inc. (U.S.), Nestle S.A. (Switzerland), Unilever PLC (U.K.), Kellogg Company (U.S.), McCain Foods Limited (Canada), The Kraft Heinz Company (U.S.), Tyson Foods, Inc. (U.S.), Associated British Foods plc (U.K.), Ajinomoto Co., Inc. (Japan), Vandemoortele NV (Belgium), Lantmannen Unibake International (Denmark), Cargill, Incorporated (U.S.), Europastry, S.A. (Spain), JBS S.A. (Brazil), ARYZTA AG (Switzerland), and Nomad Foods Limited (U.K.), and others, are attempting to increase market demand by investing in research and development operations.

Pilgrim's Pride Corporation is a chicken and pork company. Pilgrim's Pride Corporation obtained the Meats and Meals business of Kerry Consumer Foods in the UK and Ireland. This acquisition is anticipated to strengthen PPC's portfolio by including popular brands such as Denny, Richmond, and Fridge Raider in its brand family. Kerry Meals is a principal ethnic chilled and frozen ready meals business in the UK; Kerry Meats is a manufacturer of branded and private label meats, meat snacks, and food-to-go products in the UK and Ireland. Kerry provides customers with globally best-known food, beverages, and pharma brands.

The Frostkrone Food Group is a German company providing appetizing cheese delicacies, savory cream cheese fillings, scrumptious creamy delights, sweet confectionery, red-hot pizza pockets suiting every taste, and imaginative buffet selections that are taken from all four corners of the world. The company employs over 700 people worldwide that innovate and develop finger food ideas. The Frostkrone Food Group acquired Abergavenny Fine Foods Ltd, which is the best in the British retail and food service sector. Abergavenny Fine Foods Ltd is particulate in finger food and snack combinations in the form of deep-frozen goods or as fresh produce. Its product range includes finger foods such as Halloumi Fries, Jalapeno Poppers, Macncheese Croquettes, Jaffa Cake Bites, and goat cheese products.

Key Companies in the Frozen Processed Food market include

- General Mills, Inc. (U.S.)

- Conagra Brands, Inc. (U.S.)

- Nestle S.A. (Switzerland)

- Unilever PLC (U.K.)

- Kellogg Company (U.S.)

- McCain Foods Limited (Canada)

- The Kraft Heinz Company (U.S.)

- Tyson Foods, Inc. (U.S.)

- Associated British Foods plc (U.K.)

- Ajinomoto Co., Inc. (Japan)

- Vandemoortele NV (Belgium)

- Lantmannen Unibake International (Denmark)

- Cargill, Incorporated (U.S.)

- Europastry, S.A. (Spain)

- JBS S.A. (Brazil)

- ARYZTA AG (Switzerland) and Nomad Foods Limited (U.K.)

Frozen Processed Food Industry Developments

April 2022: An Indian company that offers chilled meat and frozen foods, Prasuma, announced new snacks to its frozen food offerings. It also launched frozen chicken nuggets, frozen veg and chicken spring rolls, frozen veg and mini chicken samosas, mutton and chicken shammi kabads, mutton, chicken seekh kababs, and bacon.

February 2022: Tyson Foods Inc. Introduced its plans to build a new facility in Bowling Green, Kentucky, to spread its production of bacon by investing USD 355 million. It started producing products for the Wright Brand and Jimmy Dean brands, providing a range of frozen and refrigerated products in the market.

February 2021: A leading plant-based frozen food company, Strong Roots, announced a strategic partnership with McCain Foods, the family-owned leader in frozen potato specialties and appetizers, with the investment of USD 55 million in Strong Roots to take a minority stake in the business.

Frozen Processed Food Market Segmentation

Frozen Processed Food Type Outlook

- Frozen ready meals

- Frozen seafood & meat products

- Frozen snacks & bakery products

- Others

Frozen Processed Food Distribution Channel Outlook

- Supermarkets/ Hypermarkets

- Specialty stores

- Convenience stores

- Online

Frozen Processed Food Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.