Fiber to the Premises Companies

Fiber to the Premises (FTTP) companies provide high-speed broadband connectivity by deploying fiber-optic cables directly to homes and businesses.

Fiber to the Premises (FTTP) companies provide high-speed broadband connectivity by deploying fiber-optic cables directly to homes and businesses.

Competitive Landscape of the Fiber to the Premises Market:

The fiber to the premises (FTTP) market is experiencing a surge, fueled by insatiable demand for faster internet speeds, bandwidth-hungry applications, and the rise of the connected home. Navigating this dynamic landscape requires a clear understanding of the competitive forces at play. Let's delve into the strategies adopted by key players, the factors shaping market share, the emergence of new players, and the overall competitive scenario.

Some of the Fiber to the Premises companies listed below:

Strategies Adopted by Key Players:

Factors for Market Share Analysis:

New & Emerging Companies:

Latest Company Updates:

November 2023- Lightning Fibre, an Eastbourne-based broadband internet service provider, is deploying a new Fiber-to-the-Premises (FTTP) network in parts of Sussex and Kent, England. In response to CityFibre recently launching faster speed tiers, Lightning Fibre has also added a new 2.5Gbps symmetric product tier for residential customers on its network. Additionally, Lightning Fibre plans to launch a Virtual Landline (VoIP) service in January. This will include a Pay As You Go package for £6 per month plus 10p per minute, or an inclusive package with UK landlines and mobiles for £14 per month.

July 2023- The alternative internet service provider County Broadband has started building their fiber-optic network capable of gigabit speeds all the way to people's homes (FTTP) in five new villages in Essex, England. This is part of their goal to provide service to 500,000 homes and businesses in eastern England by the end of 2027. The five new villages are: South Hanningfield and West Hanningfield near Chelmsford, and Tollesbury, Tolleshunt D'Arcy, and Tolleshunt Knights in rural Essex. So far, County Broadband has installed fiber-optic connections to over 6,700 homes, companies, and community buildings across the countryside of Essex.

April 2023- Breezeline, the operating name of the cable company Cogeco US which is a subsidiary of Cogeco Communications Inc. (TSX: CCA), has announced it is prepared to launch services on a 500-mile fiber-to-the-premises (FTTP) network in Monongalia County, West Virginia. When the FTTP network is fully completed, it will reach over 40,000 homes and businesses in the county. Services are now accessible on the FTTP network in the areas of Brookhaven, Cheat Lake, and Morgantown. Breezeline stated that Westover, Star City, and Granville are next on the agenda for the FTTP network rollout.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

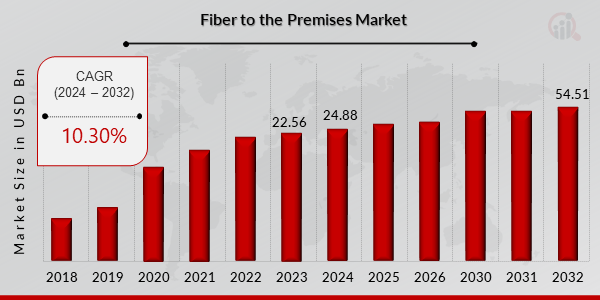

The industry is expected to benefit significantly from the deployment of cutting-edge networking technologies like the internet of things (IoT), which will accelerate the growth rate of the fiber-to-the-premises market throughout the projected period. Another recent development in the internet services industry is the internet of things (IoT). For these services to work, the fiber-to-the-premises network must supply excellent high-speed internet content.

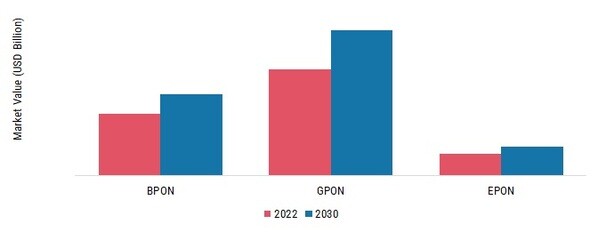

The market segmentation, based on Type, includes BPON, GPON, and EPON. The GPON segment may dominate the market. GPON is a fiber-optic access technology that enables the delivery of high-speed broadband services to residential and business customers. It provides a downstream capacity of up to 2.5 Gbps and an upstream capacity of up to 1.25 Gbps, making it suitable for a wide range of applications such as internet access, voice, video, and interactive gaming.

Based on Application, the global market segmentation includes IT & Telecommunication, Government, Transportation, Industrial, Aerospace & Defense, and Others. The IT & Telecommunication segment is expected to dominate the market. The demand for high-speed broadband services, driven by the increasing use of data-intensive applications and the need for reliable and high-quality connectivity, is a key factor contributing to the growth of the FTTP market in the IT & Telecommunication segment.

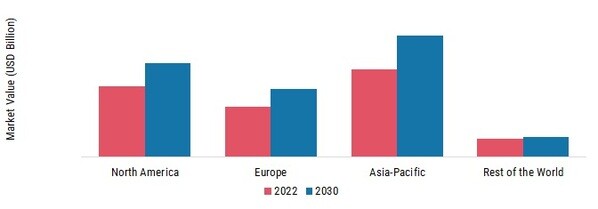

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region is expected to lead the market for fiber to the premises globally. The key factor driving an uptick in the regional market's growth is the industry's ongoing technical progress. This factor is creating an increase in the use of the FTTP system throughout the area. Another factor promoting the expansion of the regional market is the quick integration of FTTP with the legacy system.

The fiber premises market in North America is expected to develop significantly. Significant growth contributors to the area include the US and Canada, both of which have established market participants. The region's expanding smart device user base is also anticipated to increase demand for these systems.

The major market players are investing a lot of money in R&D to expand their product lines, which will spur further market growth. With significant market development like new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking various strategic activities to expand their global presence. To grow and thrive in a market climate that is becoming more competitive and growing, competitors in the Fiber to Premises industry must offer affordable products.

Manufacturing locally to cut operating costs is one of the main business tactics manufacturers use in the global Fiber to Premises industry to benefit customers and expand the market sector. Major market players, including Huawei, Verizon, Altice, Sun Telecommunication, and others, are attempting to increase market demand by funding R&D initiatives.

Huawei Technologies is a global provider of ICT infrastructure and smart products. It provides wireless networks, fixed networks, cloud core networks, carrier software, IT infrastructure, network energy, professional services, and network rollout services to telecom carriers. In addition, the company develops a digital infrastructure platform that uses cloud computing, software-defined networking, big data, and IoT to allow the digital transformation of the government, public utilities, finance, energy, transportation, and industrial industries. In addition, Huawei offers smartphones, tablets, wearable devices, integrated home devices, and apps for various devices to consumers and companies.

Verizon Communications offers goods and services for communications, information, and entertainment. Verizon Consumer Group and Verizon Business Group are its two operating segments. The Consumer division distributes home fixed connection solutions, such as Internet, video, and phone services, and wireless network access to resellers on a wholesale basis. It also offers wireless and wireline communications services and equipment. The Wireless and Wireless Products and Services offered by the Business division are categorized into four main client groups: Global Enterprise, Small and Medium Business, Public Sector and Other, and Wholesale. To supply different IoT goods and services, it also commercializes communications products and upgraded services, such as video and data services, corporate networking solutions, security and managed network services, local and long-distance phone services, and network access.

CommScope

MiniXtend

Allied Telesis

Verizon

Altice

Fibernet

CommScope

Sun Telecommunication

Corning

Pantech

Jul 2023: Freedom Fibre, an alternative network operator, announced that it is exploring a possible acquisition of VXFIBER and its subsidiary, ISP LilaConnect, to roll out a new gigabit-capable Fibre-to-the-Premises (FTTP) broadband network in the UK.

Apr 2023: Adtran, a leading mobile network operator, and broadband services provider, announced that it is beefing up its fiber to the premises (FTTP) network to supply 10-Gbps optical line terminals (OLTs) to Israel's Partner Communications. The company currently passes almost 1 million homes to enable more multigigabit services. The Adtran systems feature Combo PON technology, designed to transition smoothly from GPON to XGS-PON.

Feb 2023: Fern Trading Limited, the UK-based company specializing in solar energy, announced its plan to consolidate its four fiber business units into one new entity. The company has confirmed combining Jurassic Fibre, Swish Fibre, Giganet, and AllPoints Fibre into a single Fibre-To-The-Premises (FTTP) company. These four businesses will combine their regional operations to create a national wholesale full fiber network.

Jan 2023: County Broadband, a UK-based fiber network operator, announced a full-fibre network for additional five villages in South Cambridgeshire. The company focuses on deploying its infrastructure in rural communities, and the expansion is part of its plans to accelerate rollout across the East of England. The alternative network provider aims to bring full-fiber broadband to 500k rural and remote locations in the East of England by 2027, obtaining GBP 146 MN in private investment from Aviva Investors.

Jan 2023: Private equity firm Antin Infrastructure Partners announced the completion of its acquisition of FTTH broadband providers Empire Access and North Penn Telephone to provide broadband services via fiber-to-the-premises (FTTP) in Western New York and Pennsylvania. These two companies operate an FTTP infrastructure of 1,280 fiber route miles, serving more than 96,000 customers in New York and Northern Pennsylvania.

Nov 2022: CityFibre, a leading fiber to the premises (FTTP) network builder and operator, announced that it has reached an agreement with Toob (toob), an altnet operator and broadband services provider for infrastructure sharing. toob will use CityFibre's network to offer broadband services across the UK.

May 2022: MiniXtend HD cables for 12 to 72 fibers and MiniXtend XD cables for 192 and 288 fibers have been added to Corning Incorporated's (US) line of MiniXtend cables, the company reported. High density, duct space efficiency, and a smaller carbon footprint are all features of the new MiniXtend HD and MiniXtend XD cables.

BPON

GPON

EPON

IT & Telecommunication

Government

Transportation

Industrial

Aerospace & Defense

Others

North America

US

Canada

Europe

Germany

France

UK

Italy

Spain

Rest of Europe

Asia-Pacific

China

Japan

India

Australia

South Korea

Australia

Rest of Asia-Pacific

Rest of the World

Middle East

Africa

Latin America

Fiber to the Premises Market Highlights:

© 2024 Market Research Future ® (Part of WantStats Reasearch And Media Pvt. Ltd.)