The competitive landscape of the feminine hygiene market is characterized by a diverse range of key players, each employing distinct strategies to gain and maintain market share. As of 2023The industry is witnessing the emergence of new companies, while established players continue to adapt to changing market dynamics. This analysis delves into the strategies adopted by key players, factors influencing market shareThe presence of new and emerging companies, relevant industry news, investment trends, and the overall competitive scenario.

The competitive landscape of the feminine hygiene market is characterized by a diverse range of key players, each employing distinct strategies to gain and maintain market share. As of 2023The industry is witnessing the emergence of new companies, while established players continue to adapt to changing market dynamics. This analysis delves into the strategies adopted by key players, factors influencing market shareThe presence of new and emerging companies, relevant industry news, investment trends, and the overall competitive scenario.

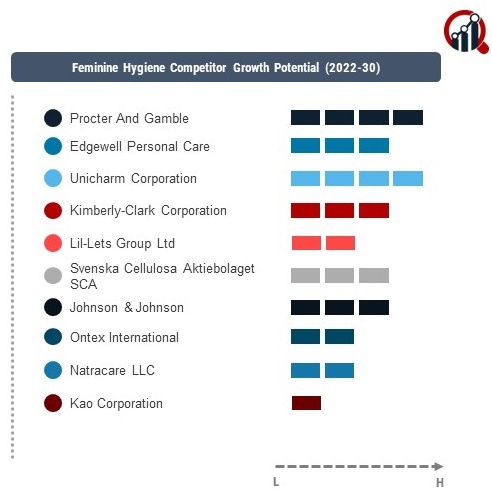

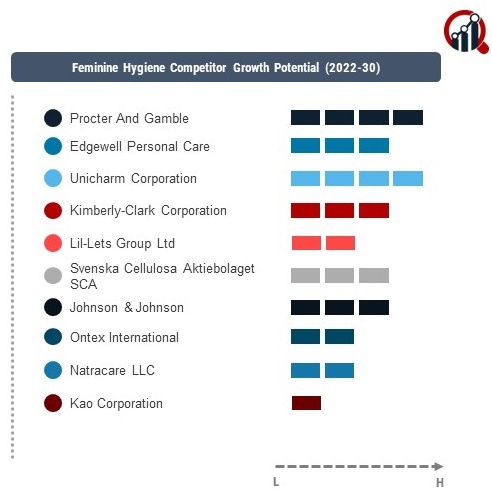

Key Players:

- Procter and Gamble,

- Edgewell Personal Care,

- Unicharm Corporation,

- Kimberly-Clark Corporation,

- Lil-Lets Group Ltd,

- Svenska

- Cellulosa Aktiebolaget SCA,

- Johnson & Johnson,

- Ontex International,

- Natracare LLC,

- Kao Corporation

Strategies Adopted:

The key players in the feminine hygiene market deploy diverse strategies to maintain and enhance their market positions. Product innovation and development, strategic partnerships, mergers and acquisitions, and aggressive marketing campaigns are among the common strategies. Procter & Gamble, for instance, has consistently invested in research and development to introduce innovative products, while Kimberly-Clark Corporation has focused on strategic collaborations to expand its market share.

Factors for Market Share Analysis:

Market share analysis in the feminine hygiene sector is influenced by various factors. Brand recognition, product quality, pricing strategy, distribution channels, and consumer loyalty all contribute to the market share of a company. AdditionallyThe ability to adapt to changing consumer preferences and sustainability initiatives are increasingly becoming critical factors in determining market share.

New and Emerging Companies:

The feminine hygiene market is witnessing the entry of new and emerging companies that bring fresh perspectives and innovative solutions to the industry. Start-ups focused on sustainable and organic products are gaining traction, challenging traditional players. These companies often leverage e-commerce platforms and digital marketing to establish their presence in the market.

Industry News and Current Companies:

The feminine hygiene market is dynamic, with frequent industry news shaping the competitive landscape. Companies are actively participating in events, launching new products, and announcing strategic partnerships to strengthen their market positions. Staying abreast of industry news is crucial for understanding the evolving dynamics of the feminine hygiene market.

Investment Trends:

Investment trends in the feminine hygiene market reflect the industry's growth potential and attractiveness to investors. Venture capital investments in start-ups offering innovative and sustainable solutions have increased. Moreover, established players are allocating substantial resources to research and development to capitalize on emerging trends and gain a competitive edge.

Overall Competitive Scenario:

The overall competitive scenario in the feminine hygiene market is characterized by intense competition among key players, with a growing emphasis on sustainability and innovation. Companies are vying for consumer attention by differentiating their products through eco-friendly materials, unique formulations, and improved functionality. The market's competitive nature is also fostering collaborations and partnerships between companies seeking synergies to strengthen their positions.

Recent Development

The feminine hygiene market witnessed several notable developments. Procter & Gamble, a market leader, unveiled a line of eco-friendly and biodegradable sanitary products, aligning with the increasing consumer demand for sustainable options. Kimberly-Clark Corporation announced a strategic alliance with a leading e-commerce platform to enhance its online presence and improve accessibility for consumers.

Johnson & Johnson introduced a marketing campaign highlighting the health benefits of its feminine hygiene products, aiming to educate consumers and build brand loyalty. Essity AB expanded its product portfolio with the launch of innovative menstrual hygiene products designed for comfort and discretion. Unicharm Corporation, recognizing the importance of digital platforms, invested in advanced e-commerce infrastructure to streamline online sales.

In terms of new and emerging companies, several start-ups gained attention for their focus on eco-friendly and organic feminine hygiene products. These companies leveraged social media platforms to connect with environmentally conscious consumers, contributing to the diversification of product offerings in the market.

Industry news highlighted a growing trend of mergers and acquisitions within the feminine hygiene sector. Companies sought strategic alliances to strengthen their market positions and capitalize on complementary strengths. These developments underscore the industry's dynamic nature and the continuous efforts of key players to adapt to evolving consumer preferences.

Investment trends reflected a sustained interest in companies promoting sustainability and innovation. Venture capital firms directed funding towards start-ups with novel solutions, while established players allocated significant resources to research and development initiatives. The overall competitive scenario remained robust, with companies navigating the complexities of a rapidly evolving market landscape.

Feminine Hygiene Market Overview

Feminine Hygiene Market was valued USD 37.8 billion in 2021 and is expected to reach USD 58.8 billion by 2030 at 5.7% CAGR during the forecast period 2022-2030.

The feminine hygiene market is driven by factors such as increasing disposable income of the middle class in emerging countries such as Brazil and China, and the emergence of low-cost feminine hygiene products. Additionally, growing awareness of female health and hygiene is expected to boost market growth over the forecast period. For instance, Procter & Gamble (P&G) has been conducting a program Parivartan across the schools in India to educate girls about mensuration cycle and the importance of maintaining hygiene. Furthermore, the increasing demand for products such as tampons and panty liners in developing countries is anticipated to fuel the growth of the market.

Despite the drivers, the rising number of products recalls due to growing allergy cases among women is anticipated to hamper revenue growth of the market.

Currently, the feminine hygiene market is dominated by many players. Strategic collaborations, mergers, and product launches are some of the strategies undertaken by key players in the market. For instance, in February 2019, Procter & Gamble (P&G) announced its acquisition of This is L., a period care startup that manufactures organic pads and tampons.

Segmentation

The global feminine hygiene market has been segmented into product type, distribution channel, and region.

The market, based on product type, has been segmented into sanitary napkins/pads, tampons, panty liners, menstrual cups, and feminine hygiene wash. The sanitary napkins/pads segment is anticipated to hold the largest market share as they have a high adoption rate among women across all geographic regions. The tampons segment is expected to be the fastest-growing due to the increased awareness about benefits associated with tampons among the female population and growing adoption among the female athletes.

The market, by distribution channel, has been segmented into supermarket and department stores, retail pharmacies, online retail stores, and others. Supermarkets and department stores segment are expected to hold the major share as a majority of women tend to purchase sanitary items along with household items.

The market, by region, has been segmented into the Americas, Europe, Asia-Pacific, and the Middle East & Africa. The feminine hygiene market in the Americas has further been segmented into North America and Latin America, with the North American market divided into the US and Canada. The European market has been segmented into Western Europe and Eastern Europe. Western Europe has further been classified as Germany, France, UK, Italy, Spain, and the rest of Western Europe. The feminine hygiene market in Asia-Pacific has been segmented into Japan, China, India, South Korea, Australia, and the rest of Asia-Pacific. The market in the Middle East & Africa has been segmented into the Middle East and Africa.

Key Players

Procter and Gamble, Edgewell Personal Care, Unicharm Corporation, Kimberly-Clark Corporation, Lil-Lets Group Ltd, Svenska Cellulosa Aktiebolaget SCA, Johnson & Johnson, Ontex International, Natracare LLC, and Kao Corporation are some of the key players in the feminine hygiene market.

Regional Market Summary

Global Feminine Hygiene Market Share (%), by Region, 2018

Source: World Health Organization (WHO), Food and Drug Administration (FDA), Women's Health

The Asia-Pacific region is expected to dominate the global feminine hygiene market owing to the growing disposable income of the middle-class population, especially in countries such as China and India which has led to rising in women’s buying quality hygiene products. Moreover, awareness about feminine hygiene products is growing at a fast pace owing to several initiatives taken by the government and the non-government organization in this region is expected to propel the market.

The Americas is anticipated to hold second market position owing to various factors such as the high penetration of high-end products such as tampons, panty liners, and internal cleansers, an increasing number of working women, and increasing demand by women for organic and biodegradable products.

Europe is expected to show a considerable amount of growth in the global feminine hygiene market. The market growth in the region is due to factors such as easy access to feminine hygiene products, rapid urbanization, growing disposable income, and increasing spending on menstrual products. According to the data published by the Bloody Good Period in 2018, the average lifetime spends on period products adds up to around USD 5,380.56 in the UK.

The market in the Middle East & Africa is expected to account for the least share of the global market due to low disposable incomes and limited awareness about menstrual hygiene in the region.

Global Feminine Hygiene Market, by Product Type

- Sanitary Napkins/Pads

- Tampons

- Panty Liners

- Menstrual Cups

- Feminine Hygiene Wash

Global Feminine Hygiene Market, by Distribution Channel

- Supermarket and Department Stores

- Retail Pharmacies

- Online Retail Stores

- Others

Global Feminine Hygiene Market, by Region

- Americas

- North America

- Latin America

- Europe

- Western Europe

- Germany

- France

- Italy

- Spain

- UK

- Rest of Western Europe

- Eastern Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

Intended Audience

- Pharmaceutical Companies

- Research and Development (R&D) Companies

- Government Research Institutes

- Academic Institutes and Universities

- Venture Capitalists

The competitive landscape of the feminine hygiene market is characterized by a diverse range of key players, each employing distinct strategies to gain and maintain market share. As of 2023The industry is witnessing the emergence of new companies, while established players continue to adapt to changing market dynamics. This analysis delves into the strategies adopted by key players, factors influencing market shareThe presence of new and emerging companies, relevant industry news, investment trends, and the overall competitive scenario.

The competitive landscape of the feminine hygiene market is characterized by a diverse range of key players, each employing distinct strategies to gain and maintain market share. As of 2023The industry is witnessing the emergence of new companies, while established players continue to adapt to changing market dynamics. This analysis delves into the strategies adopted by key players, factors influencing market shareThe presence of new and emerging companies, relevant industry news, investment trends, and the overall competitive scenario.