Door Intercom Companies

Door intercom companies specialize in the design and manufacture of intercom systems for homes, offices, and businesses, allowing secure and convenient communication at entry points.

Door intercom companies specialize in the design and manufacture of intercom systems for homes, offices, and businesses, allowing secure and convenient communication at entry points.

*Disclaimer: List of key companies in no particular order

Competitive Landscape of Door Intercom Market:

The global door intercom market stands at a crossroads of security, convenience, and technological advancement. Valued at [insert relevant market size and forecast], this dynamic landscape offers immense potential for growth, driven by rising security concerns, smart home integration, and the relentless march of technological innovation. To navigate this competitive terrain, understanding the strategies of key players, emerging trends, and factors determining market share is crucial.

Some of the Door Intercom companies listed below:

Strategies Adopted by Key Players

The battle for market share is fought on multiple fronts. Product differentiation is key, with players vying to offer features like high-resolution video, facial recognition, two-way audio, and integration with smart home systems. Technological innovation plays a crucial role, with advancements in wireless connectivity, cloud storage, and artificial intelligence shaping the future of door intercoms. Competitive pricing is another important factor, especially in budget-conscious segments.

Building strong distribution channels across online and offline platforms is essential for reaching a wider audience. Strategic partnerships with technology providers, homebuilders, and security companies open doors to new markets and expedite growth. Leveraging data analytics to understand customer preferences and tailor offerings further strengthens market position of sales channels (direct, distributors, resellers) and pricing strategies must be considered.

Factors Shaping Market Share Analysis:

New Entrants and Emerging Trends:

The door intercom market welcomes new players drawn by the rising demand and evolving trends. Some notable examples include:

Latest Company Updates:

October 2023- Hikvision has of late launched a novel 2-wire HD intercom solution custom made for the apartment buildings. Keeping a focus on the intuitive features and high image quality, this solution will support efficient and seamless communications amid visitors and residents. A key benefit of this video intercom system is its compatibility with wiring topologies found commonly in the apartment buildings. Understanding that various buildings have different wiring configuration, the company has come up with a system which can be easily installed sans altering the current setup. This along with saving time and effort will also cut down the requirement for extra cabling and the associated expenses.

September 2023- An intelligent communication solutions provider, Zenitel has lately revealed the introduction of two latest door entry intercoms. These new add-ons display the company’s commitment to offer secure and convenient entry through cutting-edge video performance and audio with easy access control. The key message of the product launch is secure, convenient access. The company is thrilled to offer security system integrators & building owners with such novel door entry intercoms.

February 2023- A pioneer in the cloud-managed enterprise building security & management, Verkada has launched its latest addition to their product line, the Verkada Intercom & a variety of updates which expand the reach of the company’s platform. This latest launch will empower the front desk staff for making smart entry decisions. With this novel video intercom, the customers will be able to answer calls just from anywhere with clear audio, sharp video, 4 smart receiver methods, & intuitive management & security tools in the Verkada Command.

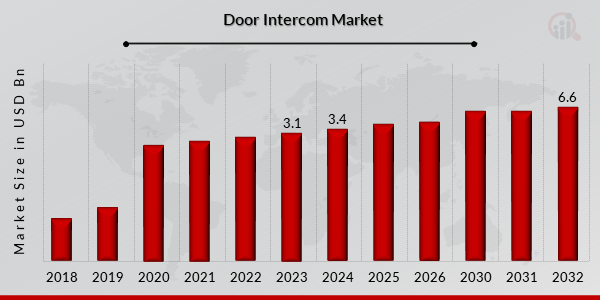

Door Intercom Market Size was valued at USD 3.1 Billion in 2023. The Door Intercom Market industry is projected to grow from USD 3.4 Billion in 2024 to USD 6.6 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 8.5% during the forecast period (2024 - 2032). The important element propelling the growth of the door intercom market is the rapid urbanization occurring in many economies, together with greater building automation. The key element boosting the door intercom market's expansion is the rise in safety standards. Additionally, it is projected that the door intercom market has developed faster due to the adoption of cutting-edge technologies.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

COVID-19 had disrupted daily life and led to considerable adjustments in individuals, groups, and governments' priorities, policies, and activities. These discoveries were stimulating innovation and technical progress. The door intercom is a piece of necessary hardware in various sectors, including consumer electronics, healthcare, IT & ITES, automotive, telecommunication, and government. The Electronic Components Business Association claims that the implementation of COVID-19 had delayed product launches, disrupted supply chains, and affected other industry operations.

Home security should prioritize everyone who owns or leases a home. Additionally, since most family members work, every person needs a safe and secure place to live. Since it is difficult to monitor the home constantly, most of the day is spent with the home unattended, and home invasion offenses are at an all-time high. Another reason for the necessity for home security is when an older adult is left alone or when children are left with a nanny or housekeeper. HomeOS, a home security system, is thus appropriate and desirable for residents' ease and safety. This will be accomplished by utilizing sophisticated remote monitoring to transform your house into a smart home. An intercom security system, a component of an access control system, enables persons inside a facility to hear or see the person trying to enter before allowing access by opening a door or gate. Intercoms are connected with products like video surveillance, access control, and home automation; interoperability is currently used most frequently in the intercom industry, according to Craig Szmania, CEO of 2N USA. Integrating several systems is only made possible through standardization.

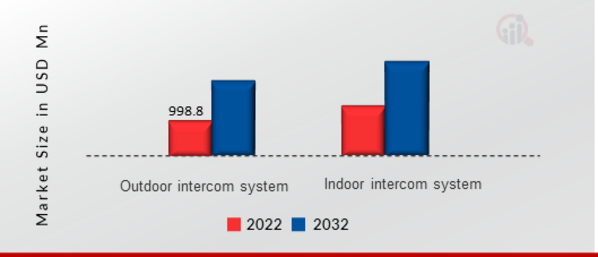

On the basis of product type, the Door Intercom Market has been segmented into outdoor intercom system and indoor intercom system.

A device called an outside intercom enables two-way communication between people within a building and people outside. Additionally, tenants can use the intercom to access doors or gates for themselves or visitors. A home intercommunication system can be much more than just a convenient method to invite family members over for dinner or call them on the phone. For a comparatively low price, client can get a paging system with a radio to play music throughout the house. Additionally, a front-door speaker that enables to converse with visitors before opening the door would improve house security.

September 2021: Schneider Electric launched Geo SCADA as a managed service. It enables customers to manage and maintain the telemetry system with Schneider Electric. Geo SCADA enables any organization to develop a future-proof, resilient infrastructure at a low cost. While lowering CAPEX and OPEX, freeing up resources, and streamlining regulatory and sustainability reporting.

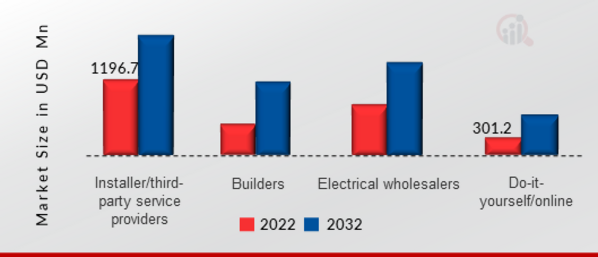

Based on sales channel the Door Intercom Market has been bifurcated into installer/third-party service providers, builders, electrical wholesalers, and do-it-yourself/online. Any unrelated individual, business, or other entity that renders services to a firm is referred to as a third-party service provider. While receiving payment for their services, outside service providers do not hold any ownership or interest in the company. Home door intercoms are highly sought after since customers are most concerned with their and their families' safety. Additionally, it is projected that the number of residential constructions will increase throughout the forecast year, boosting the product's sales. The demand for external wireless intercom systems has also increased due to the rising crime rate in various nations. The buying of wireless intercom systems is on the rise as an additional home security method. Due to the rising crime rate, there is a need for more security. The market's need for safety appliances is driven by rising demand for home automation and smart appliances.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

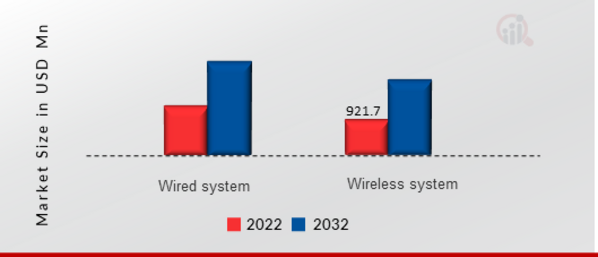

On the basis of connectivity, the Door Intercom Market has been segmented into the wired system, and wireless system. The Wired Connection sub-segment is again bifurcated into 2-Wire Systems, Cat-5 Systems, and Others. The Wireless Connection sub-segment is again bifurcated into Wi-Fi, and Radio Frequencies. A connection that uses two wires to link the exterior panel to the indoor monitor is referred to as a two-wire digital door entry system. a form of communication where both are talking and listening travel along the same path. There are two wires in the intercom channels (one path). By adding devices to the system and using the Switchboard (G21) or PC as the management and control center for the entire system, the CAT5 system can perform advanced functions like lift control and public picture memory in addition to performing more basic tasks like call making, conversation, monitoring, door lock release, network alarm, and message to the indoor monitor.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

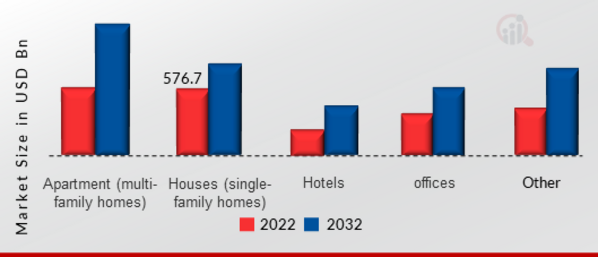

On the basis of application, the market has been segmented into apartment (multi-family homes), houses (single-family homes), hotels, offices, and others. An electronic device known as an apartment intercom system, also referred to as an apartment buzzer, permits two-way communication and grants access to the property to tenants and their guests. Intercoms are devices with a speaker, microphone, and occasionally a camera installed at a building's entrance. Whether a single hotel or a chain of hotels, security, safe accommodations, and the hotel's brand image is essential to a good guest experience, many large hotels are increasingly adopting door intercoms and communication systems to ensure a secure atmosphere for their guests due to enhanced security regulations for lodging facilities. Additionally, these gadgets allow consumers to record security camera films and upload them on websites like YouTube or Google+, which increases online traffic for companies using door intercom systems. Over the years, this element is anticipated to have a favorable effect on the market expansion.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

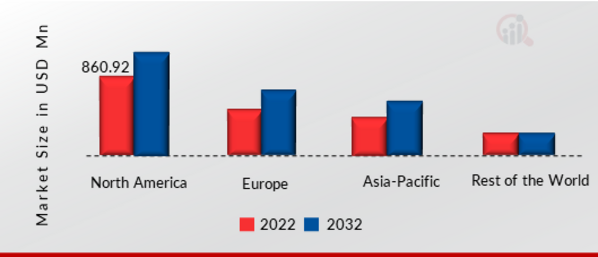

By Region, the study segments the market into North America, Europe, Asia-Pacific, and Rest of the World. The Asia-Pacific region dominated the door intercom market in 2021 and is predicted to do so again throughout the forecast period, 2023-2032. Countries in the Asia-Pacific region include China, India, Japan, South Korea, Australia, Southeast Asia, and others. Indoor Intercom System has grown rapidly in the region in recent years. Countries such as China, India, Japan, and South Korea have seen significant growth in their communications systems, resulting in high demand for wired and wireless door intercom systems.

The European region holds the second-largest market share in the door intercom market due to the availability of a well-established wireless infrastructure system that allows consumers to convert to an audio-visual communication system. Growth in personal disposable income is another aspect driving market demand in this region. The rising necessity for video monitoring at entry and exit points to avoid physical intrusions is directly tied to the adoption of intercom services. Door intercom systems, like any other linked technology, rely on networks for data transfer and are thus open to compromise.

Further, the countries considered in the scope of the Door Intercom Market are the US, Canada, Mexico, UK, Germany, France, Italy, Spain, Switzerland, Austria, Belgium, Denmark, Finland, Greece, Hungary, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Sweden, Romania, Ireland, China, Japan, Singapore, Malaysia, Indonesia, Philippines, South Korea, Hong Kong, Macau, Singapore, Brunei, India, Australia & New Zealand, South Africa, Egypt, Nigeria, Saudi Arabia, Qatar, United Arab Emirates, Bahrain, Kuwait, and Oman, Brazil, Argentina, Chile, and others.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Major market players are spending a lot of money on R&D to increase their product lines, which will help the Door Intercom Market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Door Intercom industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

Dahua Technology Co., Ltd’s strategy focuses on AIoT and the IoT Digital Intelligence Platform, strengthening the fundamental research system. At the same time, the company is gaining insights into industry scenarios and has an in-depth understanding of client needs. With its partners, the company aims to build a smart IoT ecosystem featuring co-construction to provide clients with improved smart IoT solutions, facilitate the digital innovation of cities and the intelligent digital upgrade of enterprises, and boost the sustainable, green, and high-quality development of the economy and society.

April 2022: Hager Group expanded its production capacity with a new production facility in Obernai, France. The company inaugurated its 2,600 m² production facility. The facility is set to increase gradual capacity by over 40% in the first year, doubling it in the coming years.

March 2022: Gira launched its official YouTube channel, providing a full range of content related to intelligent building design and management. The channel provides the latest ideas to enable smart home living while underlining the quality and utility of its extensive product range.

January 2020: Samsung Electronics acquired TeleWorld Solutions (TWS), a network services provider in the United States, as a part of its plans to boost 5G network business revenue. The acquisition of TWS will address the need for end-to-end support in delivering network solutions. The service offerings and customers of TWS complement Samsung’s growth among network infrastructure clients.

Door Intercom Market Highlights:

© 2024 Market Research Future ® (Part of WantStats Reasearch And Media Pvt. Ltd.)