Certified Global Research Member

Key Questions Answered

- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

Why Choose Market Research Future?

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

The clinical laboratory services market is shaped by various factors that influence its growth and dynamics. Firstly, the increasing prevalence of chronic diseases and infectious illnesses drives the demand for diagnostic testing services. Conditions such as cancer, cardiovascular diseases, diabetes, and infectious diseases require accurate and timely laboratory tests for early detection, diagnosis, and treatment monitoring. As the global burden of these diseases continues to rise, healthcare providers rely on clinical laboratories to perform a wide range of tests, including blood tests, urine tests, genetic tests, and microbiological assays, to support patient care and disease management.

Secondly, advancements in medical technology and laboratory automation contribute to market growth by enhancing the efficiency, accuracy, and throughput of laboratory testing processes. Automation systems and instrumentation streamline sample processing, reduce turnaround times, and minimize the risk of errors, thereby improving workflow efficiency and laboratory productivity. Moreover, the integration of digital health technologies, such as laboratory information management systems (LIMS) and electronic medical records (EMR), enables seamless data management, result reporting, and information sharing between healthcare providers and clinical laboratories, further driving market expansion.

Another significant factor driving the clinical laboratory services market is the growing demand for personalized medicine and molecular diagnostics. Advances in genomic sequencing technologies and biomarker discovery have paved the way for precision medicine approaches that tailor treatment strategies to individual patients' genetic makeup, lifestyle factors, and disease characteristics. Clinical laboratories play a pivotal role in providing molecular diagnostic tests, genetic screening assays, and companion diagnostics that enable personalized treatment decisions and targeted therapies across various medical specialties, including oncology, cardiology, and infectious diseases.

Moreover, demographic trends such as population aging and urbanization impact the clinical laboratory services market. The aging population is more prone to age-related health issues, chronic diseases, and complex medical conditions that require comprehensive diagnostic testing and monitoring. As the global population continues to age, the demand for laboratory services is expected to increase, driven by the growing healthcare needs of elderly individuals. Urbanization, on the other hand, leads to greater access to healthcare services and diagnostic facilities, driving the demand for clinical laboratory services in urban areas with dense populations and higher healthcare expenditures.

Furthermore, regulatory policies and quality standards play a crucial role in shaping the clinical laboratory services market. Regulatory agencies worldwide impose stringent regulations and accreditation requirements to ensure the quality, safety, and accuracy of laboratory testing services. Compliance with regulatory standards, such as Clinical Laboratory Improvement Amendments (CLIA) in the United States and ISO 15189 accreditation in Europe, is essential for clinical laboratories to demonstrate their proficiency and maintain public trust. Moreover, reimbursement policies and insurance coverage for laboratory tests influence healthcare providers' utilization of clinical laboratory services and patients' access to diagnostic testing.

Additionally, the COVID-19 pandemic has accelerated the adoption of laboratory testing services, particularly for diagnostic testing and surveillance of infectious diseases. Clinical laboratories have played a pivotal role in conducting COVID-19 testing, including PCR testing, antigen testing, and serological assays, to detect and monitor the spread of the virus. The pandemic has underscored the importance of robust laboratory infrastructure, rapid testing capabilities, and data-driven decision-making in public health emergency preparedness and response efforts, highlighting the resilience and adaptability of the clinical laboratory services market.

Covered Aspects:

| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 221.64 Billion |

| Growth Rate | 5.80% (2022-2030) |

Clinical Laboratory Services Market Highlights:

Clinical Laboratory Services Market Overview

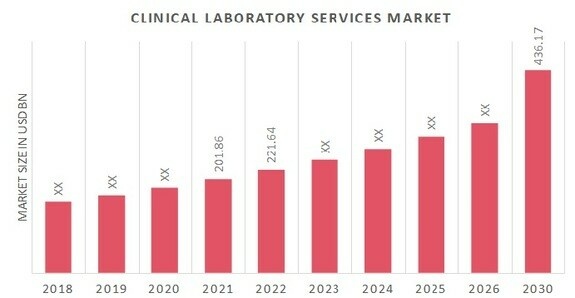

Clinical Laboratory Services Market Size was valued at USD 201.86 billion in 2021 and is projected to grow from USD 221.64 billion in 2022 to USD 436.17 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 5.80% during the forecast period (2022 - 2030).Rising number of advancements of quick & inescapable testing and increasing frequencies of ongoing illnesses are boosting the market growth. Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Clinical Laboratory Services Market Trends

- Increasing prevalence of chronic diseases fuels market growth

The rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, Alzheimer’s, obesity, arthritis, and cancer demands clinical diagnostics. Clinical pathology tests are performed on collected clinical specimens at a clinical laboratory to obtain information about the patient’s health and aid in diagnosing, preventing, and treating diseases. Hence, the growing incidence of chronic diseases is anticipated to fuel the market growth during the assessment period. Cancer caused a significant impact on society across the globe. As per the World Health Organization, there were 10 million deaths caused due to the cancer in 2020.

Moreover, early diagnosis of diseases such as cancer, heart disease, respiratory disease, kidney disease, and others can substantially improve the chances of successful treatment. US government and various international organizations have launched several initiatives to raise awareness about early diagnosis. For instance, in 2020, the American Society of Nephrology has launched a new initiative Acute Kidney Injury (AKI) to encourage excellence in the prevention and treatment of AKI by establishing a foundational program that transforms education and AKI care delivery.

Clinical Laboratory Services Market Segment Insights

Clinical Laboratory Services Type Insights

The clinical laboratory services market segmentation, based on type, includes biochemistry, endocrinology, microbiology, hematology, histopathology, cytology, and genetic testing. The biochemistry segment held the majority share in 2021 contribution to around XX% in respect to the clinical laboratory services revenue. This is due to the rising prevalence of heart and renal diseases, the demand for biochemical laboratory testing is also escalating, as biochemical tests are of great importance in the diagnosis of heart diseases.

August 2021: OPKO Health, Inc. (US), a subsidiary of BioReference Laboratories (US), acquired F. Hoffmann-La Roche Ltd. (Switzerland), the US's centralized prenatal laboratory testing business. This helped the company further strengthen its genetic testing service capabilities.

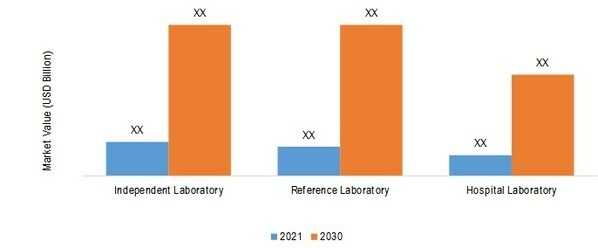

Clinical Laboratory Services Application Insights

The clinical laboratory services market segmentation, based on application, includes independent laboratory, reference laboratory, and hospital laboratory. The hospital laboratory dominated the market in 2021 and independent laboratory is projected to be the faster-growing segment during the forecast period, 2022-2030. Hospitals being a primary center for providing healthcare services have clinical and medical laboratories as their major departments. These laboratories operate in multiple disciplines of chemistry, microbiology, virology, hematology, histology, immunology or molecular diagnostics, and the blood bank. This can be attributed to high test volumes followed by favorable reimbursements. According to the article published in the Journal of the American Medical Association (JAMA) Network in 2021, more than 12 billion clinical laboratory tests are analyzed in the US each year, making them the highest-volume health care service nationwide.

December 2021: Eurofins Scientific (Luxembourg) signed an agreement with Transgenic, Inc. (Japan) to acquire Genetic Lab Co., Ltd. This acquisition further enhanced Eurofin's expansion in Asia-Pacific and complemented clinical diagnostics laboratories across the globe, which are primarily focused on specialized and advanced genetic testing.

Figure 2: Clinical Laboratory Services Market, by Application, 2021 & 2030 (USD Billion) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Clinical Laboratory Services Regional Insights

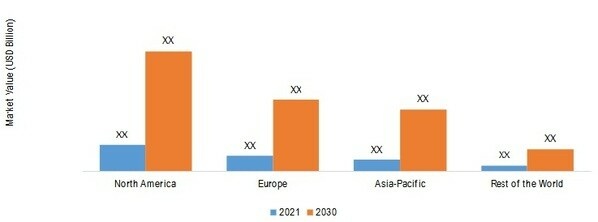

By Region, the study segments the market into North America, Europe, Asia-Pacific, and Rest of the World. North America clinical laboratory services market is propelling due to the rising incidences of chronic diseases, growing awareness among people regarding disease management and early diagnosis. Moreover, growing popularity of personalized medicine in the US is projected to create lucrative growth opportunities.

Further, the major countries studied are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: CLINICAL LABORATORY SERVICES SHARE BY REGION 2021 (%) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe clinical laboratory services market accounts for the second-largest market share due to a government initiative to increase awareness about preventive screening, improved public and private funding for clinical laboratory test development research, and high adoption of genome-based laboratory tests. Furthermore, the Germany clinical laboratory services market attributed to hold the largest market share, and the France clinical laboratory services market was expected the fastest growing market in the Europe region

The Asia-Pacific clinical laboratory services market is expected to grow at a steady pace from 2022 to 2030. This is owing to the increasing healthcare infrastructure, rising number of hospitals & clinical diagnostic laboratories in China and India. Moreover, China clinical laboratory services market attributed to held the largest market share, and the India clinical laboratory services market was the fastest growing market in the Asia-Pacific region.

Clinical Laboratory Services Key Market Players & Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the clinical laboratory services market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the clinical laboratory services industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

Additionally, Laboratory Corporation of America Holdings (US) operates as an independent clinical laboratory company worldwide. It operates through two segments, LabCorp Diagnostics, and Covance Drug Development. In February 2022, Laboratory Corporation of America Holdings collaborated with Ascension, a US-based Catholic and non-profit health system, to expand its clinical test services. The collaboration aims to administer Ascension's hospital-based laboratories in 10 states, further growing its laboratory services across the US.

Mayo Medical Laboratories (US) offers clinical testing to support health care systems, hospitals, specialty clinics, and other clinical laboratories. It provides scientific testing services for various indications, including cardiology, genetics and pharmacogenomics, drugs of abuse, and hematology. In April 2020, the company introduced serology testing service to identify the immune response to ARS-CoV-2. The test aims to detect antibodies specific to the coronavirus. The service launch enhanced the company’s portfolio in infectious disease diagnostic services.

Key Companies in the clinical laboratory services market includes.

-

Mayo Medical Laboratories (US)

-

Laboratory Corporation of America Holdings (US)

-

Quest Diagnostics (US)

-

Spectra Laboratories, Inc. (US)

-

Eurofins Scientific (Luxembourg)

-

Sonic Healthcare Limited (Australia)

-

NeoGenomics Laboratories, Inc. (US)

-

Fresenius Medical Care AG & Co. KGaA (Germany)

-

Clinical Reference Laboratory (US)

-

OPKO Health, Inc. (US), among others

Clinical Laboratory Services Industry Developments

January 2021: OPKO Health, Inc. (US), a subsidiary of BioReference Laboratories (US), launched Scarlet Health, an in-home diagnostic service that is fully digitally integrated. This launch helped the company expand its digital health business area.

October 2020: NeoGenomics Laboratories, Inc. (US) partnered with PPD, Inc. (US), and launched a state-of-the-art research laboratory in China. The NeoGenomic expansion helps and local Chinese pharmaceutical companies conduct clinical trials and testing in China.

March 2020: NeoGenomics Laboratories, Inc. (US) entered a three-year agreement with HealthTrust Purchasing Group (HPG) (US), to serve as the cornerstone laboratory for HPG's Specialized Reference Laboratory for Oncology & Cancer Genetics, a newly created category for oncology diagnostics in personalized medicine.

Clinical Laboratory Services Market Segmentation

Clinical Laboratory Services Type Outlook

- Biochemistry

- Endocrinology

- Microbiology

- Hematology

- Histopathology

- Cytology

- Genetic Testing

Clinical Laboratory Services Application Outlook

- Independent Laboratory

- Reference Laboratory

- Hospital Laboratory

Clinical Laboratory Services Regional Outlook

-

North America- US

- Canada

-

Europe- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World- Middle East

- Africa

- Latin America

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.