- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Global Bio-Based Surfactants Market Overview

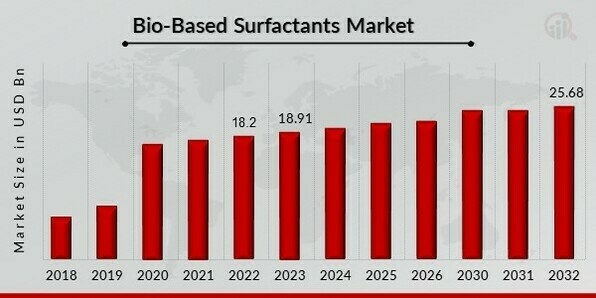

The bio-based surfactants market size was valued at USD 18.91 billion in 2023. The bio-based surfactants industry is projected to grow from USD 19.64 billion in 2024 to USD 25.68 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.90% during the forecast period (2024 - 2032). The increased emphasis on precision nutrition and investments and funds made by government authorities and organizations in the agriculture sector are the key market drivers enhancing market growth. Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Bio-Based Surfactants Market Trends

-

Increasing Demand for Detergents is driving the market growth

Market CAGR for bio-based surfactants is driven by the rising demand for detergent. Laundry detergents, carpet cleaners, and dishwasher detergents are illustrations of household detergents available in the market. This industry accounts for almost half of all-natural surfactant consumption. The preliminary role of laundry detergents is to strip dirt from fabrics and suspend it in the water during washing. Fabric softeners are used for the final rinse. Surfactants are utilized in dishwasher detergents to wet surfaces and aid in soil displacement. The surfactant status in automated dishwasher detergents is inferior that in hand dishwashing detergents to decrease foaming. The surfactant level in automatic dishwasher detergent powders is lower than in hand dishwashing detergents to decrease foaming in the dishwasher. Automatic and hand dishwashing detergent deals are almost identical.

Consumers in Western Europe and Japan, who are more aware of environmental issues regarding surfactant utilization, are the first to embrace non-petroleum-based goods. The dramatic increase in the cost of crude oil in 2007-2008 piqued the interest of consumer commodity formulators and consumers alike in oleochemical-based surfactants. Environmental issues, regulatory enforcement, and fluctuating oil cost are presently the key drivers of market adoption. Natural surfactant demand is anticipated to be heavily influenced by industrial production in detergents and cosmetics, where environmental problems are more prevalent. Since protection is so essential in the cosmetics industry, natural design is better than chemical pathways.

Increasing Government regulations and initiatives drive market growth. Governments around the globe are implementing regulations and initiatives to encourage the adoption of bio-based surfactants and other sustainable products. For example, the European Union has implemented the Bioeconomy Strategy, which aims to create a more sustainable and circular economy by promoting the use of renewable resources.

Furthermore, advancements in biotechnology are the major factor driving the market growth. Biotechnology is playing an increasingly essential role in the development of bio-based surfactants. Advancements in genetic engineering, fermentation, and bioprocessing technologies are enabling the production of new and improved surfactants from a wide range of renewable feedstocks driving the bio-based surfactants market revenue.

Bio-Based Surfactants Market Segment Insights

Bio-Based Surfactants Product Type Insights

The bio-based surfactants market segmentation, based on product type, includes rhamnolipids, methyl glucoside esters, alkyl polyglucosides (APG), sucrose esters, anionic apg derivatives, methyl ester sulfonates (MES), and others. The alkyl polyglucosides (APG) segment dominated the market, accounting for major market revenue. This is due to a surge in demand for home care and personal care products and growing awareness of health hazards caused due to the usage of conventional and inorganic surfactants.

Bio-Based Surfactants Foam Insights

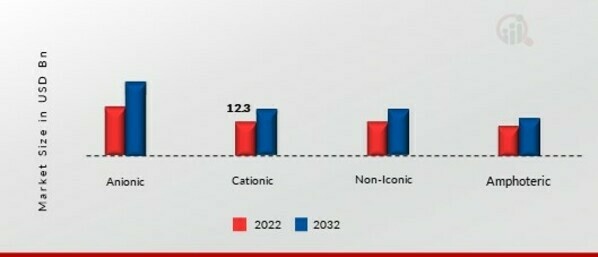

The bio-based surfactants market segmentation, based on foam, includes anionic, cationic, non-iconic, and amphoteric. The non-iconic segment dominated the market, accounting for major market revenue over the forecast period. This is due to their low toxicity; demand for these bio-based surfactants increases.

Figure 1: Bio-Based Surfactants Market, by Foam, 2022 & 2032 (USD billion) Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Bio-Based Surfactants Industry Insights

The bio-based surfactants market segmentation, based on industry, includes household detergents, industrial & institutional cleaners, cosmetic & personal care, textile, oilfield chemicals, agriculture chemicals, and others. The household detergents category generated the most income over the forecast period. This is owing to the rising demand for washing machines, especially in developing economies. Several vendors across the globe attempt to broaden their presence by establishing manufacturing facilities in emerging economies, which also have significant sales opportunities. Moreover, products with natural ingredients are also common in the toiletries and cosmetics sectors.

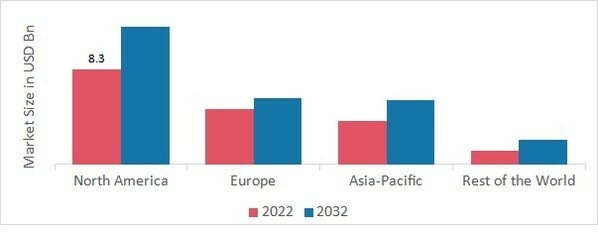

Bio-Based Surfactants Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia Pacific bio-based surfactants market area will dominate this market, owing to the shifting preference of customers towards natural products and bio-based ingredients owing to the potentially hazardous impact conventional surfactants have on the skin is likely to exhibit considerable growth in this region. Moreover, China's bio-based surfactants market held the largest market share, and the Indian bio-based surfactants market was the fastest-growing market in the Asia-Pacific region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: BIO-BASED SURFACTANTS MARKET SHARE BY REGION 2022 (%)  Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Europe's bio-based surfactants market accounts for the second-largest market share due to the growing adoption of bio-based products owing to high awareness regarding the negative effects of chemical surfactants on the environment and human health, driving the growth of the market in this region. Further, the German bio-based surfactants market held the largest market share, and the UK bio-based surfactants market was the fastest-growing market in the European region.

The Asia-Pacific bio-based surfactants market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to the growing investment of foreign manufacturers in South-Asian countries such as China, India, South Korea, and others to set up manufacturing bases owing to the easy availability of raw materials and labor force drives regional growth. Moreover, China bio-based surfactants market held the largest market share, and the Indian bio-based surfactants market was the fastest-growing market in the Asia-Pacific region.

Bio-Based Surfactants Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the bio-based surfactants market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product introduction, contractual agreements, higher investments, mergers and acquisitions, and collaboration with other organizations. To enhance and survive in a more competitive and growing market climate, the bio-based surfactants industry must offer cost-effective items.

Manufacturing locally to minimize operational prices is one of the major business tactics manufacturers use in the bio-based surfactants industry to benefit clients and increase the market sector. Major players in the bio-based surfactants market, including AkzoNobel N. V (Netherland), BASF Cognis (Germany), Croda International (UK), Chemtura Corporation (USA), Ecover (Belgium), Evonik Industries (Germany), others, are attempting to increase market demand by investing in research and development operations.

BASF SE (BASF) is a chemical company. It carries out the production, marketing, and sales of chemicals, plastics, crop protection products, and performance products. Its product line comprises solvents, adhesives, surfactants, fuel additives, electronic chemicals, pigments, paints, food additives, fungicides, and herbicides. The company serves various industries, including construction, furniture and wood, agriculture, electronics and electrical, paints and coatings, automotive, home care, nutrition, chemicals, etc. BASF carries out R&D in alliance with customers, scientists, and partners. In July 2021, BASF launched a new bio-based surfactant called Dehyton AO 45. This surfactant is made from 100% renewable raw materials and can be used in various personal care and household cleaning products.

Solvay SA is a chemical manufacturing company. It manufactures and distributes specialty polymers, essential chemicals, and chemical materials. It serves customers operating in aeronautics & automotive, natural resources & environment, electrical & electronics, agrochemical, food, consumer goods, building & construction, healthcare, industrial applications, and other sectors. The firm uses special chemicals made with eco-friendly materials to expand product quality and performance. It innovates and partners with consumers worldwide in many diverse end markets. In December 2021, Solvay launched a new bio-based surfactant called Rhovanil Natural Crystal White. This surfactant is made from plant-based raw materials and can be used in various applications, including personal care and household cleaning products.

Key Companies in the Bio-Based Surfactants market include

-

BASF SE (Germany)

-

Air Products and Chemicals, Inc (US)

-

Stepan Company (US), Clariant (Switzerland)

-

Croda International PLC (UK)

-

Kao Corporation (Japan)

-

Sasol (South Africa)

-

Galaxy Surfactants Ltd (India)

-

Akzo Nobel NV (Netherlands)

-

Solvay (Belgium)

-

Sirius International BV (Netherlands)

-

Enaspol AS (Czech Republic)

Bio-Based Surfactants Industry Developments

January 2022: Clariant launched a new range of bio-based surfactants called GlucoTain Care. These surfactants are made from renewable resources and are designed for use in personal care products such as shampoos and body washes.

September 2021: Stepan Company launched a new line of bio-based surfactants called STEPANOL AM. These surfactants are derived from natural, renewable resources and are designed for personal care and household cleaning products.

August 2021: Evonik launched a new bio-based surfactant called REWOPOL SB CS 50. This surfactant is made from renewable raw materials and can be used in various applications, including personal care and household cleaning products.

March 2021: Allied Carbon Solutions Co. Ltd., a leading biomass-based surfactant manufacturing company, partnered with BASF to strengthen its position in bio-based surfactants for industrial and home care products. This partnership aimed to strengthen product development and further advancement of products such as sophorolipids.

Bio-Based Surfactants Market Segmentation

Bio-Based Surfactants Product Type Outlook

-

Rhamnolipids

-

Methyl Glucoside Esters

-

Alkyl Polyglucosides (APG)

-

Sucrose Esters

-

Anionic APG Derivatives

-

Methyl Ester Sulfonates (MES)

-

Others

Bio-Based Surfactants Industry Outlook

-

Household Detergents

-

Industrial & Institutional Cleaners

-

Cosmetic & Personal Care

-

Textile

-

Oilfield Chemicals

-

Agriculture Chemicals

-

Others

Bio-Based Surfactants Foam Outlook

-

Anionic

-

Cationic

-

Non-Iconic

-

Amphoteric

Bio-Based Surfactants Regional Outlook

-

North America

-

US

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

-

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.