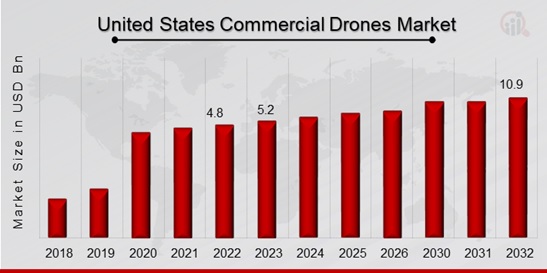

United States Commercial Drones Market Overview

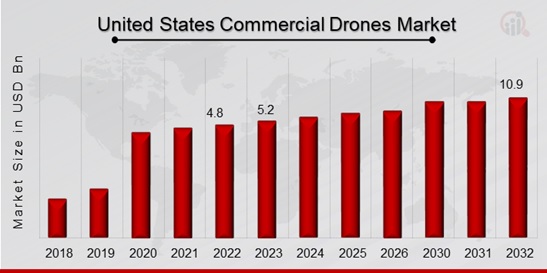

United States Commercial Drones Market Size was valued at USD 4.8 Billion in 2022. The Commercial Drones market industry is projected to grow from USD 5.2 Billion in 2023 to USD 10.9 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.60% during the forecast period (2024 - 2032). Growing demand for mini commercial drones and the development of advanced ADS-B transponder technologies and remote sensing are the main market drivers anticipated to propel the commercial drone market in the United States.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

US Commercial Drones Market Trends

-

Growing Adoption of Cutting-Edge Technologies, such as Artificial Intelligence, is Driving Market Growth.

Advances in electronics technology, including processors, microcontrollers, cameras, mobile hardware, and contemporary computing, have updated the product line for commercial drones. With more developments, companies can develop internal measuring and annotation tools for area, volume, and distance calculations. Consequently, businesses worldwide are calling for more and more machine learning and artificial intelligence solutions to write correct information and real-time data from millions of data collection points. Large volumes of data are managed and stored using artificial intelligence technology, which improves UAV performance. The most recent technologies, such as Ground Control Point (GCP), which is based on 150,000 images of particular GCPs, are utilized by various industry companies. Upgrades from OEM companies are anticipated to be a major factor in the growth of the United States market in the upcoming years.

Furthermore, drones are helping construction companies overcome the drawbacks of old methods, such as human error, and increase the operational efficiency and cost-effectiveness of land surveying techniques. Using drones to monitor a construction site's high-risk regions visually is becoming increasingly common. Drone data collection in real-time also contributes to on-site management and communication efficiency. Additionally, by taking overhead photos of the project's development, drones assist surveyors and engineers in inspecting high-rise constructions. In addition, they streamline the activities at a building site by giving site managers an overview of possible problems and facilitating important decision-making processes. One-fifth of the project's overall cost and one-tenth of the earth movement cost are expected to be decreased with the usage of aerial intelligence. The benefits of using drones in the construction industry are anticipated to propel the United States market's expansion shortly. Thus, driving the commercial drone market revenue.

United States Commercial Drones Market Segment Insights

-

Commercial Drones Weight Insights

Based on Weight, the United States Commercial Drones market segmentation includes <2 Kg, 2 Kg – 25 kg, and 25 Kg – 150 Kg. The <2Kg segment mostly dominated the market because of their lightweight design and small size, increasing their versatility and allowing them to navigate challenging areas to acquire data precisely. Furthermore, drones weighing less than 2 kg are subject to less restrictive laws in many places, making their deployment for enterprises easier and more flexible. They reduce operating hurdles by requiring simpler licenses and permits. In addition, technological developments are creating strong yet lightweight parts, which raise the potential of these drones. They can fly for longer periods and still carry complex sensors and cameras. Moreover, a greater variety of enterprises can afford smaller drones due to their affordability.

The 25 – 150 kg category is anticipated to be the fastest growing due to the increasing advancement of passenger-specific Electric-Vertical Takeoff Landing (eVTOL) aircraft. Furthermore, the segment's growth is expected to be aided over the projected period by technological advancements in drones in the 25–150 kg weight range.

-

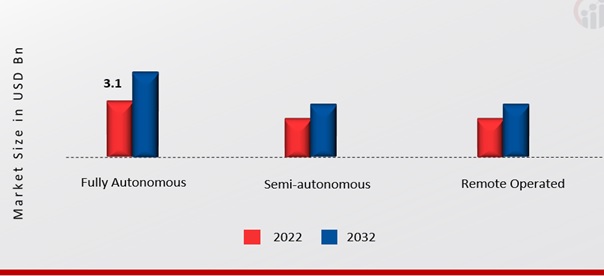

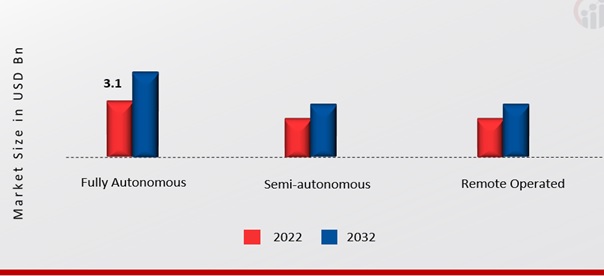

Commercial Drones Technology Insights

Based on Technology, the United States Commercial drone market segmentation includes fully autonomous, semi-autonomous, and remote-operated. The fully autonomous category generated the most income. Drones that are fully autonomous can quickly survey large areas and produce high-quality maps that can be used in urban planning, land development, and construction. Accurate mapping and surveying may be accomplished without continual human intervention because of automated flight patterns and sophisticated sensors that enable exact data collection.

The remote-operated category is expected to have the quickest rate. Many commercial drones are operated remotely using remote control systems by certified pilots or operators. These systems give the drone fine control over its payload operations, navigation, and motions. Drones have a variety of sensors and cameras installed, enabling remote sensing. Operators can remotely capture high-resolution photos, videos, and other data for mapping, monitoring, and surveillance applications.

Figure 1: United States Commercial Drones Market, by Technology, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Commercial Drones System Insights

Based on the System, the United States Commercial drone market segmentation includes hardware (airframe, propulsion system, and payload), software, and others. The hardware category is anticipated to lead the market. Due to the increasing use of drones for United States commercial purposes, including aerial photography, pipeline inspection, surveillance, and wildlife monitoring. During the COVID-19 epidemic, there was also a significant demand for medical drones to transport medications and vaccines to remote locations.

The software segment is projected to be the fastest growing. Drone control and autonomous flight are made possible by software for navigation and autopilot. These systems maintain precise positioning, heading, and altitude throughout flights using GPS and additional sensors.

Commercial Drones Application Insights

Based on Application, the United States Commercial drone market segmentation includes filming & photography, horticulture and agriculture, inspection and maintenance, mapping and surveying, surveillance & monitoring, delivery and logistics, and others. The film & photography category is predicted to have the largest market share during the forecast period. The increase in the purchasing of drones for aerial photography and cinematography, such as the Parrot Anafi FPV, DJI Mavic 2 Zoom, PowerVision PowerEgg X Wizard, Autel EVO II (with 8K video), and many more, is anticipated to propel the segment expansion throughout the project.

The delivery and logistics category is expected to have the quickest rate. The industry is anticipated to rise as VTOL drone development increases to deliver cargo, passengers, food, and medications. Furthermore, throughout the forecast period, the market is anticipated to be driven by the growing use of drones for delivery for e-commerce sites like Amazon.

Commercial Drones Country Insights

Several government agencies, small enterprises, and other start-ups in the United States have been experimenting with integrating drones into a variety of industries, including infrastructure, law enforcement, agriculture, last-mile delivery, medical transport, and entertainment, with the help of the Federal Aviation Administration (FAA) have been experimenting with drone use across the nation. In the upcoming years, major corporations such as Amazon, Google, Walmart, and Uber have been experimenting with drones for delivery. For instance, Walmart announced in May 2022 that it will launch its delivery service in six states using the operator DroneUp, making it the nation's first extensive drone delivery initiative. According to the company's prediction, portions of Arizona, Arkansas, Florida, Texas, Utah, and Virginia may get more than one million packages per year via drone. Lockeford, California, Amazon customers will be among the first to receive Prime Air drone deliveries in the United States after the company tested its drone service in June 2022. Throughout the projection period, the government's backing and the nation's growing drone operator population will stimulate demand for the drone industry in the United States.

US Commercial Drones Key Market Players & Competitive Insights

The Commercial drone market is expected to grow even more due to major players in the industry making significant R&D investments to extend their lines of equipment. Alongside these significant market developments, market participants engage in various strategic actions to broaden their market reach. These activities include introducing new Weights, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. The drones commercial Drones sector needs to provide affordable products to grow and thrive in a more cutthroat and dynamic market.

Major United States Commercial Drones market players are attempting to increase market demand by investing in research and development operations, including 3D Robotics, Inc., AeroVironment Inc., FLIR Systems, Inc., Teal Drones, Intel Corporation, AgEagle Aerial Systems Inc., PrecisionHawk, Inc., and Skydio, Inc.

Key Companies in the United States Commercial Drones market include

- 3D Robotics, Inc.

- AeroVironment Inc.

- FLIR Systems, Inc.

- Teal Drones

- Intel Corporation

- AgEagle Aerial Systems Inc.

- PrecisionHawk, Inc.

- Skydio, Inc.

US Commercial Drones Industry Developments

May 2022: Walmart announced that it would reach 4 million additional households with drone deliveries. Walmart claims that by taking this action, it will expand its current drone delivery network to 34 locations in Arizona, Arkansas, Florida, Texas, Utah, and Virginia, enabling it to deliver more than a million products to consumers' homes annually. The aerial service will be offered daily from 8 a.m. to 8 p.m. Each delivery weighing up to 10 pounds will cost USD 3.99.

United States Commercial Drones Market Segmentation

Commercial Drones Weight Outlook

- <2 Kg

- 2 Kg – 25 kg

- 25 Kg – 150 Kg

Commercial Drones Technology Outlook

- Fully Autonomous

- Semi-autonomous

- Remote Operated

Commercial Drones System Outlook

-

- Airframe

- Propulsion System

- Payload

- Software

- Others

Commercial Drones Application Outlook

- Filming & Photography

- Horticulture and Agriculture

- Inspection and Maintenance

- Mapping and Surveying

- Surveillance & Monitoring

- Delivery and Logistics

- Others

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 4.8 Billion |

| Market Size 2023 |

USD 5.2 Billion |

| Market Size 2032 |

USD 10.9 Billion |

| Compound Annual Growth Rate (CAGR) |

9.60% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Weight, Technology, System, and Application |

| Countries Covered |

United States |

| Key Companies Profiled |

3D Robotics, Inc., AeroVironment Inc., FLIR Systems, Inc., Teal Drones, Intel Corporation, AgEagle Aerial Systems Inc., PrecisionHawk, Inc., and Skydio, Inc. |

| Key Market Opportunities |

· Increased use of commercial drones in the mining sector · Growing adoption in the agriculture sector |

| Key Market Dynamics |

· Growing demand for mini commercial drones · Development of advanced ADS-B transponder technologies and remote sensing |

Frequently Asked Questions (FAQ) :

The United States Commercial drone market size was valued at USD 4.8 Billion in 2022.

The market is projected to grow at a CAGR of 9.60% during the forecast period, 2024-2032.

The key players in the market are 3D Robotics, Inc., AeroVironment Inc., FLIR Systems, Inc., Teal Drones, Intel Corporation, AgEagle Aerial Systems Inc., PrecisionHawk, Inc., and Skydio, Inc., among others.

The <2 Kg category dominated the market in 2022.

The fully autonomous category had the largest share of the market.