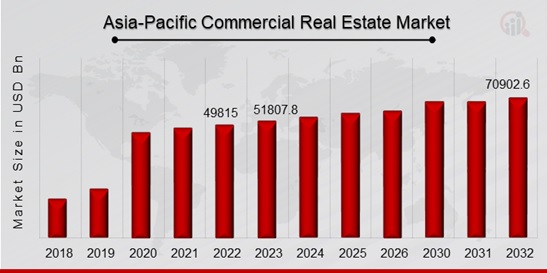

Asia-Pacific Commercial Real Estate Market Overview

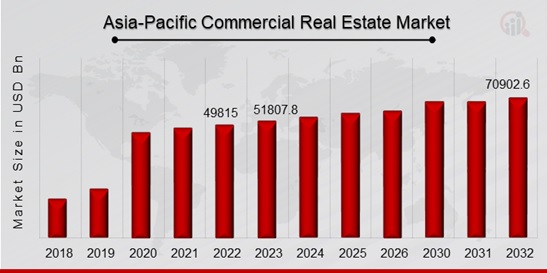

Asia-Pacific Commercial Real Estate Market Size was valued at USD 49815 Billion in 2022. The Asia-Pacific Commercial Real Estate industry is projected to grow from USD 51807.8 Billion in 2023 to USD 70902.6 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.00% during the forecast period (2023 - 2032). The increasing number of people living in metropolitan areas is one of the major market drivers driving the Asia-Pacific Commercial Real Estate market. Asia-Pacific Commercial Real Estate is being adopted by industries due to its capacity to raise awareness of environmental sustainability.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Asia-Pacific Commercial Real Estate Market Trend

- Fast population growth in metropolitan regions is driving the market growth

The demand for Commercial Real Estate is fueled by the Asia-Pacific region's economic boom, especially in nations like China, India, and Southeast Asia, where enterprises are expanding and needing spaces for offices, stores, and factories. A major factor driving demand for the development of Commercial Real Estate, such as office buildings, shopping malls, and residential complexes, is the migration of people from rural to urban regions or rapid urbanization. Real estate transactions and development projects may be slowed down or made more difficult by the strict laws and bureaucratic procedures that governments in the Asia-Pacific area sometimes impose. Foreign ownership limits, construction codes, zoning laws, and land-use limitations are a few examples of these policies. Furthermore, in the Commercial Real Estate industry, investors and developers may face uncertainty due to political instability, geopolitical conflicts, and policy changes, which can affect the market CAGR. Uncertain political climates can cause property transactions to be disrupted and discourage foreign investment, which can increase market volatility and lower investor confidence.

Furthermore, government spending on infrastructure initiatives like ports, airports, and transportation networks frequently encourages the growth of nearby Commercial Real Estate, which raises demand for logistics, office, and retail space. Growing urbanization and the middle class are affecting the market for various kinds of Commercial Real Estate, such as shopping centers, apartment buildings, and entertainment facilities. There may be an overabundance of Commercial Real Estate properties in several Asia-Pacific regions, which would push down on property values and result in higher vacancy rates and falling rental yields. Market overstock can be caused by speculative development, sudden spikes in construction, or developer miscalculations of the dynamics of demand and can affect the commercial real estate market revenue.

Asia-Pacific Commercial Real Estate Market Segment Insights

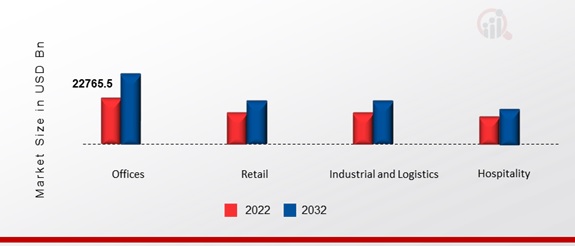

- Asia-Pacific Commercial Real Estate Type Insights

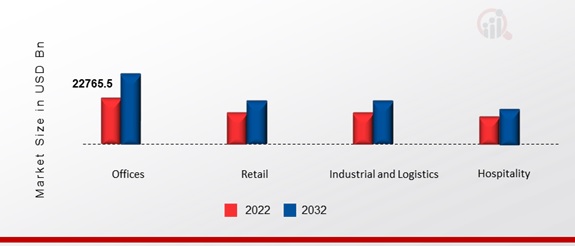

The Asia-Pacific Commercial Real Estate market segmentation, based on type, includes Offices, Retail, Industrial and Logistics, and Hospitality. The offices segment dominated the market. This is because they offer spaces for employees to work and relax as well as a setting for group creativity, productivity, and welfare. Offices are crucial for cooperation. Oversee supply chains and preserve connections with partners and suppliers. The demand for office space in prime locations may be influenced by this desire for close access to important stakeholders.

Figure 1: Asia-Pacific Commercial Real Estate Market, by Type, 2022 & 2032 (USD Billion)

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Asia-Pacific Commercial Real Estate Country Insights

The Asia Pacific region's growing economy, population, and rapid urbanization are the main factors driving market expansion. The need for retail spaces is fueled by the expanding middle class and increased consumer expenditure in the area, and the expansion of industries like manufacturing and technology is improving the prognosis for market growth. The demand for Commercial Real Estate, which includes office spaces, retail stores, industrial facilities, and residential properties, is fueled by China's ongoing economic expansion and urbanization. China, the second-biggest economy in the world, attracts investment and increases demand for Commercial Real Estate by providing substantial prospects for both domestic and foreign firms. Due to China's fast urbanization, there is a growing demand for Commercial Real Estate in important metropolitan areas as a result of city growth and the creation of new urban centers. Millions of people are moving to cities from rural areas in pursuit of work and better prospects. Thus, there will always be a need for office space, shopping malls, and residential buildings to house the expanding urban population.

Figure 2: ASIA-PACIFIC COMMERCIAL REAL ESTATE MARKET SHARE BY REGION 2022 (USD Billion)

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Asia-Pacific Commercial Real Estate Key Market Players & Competitive Insights

Leading market players are putting a lot of money into R&D to expand their product lines, which will help the Asia-Pacific Commercial Real Estate market continue to thrive. In addition, market players are engaging in a range of calculated initiatives to increase their presence, with significant market developments involving the introduction of new products, contracts, M&A transactions, increased investment, and cooperation with other enterprises. to grow and endure in an increasingly cutthroat and dynamic market, Asia-Pacific Commercial Real Estate industry must provide reasonably priced goods.

Major players in the Asia-Pacific Commercial Real Estate market are engaging in research and development activities in an effort to boost market demand, including DLF Ltd., Godrej Properties Ltd., Housing Development and Infrastructure Ltd (HDIL), Oberoi Realty, India Bulls Real Estate, Prestige Estate Projects Ltd.

Key Companies in the Asia-Pacific Commercial Real Estate market include

- DLF Ltd.

- Godrej Properties Ltd.

- Housing Development and Infrastructure Ltd (HDIL)

- Oberoi Realty

- IndiaBulls Real Estate

- Prestige Estate Projects Ltd

- Supertech Limited

- HDIL Ltd

- Brigade Group

- Unitech Real Estate Pvt Ltd

- MagicBricks

- Acres

- Sulekha Properties

- RE/MAX India

- JLL India

- Anarock Property Consultants

- Awfis

Asia-Pacific Commercial Real Estate Industry Developments

June 2023: Prologis, Inc. said that it has paid $3.1 billion to opportunistic real estate funds associated with Blackstone to acquire industrial buildings spanning roughly 14 million square feet.

March 2023: the manager of Link Real Estate Investment Trust, Link Asset Management Limited, has announced that it has successfully completed the purchase of two suburban retail properties in Singapore.

Asia-Pacific Commercial Real Estate Market Segmentation

Asia-Pacific Commercial Real Estate Type Outlook

- Offices

- Retail

- Industrial and Logistics

- Hospitality

Asia-Pacific Commercial Real Estate Regional Outlook

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Indonesia

- Thailand

- Vietnam

- Malaysia

- Singapore

- Rest of Asia-Pacific

| Report Attribute/Metric |

Details |

| Market Size 2022 |

USD 49815 Billion |

| Market Size 2023 |

USD 51807.8 Billion |

| Market Size 2032 |

USD 70902.6 Billion |

| Compound Annual Growth Rate (CAGR) |

4.00% (2023-2032) |

| Base Year |

2022 |

| Market Forecast Period |

2023-2032 |

| Historical Data |

2018-2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type and Region |

| Region Covered |

Asia-Pacific |

| Countries Covered |

China, Japan, India, Australia, South Korea, Indonesia, Thailand, Vietnam, Malaysia, Singapore, Rest of Asia-Pacific |

| Key Companies Profiled |

DLF Ltd. , Godrej Properties Ltd., Housing Development and Infrastructure Ltd (HDIL), Oberoi Realty, IndiaBulls Real Estate, Prestige Estate Projects Ltd |

| Key Market Opportunities |

· Growing middle class and rising consumer spending, and the expansion of industries |

| Key Market Dynamics |

· Increasing number of people living in metropolitan areas · Raises awareness of environmental sustainability |

Frequently Asked Questions (FAQ) :

The Asia-Pacific Commercial Real Estate market size was valued at USD 49815.2 Billion in 2022.

The market is anticipated to expand between 2023 and 2032 at a CAGR of 4.00%.

The key players in the market are DLF Ltd., Godrej Properties Ltd., Housing Development and Infrastructure Ltd (HDIL), Oberoi Realty, India Bulls Real Estate, and Prestige Estate Projects Ltd.

The offices category dominated the market in 2022.